Equities

Commodities

| Energy |

| Brent Crude Oil |

-3.03% |

| Ethanol |

-2.97% |

| Heating Oil |

-1.53% |

| Natural Gas |

+1.03% |

| RBOB Gasoline |

-7.99% |

| WTI Crude Oil |

-2.79% |

| Metals |

| Copper |

+0.00% |

| Gold 100oz |

-0.16% |

| Palladium |

+0.80% |

| Platinum |

-0.69% |

| Silver 5000oz |

-1.15% |

| Agricultural |

| Cattle |

+2.83% |

| Cocoa |

-4.47% |

| Coffee (Arabica) |

+8.16% |

| Coffee (Robusta) |

+5.12% |

| Corn |

-0.54% |

| Cotton |

-1.32% |

| Feeder Cattle |

+3.22% |

| Lean Hogs |

+0.54% |

| Lumber |

+5.46% |

| Orange Juice |

+0.35% |

| Soybean Meal |

-0.72% |

| Soybeans |

+0.96% |

| Sugar #11 |

+3.35% |

| Wheat |

+1.74% |

| White Sugar |

-2.27% |

Credit Indices

| Index |

Change |

| Markit CDX EM |

-1.00% |

| Markit CDX NA HY |

-0.63% |

| Markit CDX NA IG |

+5.15% |

| Markit CDX NA IG HVOL |

+10.77% |

| Markit iTraxx Asia ex-Japan IG |

+6.34% |

| Markit iTraxx Australia |

+3.53% |

| Markit iTraxx Europe |

+5.31% |

| Markit iTraxx Europe Crossover |

+15.46% |

| Markit iTraxx Japan |

+2.44% |

| Markit iTraxx SovX Western Europe |

+1.45% |

| Markit LCDX (Loan CDS) |

-0.06% |

| Markit MCDX (Municipal CDS) |

+6.13% |

Rate sensitives took a dive. Credit spreads widened across the board. The dollar continued to strengthen. Indian IT and pharma continued to rally…

