Equities

| MINTs | |

|---|---|

| JCI(IDN) | +1.24% |

| INMEX(MEX) | +2.96% |

| NGSEINDX(NGA) | -4.11% |

| XU030(TUR) | +2.72% |

| BRICS | |

|---|---|

| IBOV(BRA) | +8.65% |

| SHCOMP(CHN) | +0.32% |

| NIFTY(IND) | +1.04% |

| INDEXCF(RUS) | +2.54% |

| TOP40(ZAF) | +0.26% |

Commodities

| Energy | |

|---|---|

| Brent Crude Oil | +1.43% |

| Ethanol | +2.70% |

| Heating Oil | -0.44% |

| Natural Gas | +4.52% |

| RBOB Gasoline | +1.21% |

| WTI Crude Oil | +1.54% |

| Metals | |

|---|---|

| Copper | -0.33% |

| Gold 100oz | +1.09% |

| Palladium | +2.78% |

| Platinum | +1.12% |

| Silver 5000oz | +3.21% |

Currencies

| MINTs | |

|---|---|

| USDIDR(IDN) | -0.55% |

| USDMXN(MEX) | +0.77% |

| USDNGN(NGA) | +3.17% |

| USDTRY(TUR) | -0.45% |

| BRICS | |

|---|---|

| USDBRL(BRA) | -3.02% |

| USDCNY(CHN) | -0.08% |

| USDINR(IND) | +0.09% |

| USDRUB(RUS) | -3.12% |

| USDZAR(ZAF) | -1.54% |

| Agricultural | |

|---|---|

| Cattle | +0.68% |

| Cocoa | +0.64% |

