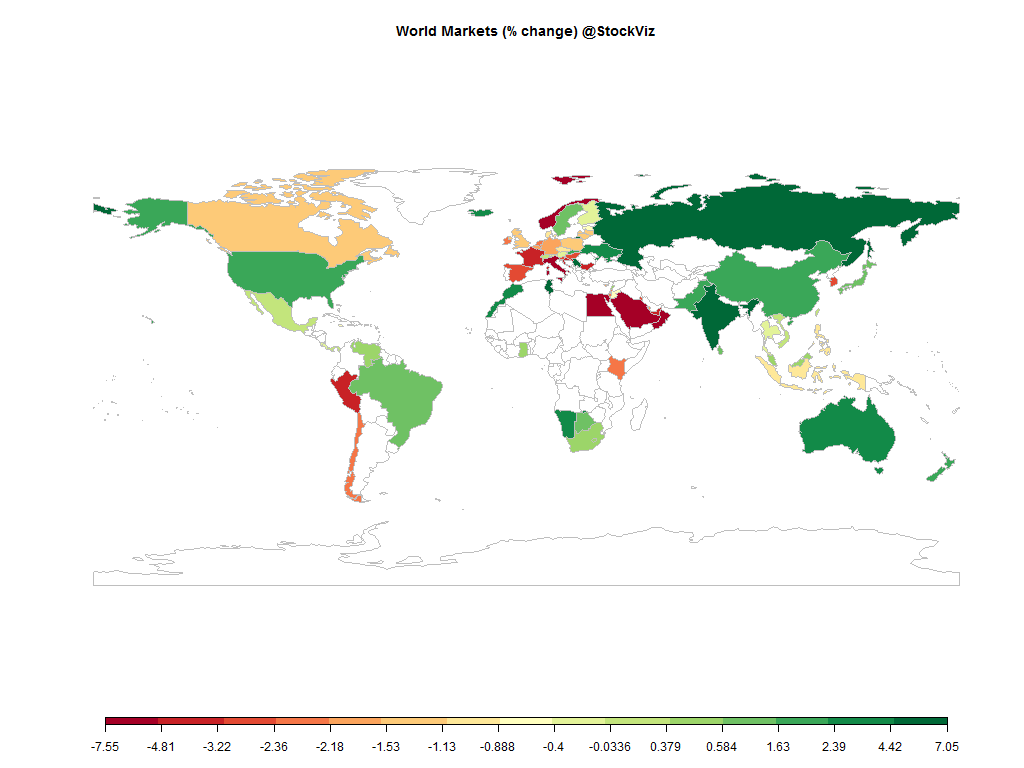

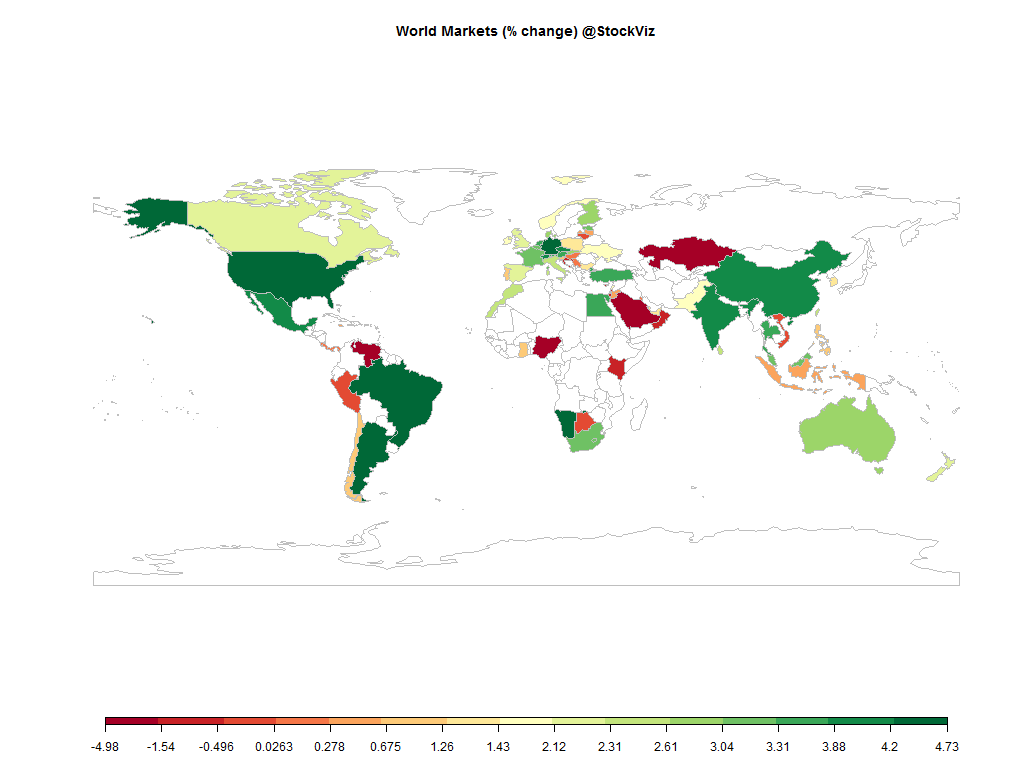

Equities

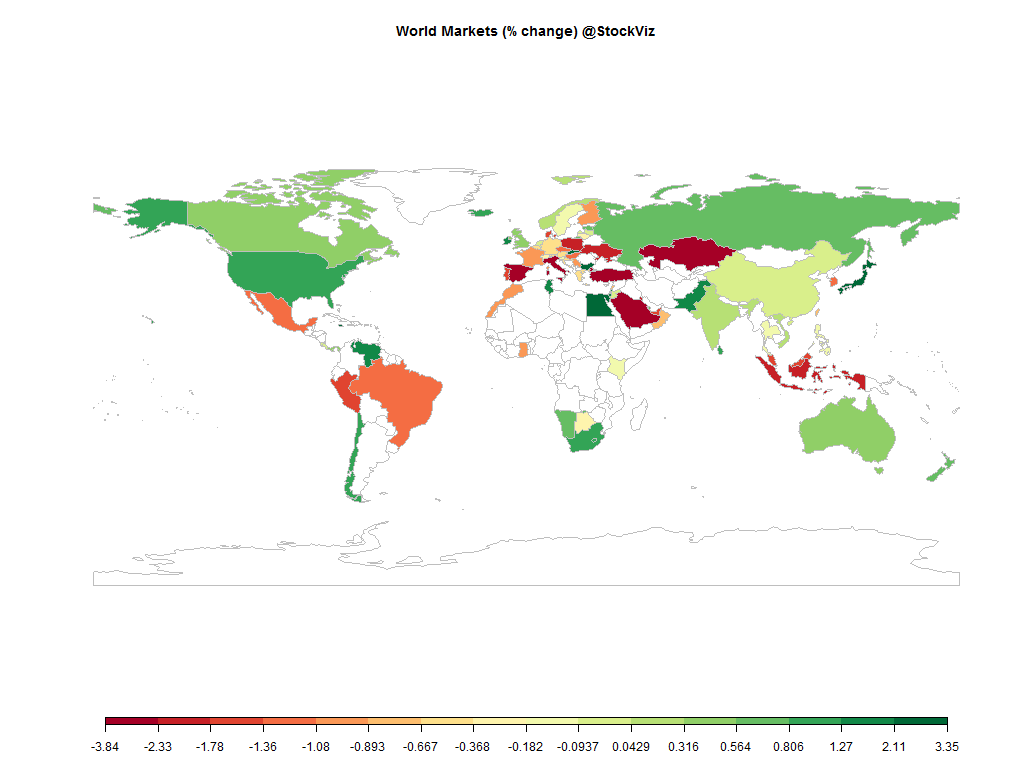

| MINTs | |

|---|---|

| JCI(IDN) | -2.01% |

| INMEX(MEX) | -1.17% |

| NGSEINDX(NGA) | -11.52% |

| XU030(TUR) | -3.38% |

| BRICS | |

|---|---|

| IBOV(BRA) | -1.09% |

| SHCOMP(CHN) | -0.08% |

| NIFTY(IND) | +0.18% |

| INDEXCF(RUS) | +0.58% |

| TOP40(ZAF) | +0.97% |

Commodities

| Energy | |

|---|---|

| Brent Crude Oil | -2.98% |

| Ethanol | +2.19% |

| Heating Oil | -1.20% |

| Natural Gas | +12.77% |

| RBOB Gasoline | -2.40% |

| WTI Crude Oil | -2.73% |

| Metals | |