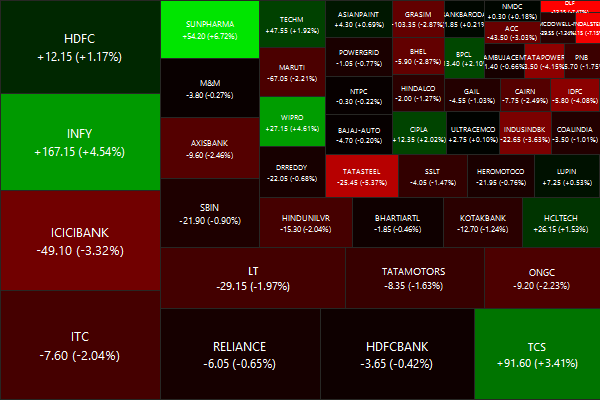

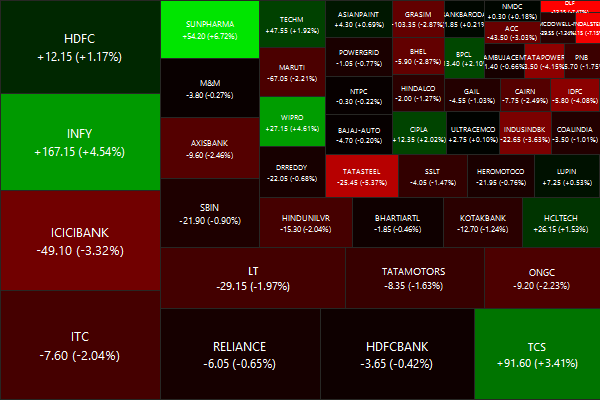

Nifty Heatmap

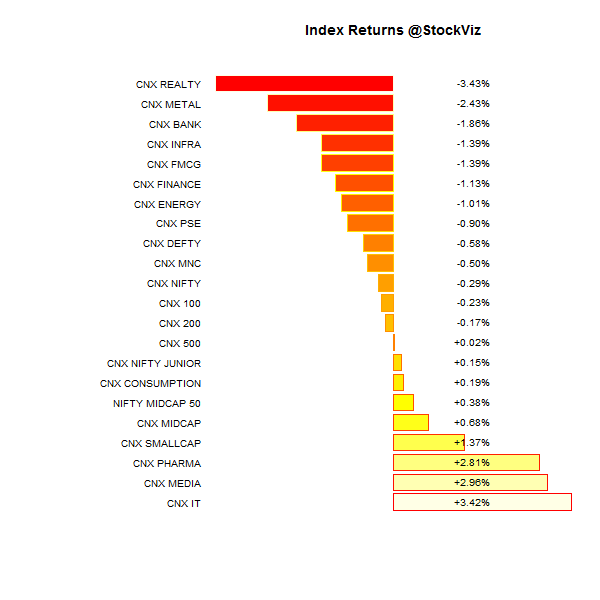

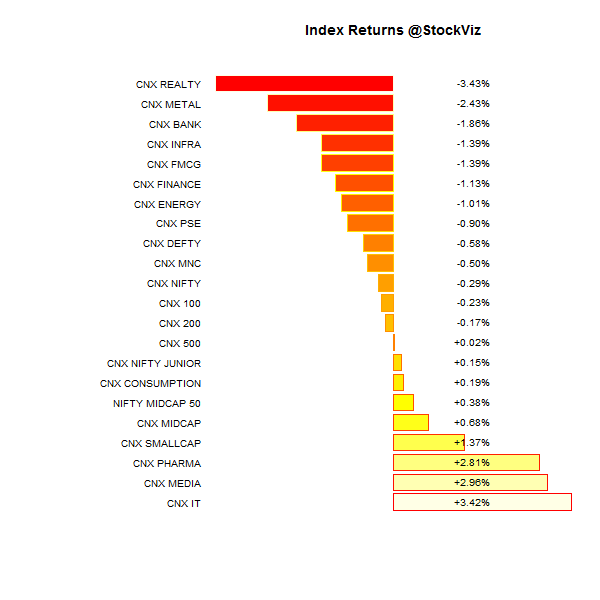

Index Returns

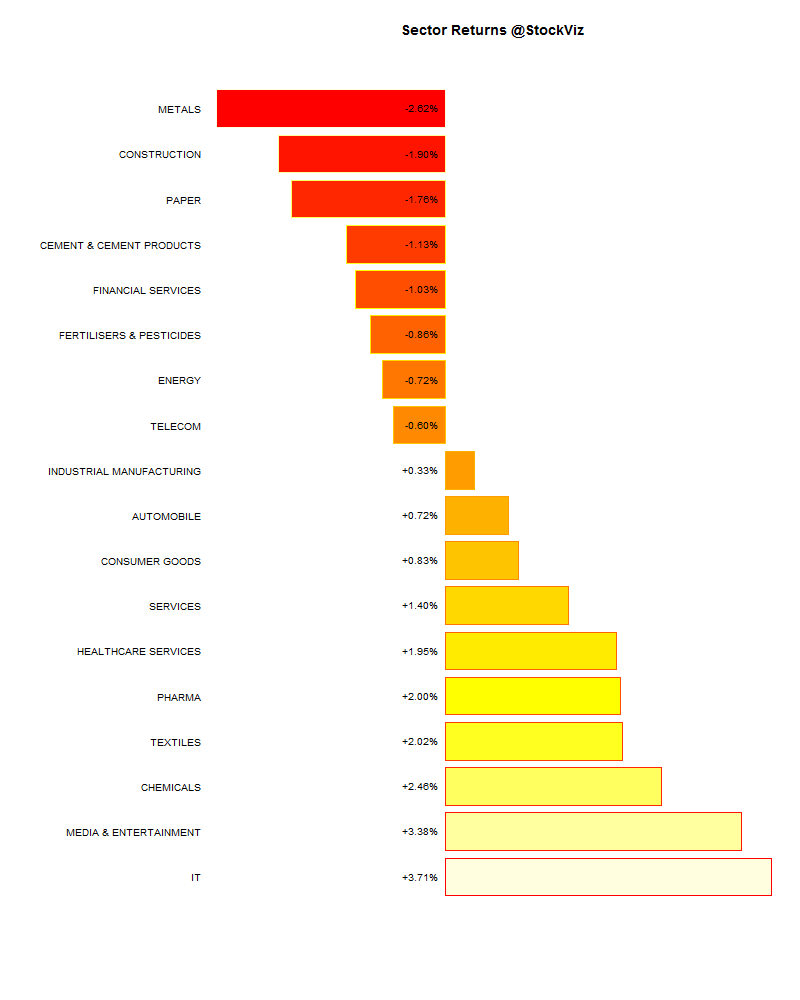

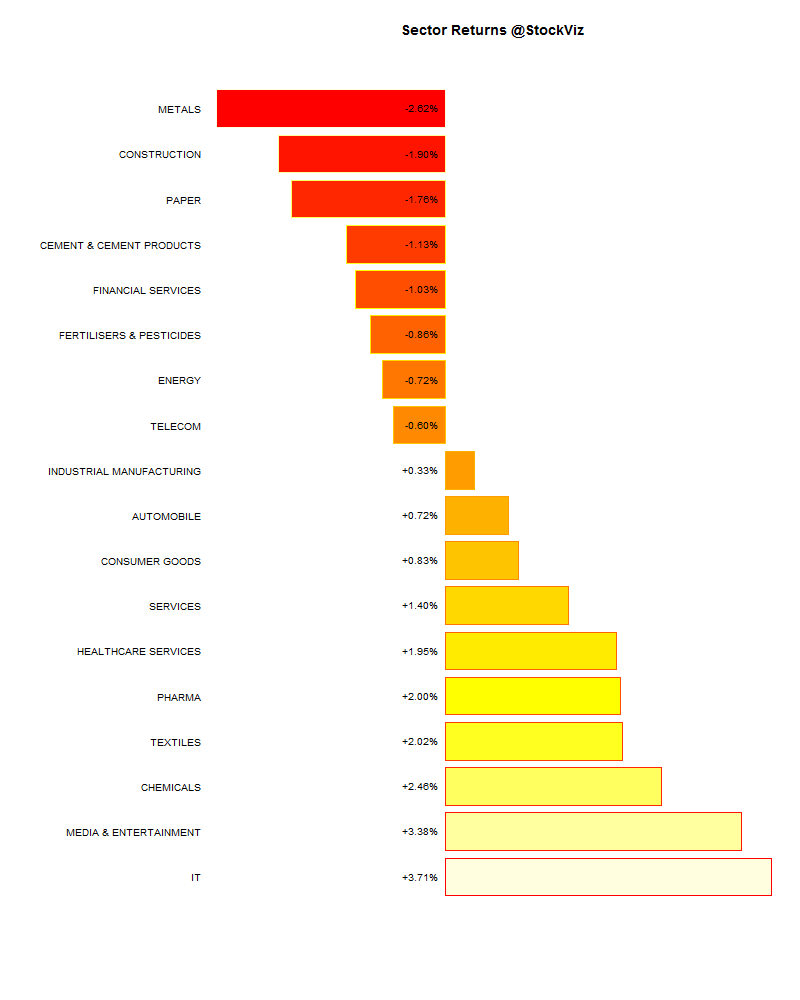

Sector Performance

Advance Decline

Market Cap Decile Performance

| Decile |

Mkt. Cap. |

Adv/Decl |

| 1 (micro) |

-4.54% |

76/59 |

| 2 |

+1.48% |

74/61 |

| 3 |

+1.06% |

71/65 |

| 4 |

+0.99% |

66/68 |

| 5 |

+2.01% |

70/65 |

| 6 |

-0.04% |

70/65 |

| 7 |

+1.61% |

71/64 |

| 8 |

+1.52% |

72/63 |

| 9 |

+0.52% |

64/71 |

| 10 (mega) |

-0.11% |

65/71 |

