Equities

| MINTs | |

|---|---|

| JCI(IDN) | +0.46% |

| INMEX(MEX) | +1.18% |

| NGSEINDX(NGA) | -1.48% |

| XU030(TUR) | +3.81% |

| BRICS | |

|---|---|

| IBOV(BRA) | +4.90% |

| SHCOMP(CHN) | +2.48% |

| NIFTY(IND) | -3.49% |

| INDEXCF(RUS) | +1.58% |

| TOP40(ZAF) | +3.10% |

Commodities

| Energy | |

|---|---|

| Heating Oil | +2.53% |

| RBOB Gasoline | +4.33% |

| Brent Crude Oil | +2.97% |

| Ethanol | -1.12% |

| Natural Gas | -4.16% |

| WTI Crude Oil | +3.44% |

| Metals | |

|---|---|

| Copper | -1.08% |

| Palladium | -1.66% |

| Gold 100oz | -2.15% |

| Silver 5000oz | -3.07% |

| Platinum | -3.70% |

Currencies

| MINTs | |

|---|---|

| USDIDR(IDN) | +0.56% |

| USDMXN(MEX) | +0.16% |

| USDNGN(NGA) | -0.25% |

| USDTRY(TUR) | +1.08% |

| BRICS | |

|---|---|

| USDBRL(BRA) | -3.55% |

| USDCNY(CHN) | -0.05% |

| USDINR(IND) | +1.92% |

| USDRUB(RUS) | -2.42% |

| USDZAR(ZAF) | +0.35% |

| Agricultural | |

|---|---|

| Corn | -4.14% |

| Cotton | +5.64% |

| Feeder Cattle | +1.27% |

| Wheat | -1.57% |

| Soybean Meal | -0.10% |

| Sugar #11 | +0.00% |

| Coffee (Robusta) | -0.22% |

| White Sugar | +0.78% |

| Cattle | +2.17% |

| Cocoa | +1.29% |

| Coffee (Arabica) | +1.83% |

| Lean Hogs | +1.58% |

| Lumber | +3.72% |

| Orange Juice | -1.00% |

| Soybeans | +0.03% |

Credit Indices

| Index | Change |

|---|---|

| Markit CDX EM | +0.02% |

| Markit CDX NA HY | +0.02% |

| Markit CDX NA IG | +0.08% |

| Markit iTraxx Asia ex-Japan IG | +0.29% |

| Markit iTraxx Australia | +2.10% |

| Markit iTraxx Europe | +2.28% |

| Markit iTraxx Europe Crossover | -0.19% |

| Markit iTraxx Japan | -0.15% |

| Markit iTraxx SovX Western Europe | +2.70% |

| Markit LCDX (Loan CDS) | +0.00% |

| Markit MCDX (Municipal CDS) | -1.28% |

With the Opposition (Congress, mostly) blocking pretty much every reform measure, the Modi magic is dead by a thousand cuts.

A weak Monsoon could stoke inflation and dampen rate-cut expectations.