|---|---|

| Copper | -0.33% |

| Gold 100oz | -0.03% |

| Palladium | -2.37% |

| Platinum | -1.35% |

| Silver 5000oz | -5.66% |

Currencies

| MINTs | |

|---|---|

| USDIDR(IDN) | +0.77% |

| USDMXN(MEX) | +0.60% |

| USDNGN(NGA) | +0.06% |

| USDTRY(TUR) | +1.77% |

| BRICS | |

|---|---|

| USDBRL(BRA) | +3.46% |

| USDCNY(CHN) | +0.15% |

| USDINR(IND) | +0.44% |

| USDRUB(RUS) | +8.63% |

| USDZAR(ZAF) | +2.38% |

| Agricultural | |

|---|---|

| Cattle | -1.60% |

| Cocoa | +0.78% |

| Coffee (Arabica) | -2.94% |

| Coffee (Robusta) | -1.56% |

| Corn | -2.33% |

| Cotton | +0.61% |

| Feeder Cattle | +1.73% |

| Lean Hogs | +0.70% |

| Lumber | +0.43% |

| Orange Juice | -5.07% |

| Soybean Meal | +1.32% |

| Soybeans | -2.50% |

| Sugar #11 | -2.06% |

| Wheat | -3.20% |

| White Sugar | -1.04% |

Credit Indices

| Index | Change |

|---|---|

| Markit CDX EM | +0.14% |

| Markit CDX NA HY | +0.38% |

| Markit CDX NA IG | -1.85% |

| Markit CDX NA IG HVOL | -0.83% |

| Markit iTraxx Asia ex-Japan IG | -4.08% |

| Markit iTraxx Australia | -2.75% |

| Markit iTraxx Europe | -2.67% |

| Markit iTraxx Europe Crossover | -8.85% |

| Markit iTraxx Japan | -4.21% |

| Markit iTraxx SovX Western Europe | -0.66% |

