Introduction

Historical volatility and implied volatility.

Read: Part I, Part II

Nifty volatility

Density plots of historical volatility over different horizons.

Read: Large Moves Happen Together, NIFTY Volatility, Historical Perspective

Charts that are updated often: Volatility and VIX Charts

Dollar ETF volatilities

When you convert Indian indices to dollars, their volatility profile changes.

Read: INDA vs. SPY Observed Volatility

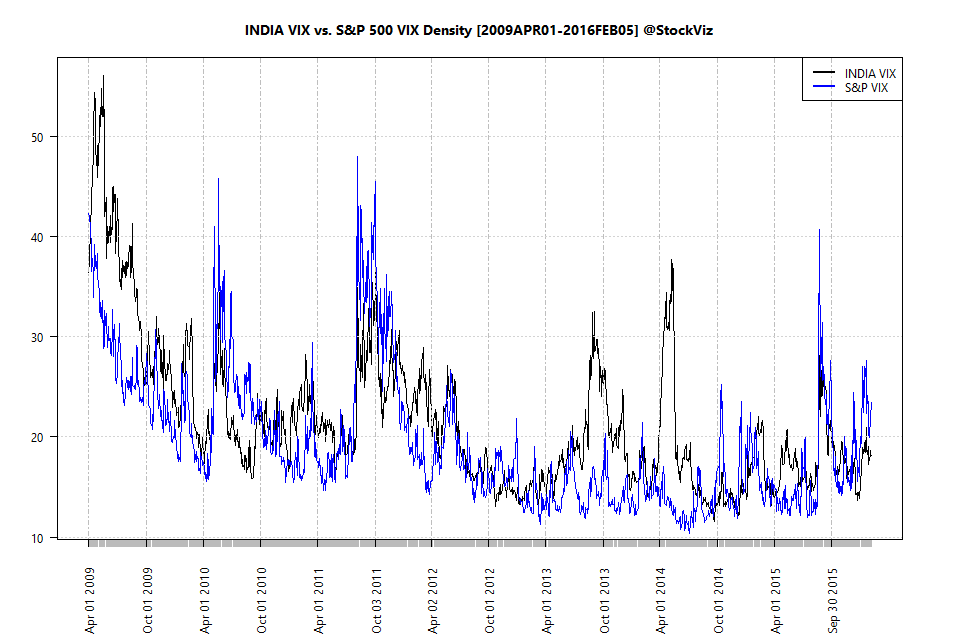

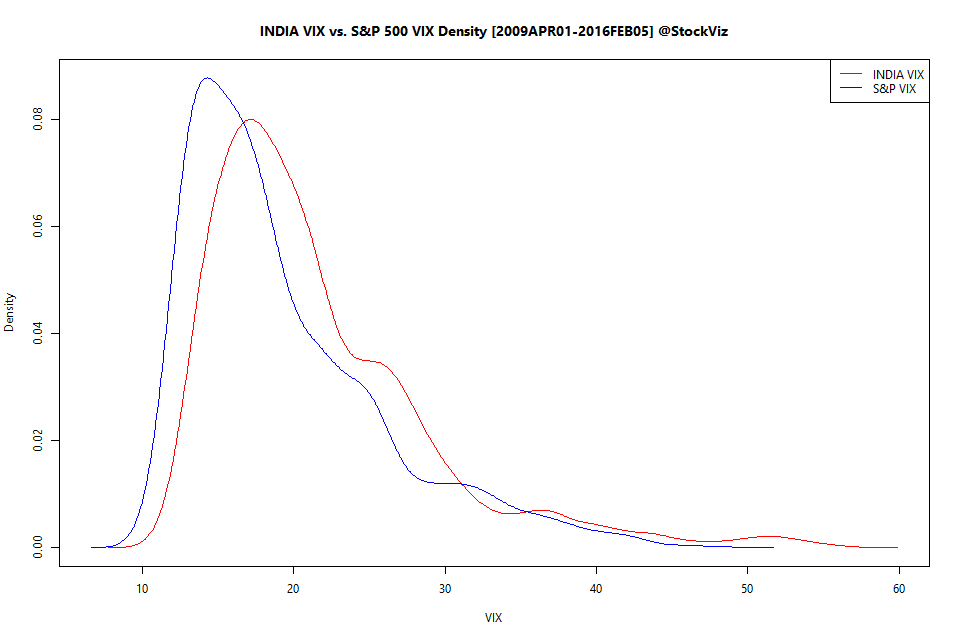

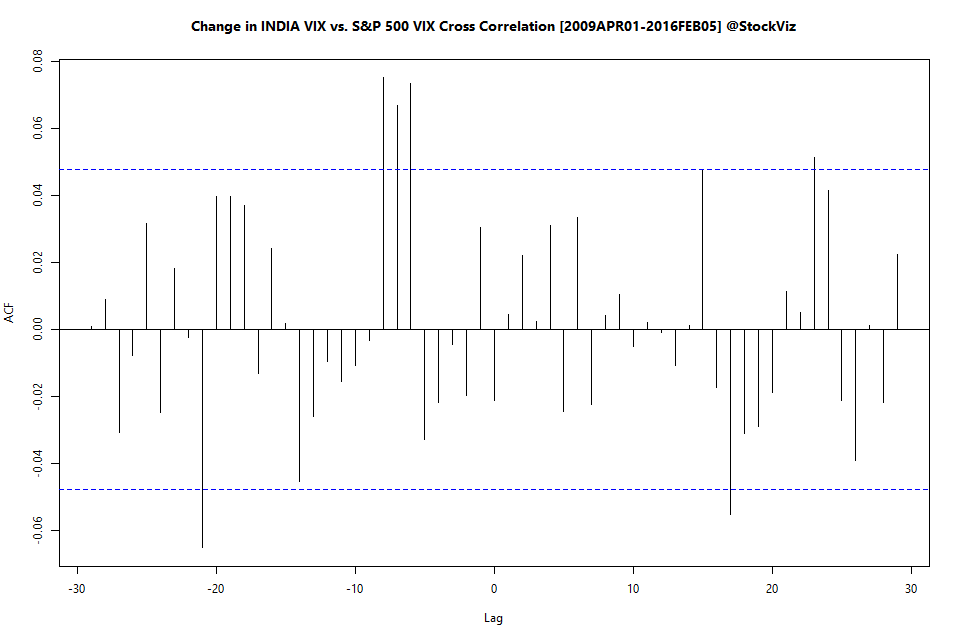

VIX – Implied Volatility Index

Do VIX indices across markets have any relationship with each other?

Read: India VIX vs. SPX VIX

Can a simple VIX based trading strategy avoid market losses?

Read: Macro Volatility and the NIFTY 50, VIX and Equity Index Returns, Part I, Part II.