Small and Mid-caps bounced back while Mega-caps remained under pressure.

Top Winners and Losers

RBI’s steadfast focus on inflation means we are in a holding pattern on rates. Whatever hopium that real-estate and banks were smoking is quickly fading away…

ETFs

Gold is getting totally pummeled by a rising US Dollar…

Gold Since 2008

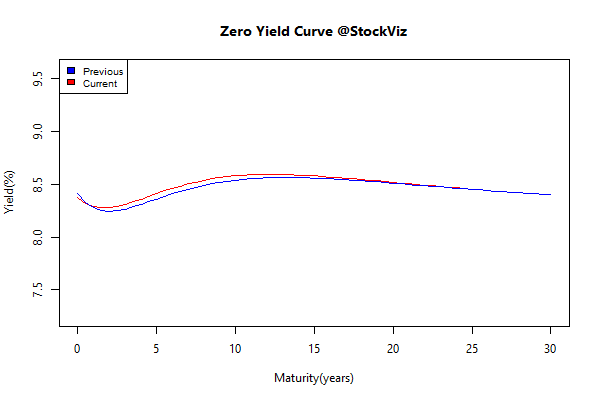

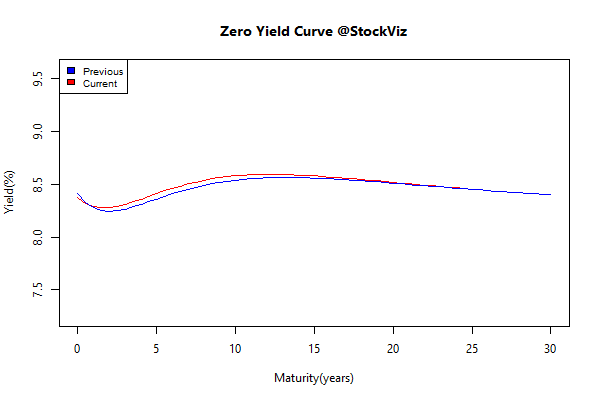

Yield Curve

Bond Indices

| Sub Index |

Change in YTM |

Total Return(%) |

| GSEC TB |

-0.10 |

+0.14% |

| GSEC SUB 1-3 |

+0.02 |

+0.20% |

| GSEC SUB 3-8 |

+0.09 |

-0.17% |

| GSEC SUB 8 |

+0.21 |

-1.57% |

Is this the start of the curve getting steeper?