| Coffee (Arabica) | -1.43% |

| Coffee (Robusta) | -0.29% |

| Corn | -3.32% |

| Cotton | -0.47% |

| Feeder Cattle | -1.49% |

| Lean Hogs | -2.37% |

| Lumber | +4.66% |

| Orange Juice | +9.06% |

| Soybean Meal | -1.38% |

| Soybeans | +0.80% |

| Sugar #11 | +1.58% |

| Wheat | -2.14% |

| White Sugar | -0.43% |

Credit Indices

| Index | Change |

|---|---|

| Markit CDX EM | +0.15% |

| Markit CDX NA HY | -0.52% |

| Markit CDX NA IG | +1.57% |

| Markit CDX NA IG HVOL | +3.01% |

| Markit iTraxx Asia ex-Japan IG | +0.10% |

| Markit iTraxx Australia | +1.12% |

| Markit iTraxx Europe | +1.12% |

| Markit iTraxx Europe Crossover | +8.18% |

| Markit iTraxx Japan | +3.92% |

| Markit iTraxx SovX Western Europe | -0.58% |

| Markit LCDX (Loan CDS) | +0.00% |

| Markit MCDX (Municipal CDS) | +0.59% |

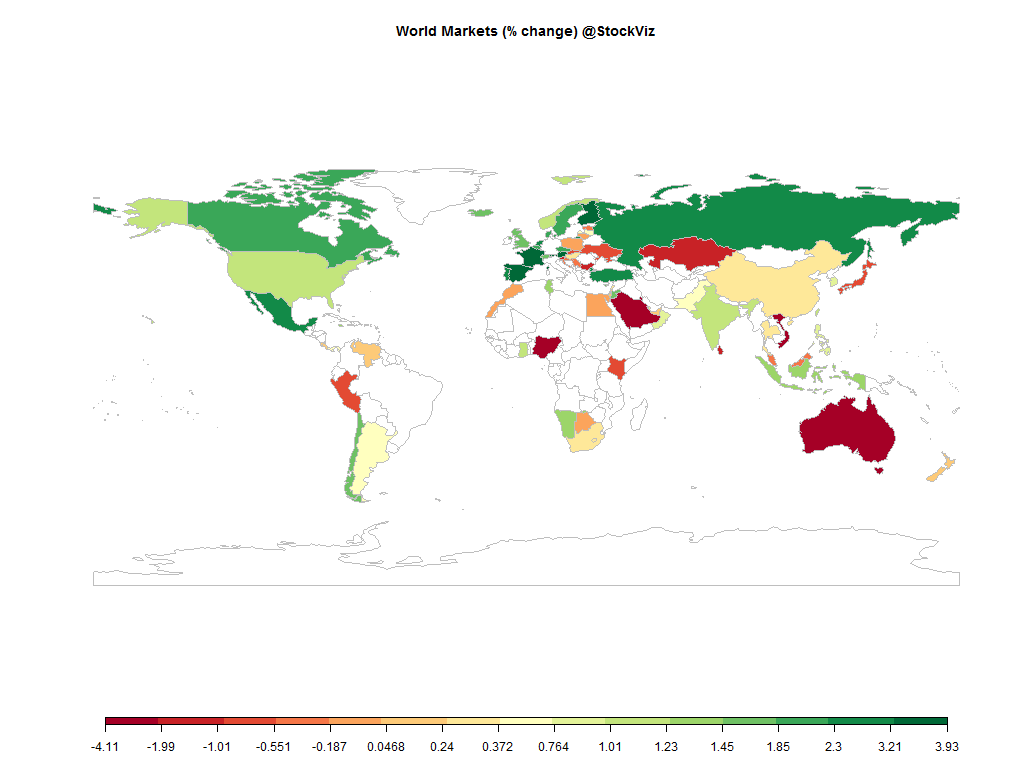

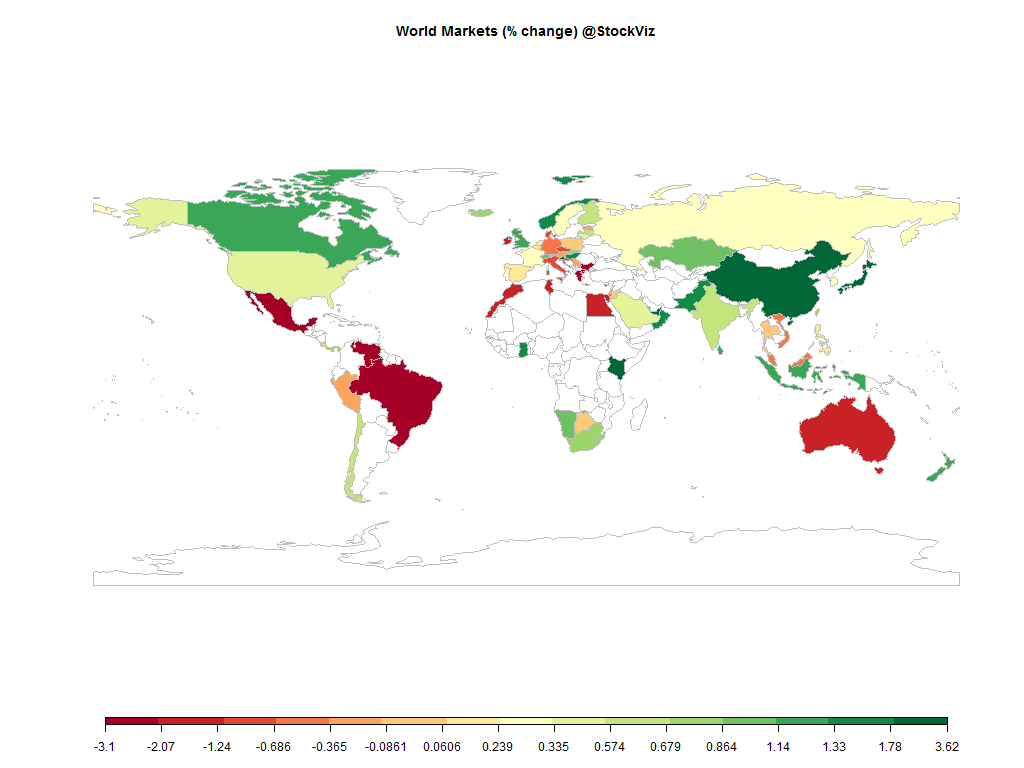

The SPX continued to make fresh highs but the best performing market was Brazil.