| Markit LCDX (Loan CDS) | +0.04% |

| Markit MCDX (Municipal CDS) | -2.00% |

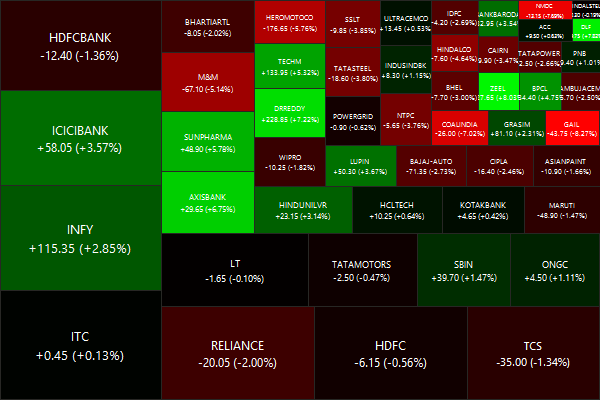

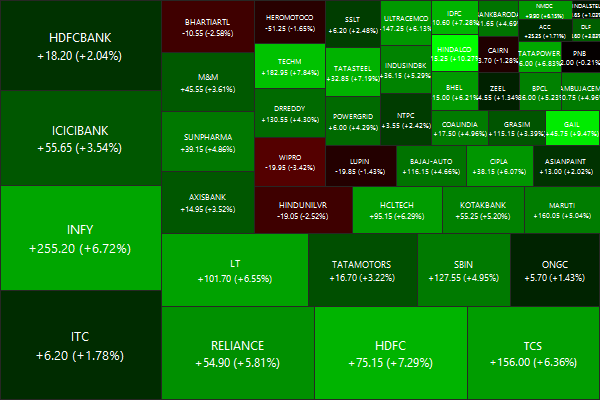

Nifty heatmap

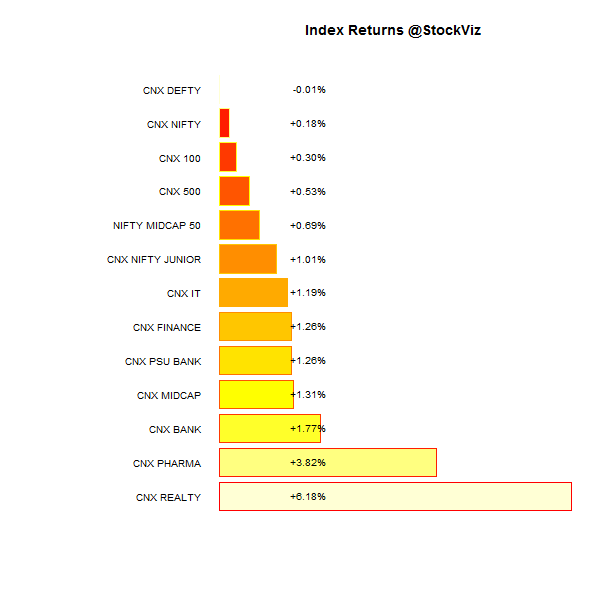

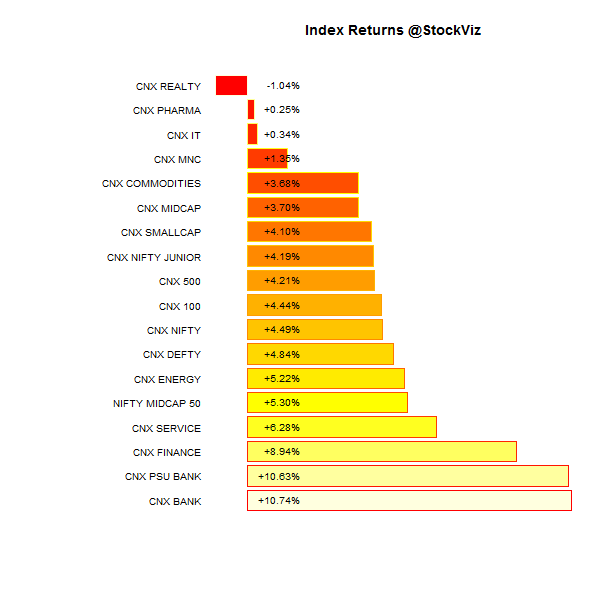

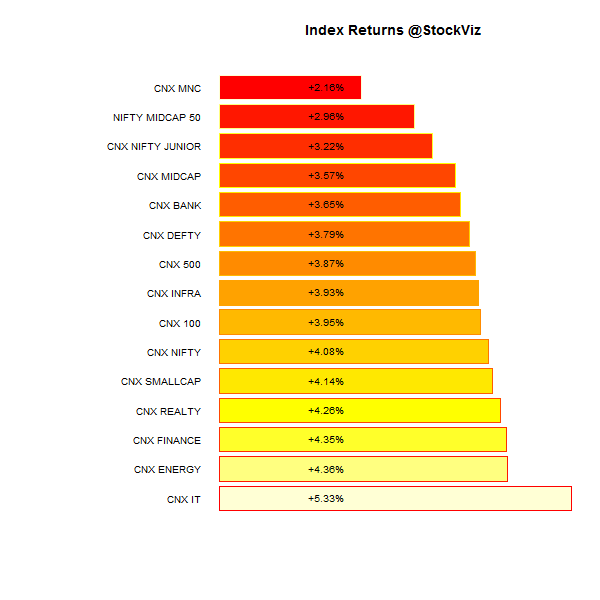

Index Returns

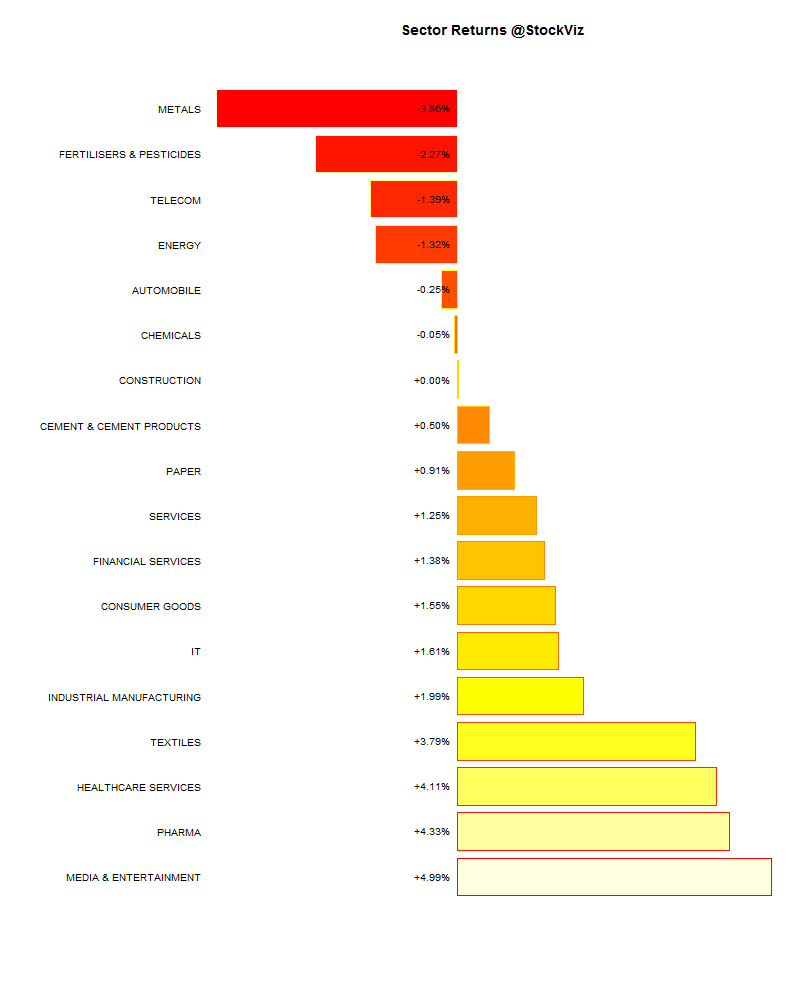

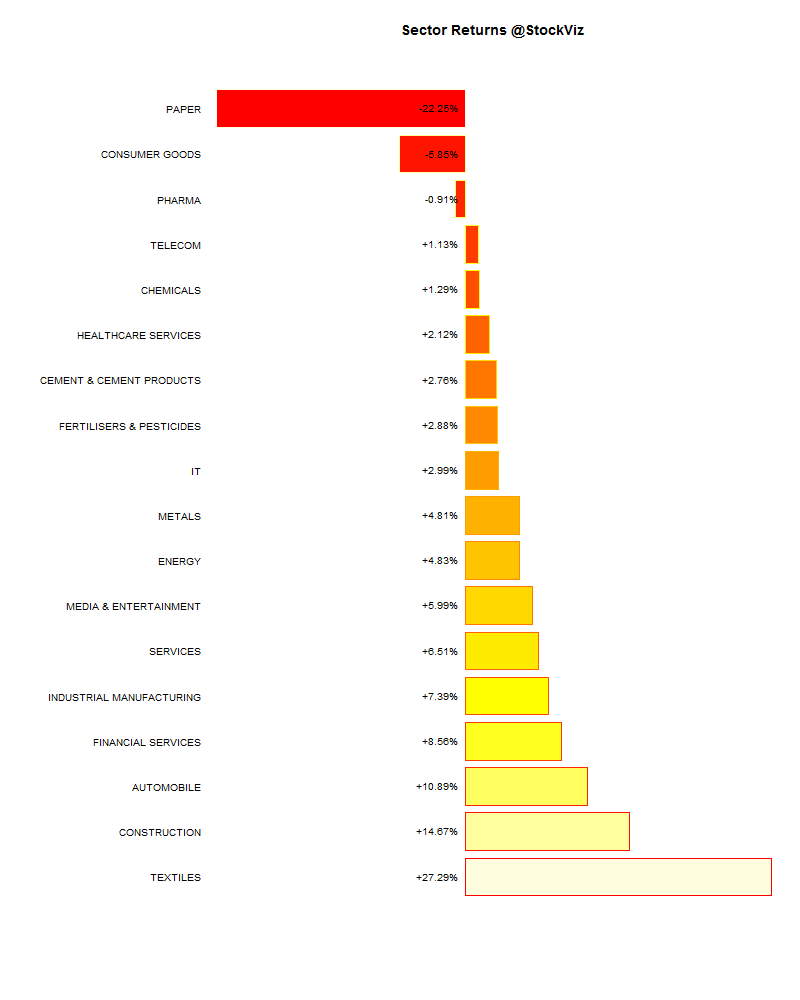

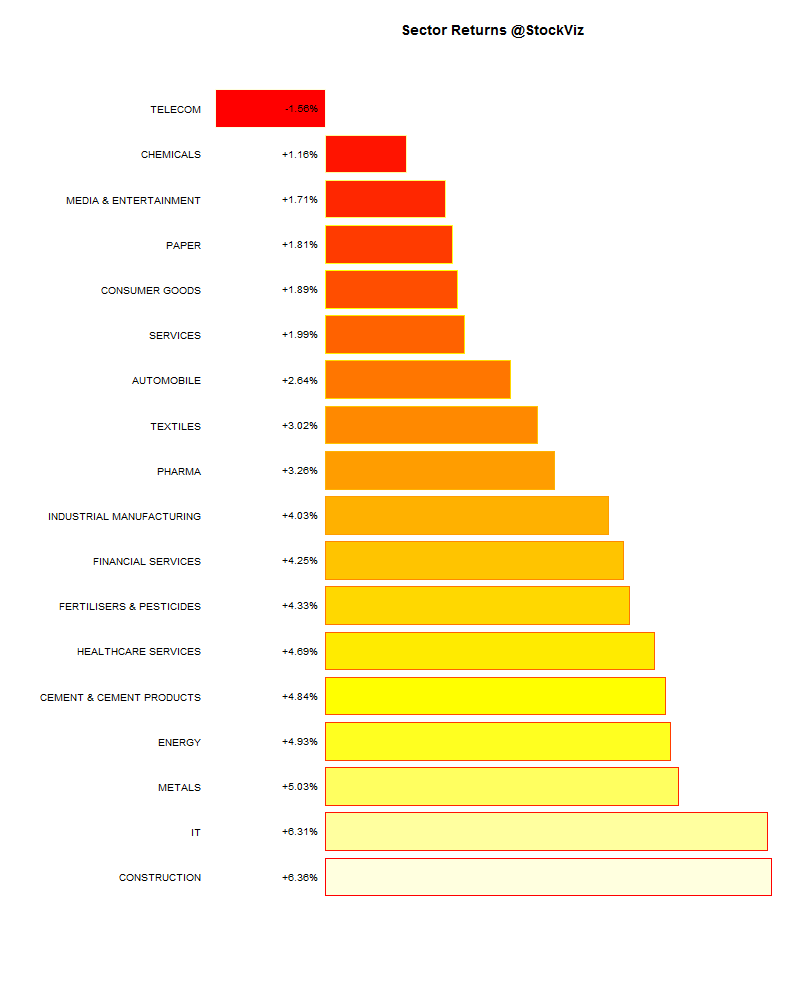

Sector Performance

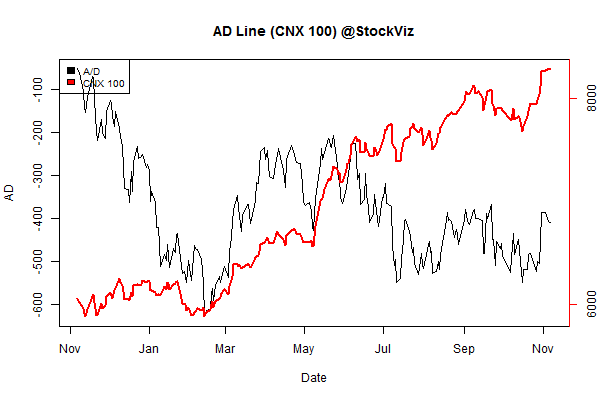

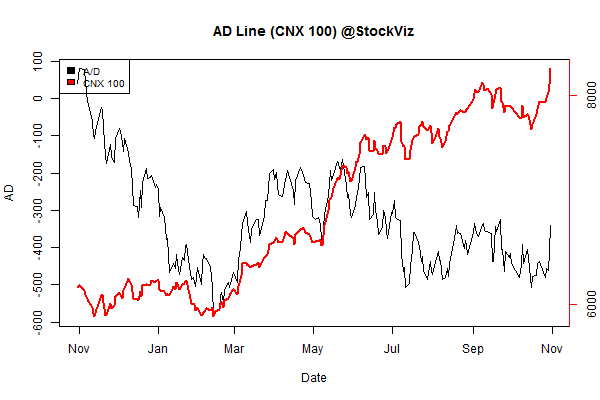

Advance Decline

Market cap decile performance

| Decile | Mkt. Cap. | Adv/Decl |