Nifty OI

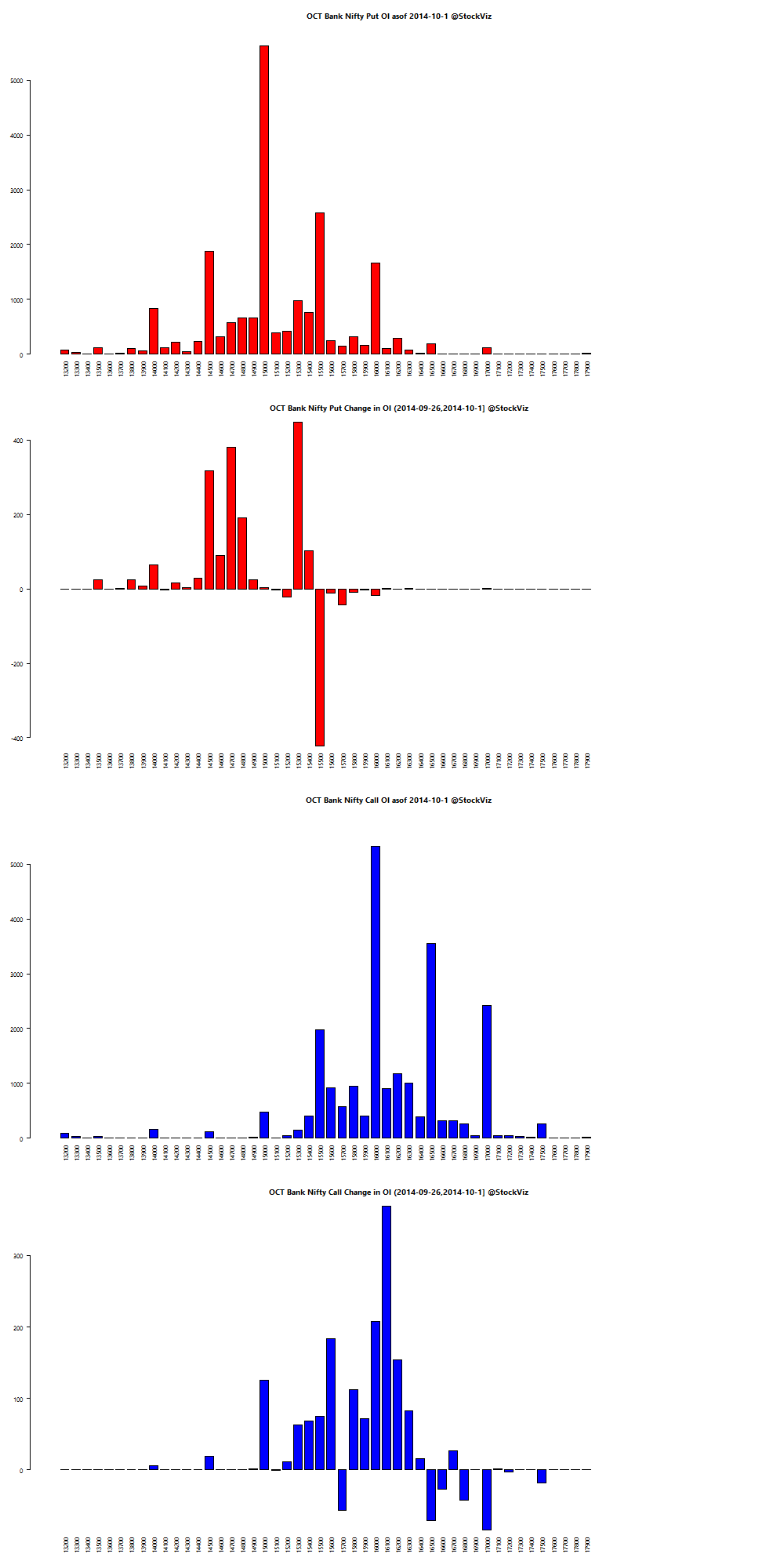

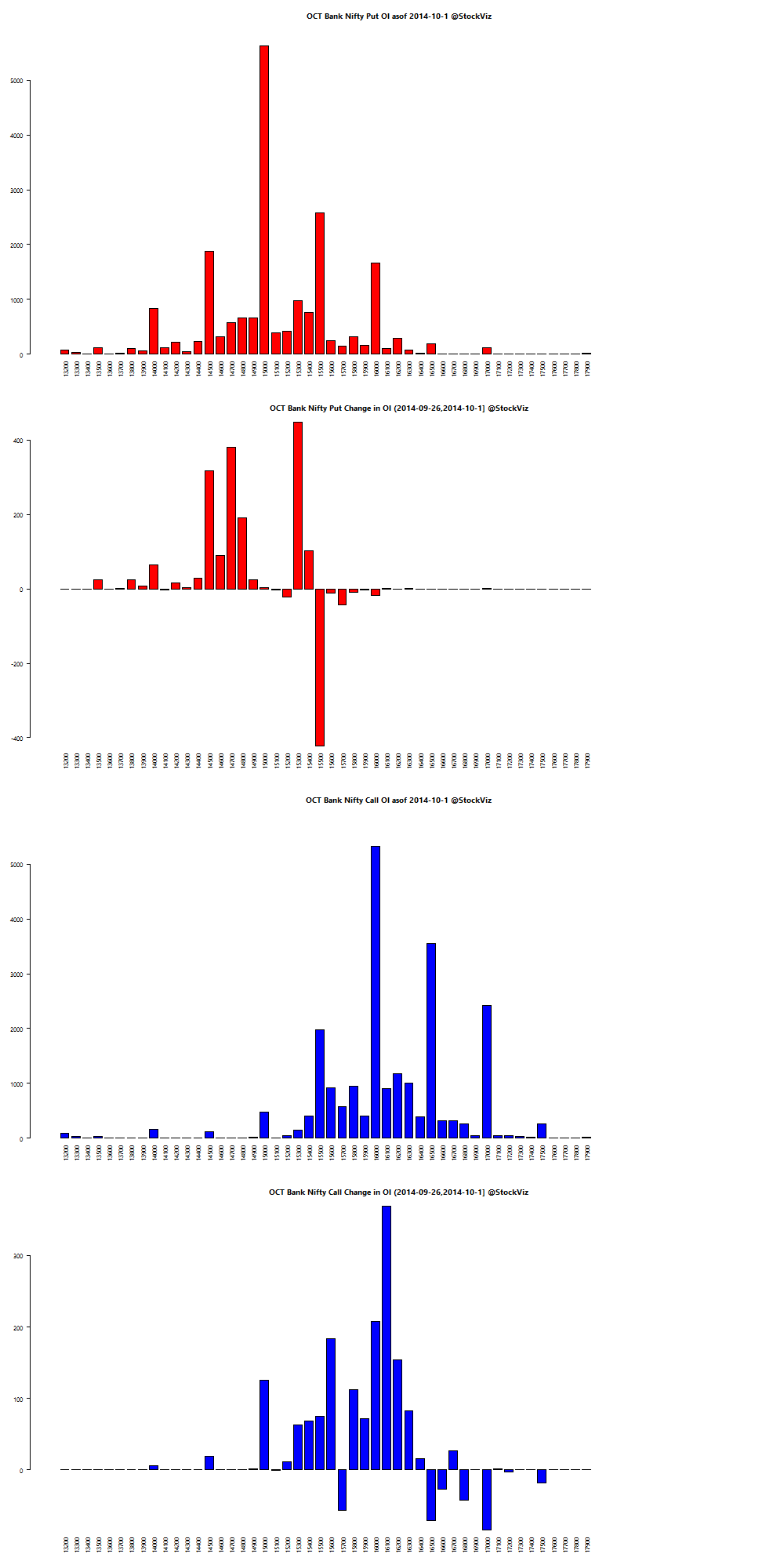

Bank Nifty OI

Theme Performance

Will momentum follow through to next week?

Thought for the weekend

We all make forecasts about the future. All of our portfolios are constructed by making forecasts and implicit assumptions about how certain asset class weightings will help us achieve our financial goals.

Of course, the future is extremely difficult to forecast. We don’t deal in certainties in life. We deal in probabilities.

Constructing a portfolio is a lot like forecasting the weather where you want to get married. You pick a place where it likely won’t rain, a time of year where it doesn’t rain much and then you cross your fingers and hope that your probabilistic forecast was smart. But you don’t just go and get married anywhere in the world just because the weather is difficult to predict.

Source: We Are All Charlatans!

Comments are closed, but trackbacks and pingbacks are open.