This is the second of three posts by Abhishek Preetam on why he is bullish on the yellow metal. Please welcome him to StockViz and follow him on twitter @AbhiPreetam

Throughout history, countries with high debt-to-GDP ratios are seen to have trouble getting back to their pre-crisis growth story. They can’t grow enough to repay their debts, and have little choice but to default.

A sovereign default usually comes in one of the following three forms:

- The country willfully does not repay, force its debtors to take a haircut to reduce its debt burden, readjust its policies and starts growing again (Russia, Argentina).

- The country starts printing more money and repays its debtors in worthless new currency (Brazil in the late 1980’s and early 1990’s)

- The country devalues its currency (Iceland) and goes through the trouble of cutting expenses, high unemployment levels, and decreased GDP growth in the short run and comes up well at last.

In all the these scenarios, countries will have high inflation for a brief time (brought on by increased money supply). During this period of hyperinflation, whoever is left holding the country’s debt (or its currency), gets wiped out. But, once the readjusted economy gets back on its foot, sound fiscal and monetary policies puts economic growth back on track.

|

Countries

|

Percent of GDP

|

Amt in (T = Trillion$, B = Billion$)

|

GDP (T = Trillion$, B = Billion$)

|

Per capita (in $)

|

|

Ireland

|

1382%

|

2.38 T

|

172.3 B

|

566756

|

|

UK

|

413.3%

|

8.981 T

|

2.173 T

|

146953

|

|

Switzerland

|

401.9%

|

1.304 T

|

324.5 B

|

171528

|

|

Netherlands

|

376.3%

|

2.55 T

|

676.9 B

|

152380

|

|

Belgium

|

335.9%

|

1.324 T

|

394.3 B

|

127197

|

|

Denmark

|

310%

|

626.1 B

|

201.7 B

|

113826

|

|

Sweden

|

282.2%

|

1.001 T

|

354.7 B

|

110479

|

|

Finland

|

271.5%

|

505.06 B

|

186 B

|

96197

|

|

Austria

|

261%

|

867.14 B

|

332 B

|

105616

|

|

Norway

|

251%

|

640.7 B

|

255.3 B

|

137476

|

|

HongKong

|

250.4%

|

815.65 B

|

325.8 B

|

115612

|

|

France

|

250%

|

5.37 T

|

2.15 T

|

83781

|

|

Portugal

|

223.6%

|

552.23 B

|

247 B

|

51572

|

|

Germany

|

185.1%

|

5.44 T

|

2.94 T

|

51572

|

|

Greece

|

182.2%

|

579.7 B

|

318.1 B

|

53984

|

|

Spain

|

179.4%

|

2.46 T

|

1.37 T

|

60614

|

|

Italy

|

146.6%

|

2.602 T

|

1.77 T

|

44760

|

|

Australia

|

138.9%

|

1.23 T

|

882.4 B

|

57641

|

|

Hungary

|

120.1%

|

225.54 B

|

187.6 B

|

22739

|

|

USA

|

101.1%

|

14.825 T

|

14.66 T

|

48258

|

During the period of readjustment, there is usually a rush into hard assets (gold and commodities in general) whose value cannot be touched by the devaluation/default. Let’s look at the present debt to GDP ratio of various world economies.

We all are aware of Greece’s condition and its upcoming obligation to start making payments on its earlier debts. According to the updates from the Greek government this October, they were not in line with the necessary economic reforms and are also predicted to be stuck in the same rut of economic stagnation in the coming months.

Currency devaluation could have been a way out for Greece. However, it is not feasible for EU economies (thanks to the Euro), and big economies like US. The Euro cannot be devalued because of the diverse set of countries involved, and the impact it will have on the other well off countries (Germany, for example). If Greece, decides to devalue their currency alone, they will have to move out of the union, which will have serious impact on its trade and economic relation with other countries.

The US could get rid of its high debt load by printing more money. This will help it get rid of its debt in the short run, but the dollar will lose its value compared to other world currencies. This also would mean that no other country will buy US bonds and hence won’t lend to US in the future. In short, the USD will lose its reserve currency status and result in a permanent global shift in power.

Looking at the present conditions and hoping that the current turmoil will be over soon seems too optimistic. We seem to be headed down a path that involves Greek default, maybe the abandonment of the Euro and more money-printing in the US.

Some strategists believe that market forgets these issues pretty fast. Just like when Brazil, that had lot of debt during the late 80’s and early 90’s, hyper inflated its way to a 7% Debt-to-GDP ratio. Investors quickly put the past behind and made Brazil one of the shining stars of world’s emerging economies. This story can happen in the case of US as well.

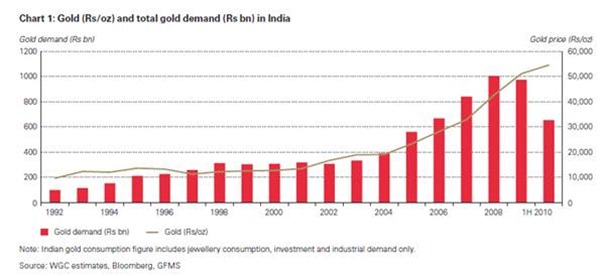

No matter what the outcome, during periods of uncertainty and hyperinflation, investors will look toward Gold as a haven and a preserve of wealth. This looks to me like a pretty good factor driving demand and yet another reason for gold prices to surge. Investors the world over increased their allocation to the yellow metal starting in 2008, and the current lull in the market after the Aug 31st correction in prices may provide investors with enough reason to start buying again.

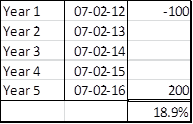

Spend 100 now, get 200 back 5 years from now. If you run this through the XIRR function on Excel, it shows that your reward is a 19% Internal Rate of Return. Sound good? Would you take this rate of return on gold? Yes. How about teak plantations? Perpetual motion machine?

Spend 100 now, get 200 back 5 years from now. If you run this through the XIRR function on Excel, it shows that your reward is a 19% Internal Rate of Return. Sound good? Would you take this rate of return on gold? Yes. How about teak plantations? Perpetual motion machine?