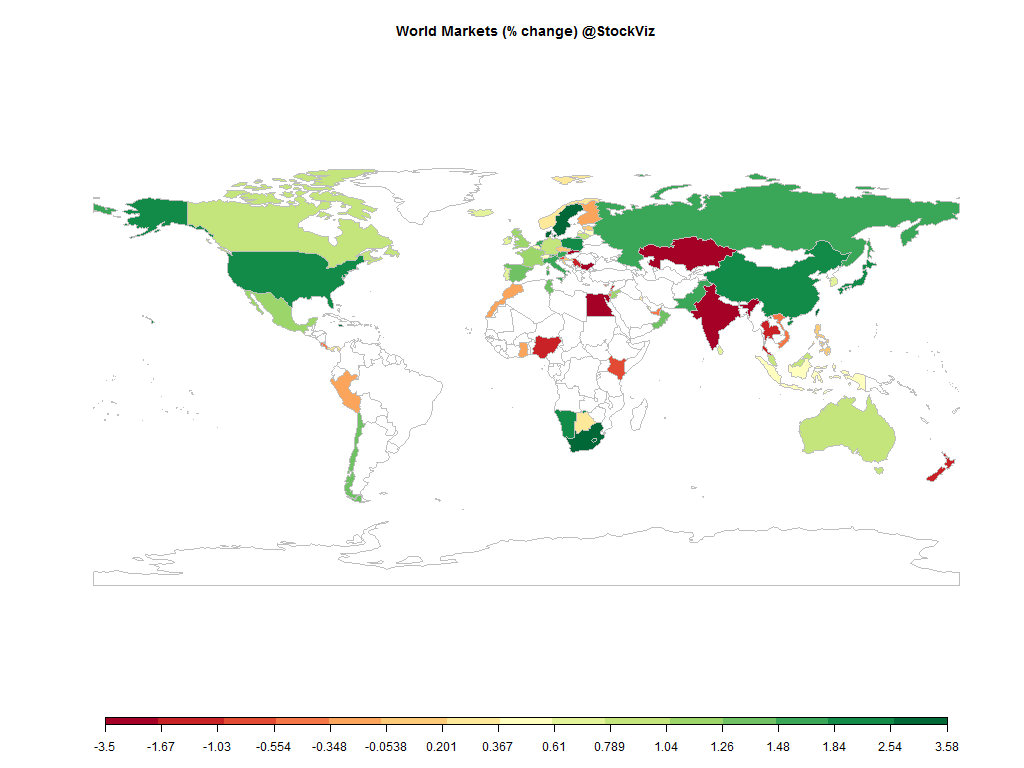

Indian equity markets were a aberration in a sea of green…

A weak Monsoon could stoke inflation and dampen rate-cut expectations.

Indian equity markets were a aberration in a sea of green…

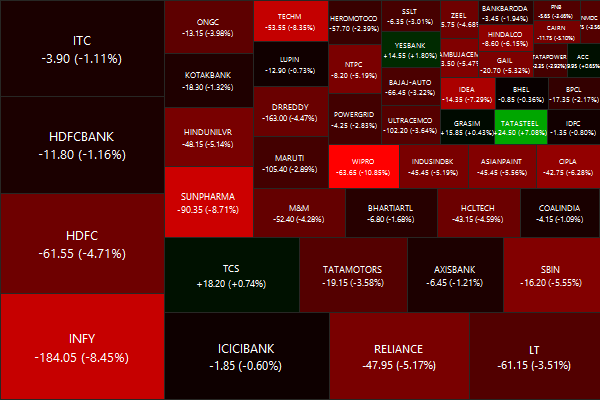

Nifty Heatmap

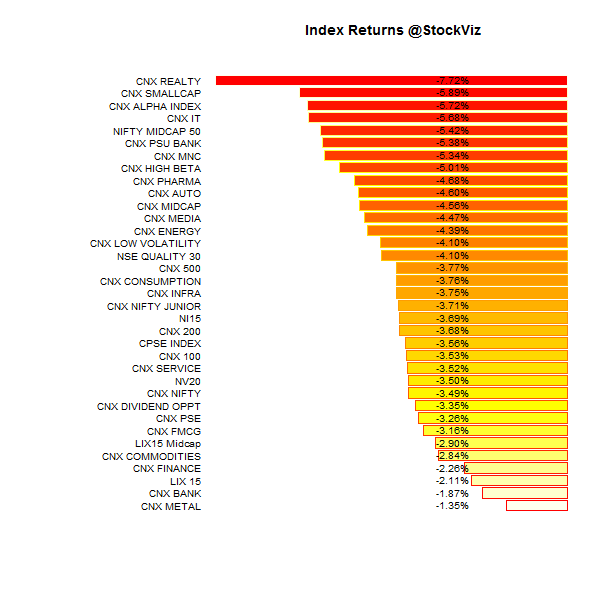

Index Returns

For a deeper dive into indices, check out our weekly Index Update.

