You often hear this whenever someone is trying to sell you something: “Don’t worry, this investment will double in 5 years” or “You will not lose money on this.” But how can you tell if it’s the right investment for you? When you look at any investment, be it real estate, gold or stocks, you need to consider two things: risk and reward.

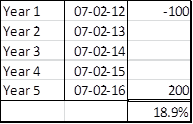

So lets dissect the first statement: what does doubling in 5 years really mean? Your cashflow looks something like this:

Spend 100 now, get 200 back 5 years from now. If you run this through the XIRR function on Excel, it shows that your reward is a 19% Internal Rate of Return. Sound good? Would you take this rate of return on gold? Yes. How about teak plantations? Perpetual motion machine?

Spend 100 now, get 200 back 5 years from now. If you run this through the XIRR function on Excel, it shows that your reward is a 19% Internal Rate of Return. Sound good? Would you take this rate of return on gold? Yes. How about teak plantations? Perpetual motion machine?

Here’s where risk plays a part in helping you gauge whether something is a good investment or not. Gold, at a 19% IRR is way better than land at the same IRR. Land at 19% is better than teak plantations at the same rate and so on. The way you figure out if you are being compensated for the risk you are taking is by comparing it with the risk-free rate for the same time period. For example, if you keep the same money in a bank fixed deposit, you’ll earn about 9% for 5 years. So the additional risk that you are taking to get to the 19% return is worth 10%.

Negative returns are those that grow less than the base rate. Getting 5% when the risk-free rate is 9% is losing money. If a stock goes up by 10% while the NIFTY 50 goes up the 12%, that’s a bad stock pick. You always need to compare the returns you get to a risk-free or passive investment in order to figure out if it makes sense. In order to compare investments across different areas, people smarter than me have come up with a variety of metrics (each of which are flawed in its own unique way) and the concept of “risk adjusted returns” which I will attempt to explain in layman terms in the future.

Tomorrow’s post will discuss the effect of inflation and transaction costs on real returns. If you have any questions, please email me: abhi@stockviz.biz

Comments are closed, but trackbacks and pingbacks are open.