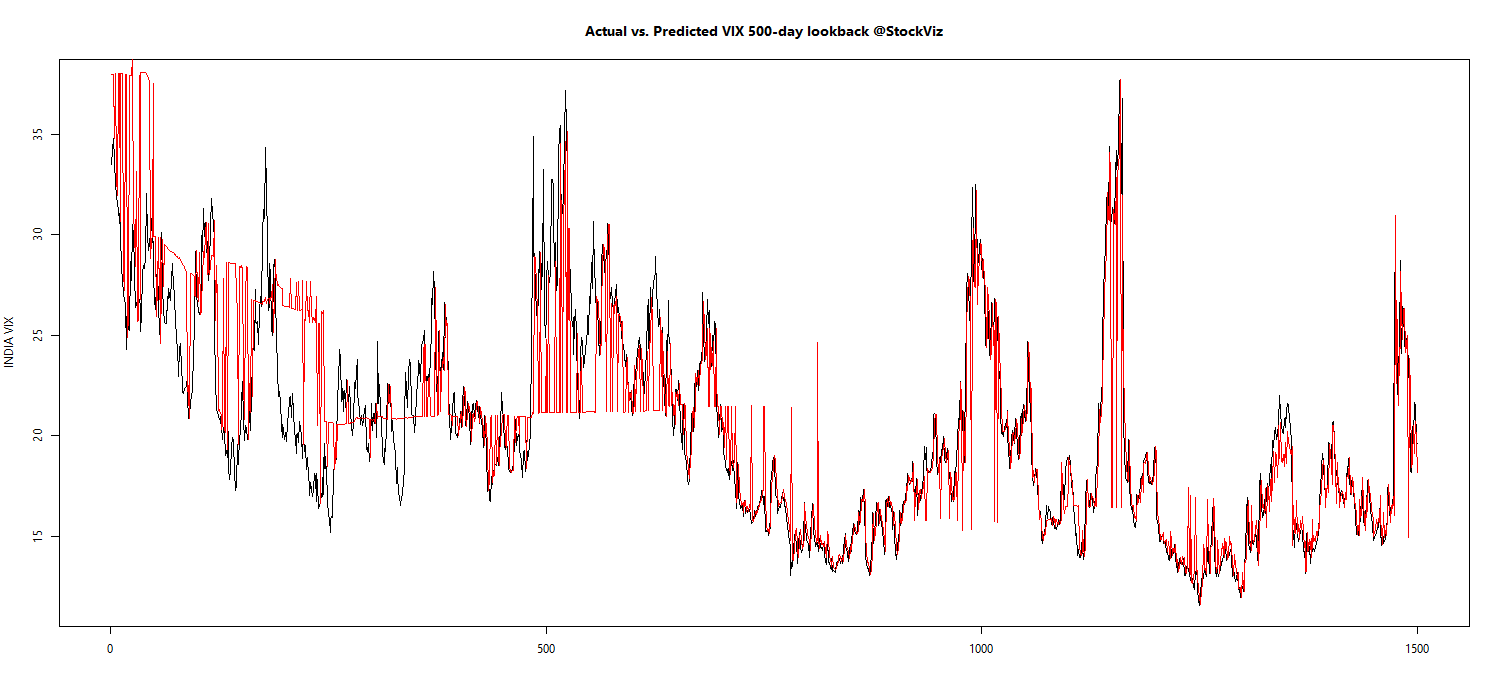

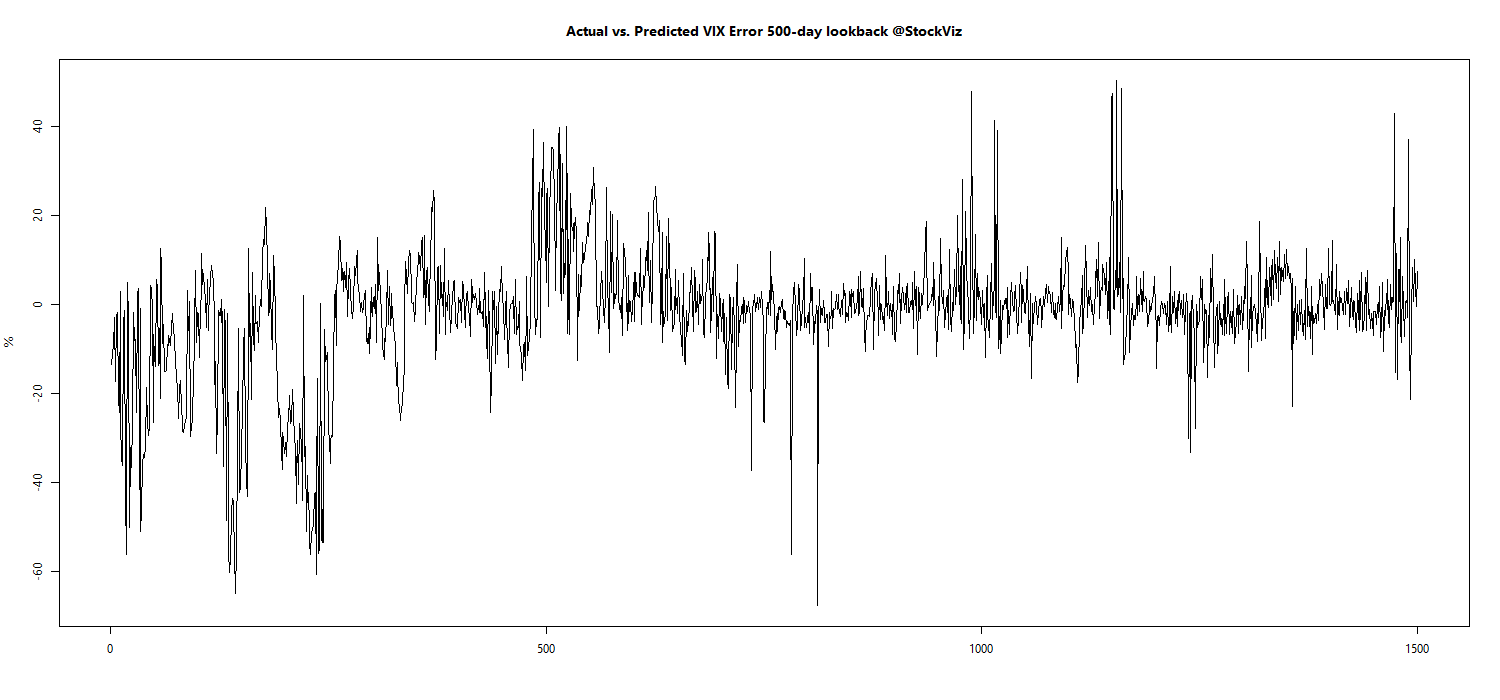

