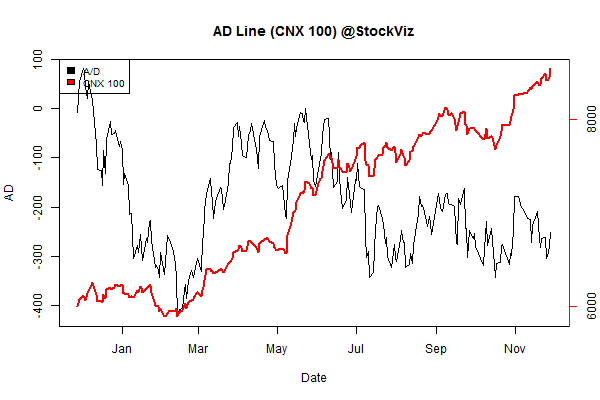

Equities

Commodities

| Energy |

| Brent Crude Oil |

-8.29% |

| Ethanol |

-29.94% |

| Heating Oil |

-6.66% |

| Natural Gas |

-0.50% |

| RBOB Gasoline |

-11.26% |

| WTI Crude Oil |

-4.06% |

| Metals |

| Copper |

-2.88% |

| Gold 100oz |

-5.36% |

| Palladium |

-12.55% |

| Platinum |

-9.38% |

| Silver 5000oz |

