Equities

Commodities

| Energy |

| Brent Crude Oil |

-0.96% |

| Ethanol |

-5.53% |

| Heating Oil |

-0.32% |

| Natural Gas |

+4.81% |

| RBOB Gasoline |

+2.21% |

| WTI Crude Oil |

+1.35% |

| Metals |

| Copper |

-1.62% |

| Gold 100oz |

+0.03% |

| Palladium |

-3.99% |

| Platinum |

-2.64% |

| Silver 5000oz |

-2.23% |

| Agricultural |

| Cattle |

+1.71% |

| Cocoa |

+0.85% |

| Coffee (Arabica) |

+3.76% |

| Coffee (Robusta) |

+1.24% |

| Corn |

-2.56% |

| Cotton |

-3.36% |

| Feeder Cattle |

+1.22% |

| Lean Hogs |

+0.71% |

| Lumber |

-0.40% |

| Orange Juice |

+0.70% |

| Soybean Meal |

-5.19% |

| Soybeans |

-4.96% |

| Sugar #11 |

+14.81% |

| Wheat |

+0.11% |

| White Sugar |

+4.54% |

Credit Indices

| Index |

Change |

| Markit CDX EM |

+0.47% |

| Markit CDX NA HY |

-0.62% |

| Markit CDX NA IG |

+2.16% |

| Markit CDX NA IG HVOL |

+4.37% |

| Markit iTraxx Asia ex-Japan IG |

+2.42% |

| Markit iTraxx Australia |

+3.32% |

| Markit iTraxx Europe |

+1.58% |

| Markit iTraxx Europe Crossover |

+10.58% |

| Markit iTraxx Japan |

+2.76% |

| Markit iTraxx SovX Western Europe |

-1.81% |

| Markit LCDX (Loan CDS) |

-0.04% |

| Markit MCDX (Municipal CDS) |

+1.93% |

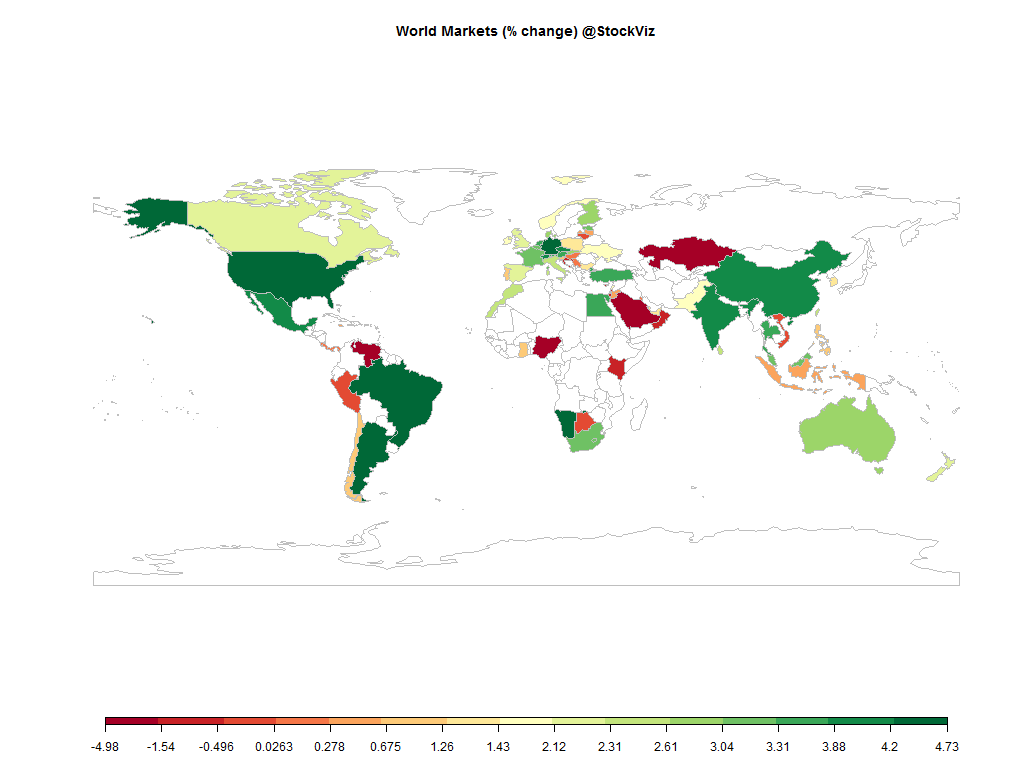

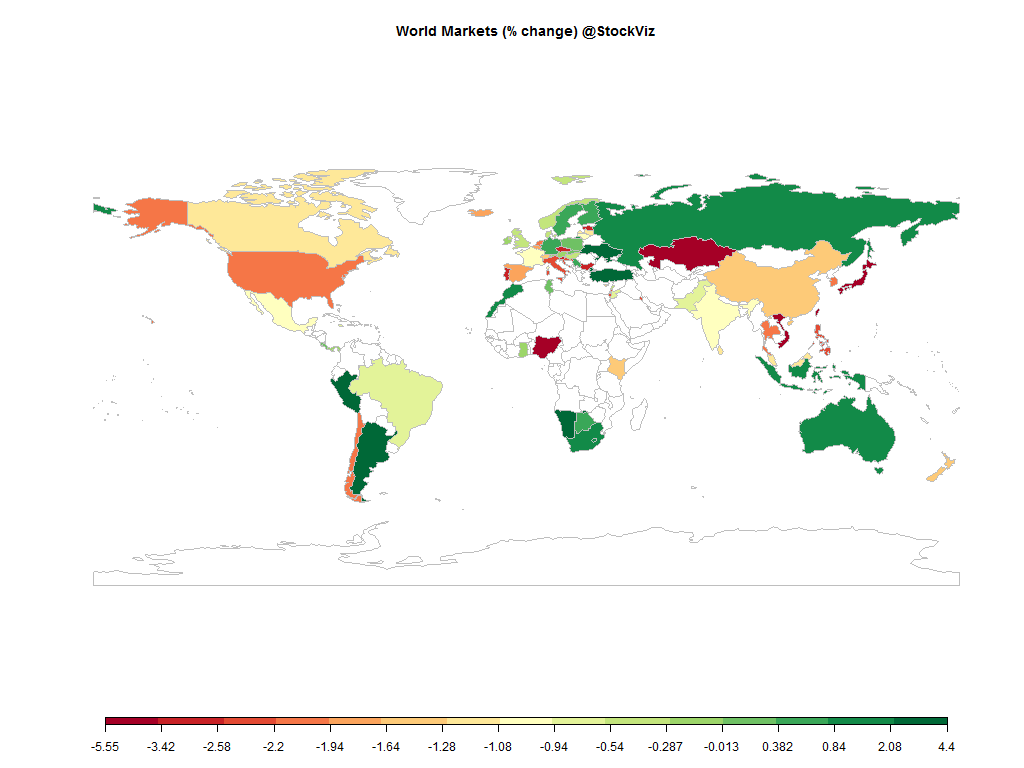

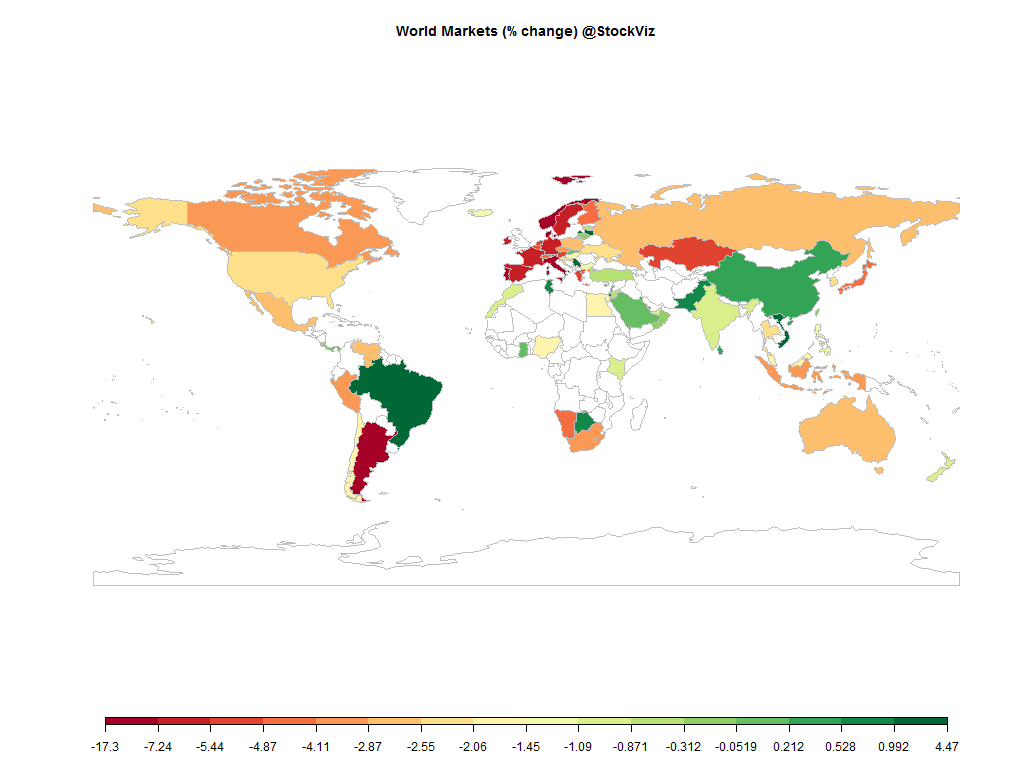

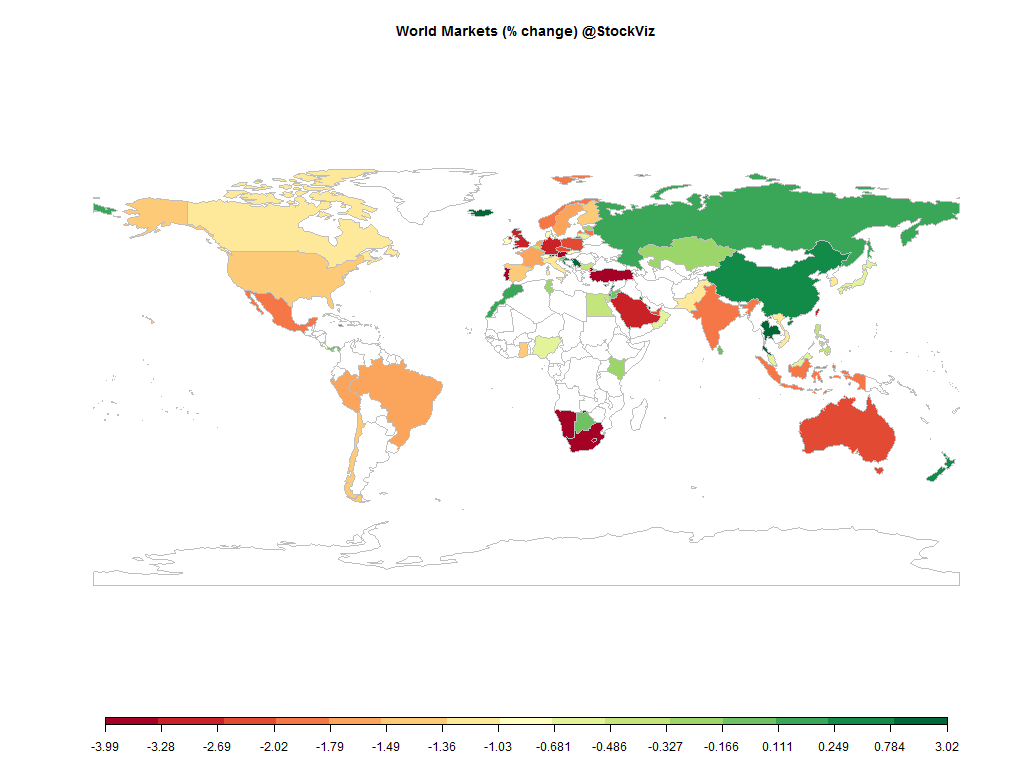

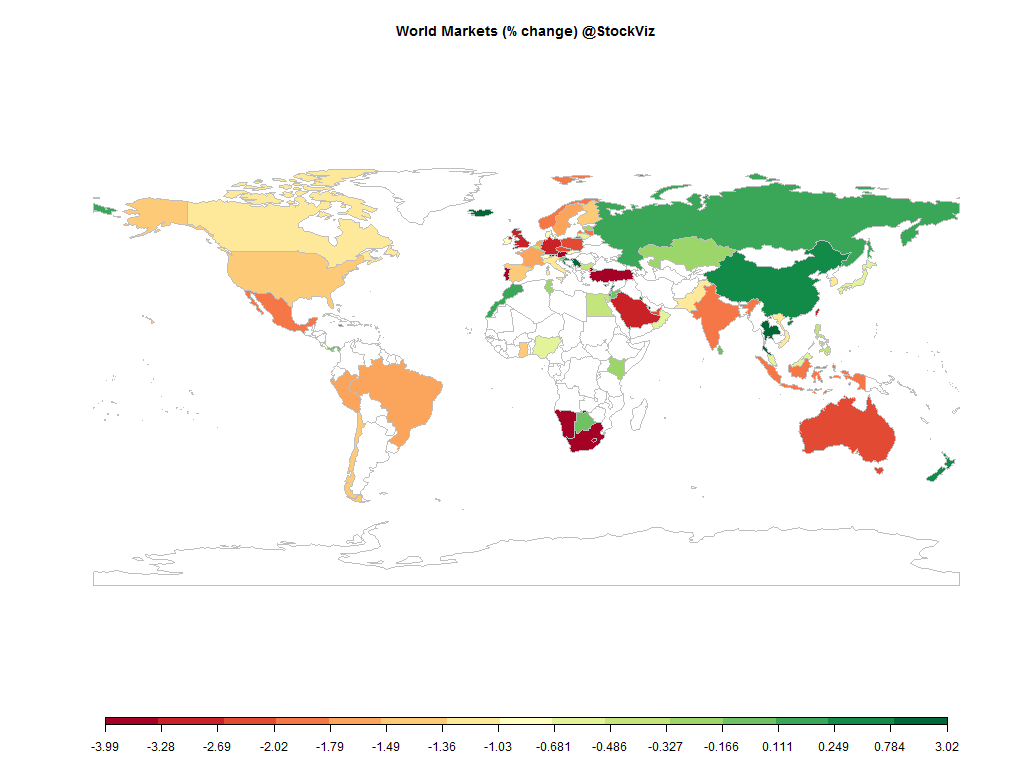

The dollar rally continued and most equity markets ended the week in the red. It took S&P’s pat on the head for the Indian markets to post a decent number on the board. Things could have been much worse if not for that. This may not be “taper tantrum” but as the US embarks on tighter monetary policy, capital has a tendency to flee frontier/emerging markets.