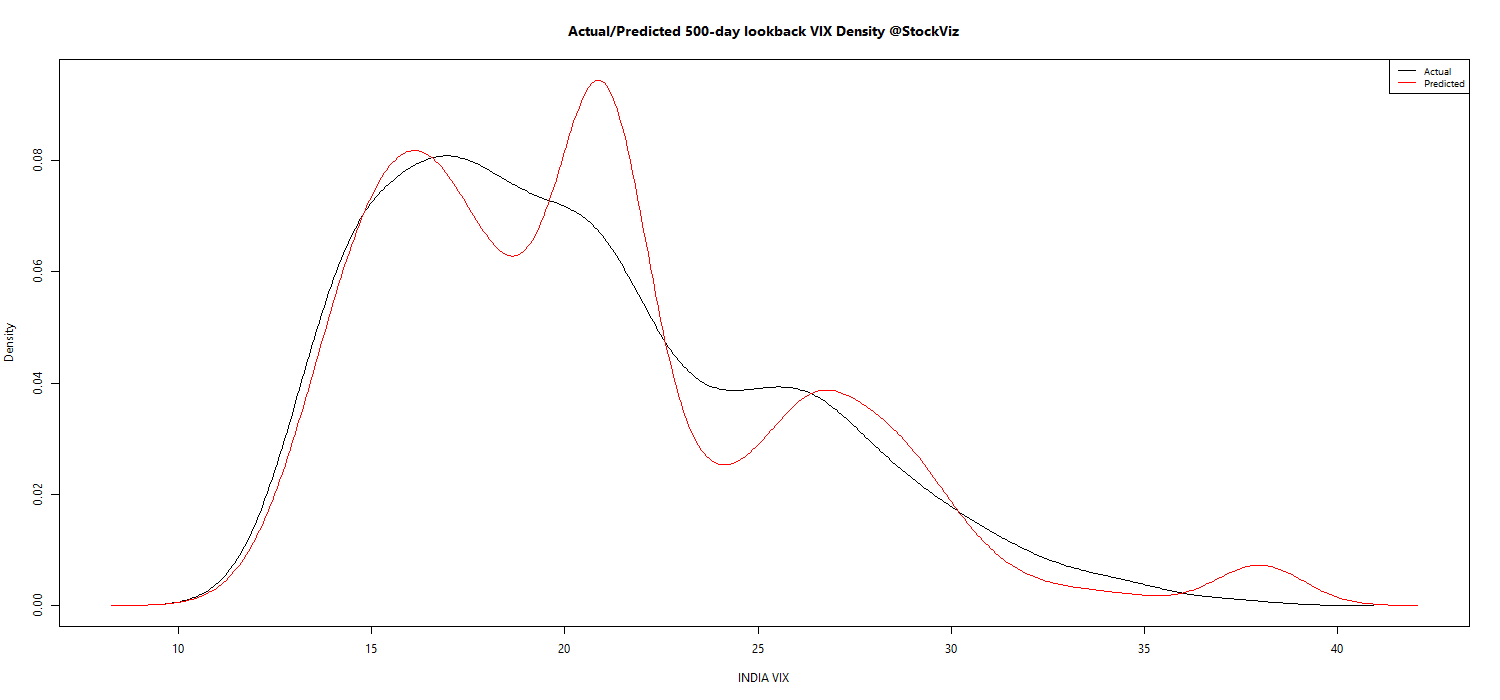