And, the dollar rally paused for the cause…

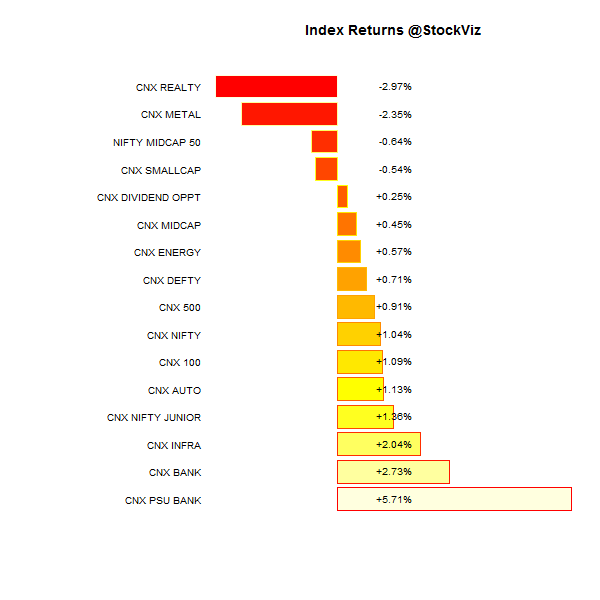

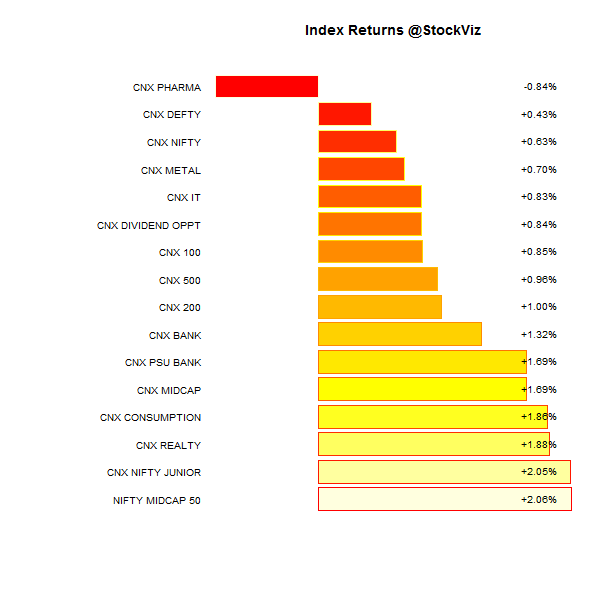

Index Returns

Market Cap Decile Performance

| Decile | Mkt. Cap. | Adv/Decl |

|---|---|---|

| 1 (micro) | -1.34% | 66/73 |

| 2 | -0.29% | 75/64 |

| 3 | -0.58% | 68/72 |

| 4 | -0.16% | 67/71 |

| 5 | -0.40% | 67/72 |

| 6 | +0.23% | 80/59 |

| 7 | +0.57% | 71/69 |

| 8 | +0.45% | 72/66 |

| 9 | +0.90% | 74/65 |

| 10 (mega) | +1.16% | 73/67 |

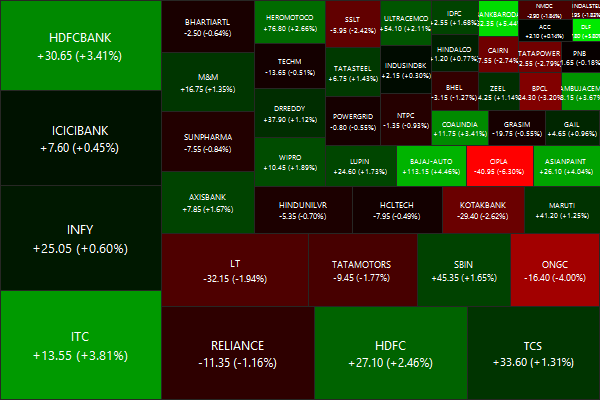

Top Winners and Losers

ETF Performance

| PSUBNKBEES | +5.99% |

| BANKBEES | +3.04% |

| INFRABEES | +1.80% |

| GOLDBEES | +1.70% |

| NIFTYBEES | +0.71% |

| JUNIORBEES | +0.64% |

| CPSEETF | -0.24% |

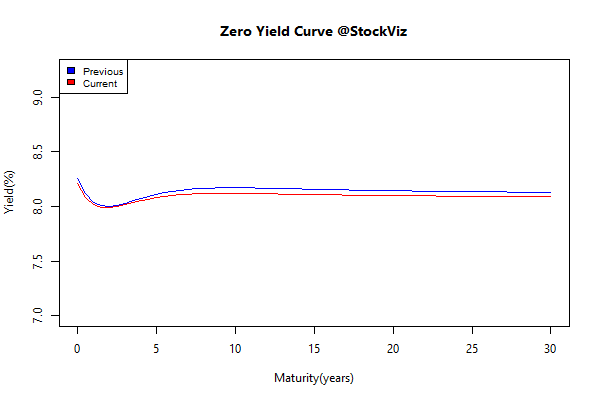

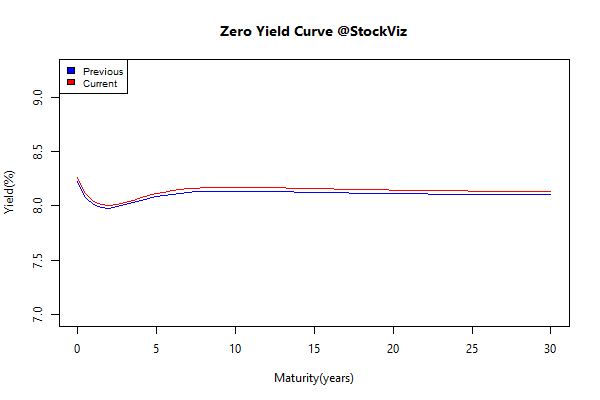

Yield Curve

Bond Indices

| Sub Index | Change in YTM | Total Return(%) |

|---|---|---|

| GSEC TB | -0.09 | +0.18% |

| GSEC SUB 1-3 | +0.04 | +0.26% |

| GSEC SUB 3-8 | +0.03 | +0.21% |

| GSEC SUB 8 | +0.01 | +0.19% |

Investment Theme Performance

| Growth with Moat | +5.57% |

| Auto | +4.89% |

| Market Elephants | +4.11% |

| ADAG Mania | +2.29% |