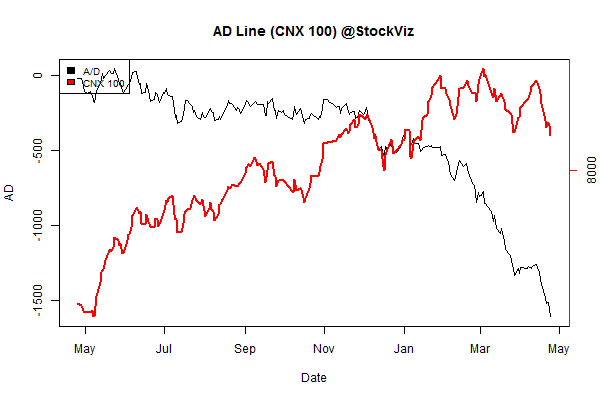

Advance Decline

Market Cap Decile Performance

| Decile | Mkt. Cap. | Adv/Decl |

|---|---|---|

| 1 (micro) | -3.87% | 70/63 |

| 2 | -2.51% | 63/70 |

| 3 | -2.25% | 60/73 |

| 4 | -3.61% | 58/74 |

| 5 | -3.80% | 61/72 |

| 6 | -3.02% | 58/75 |

| 7 | -3.28% | 58/74 |

| 8 | -3.48% | 58/75 |

| 9 | -3.61% | 62/71 |

| 10 (mega) | -3.65% | 65/68 |

A clean vertical slice…

Top Winners and Losers

Who would’ve thunk that Bosch can collapse like a mid-cap momentum stock?

ETF Performance

| GOLDBEES | +0.65% |

| INFRABEES | -0.93% |

| BANKBEES | -1.95% |

| JUNIORBEES | -2.00% |

| CPSEETF | -3.58% |

| NIFTYBEES | -3.87% |

| PSUBNKBEES | -5.98% |

Gold held steady because the rupee collapsed…

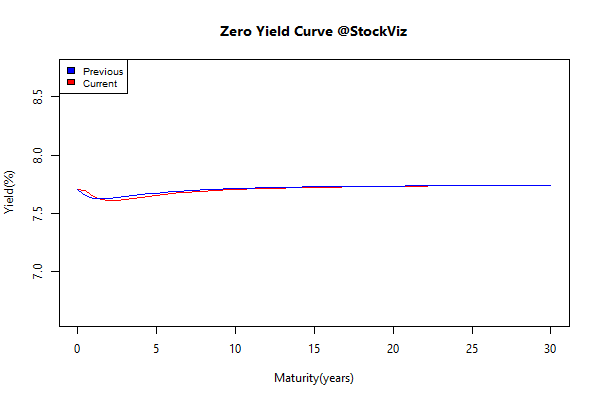

Yield Curve

Bond Indices

| Sub Index | Change in YTM | Total Return(%) |

|---|---|---|

| GSEC TB | +0.08 | +0.12% |

| GSEC SUB 1-3 | -0.07 | +0.03% |

| GSEC SUB 3-8 | +0.02 | -0.02% |

| GSEC SUB 8 | +0.03 | +0.05% |

The curve barely budged…

Investment Theme Performance

| Tactical CNX 100 | +0.00% |

| Balance Sheet Strength | -3.09% |

| Textile, Metals, Chemicals, Paper and Energy Quality to Price | -3.15% |

| CNX 100 Enterprise Yield | -4.33% |

| High Beta | -4.49% |

| Magic Formula | -4.97% |

| Auto and Consumer Goods Quality to Price | -4.98% |

| Media, Health, IT, Telecom, Services, Pharma Quality To Price | -5.33% |

| ASK Life | -5.89% |

| ADAG stocks | -6.12% |

| Momentum | -6.36% |

| Quality to Price | -6.62% |

| Low Volatility | -7.41% |

| Next Trillion | -7.53% |

| Financial Strength Value | -8.44% |

| PPFAS Long Term Value | -11.60% |

The only investment strategy that did well was the one that went into cash last week…

Equity Mutual Funds

Bond Mutual Funds

Thought for the weekend

When governments introduce austerity measures, they are trying to reduce their net borrowing – in effect, they are raising their savings rate. Such attempts to increase saving actually lead to lower, not higher, investment – and since saving equals investment, actual savings fall. So what we have here is an empirical confirmation of the existence of the paradox of thrift!

Comments are closed, but trackbacks and pingbacks are open.