MOMENTUM

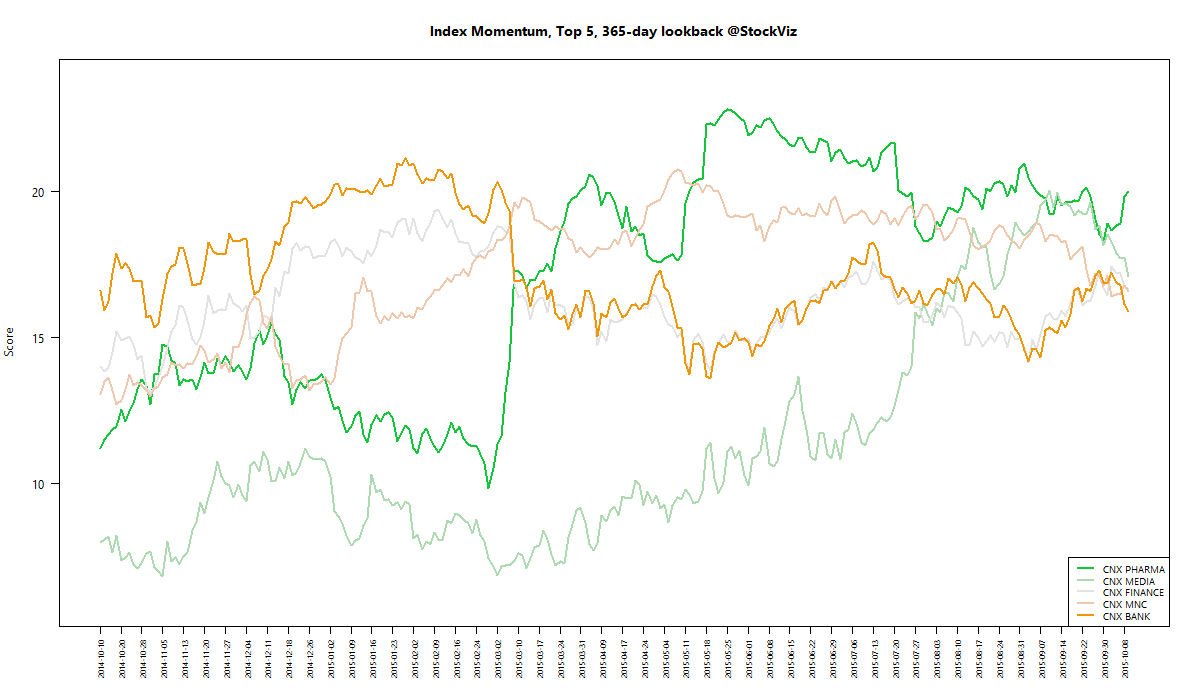

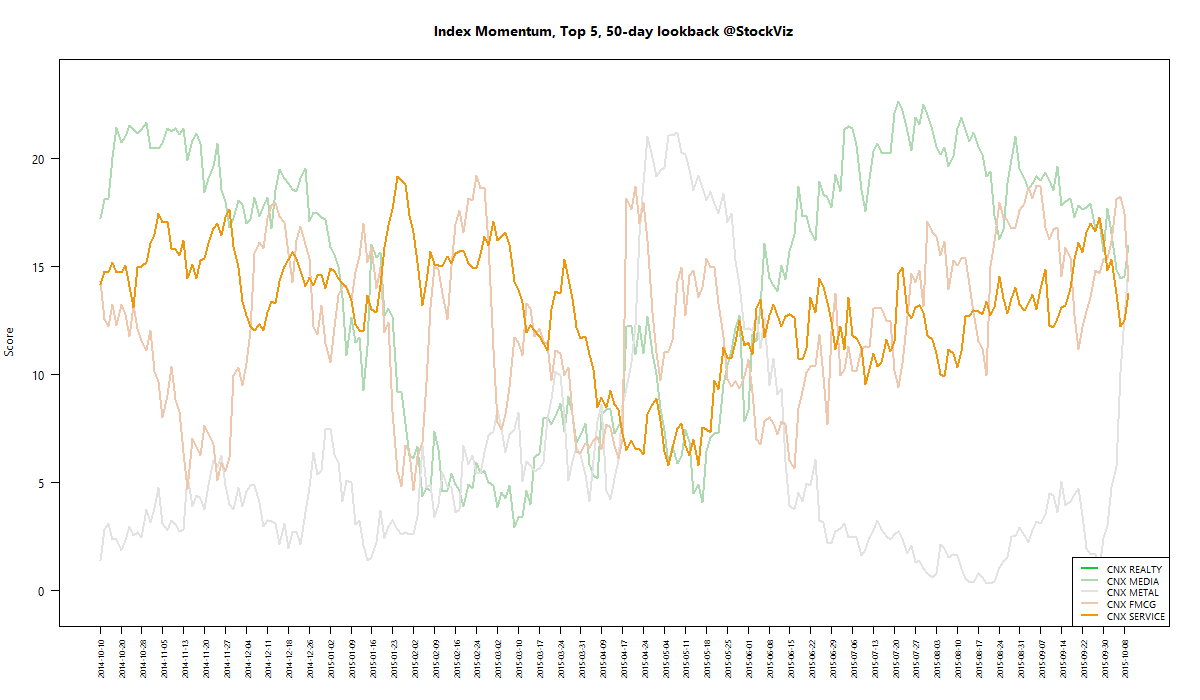

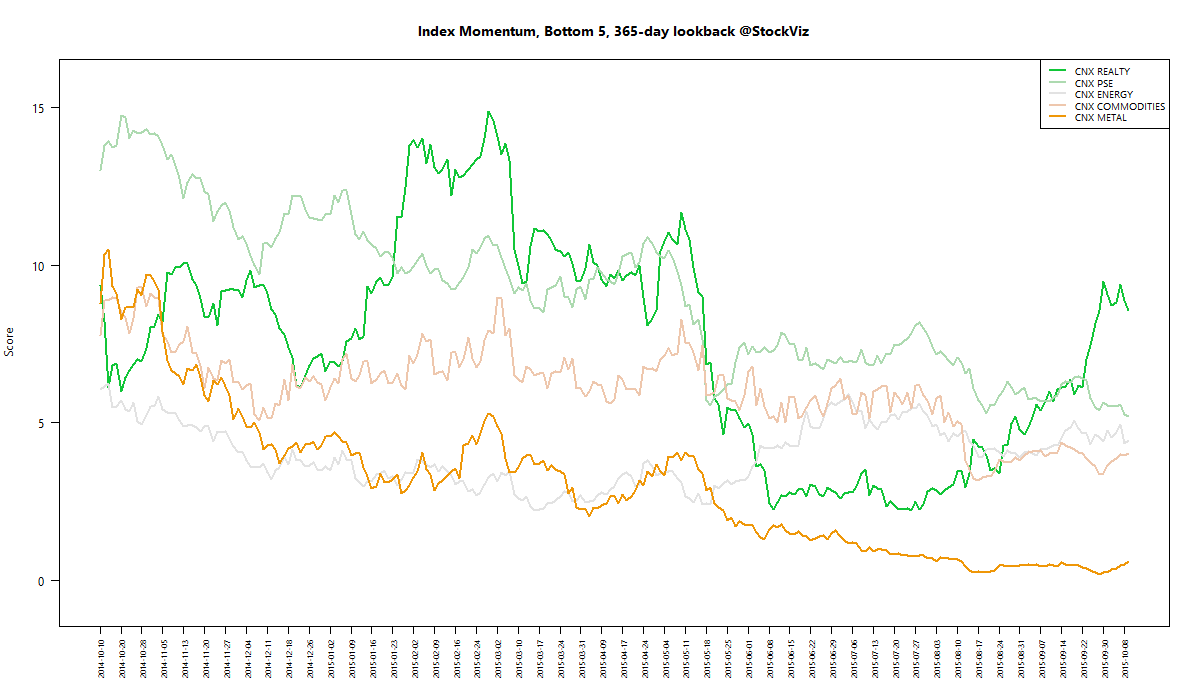

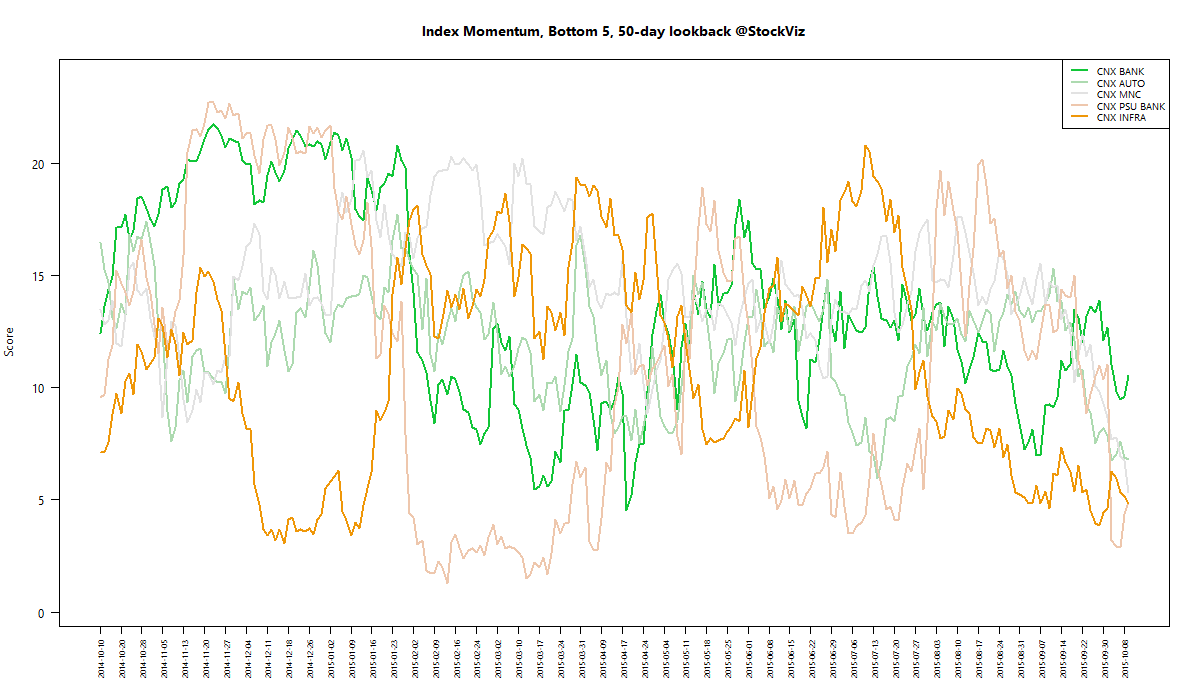

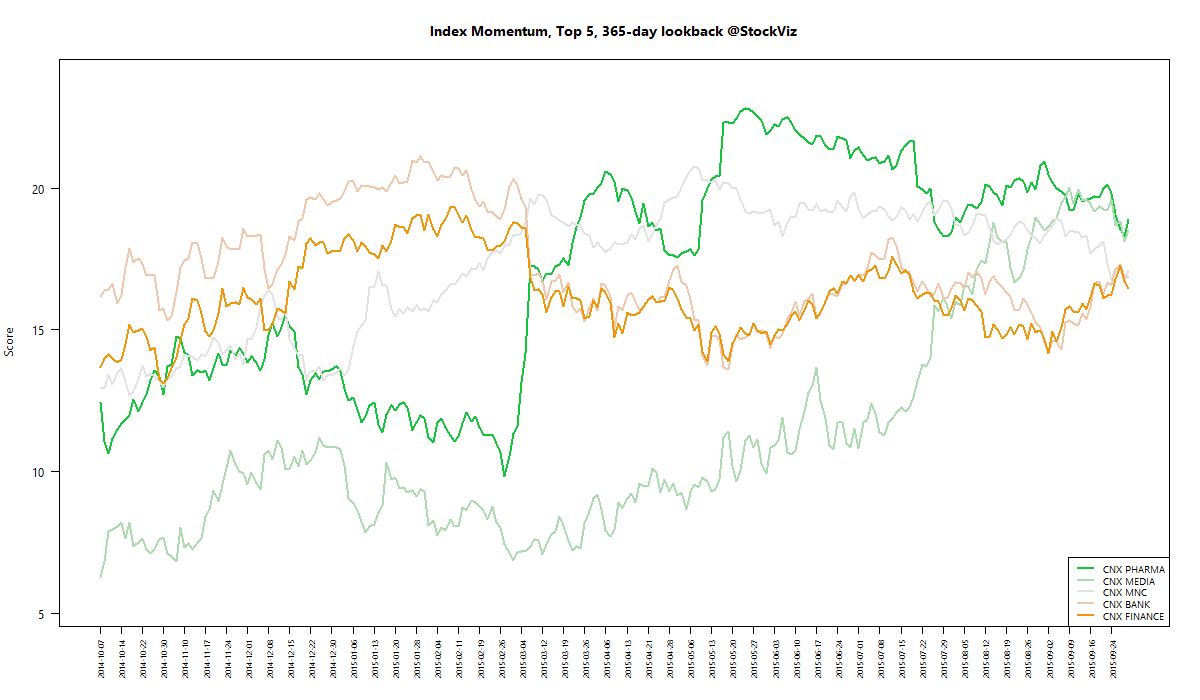