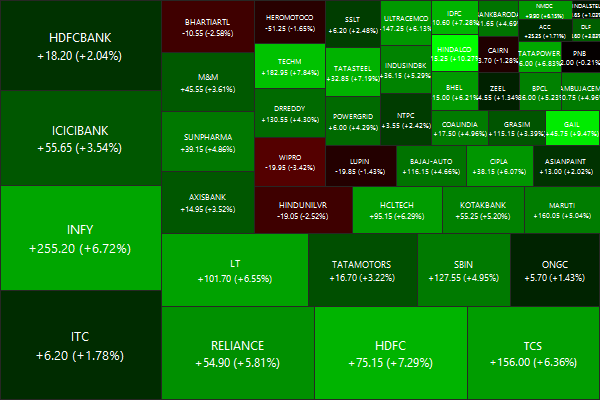

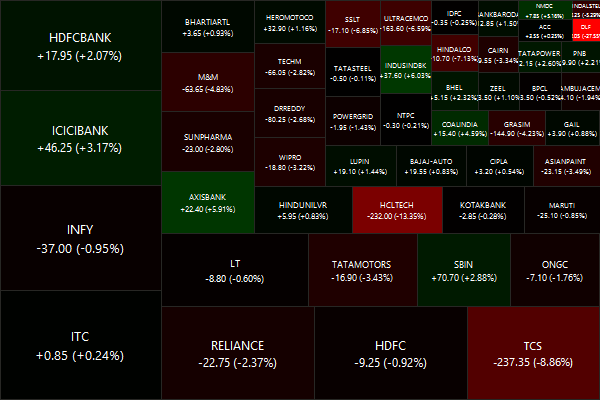

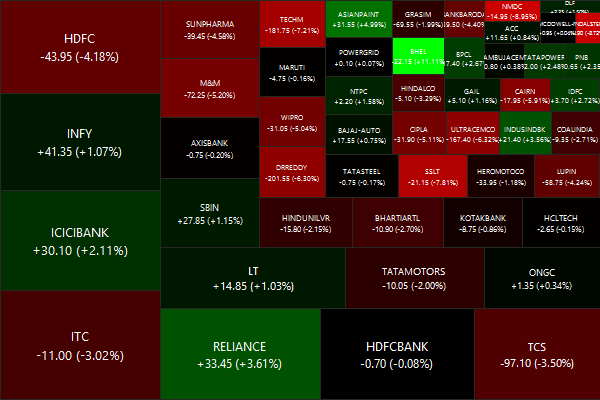

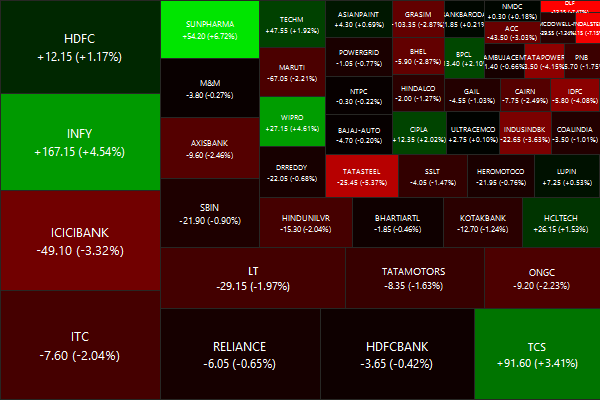

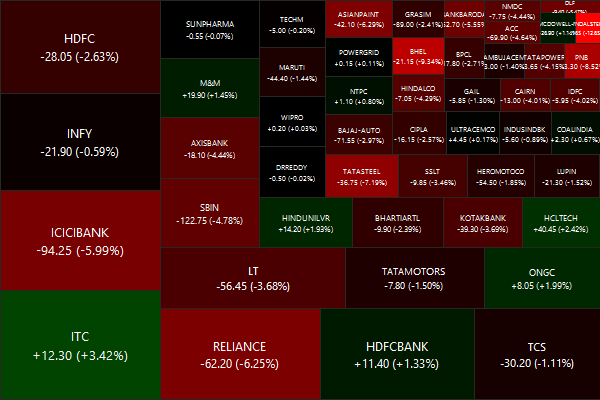

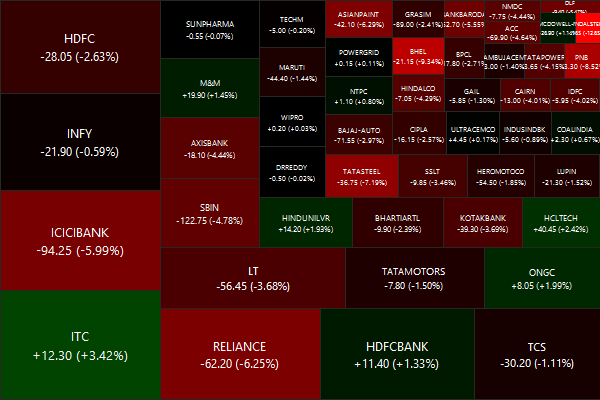

Nifty Heatmap

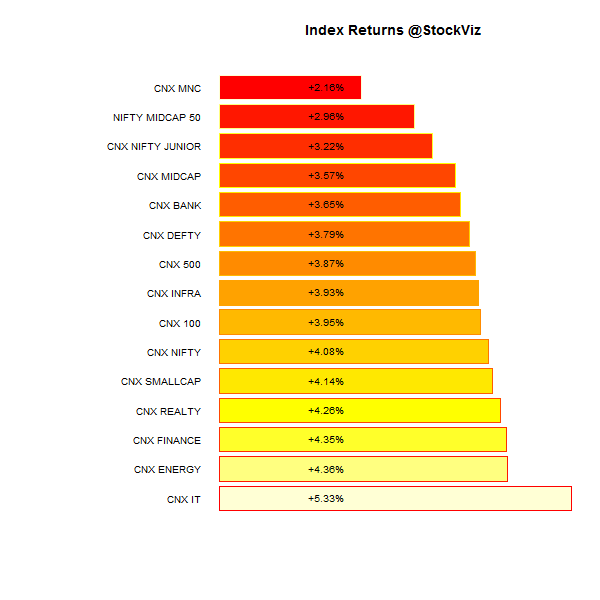

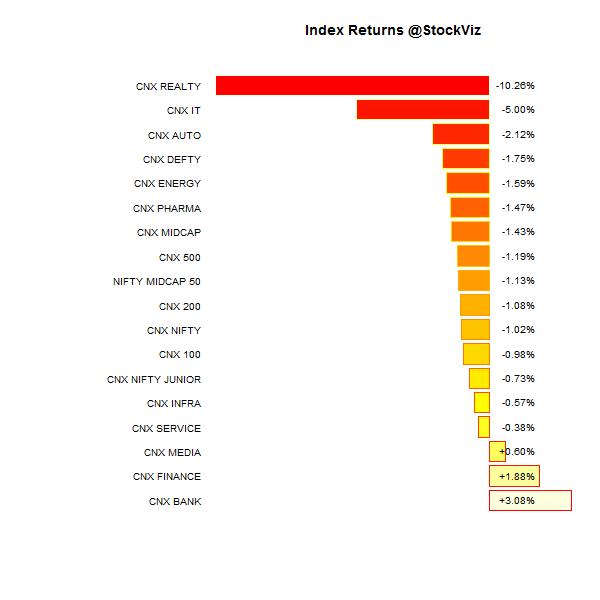

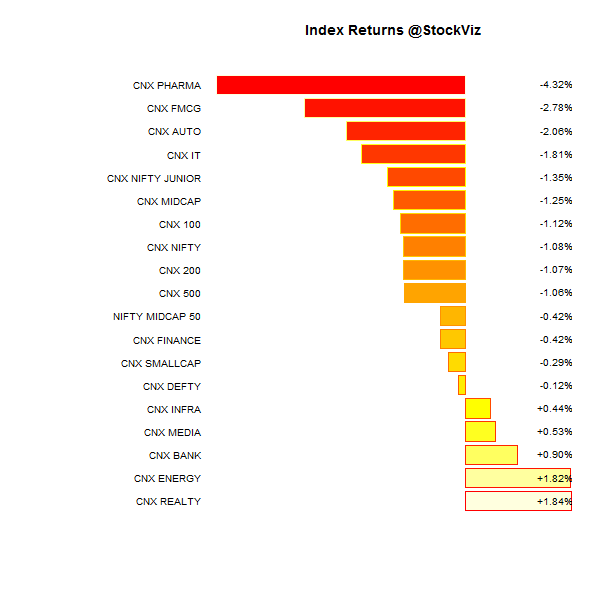

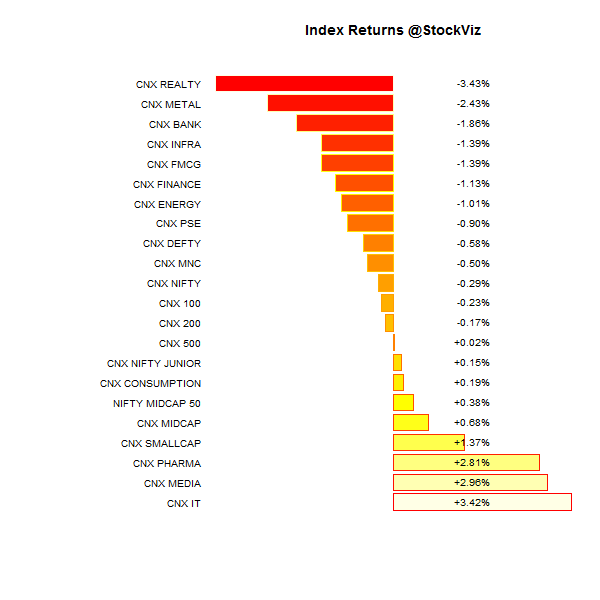

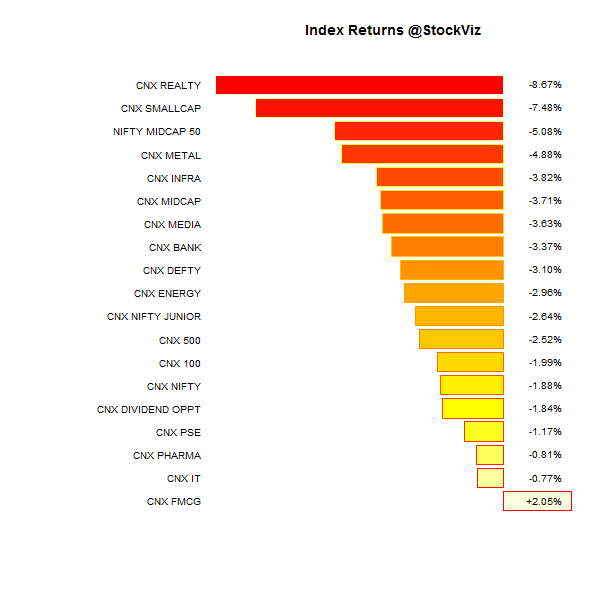

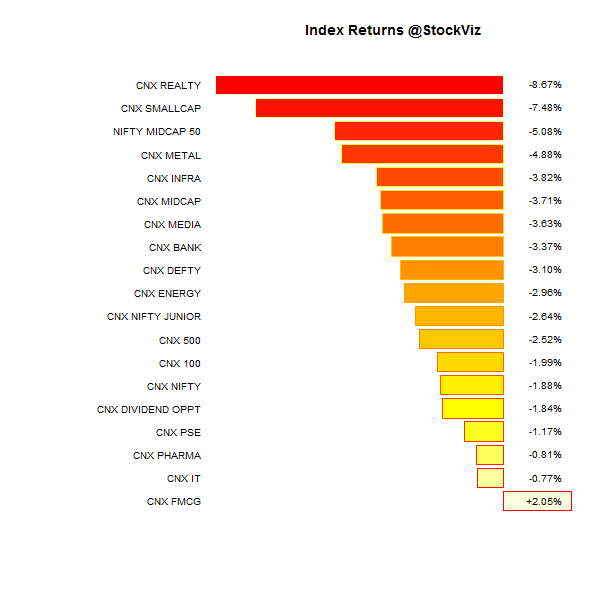