| Efficient Growth | +1.16% |

| IT 3rd Benchers | +1.14% |

| Magic Formula Investing | +0.97% |

| CNX 100 50-Day Tactical | +0.68% |

| Financial Strength Value | +0.67% |

| Balance-sheet Strength | +0.62% |

| Refract: PPFAS Long Term Value Fund | +0.41% |

| Momentum Long-Short | +0.00% |

| Piotroski ROC Small Caps | -0.15% |

| Enterprise Yield | -0.26% |

| Quality to Price | -0.44% |

| Industrial Value | -0.66% |

| Momentum 200 | -0.71% |

| Old Economy Value | -0.93% |

| The Other Value | -1.10% |

| Market Fliers | -1.60% |

Thought for the weekend

Emotions are life’s “beta”.

The concept that a stock moves with either more or less volatility than the market seems a neat analog for life. Sometimes you are the windshield, sometimes you’re the bug. We’ve all had beta 3 days, both for good or for bad. But no one except a finance person would try to quantify that with a number.

“How was your day, honey?”

Answer: “Oh, a gap up open when I got a new customer to trade with me, but a lousy close when the market went nuts after the Fed meeting. Definitely a beta 2 day. Hopefully tomorrow will be calmer.”

Source: Nick Colas: Ten Signs You’ve Been on Wall Street Too Long