-11.79% |

| Agricultural |

| Cattle |

+5.29% |

| Cocoa |

-2.17% |

| Coffee (Arabica) |

+3.51% |

| Coffee (Robusta) |

+0.79% |

| Corn |

-11.13% |

| Cotton |

-5.74% |

| Feeder Cattle |

+10.07% |

| Lean Hogs |

+11.64% |

| Lumber |

-1.12% |

| Orange Juice |

-4.42% |

| Soybean Meal |

-29.19% |

| Soybeans |

-14.56% |

| Sugar #11 |

+2.75% |

| Wheat |

-13.09% |

| White Sugar |

-1.74% |

Credit Indices

| Index |

Change |

| Markit CDX EM |

+0.26% |

| Markit CDX NA HY |

-2.12% |

| Markit CDX NA IG |

+8.12% |

| Markit CDX NA IG HVOL |

+19.25% |

| Markit iTraxx Asia ex-Japan IG |

-1.49% |

| Markit iTraxx Australia |

+2.66% |

| Markit iTraxx Europe |

+5.79% |

| Markit iTraxx Europe Crossover |

+28.88% |

| Markit iTraxx Japan |

-3.93% |

| Markit iTraxx SovX Western Europe |

-3.01% |

| Markit LCDX (Loan CDS) |

-0.07% |

| Markit MCDX (Municipal CDS) |

+11.80% |

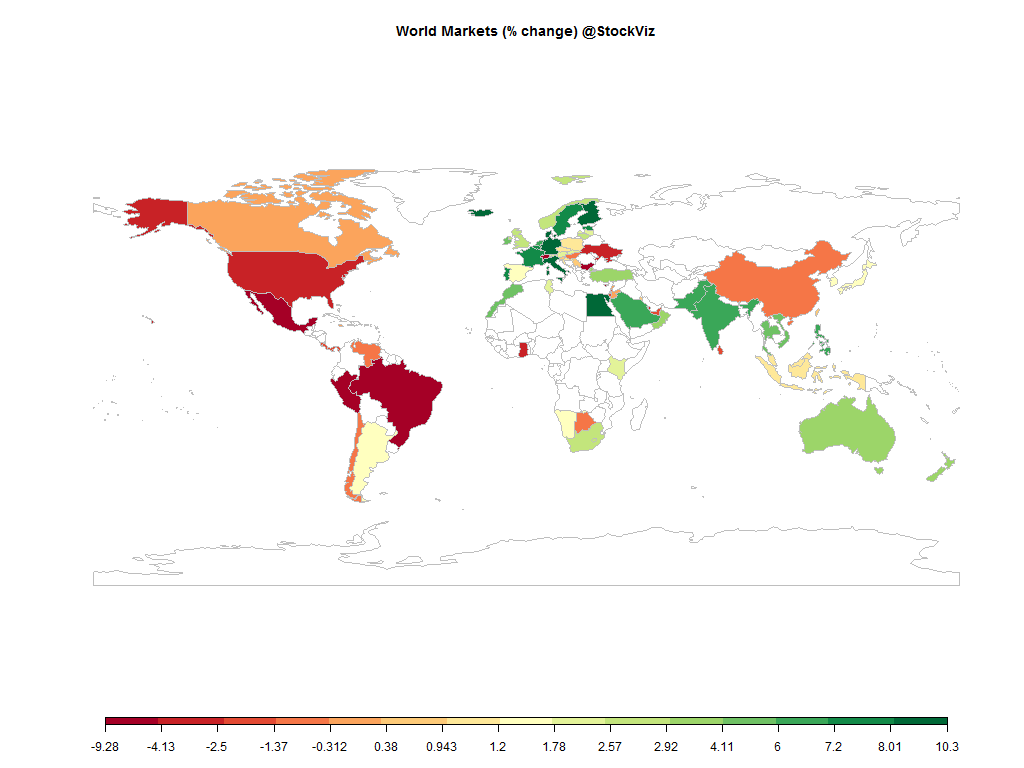

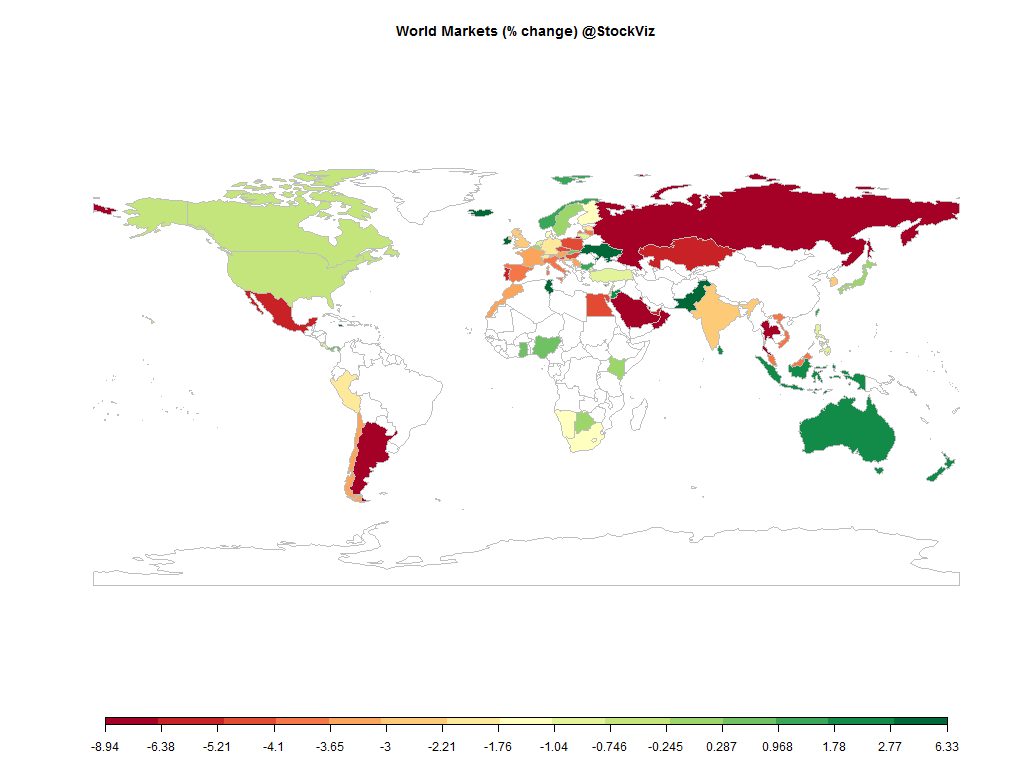

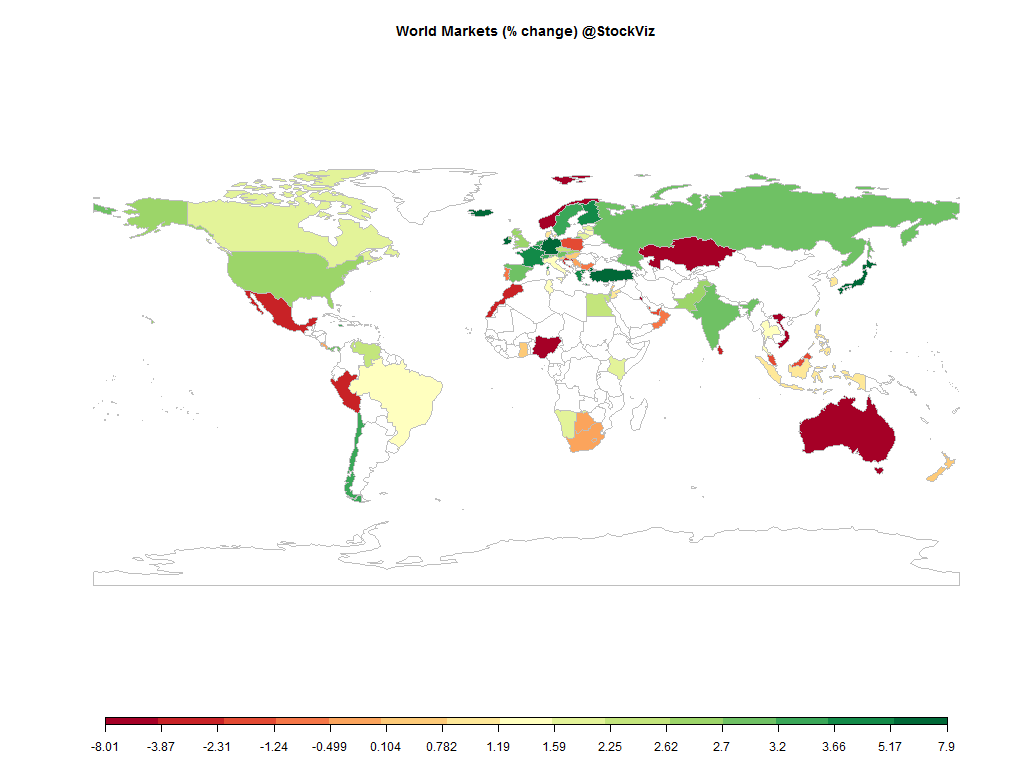

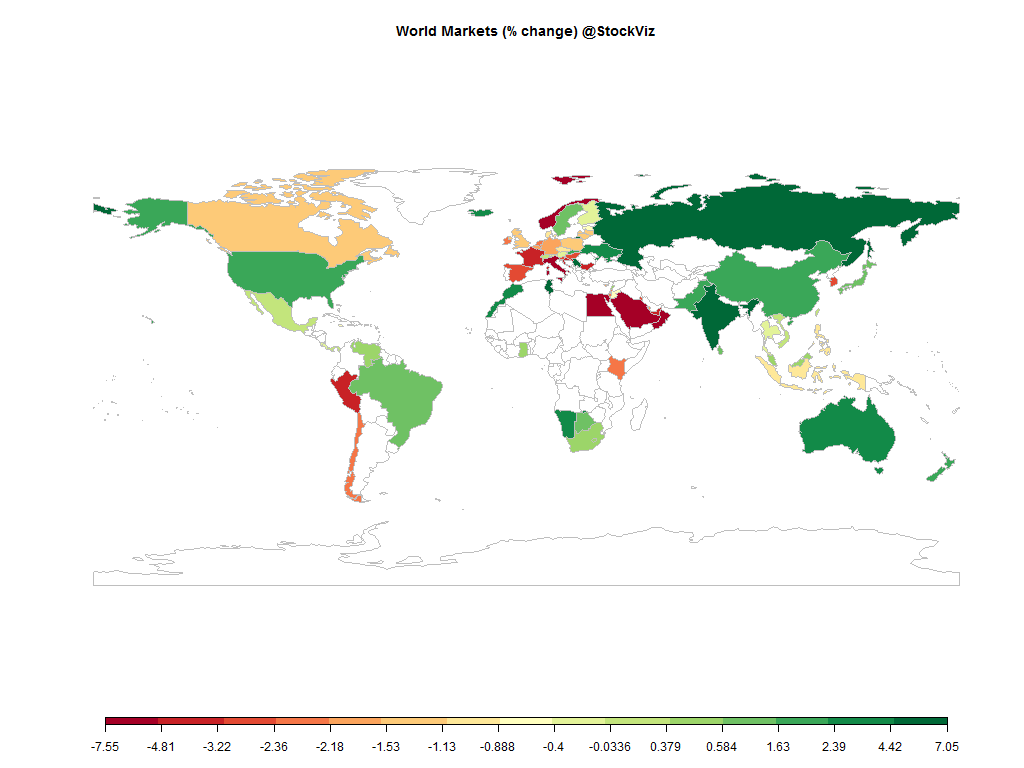

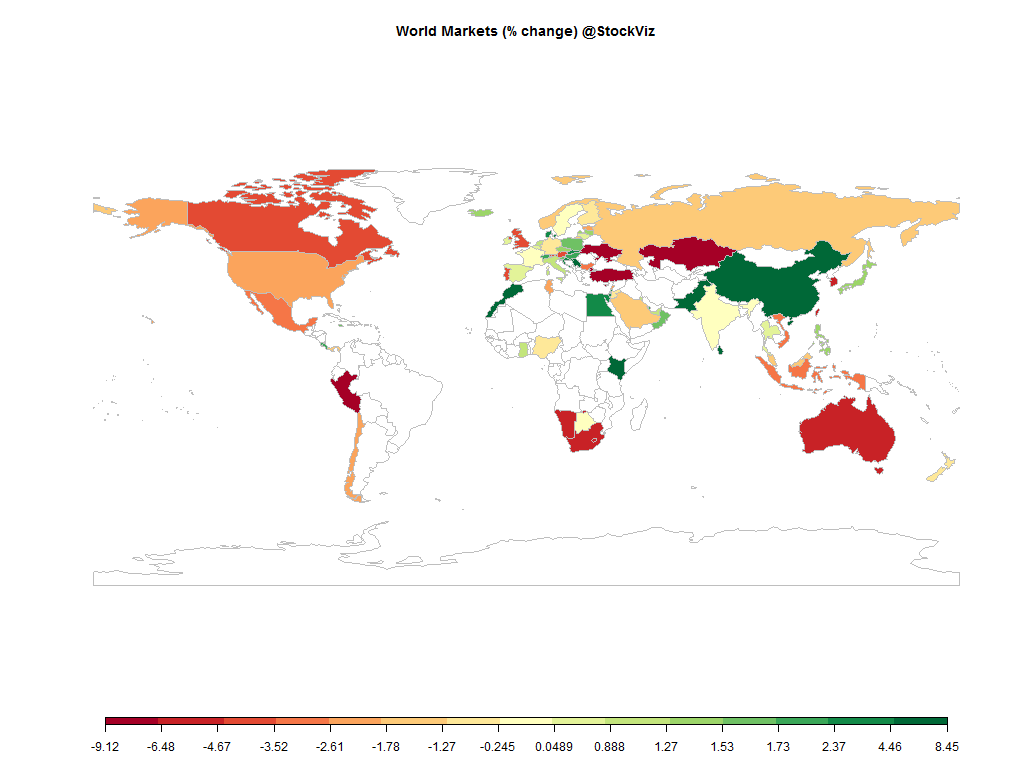