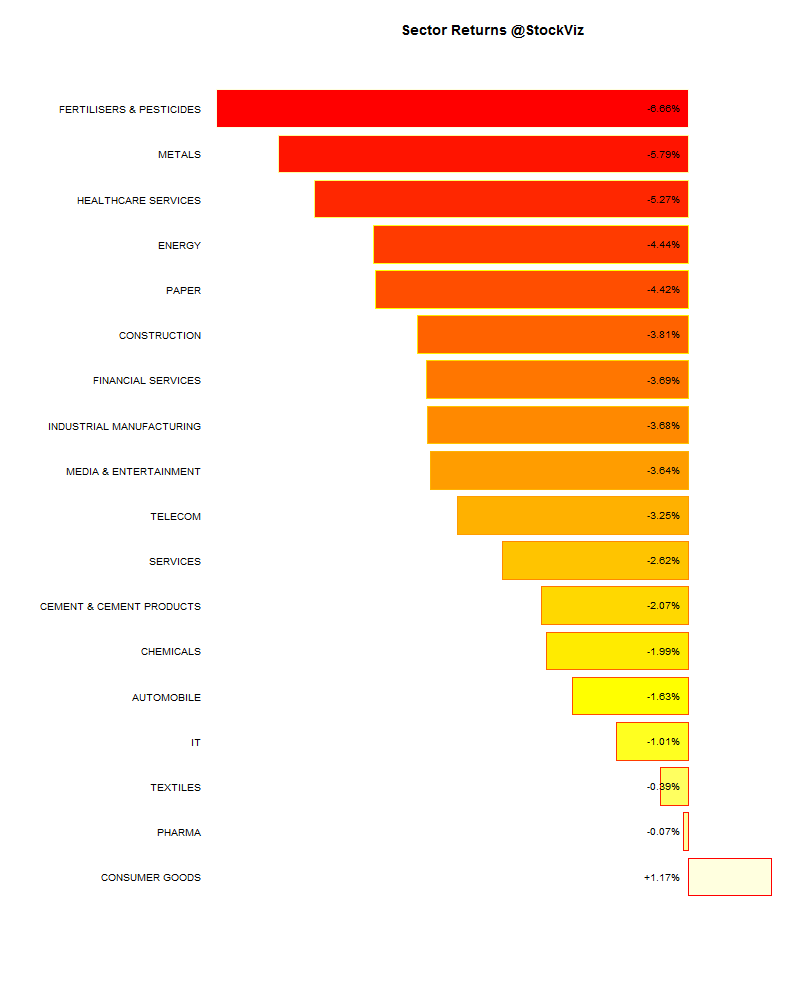

Index Returns

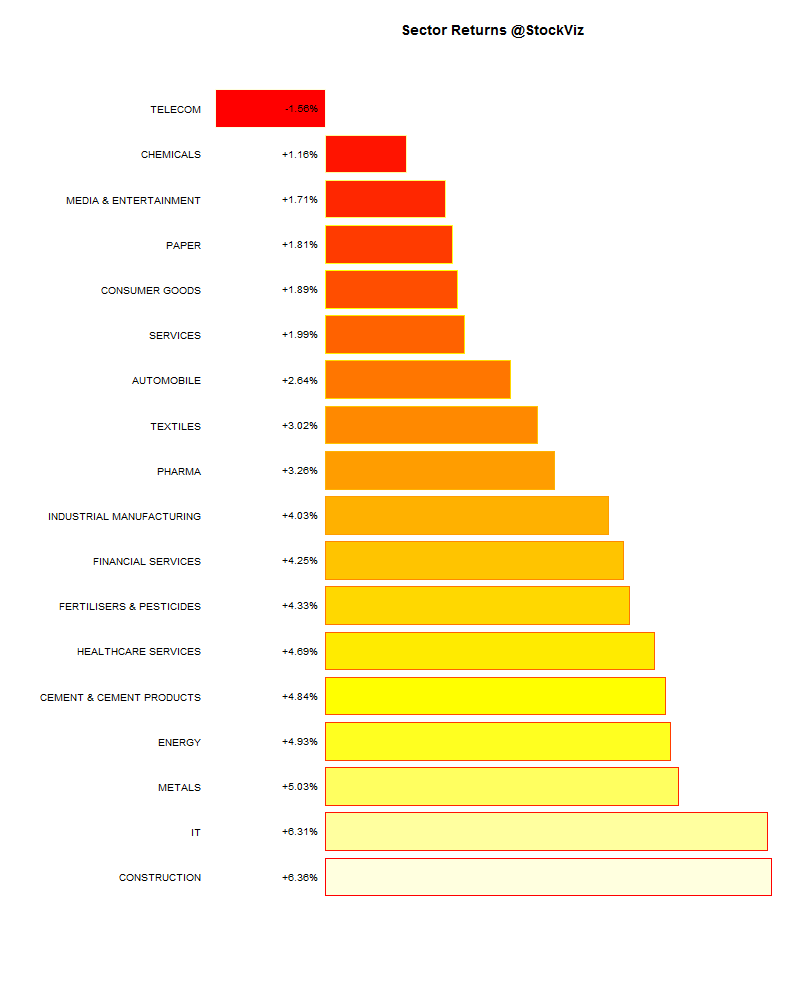

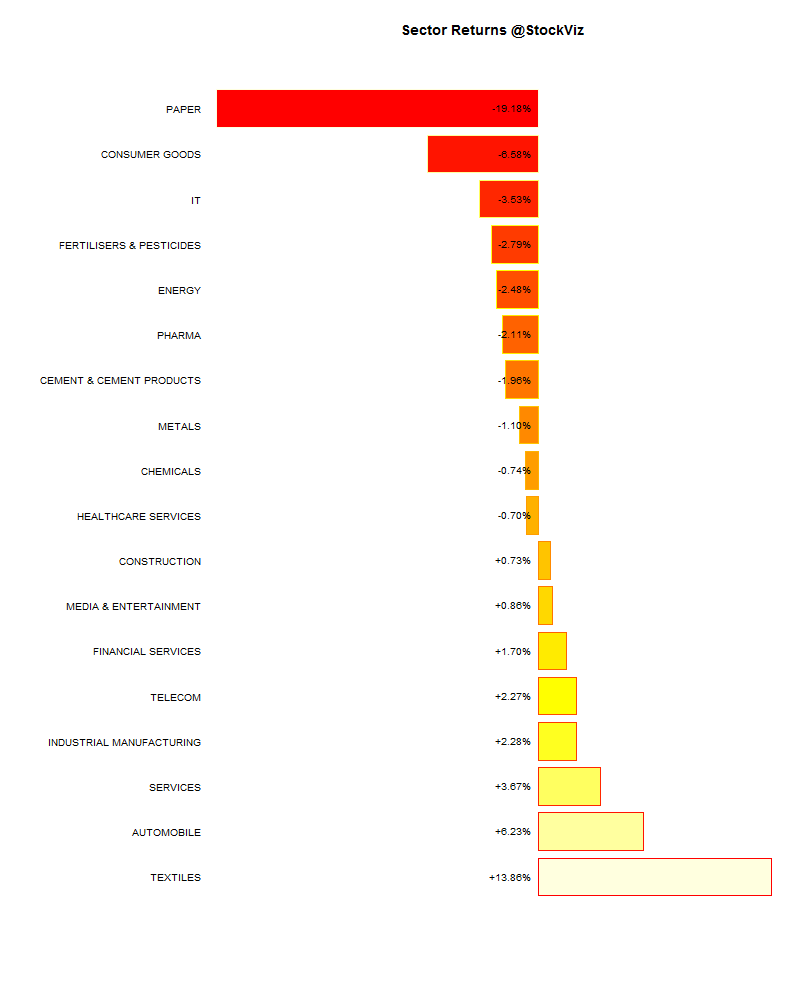

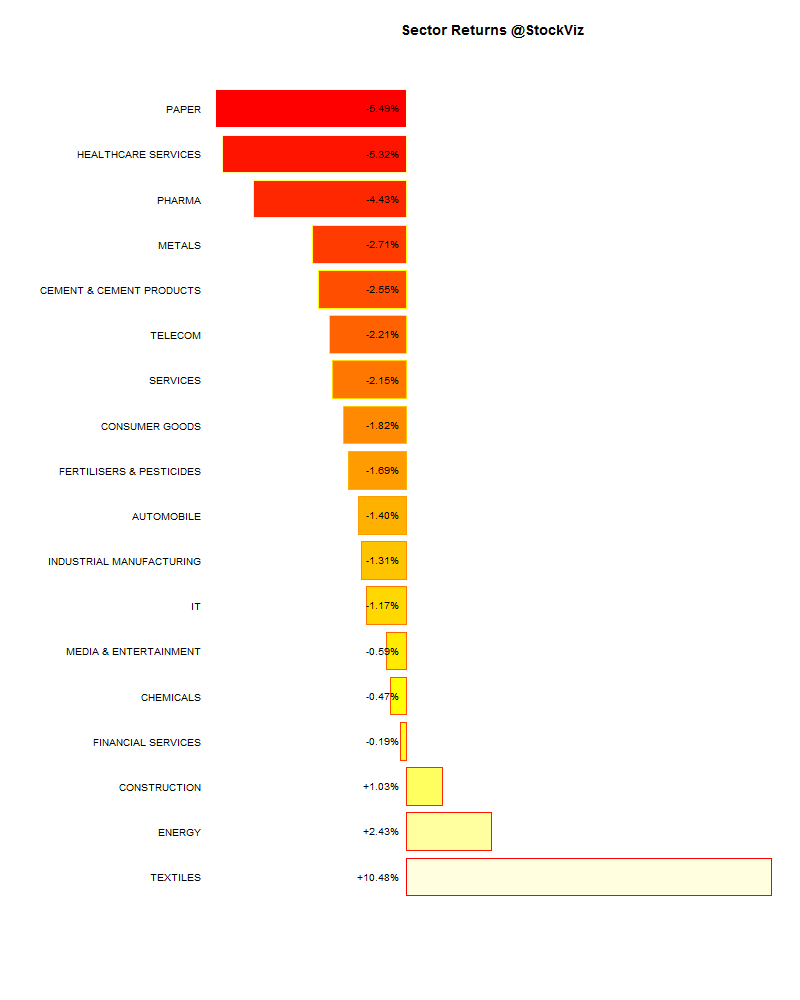

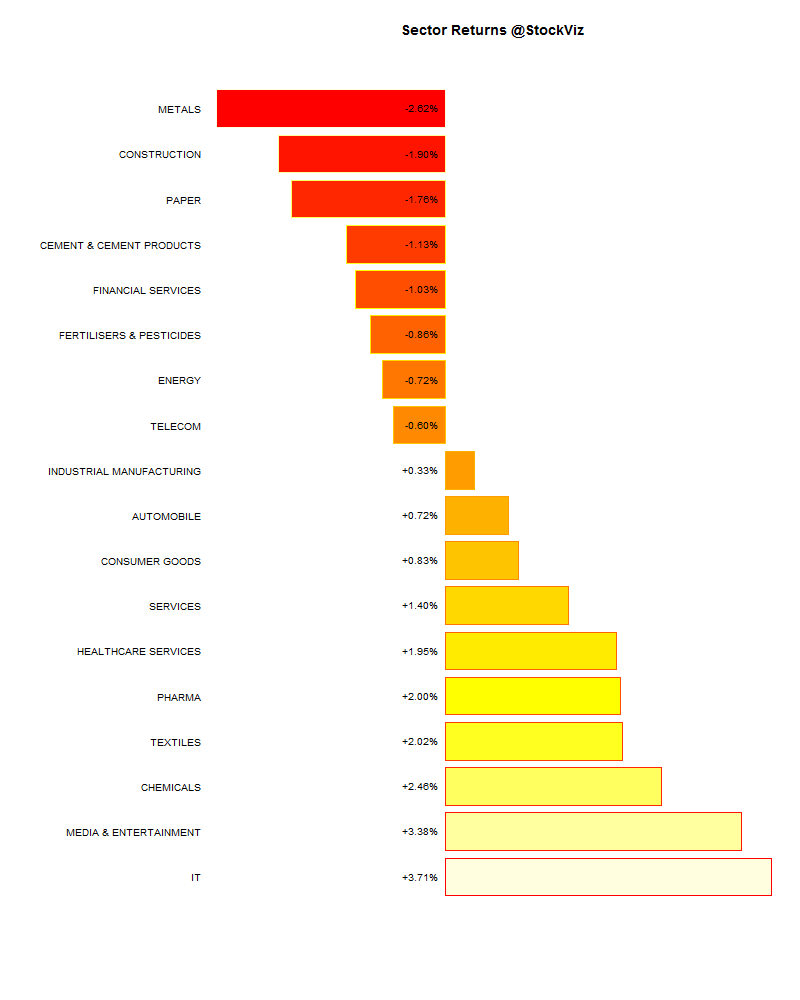

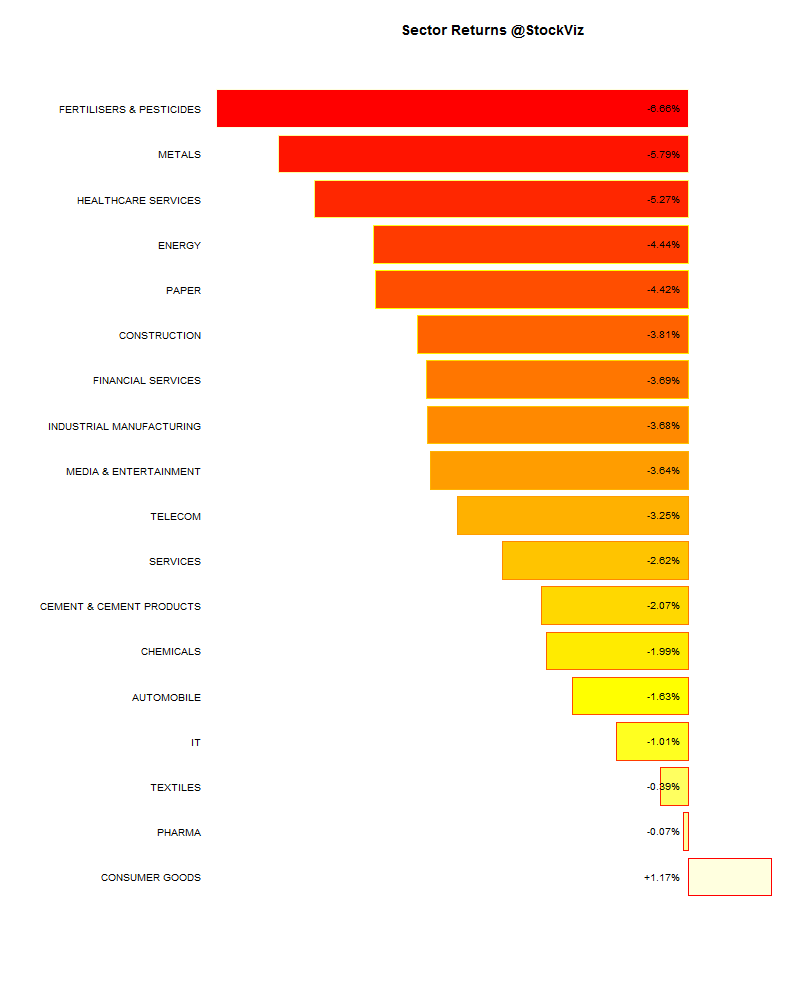

Sector Performance

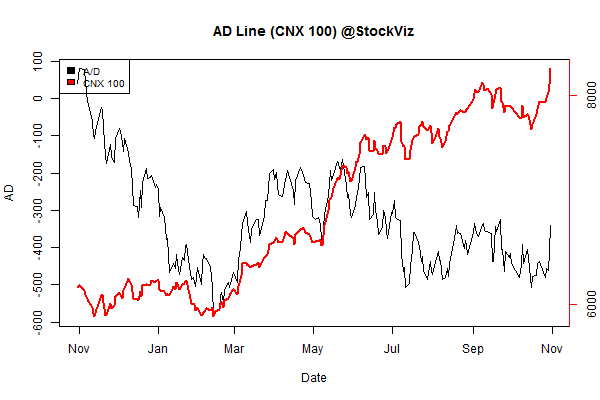

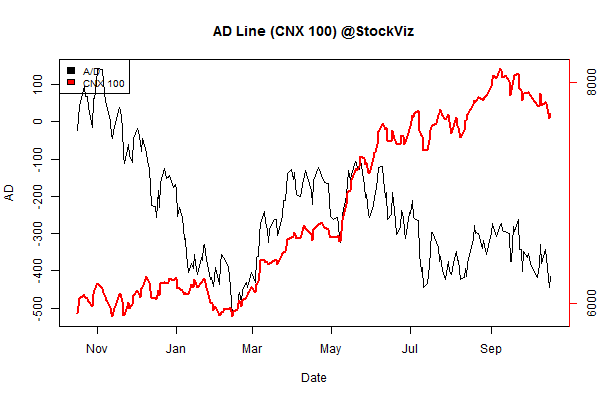

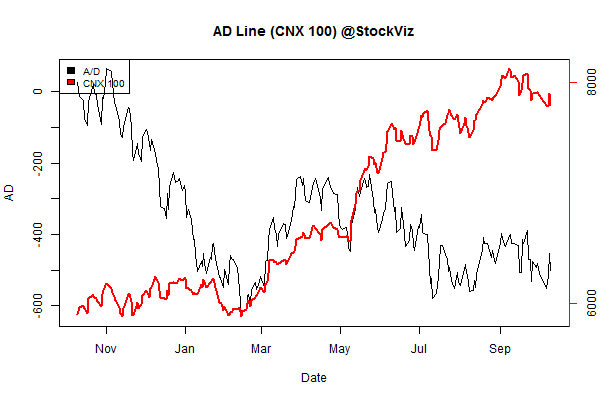

Advance Decline

Market Cap Decile Performance

| Decile |

Mkt. Cap. |

Adv/Decl |

| 1 (micro) |

-10.46% |

62/80 |

| 2 |

-6.95% |

63/79 |

| 3 |

-7.08% |

57/85 |

| 4 |

-6.95% |

54/88 |

| 5 |

-6.63% |

49/93 |

| 6 |

-5.12% |

62/80 |

| 7 |

-6.80% |

54/88 |

| 8 |

-6.25% |

63/79 |

| 9 |

-5.39% |

65/77 |

| 10 (mega) |

-2.06% |

69/73 |

Midcaps and Smallcaps bled out. The Nifty maybe down 1.88% but just look at the rest of the market…

Top Winners and Losers

Flight to safety? OFSS doesn’t count because it paid out a dividend of Rs 485/- per share… JSPL got dinged because of the coal verdict…

ETFs

WTF?! All ETFs in the red?