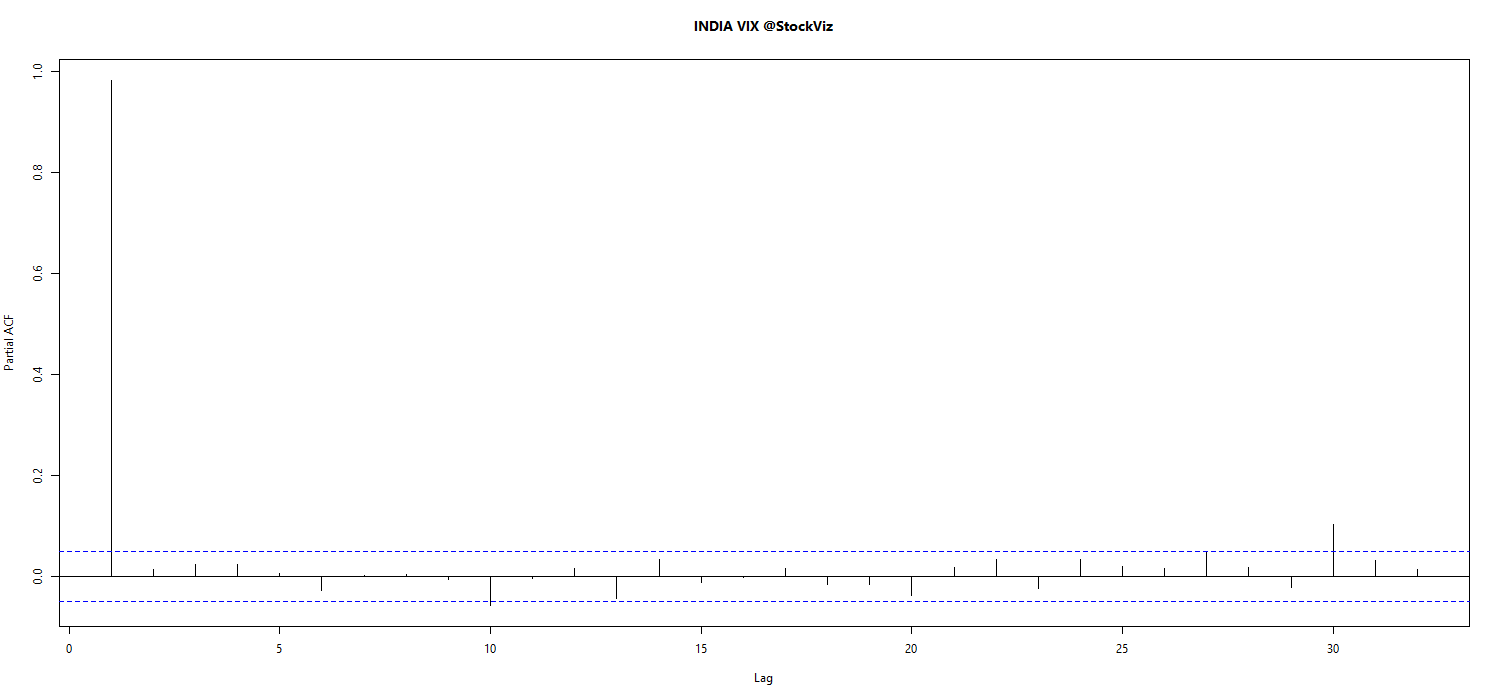

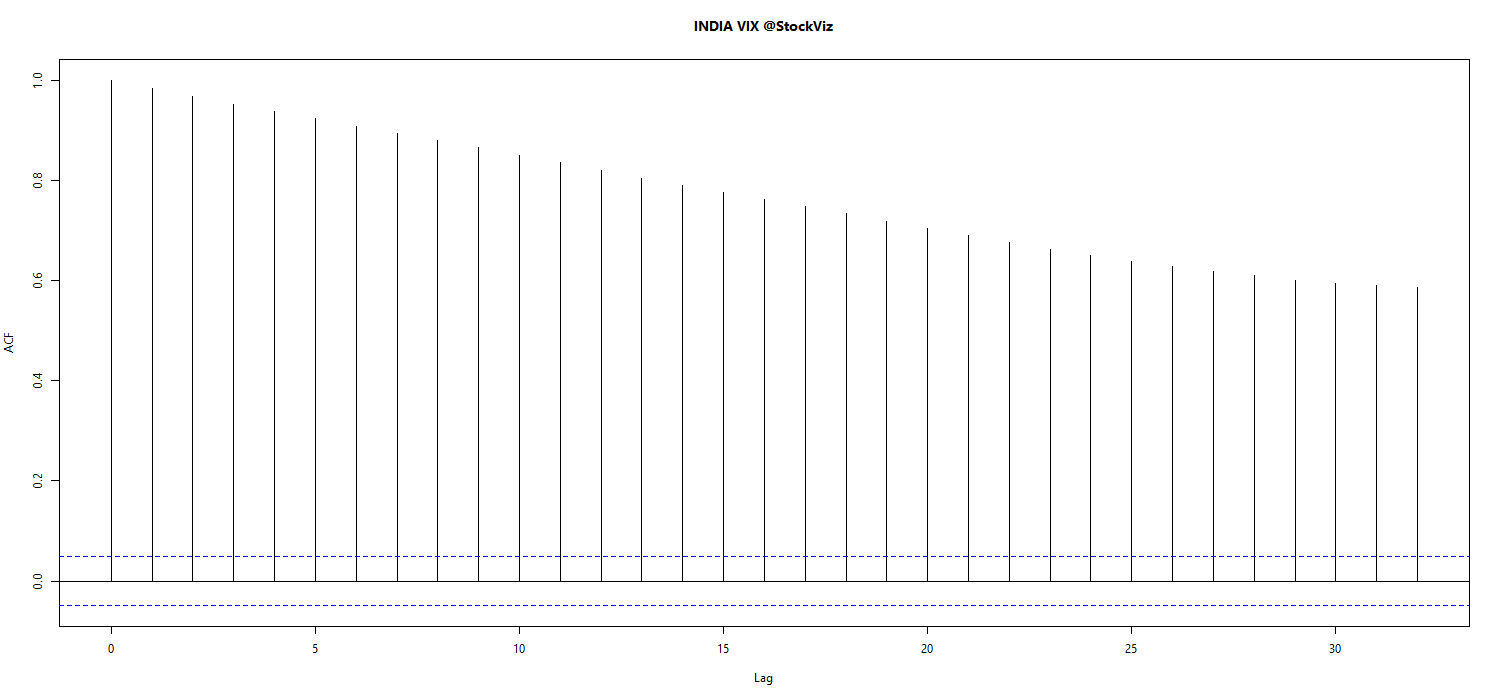

Can VIX be predicted using a simple model?

ARMA + GARCH to Predict VIX