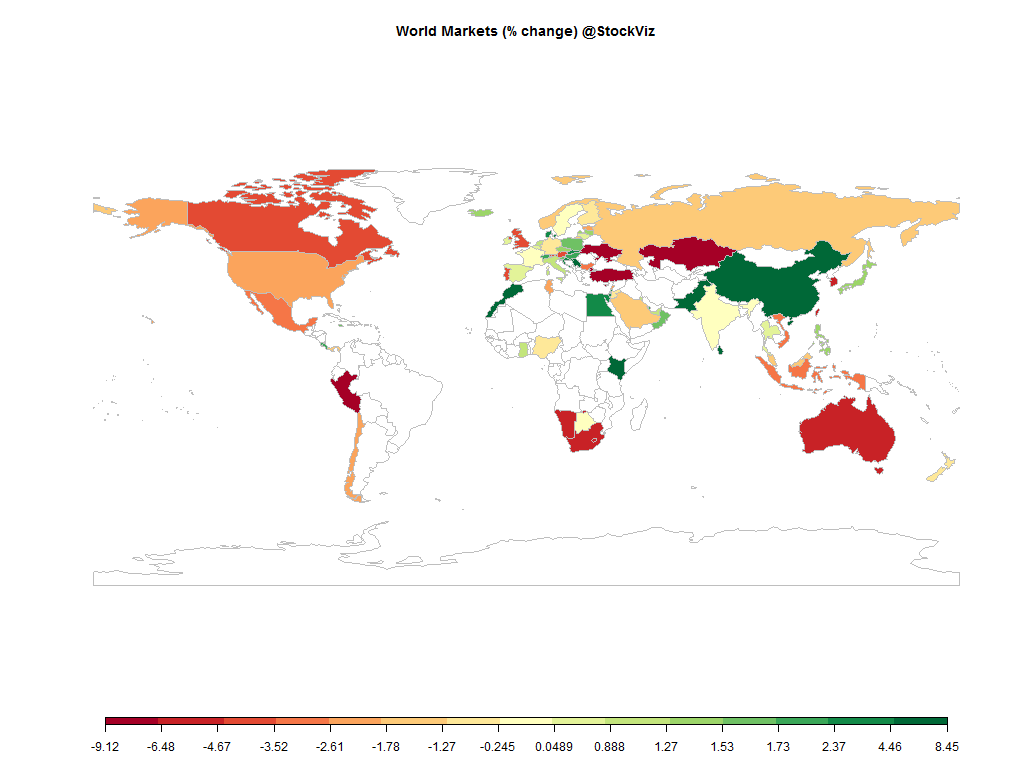

A US interest rates normalize, money that was sloshing about in frontier/emerging markets tends to flow back home. The US Dollar rallies, EM equities and credit wobble and commodities crash. Here’s to hoping that ZIRP stays on for a few more years and the ECB embarks on QE to pick up where the Fed left-off.