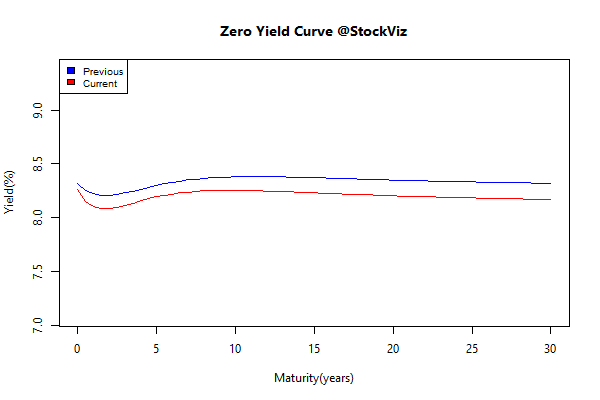

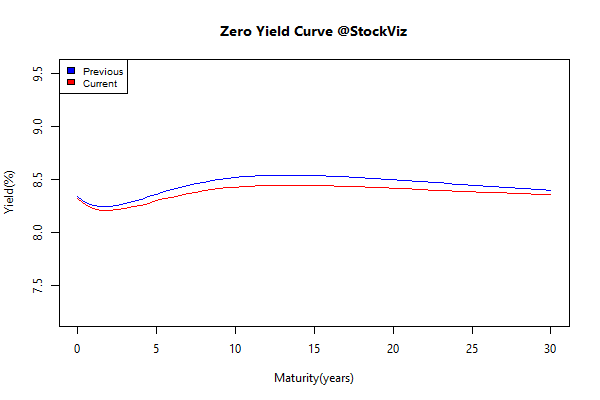

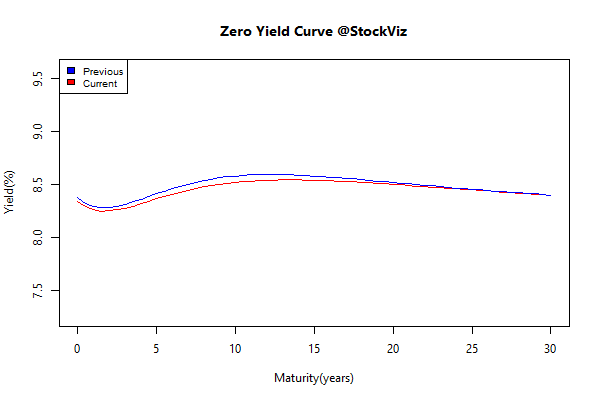

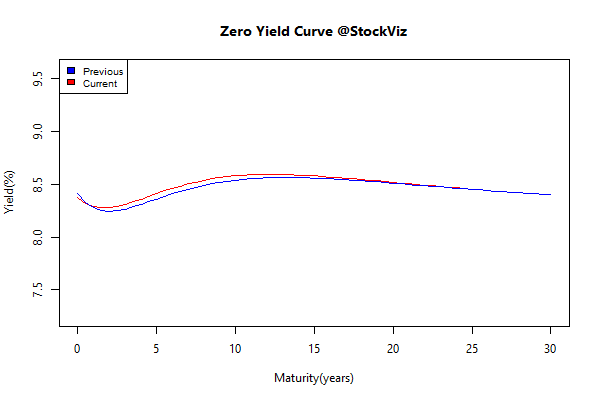

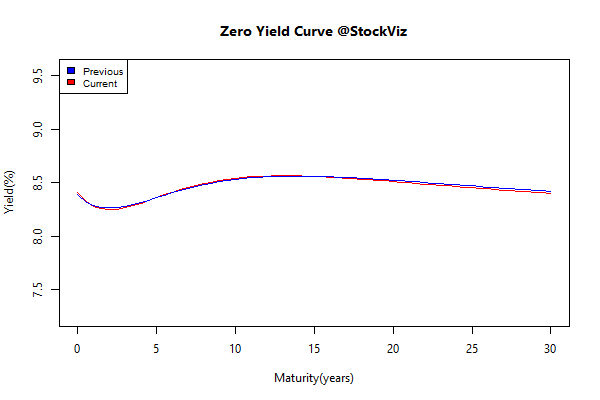

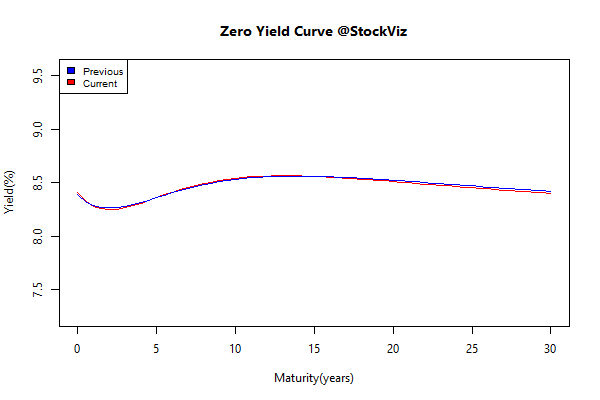

Yield Curve

Bond Indices

| Sub Index |

Change in YTM |

Total Return(%) |

| GSEC TB |

+0.01 |

+0.15% |

| GSEC SUB 1-3 |

+0.02 |

+0.29% |

| GSEC SUB 3-8 |

-0.19 |

+0.66% |

| GSEC SUB 8 |

-0.35 |

+2.52% |

Long end of the curve is probably over-bought at this point… But then again, falling inflation and an expectation of rate-cuts will do that.