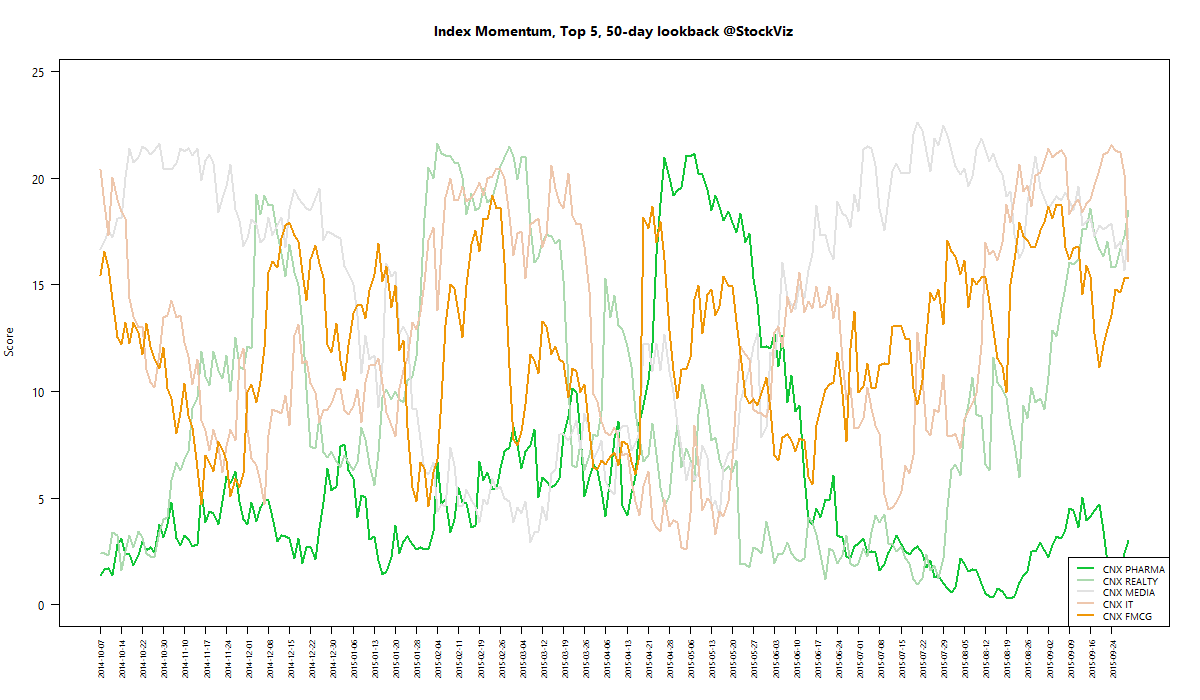

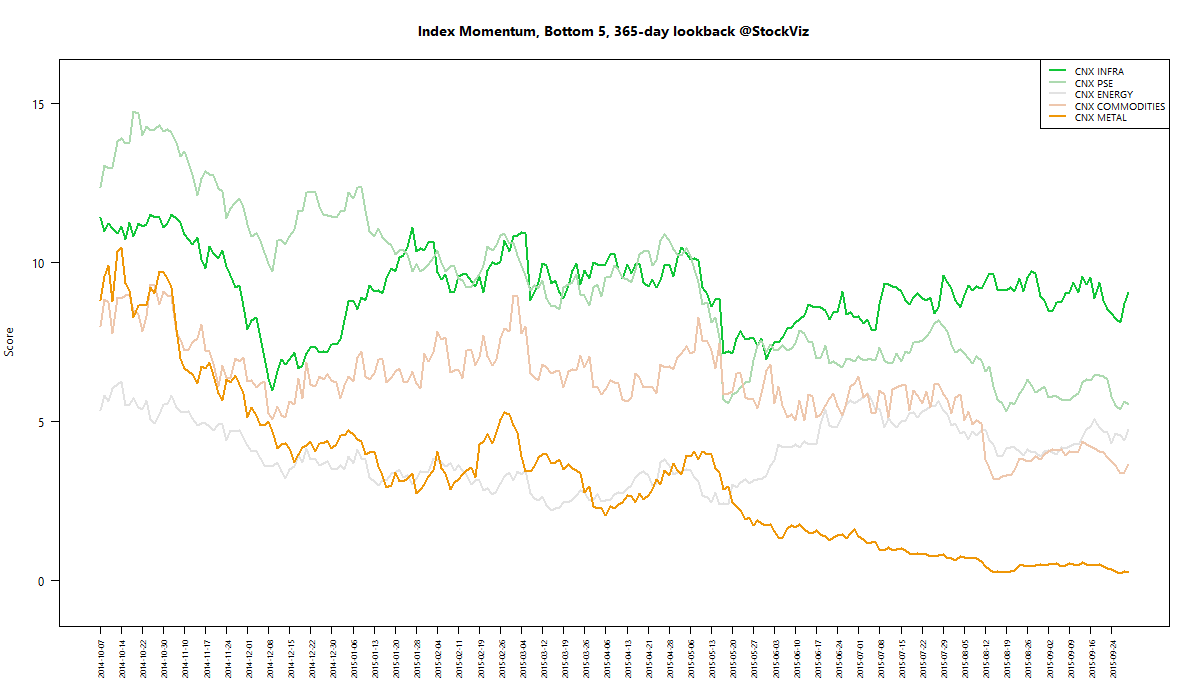

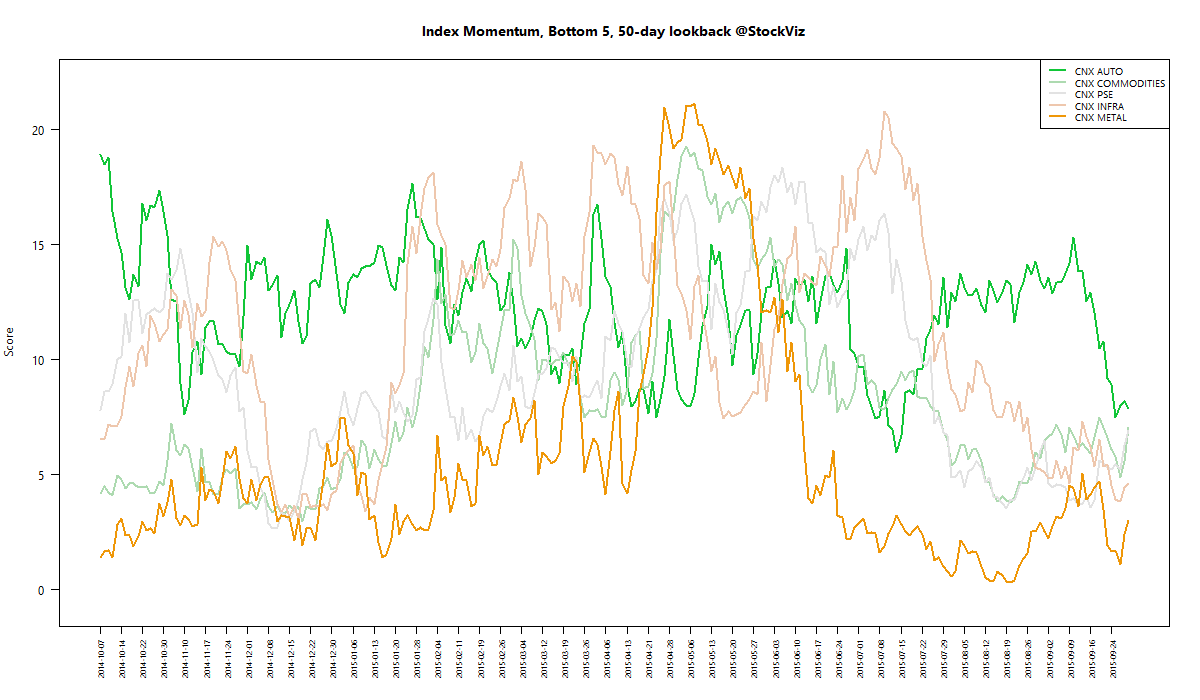

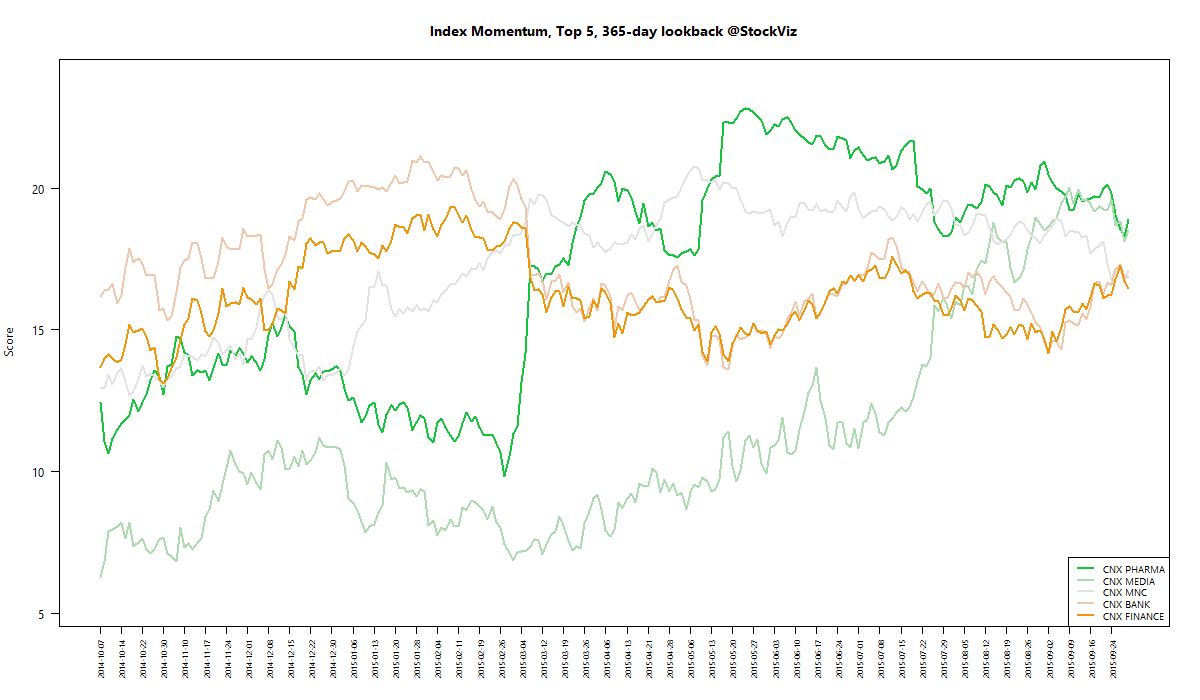

