The last few weeks have been brutal to cash-only equity investors. The NIFTY has gone nowhere even while swinging wildly on a daily basis. Is there a way to turn a profit given what has been going on?

Yes! With the help of option strategies it is possible to profit from stocks you expect to go side-ways. Here’s what we did.

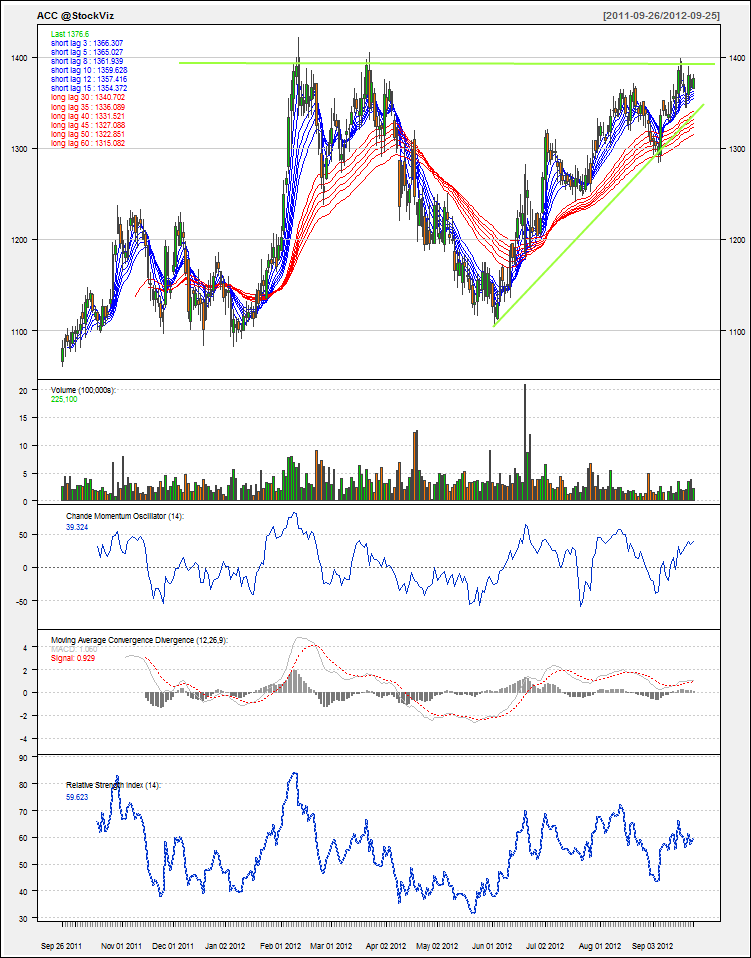

StockViz Option Ideas drew our attention to the ACC Long Call Butterfly around the 10th of December. The stock was under a pennant formation, and was on a decline from its 5 day high of Rs. 1445. With Bollinger bands enveloping 1450 and 1360 levels, there was a strong possibility that that stock was going to be range-bound for a bit.

We entered a long call butterfly trade for December expiry. With an outlay of Rs. 26,750 we bought 5 contracts (market lot of 250).

The payoff chart for our butterfly looked something like this:

With ACC ending at Rs. 1402 at option expiry, the position made us Rs. 9,950 (38%) profit in just 17 days even as equity holders sucked wind.

Here’s what your New Year’s resolution should be:

[stockquote]ACC[/stockquote]