|---|---|---|

| 1 (micro) | -0.08% | 72/68 |

| 2 | +3.25% | 78/61 |

| 3 | +3.16% | 77/62 |

| 4 | +3.00% | 70/69 |

| 5 | +2.24% | 75/65 |

| 6 | +1.28% | 70/69 |

| 7 | +3.19% | 75/65 |

| 8 | +2.16% | 71/68 |

| 9 | +1.96% | 75/65 |

| 10 (mega) | +0.72% | 70/70 |

Top winners and losers

ETFs

| PSUBNKBEES | +2.83% |

| INFRABEES | +2.70% |

| BANKBEES | +1.30% |

| NIFTYBEES | +0.50% |

| JUNIORBEES | -0.79% |

| GOLDBEES | -1.52% |

| CPSEETF | -2.36% |

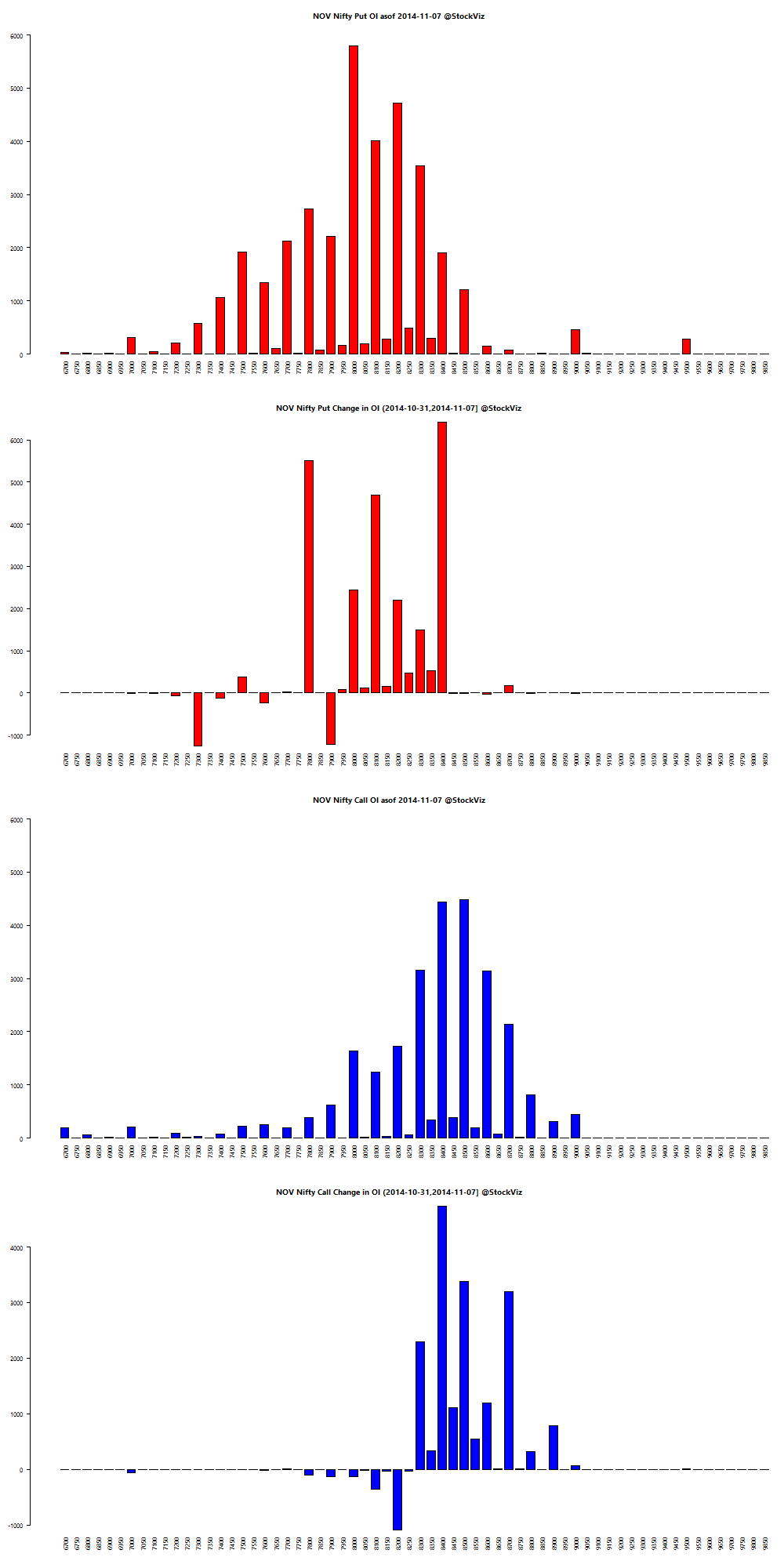

Nifty OI

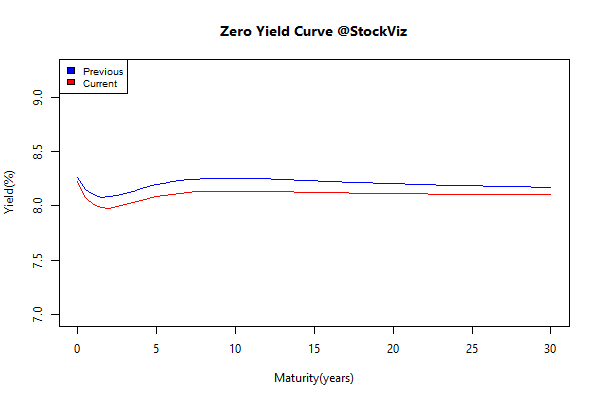

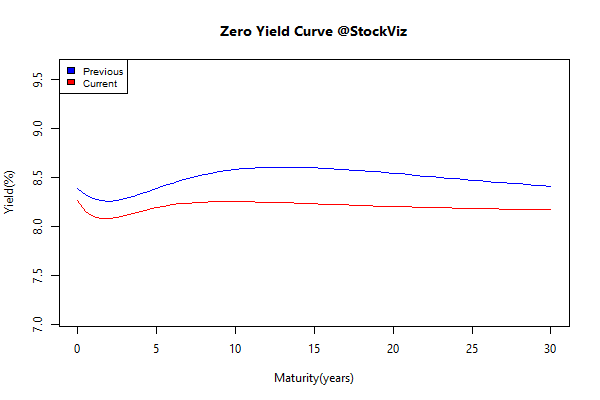