We run our proprietary momentum scoring algorithm on indices just like we do on stocks. You can use the momentum scores of sub-indices to get a sense for which sectors have the wind on their backs and those that are facing headwinds.

Traders can pick their longs in sectors with high short-term momentum and their shorts in sectors with low momentum. Investors can use the longer lookback scores to position themselves using our re-factored index Themes.

You can see how the momentum algorithm has performed on individual stocks here.

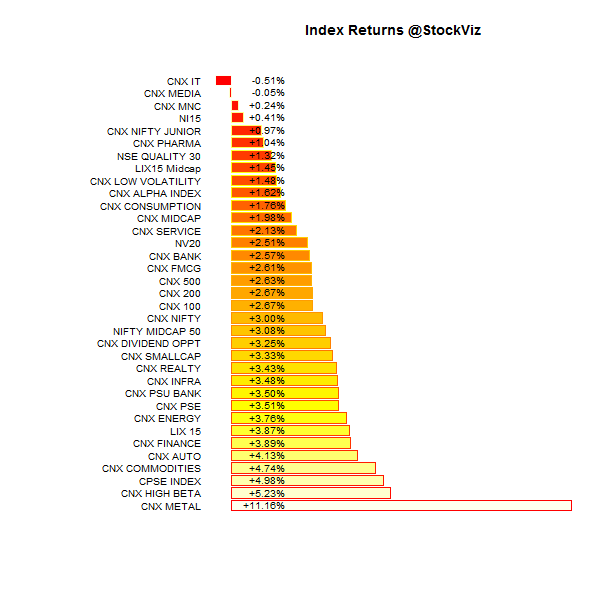

Here are the best and the worst sub-indices:

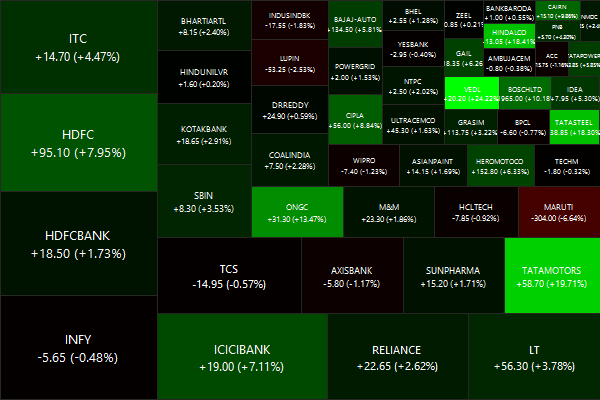

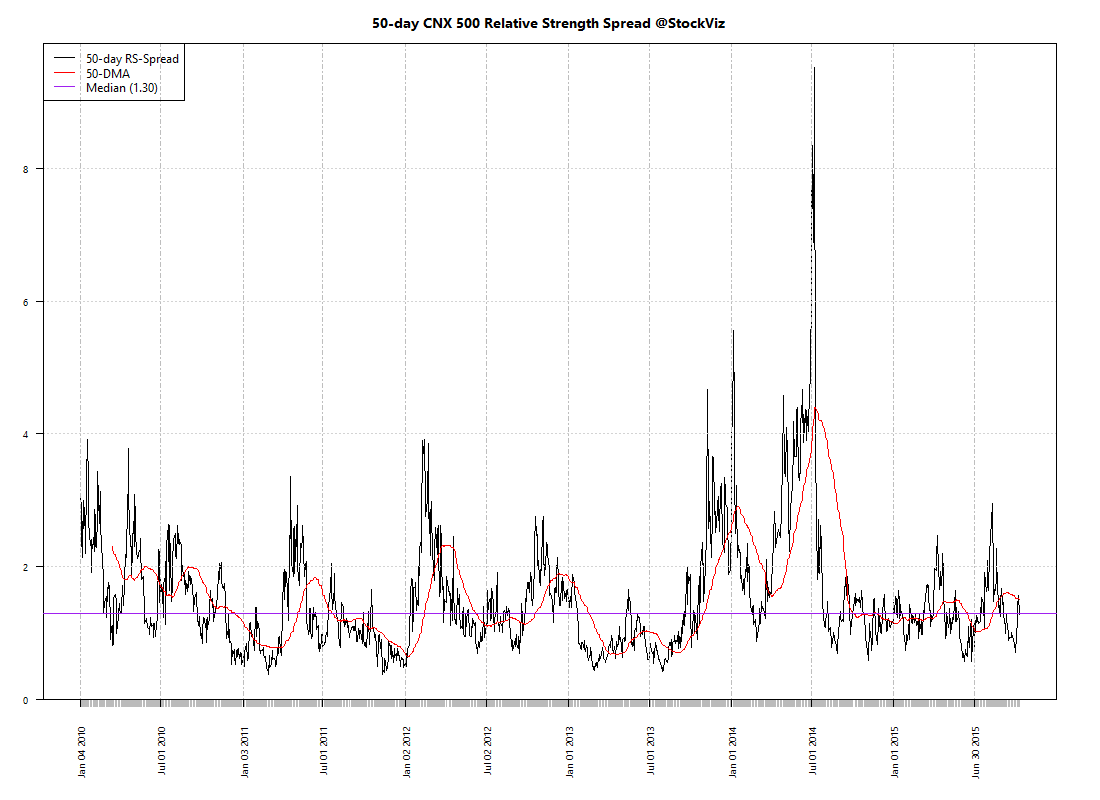

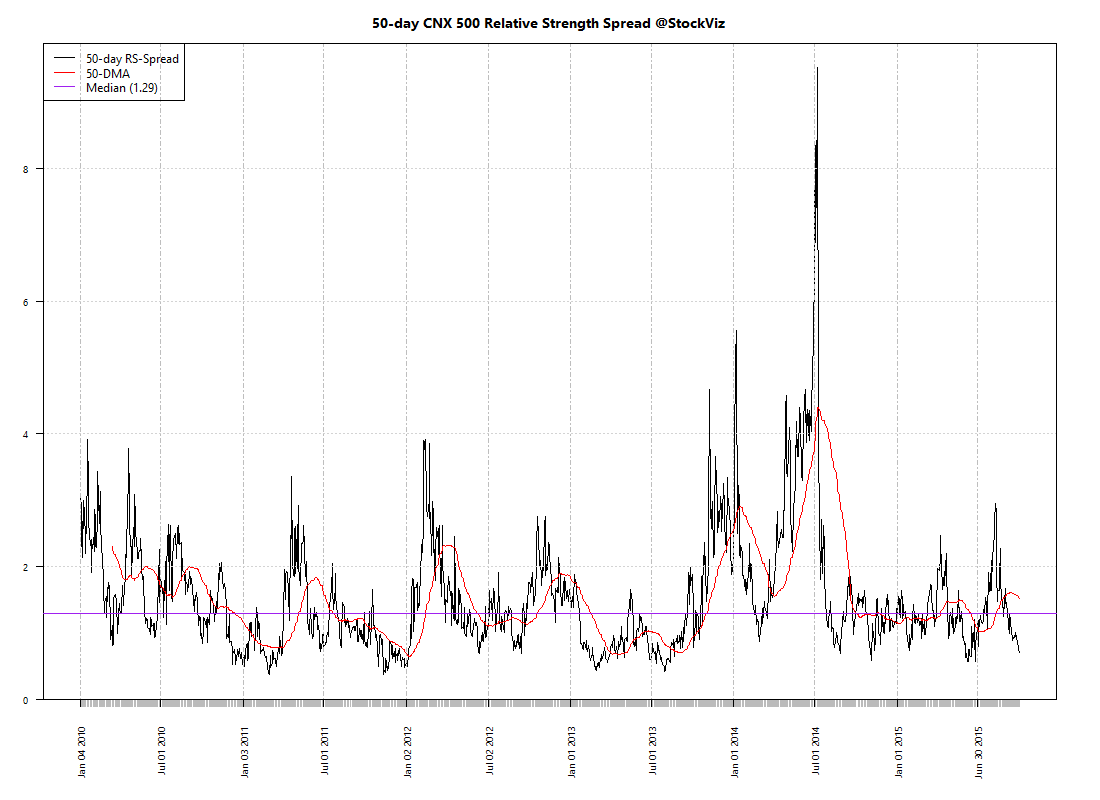

Relative Strength Spread

Refactored Index Performance

50-day performance, from July 22, 2015 through October 01, 2015:

Trend Model Summary

| Index |

Signal |

% From Peak |

Day of Peak |

| CNX AUTO |

SHORT |

15.03

|

2015-Jan-27

|

| CNX BANK |

SHORT |

16.57

|

2015-Jan-27

|

| CNX COMMODITIES |

LONG |

38.24

|

2008-Jan-04

|

| CNX CONSUMPTION |

SHORT |

7.34

|

2015-Aug-05

|

| CNX ENERGY |

LONG |

36.33

|

2008-Jan-14

|

| CNX FMCG |

LONG |

10.30

|

2015-Feb-25

|

| CNX INFRA |

LONG |

54.62

|

2008-Jan-09

|

| CNX IT |

SHORT |

87.57

|

2000-Feb-21

|

| CNX MEDIA |

SHORT |

18.02

|

2008-Jan-04

|

| CNX METAL |

LONG |

69.95

|

2008-Jan-04

|

| CNX MNC |

SHORT |

9.50

|

2015-Aug-10

|

| CNX NIFTY |

SHORT |

11.62

|

2015-Mar-03

|

| CNX PHARMA |

SHORT |

4.99

|

2015-Apr-08

|

| CNX PSE |

LONG |

35.62

|

2008-Jan-04

|

| CNX PSU BANK |

SHORT |

42.81

|

2010-Nov-05

|

| CNX REALTY |

SHORT |

90.62

|

2008-Jan-14

|

| CNX SERVICE |

SHORT |

10.92

|

2015-Mar-03

|

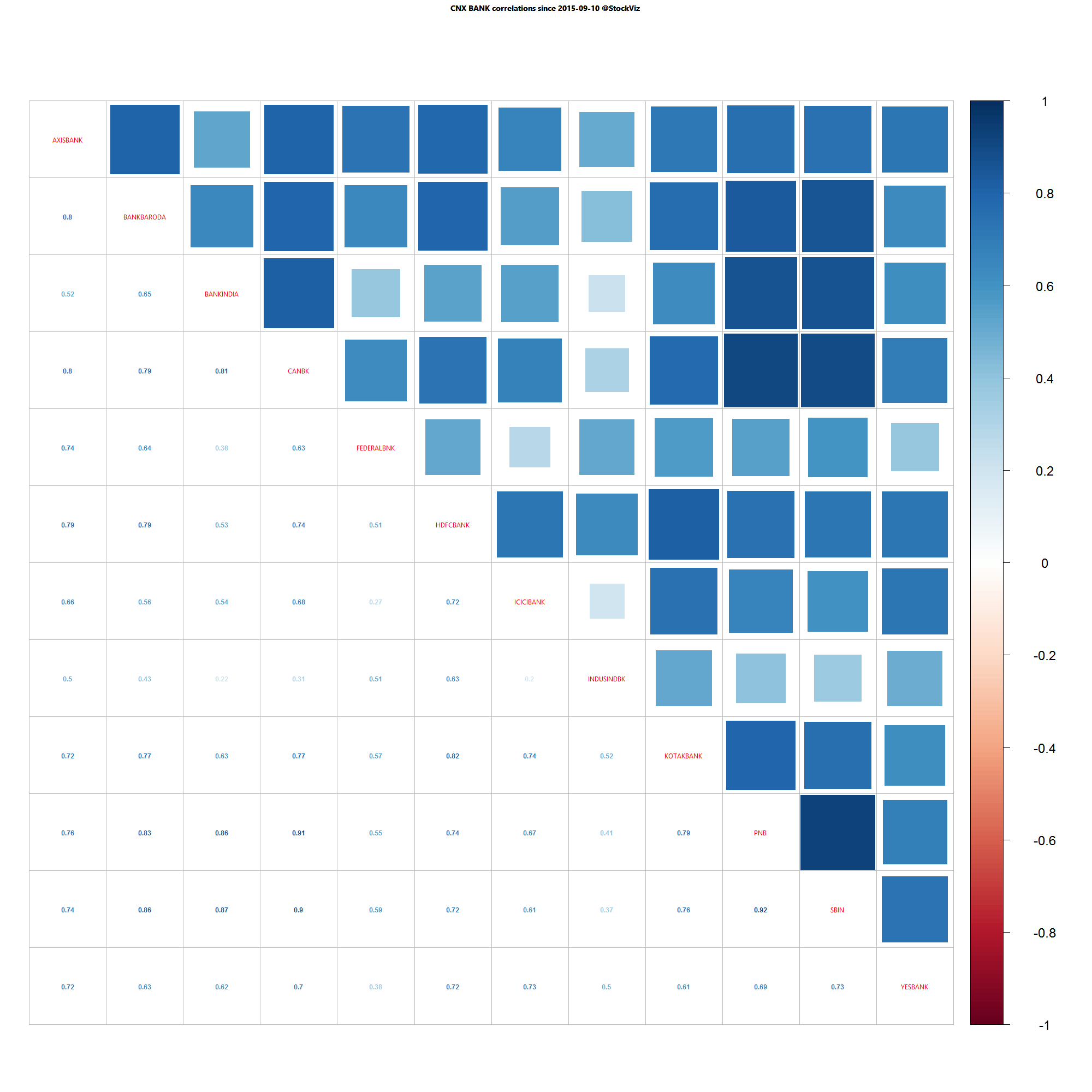

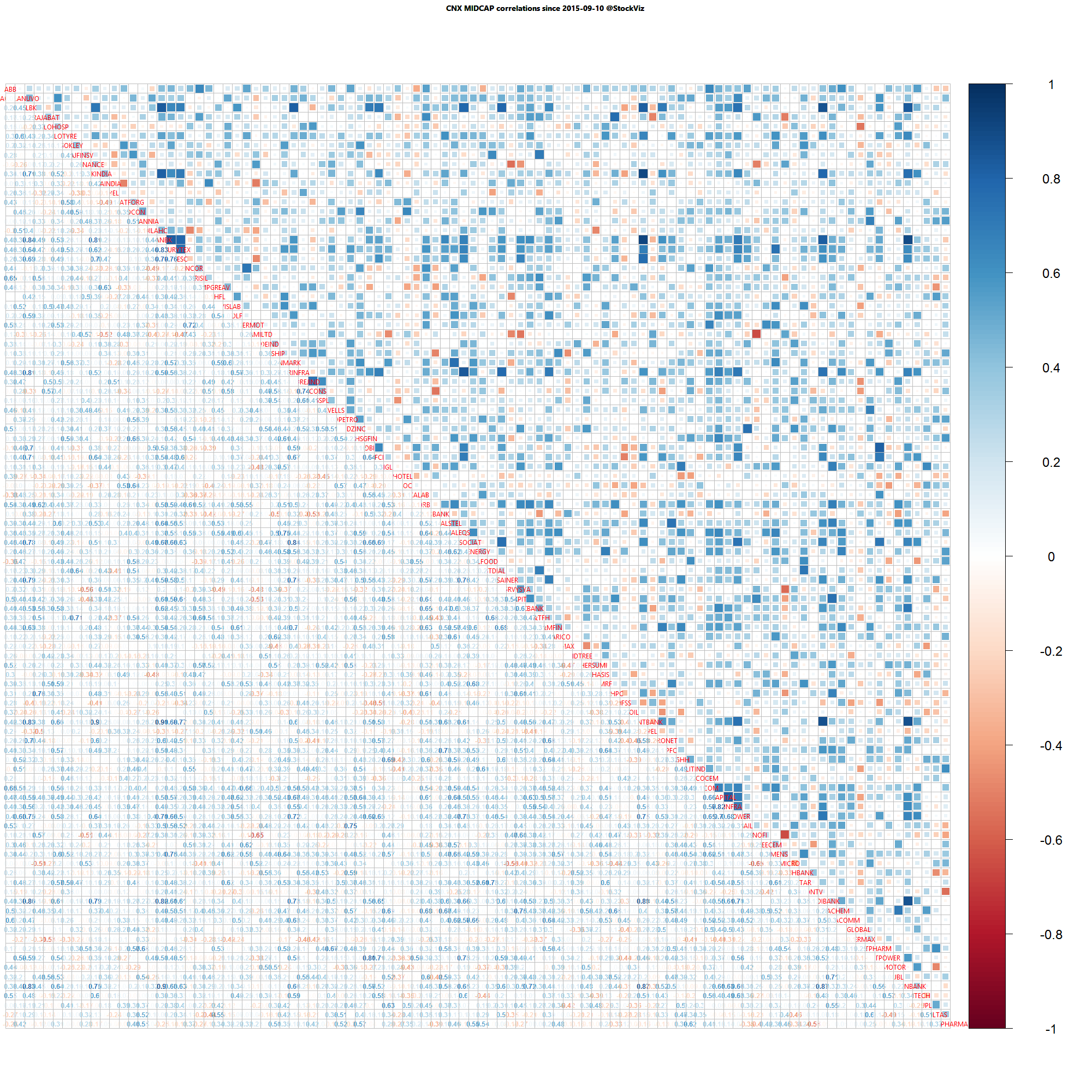

Dispersion is around its all-time lows – momentum algos will be struggling to find a toe-hold. Besides, the only thing that has worked in the last few months is long-only pharma and IT – both long USD trades.