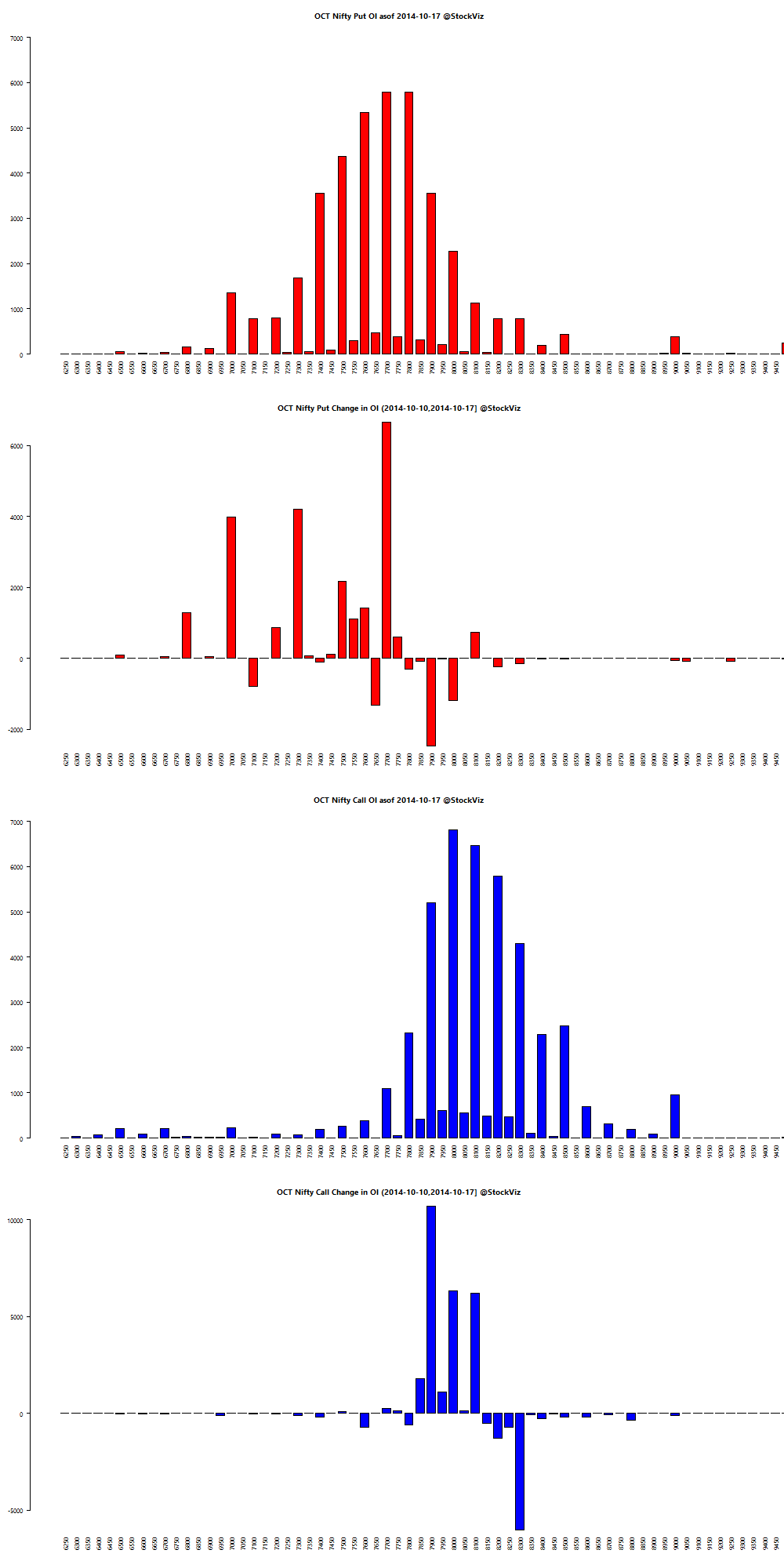

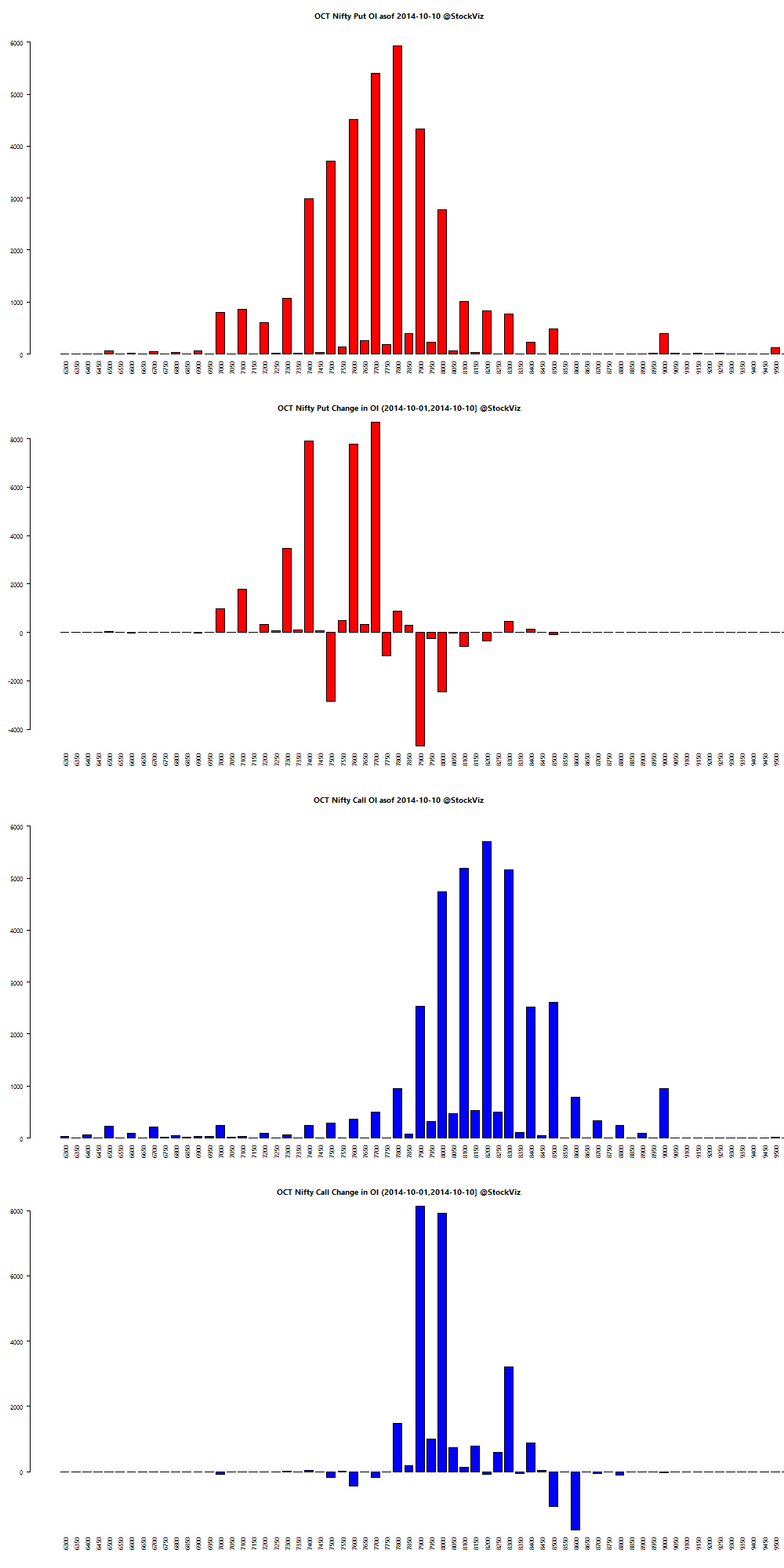

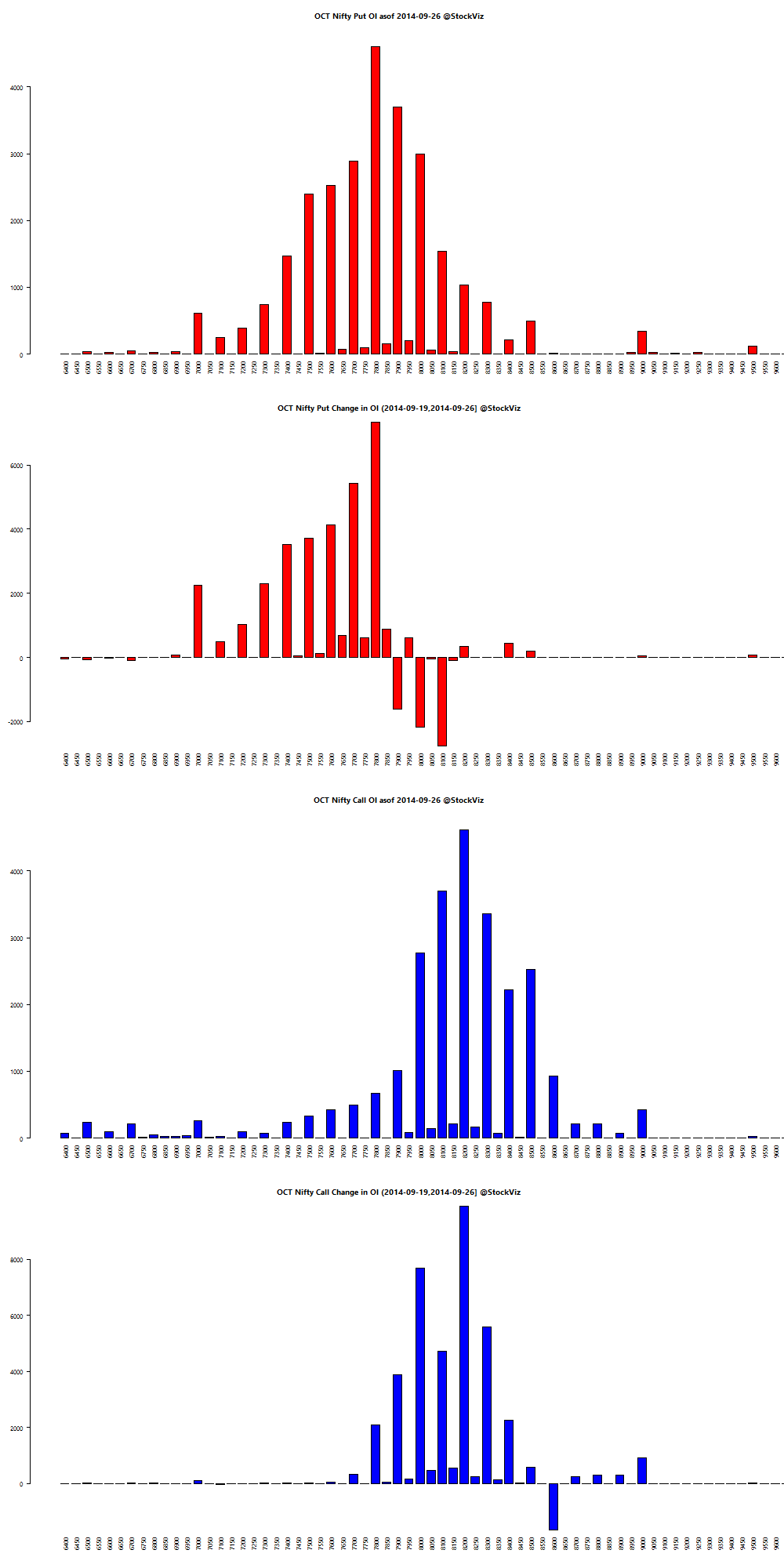

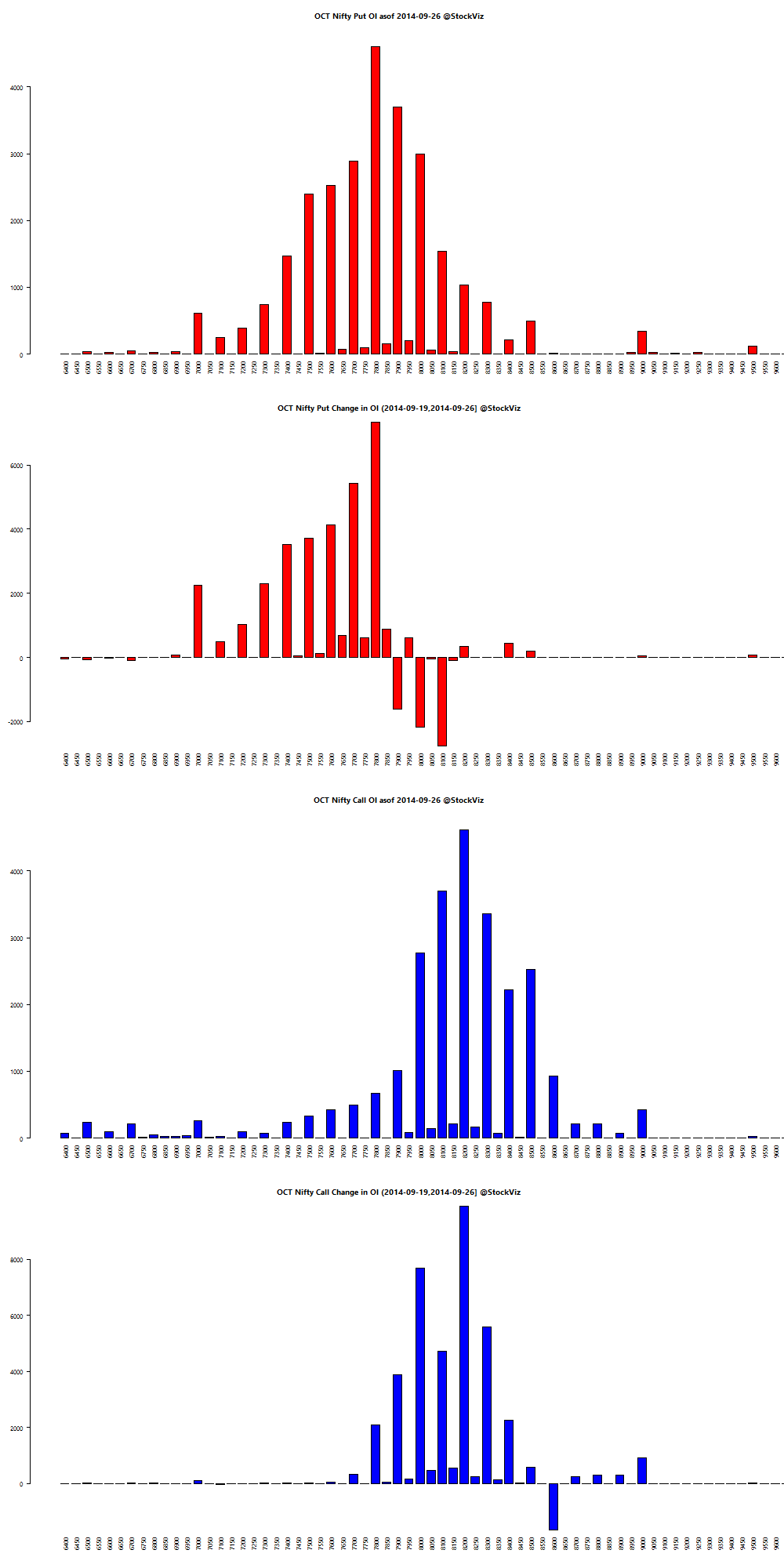

Nifty OI

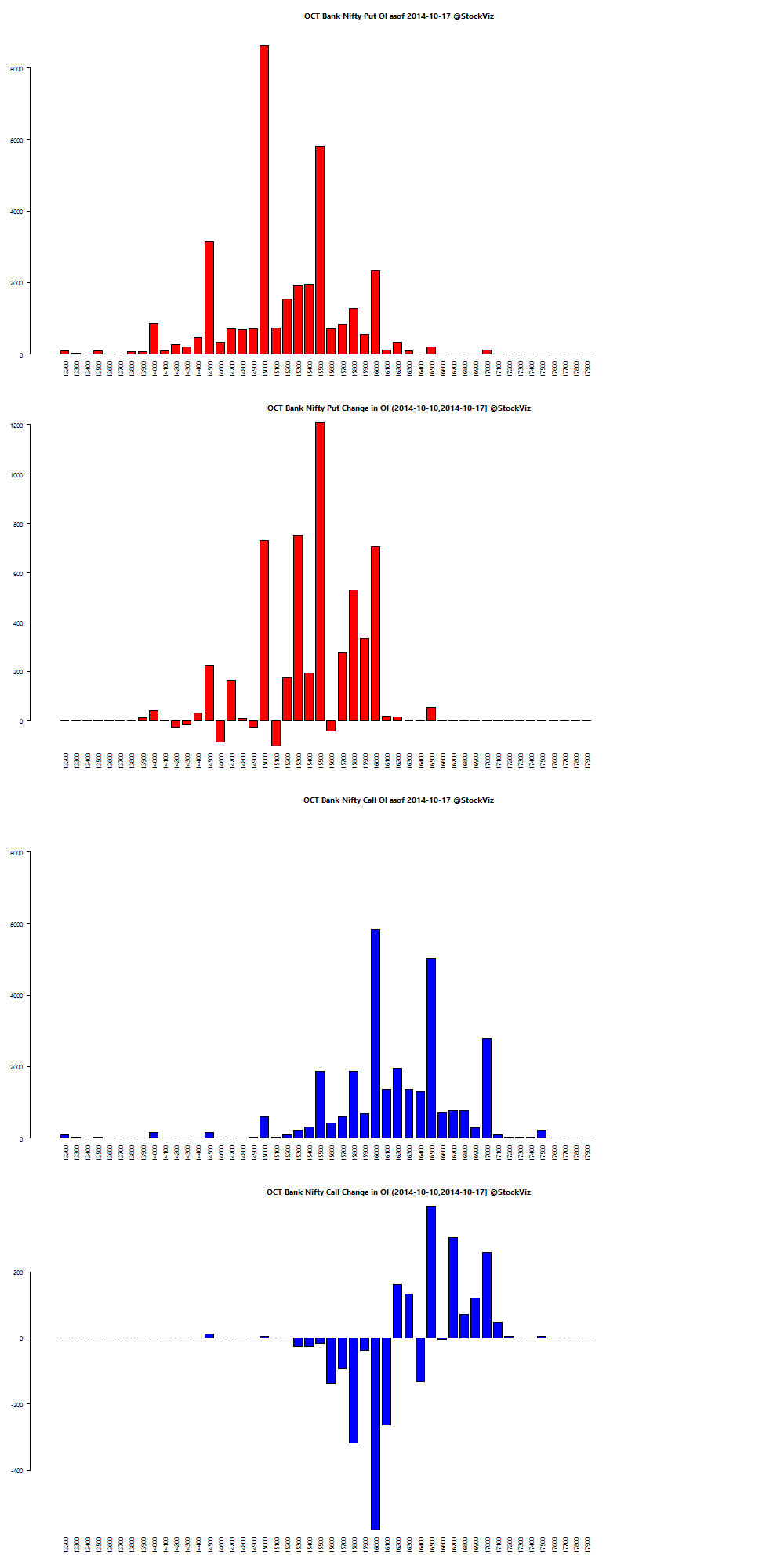

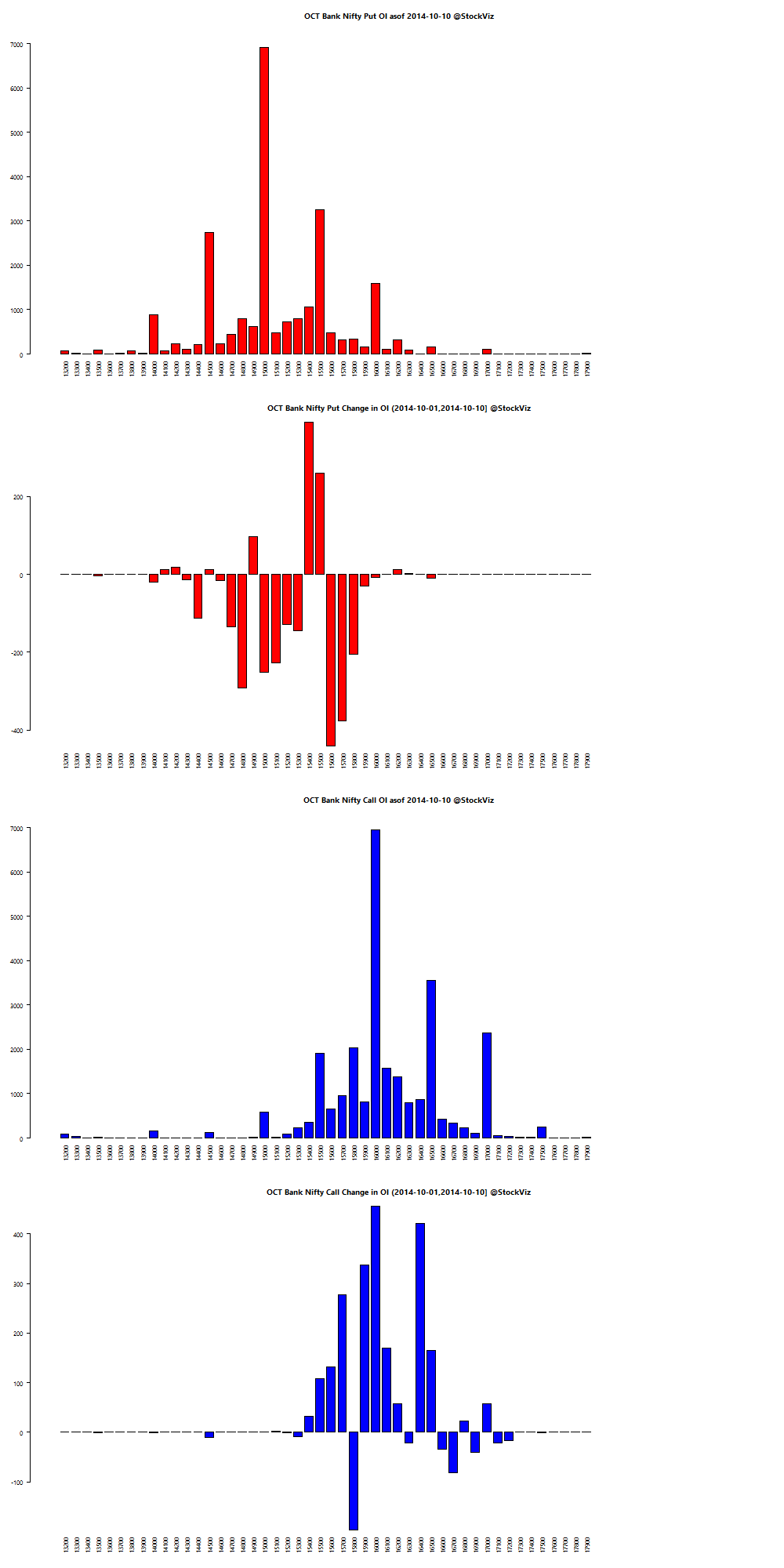

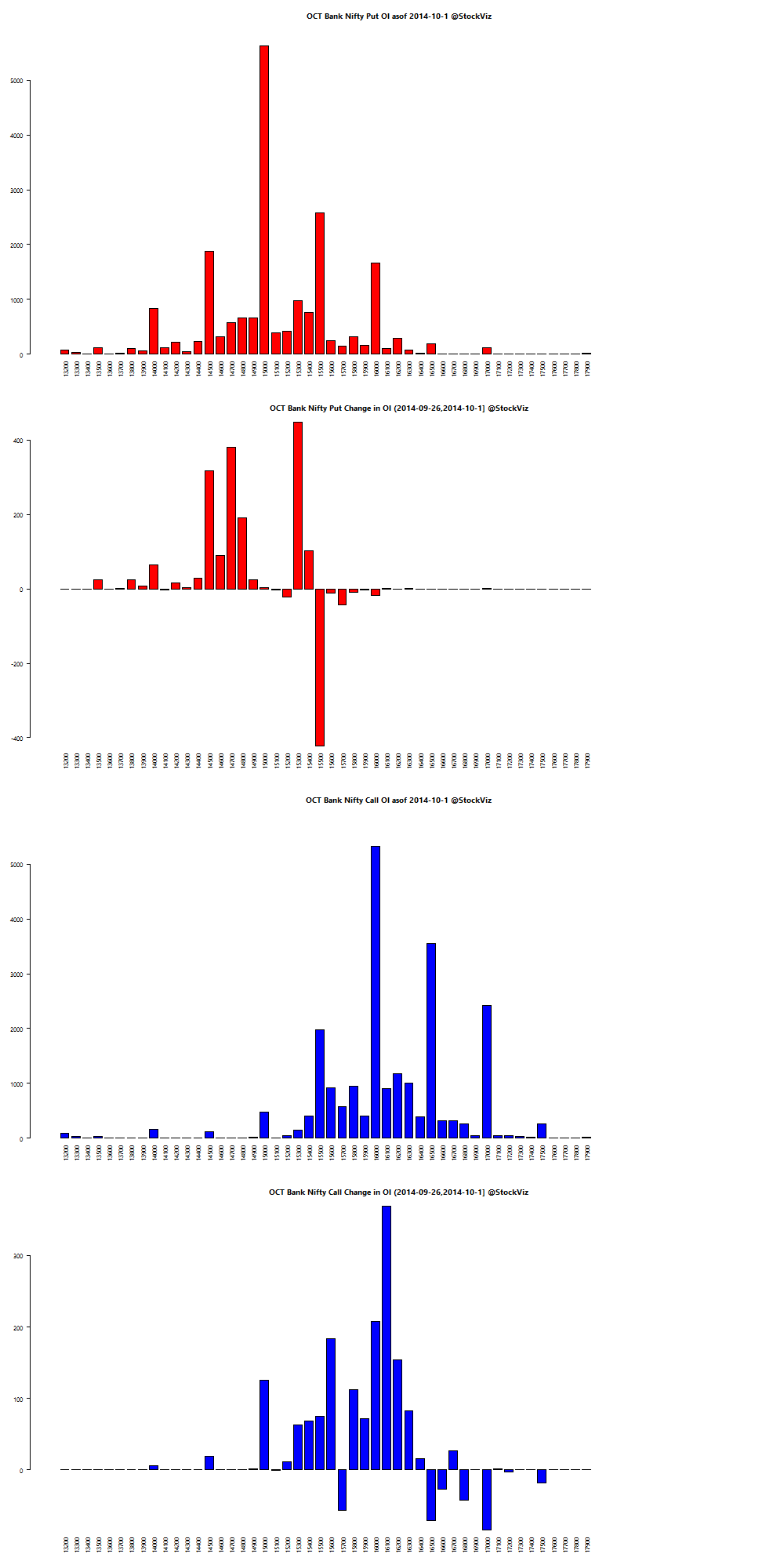

Bank Nifty OI

Theme Performance

Thought for the weekend

To make planes safer these days, engineers have designed automated systems that basically allow the planes to fly themselves. An unintended consequence of increased safety for the plane is increased complexity for the pilots. Industry experts have warned of the side effects that can arise from this increased complexity for a number of years now. One of the cautionary voices was that of an engineer named Earl Wiener. Here’s “Wiener’s Laws” adapted to the financial markets:

Every device creates its own opportunity for human error.

Any financial model is only as good as the person or team using it.

Exotic devices create exotic problems.

Complex strategies can create unforeseen complications.

Digital devices tune out small errors while creating opportunities for large errors.

Risk comes in many forms and some models can lead to a false sense of security if you’re not aware of the imbedded risks.

Some problems have no solution.

You have to choose which form of risk you want to deal with, risk now or risk in the future.

It takes an airplane to bring out the worst in a pilot.

Financial markets magnify bad behavior in even some of the most intelligent people.

Whenever you solve a problem, you usually create one. You can only hope that the one you created is less critical than the one you eliminated.

There’s no such thing a perfect portfolio or process. Every strategy involves trade-offs.

Sources:

When Exotic Devices Create Exotic Problems

The Human Factor