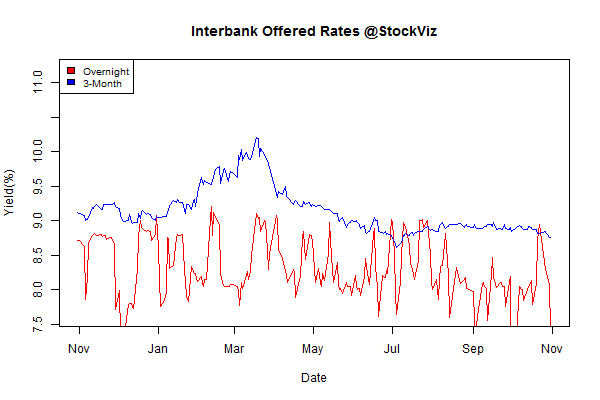

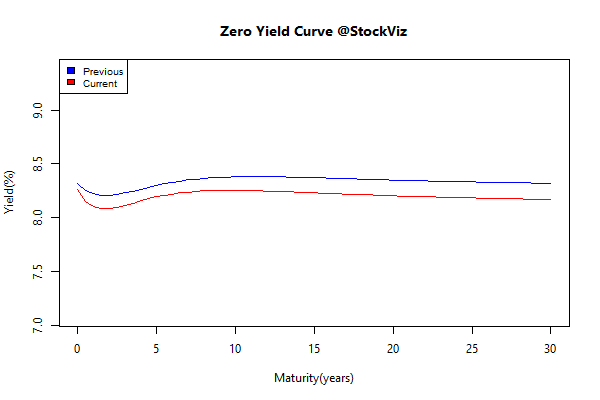

Yield Curve

Bond Indices

| Sub Index | Change in YTM | Total Return(%) |

|---|---|---|

| GSEC TB | -0.39 | +0.27% |

| GSEC SUB 1-3 | -0.21 | +0.68% |

| GSEC SUB 3-8 | -0.18 | +0.78% |

| GSEC SUB 8 | -0.07 | +0.81% |

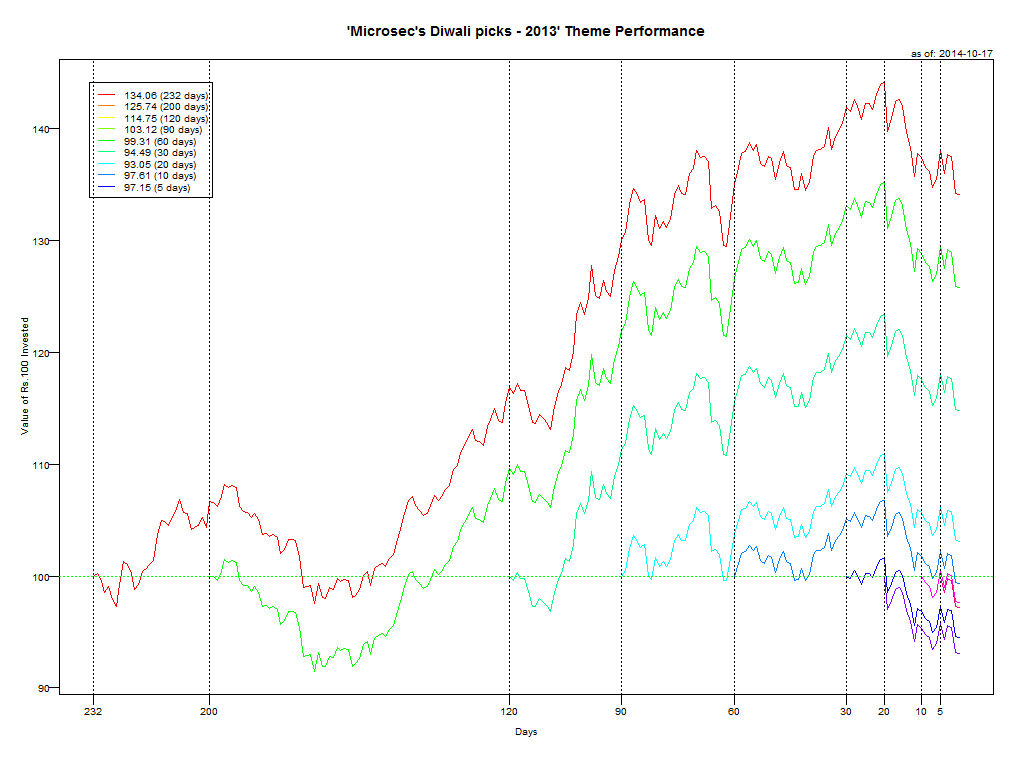

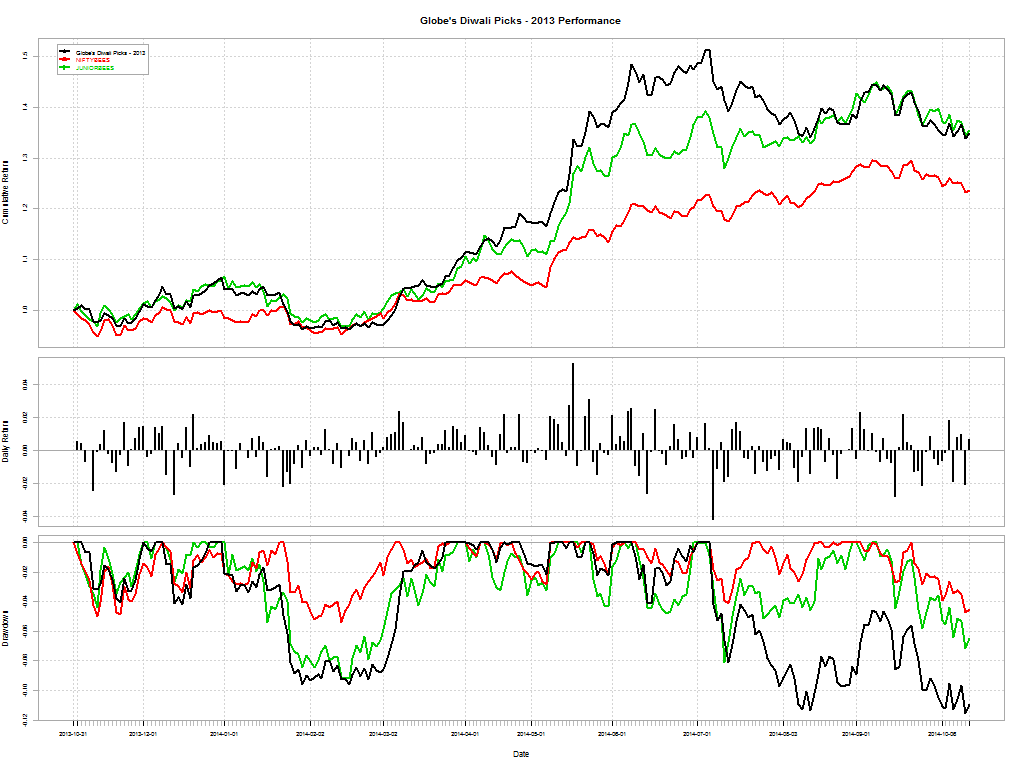

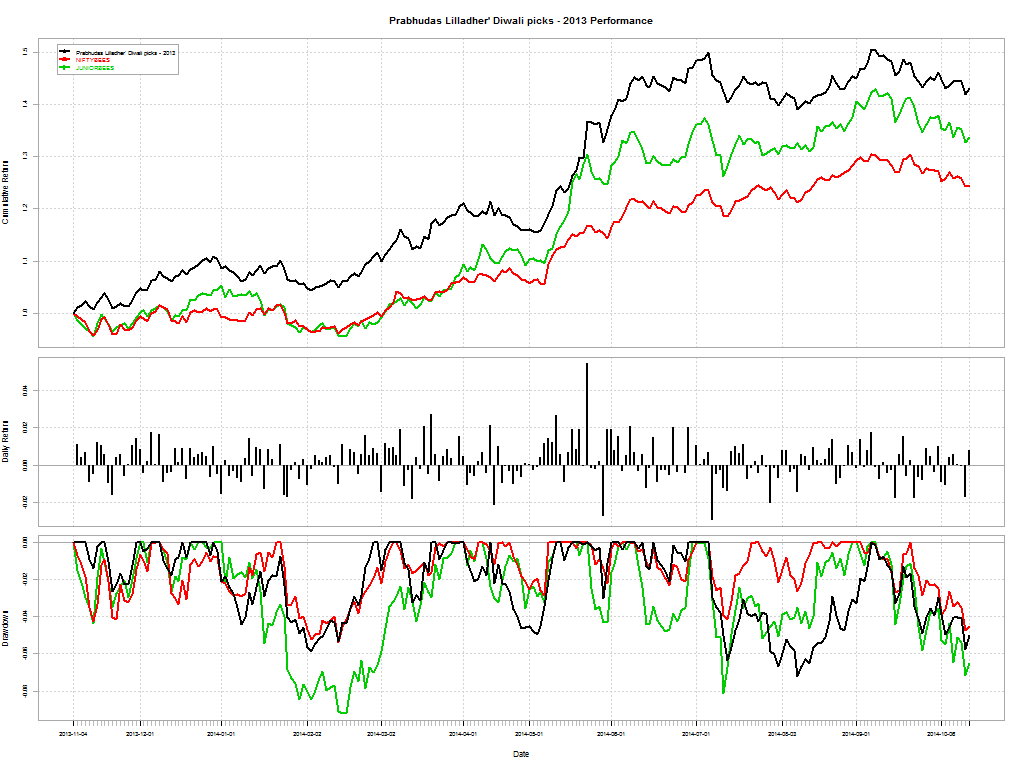

Theme Performance

| Momentum 200 | +7.17% |

| The Other Value | +2.95% |

| Auto | +2.84% |

| Growth with Moat | +2.48% |

| Market Fliers | +1.93% |

| Quality to Price | +1.70% |

| IT 3rd Benchers | +1.65% |

| Piotroski ROC Small Caps | +1.12% |

| Refract: PPFAS Long Term Value Fund | +1.02% |

| Market Elephants | +0.92% |

| Efficient Growth | +0.70% |

| Magic Formula Investing | +0.32% |

| Balance-sheet Strength | +0.19% |

| Industrial Value | +0.15% |

| Momentum Long-Short | +0.00% |

| Old Economy Value | -0.03% |

| CNX 100 50-Day Tactical | -0.15% |

| Financial Strength Value | -0.32% |

| ADAG Mania | -0.83% |

| Enterprise Yield | -1.37% |

Thought for the weekend

In poker, due to the inherently probabilistic nature of the game, technically perfect game-play can still lead to a loss, so players of those finite games make sure they keep two kinds of score: actual wins/losses, and a separate score that measures whether or not they played correctly, whatever the outcome.

This separation of technical score-keeping and outcome score-keeping leads to a more dangerous place: score-keeping becoming sufficient to sustain finite-game mindsets even when the game is ambiguous or unclear, and there is no agreement among players about what the goal is.

Money is the classic example of a mechanism for keeping score that is divorced from outcomes.

Read the whole thing here: Don’t Surround Yourself With Smarter People