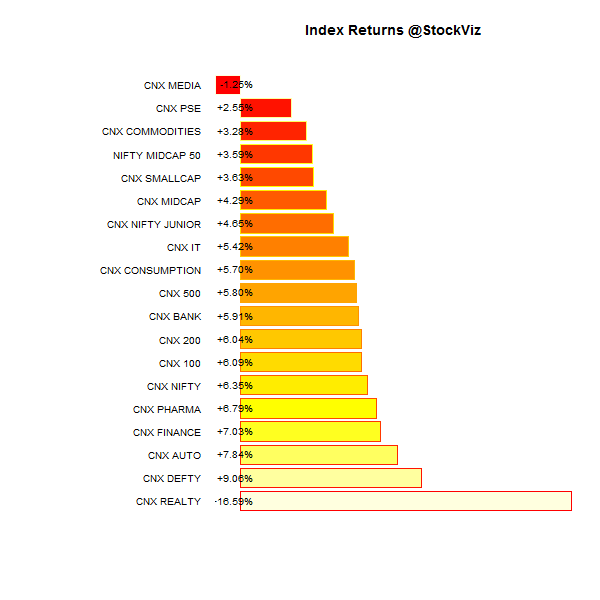

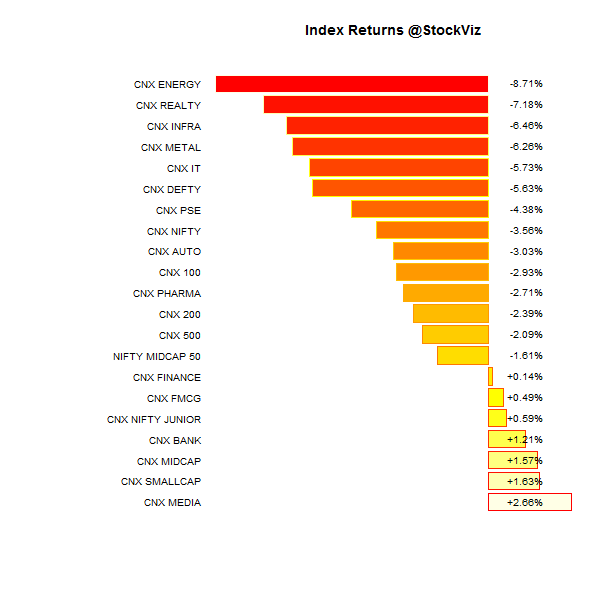

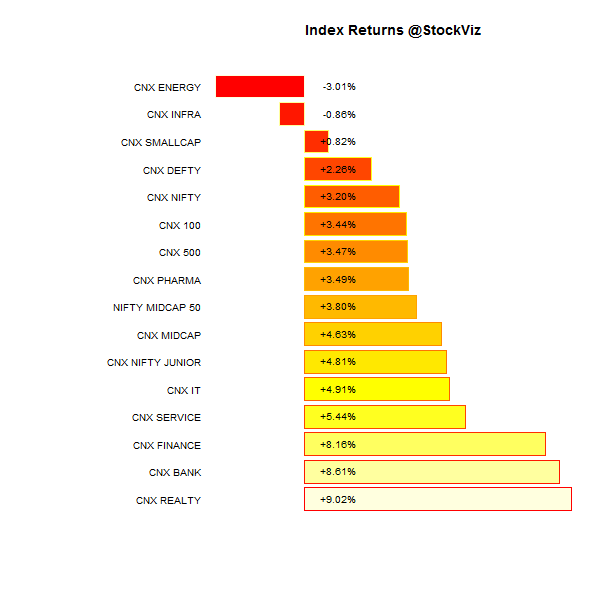

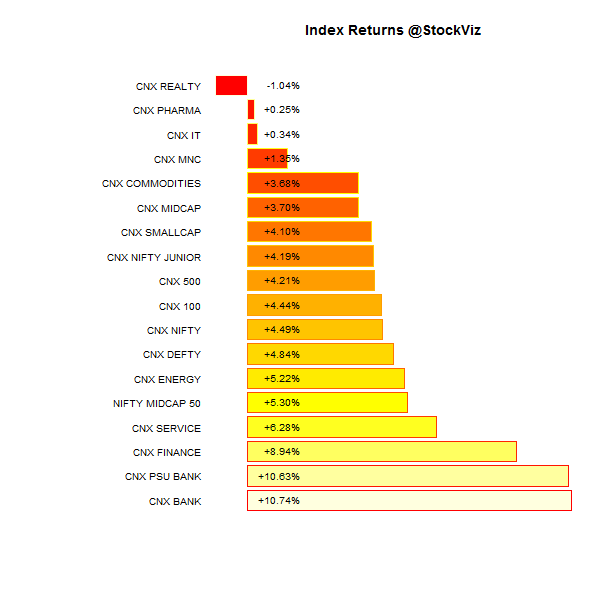

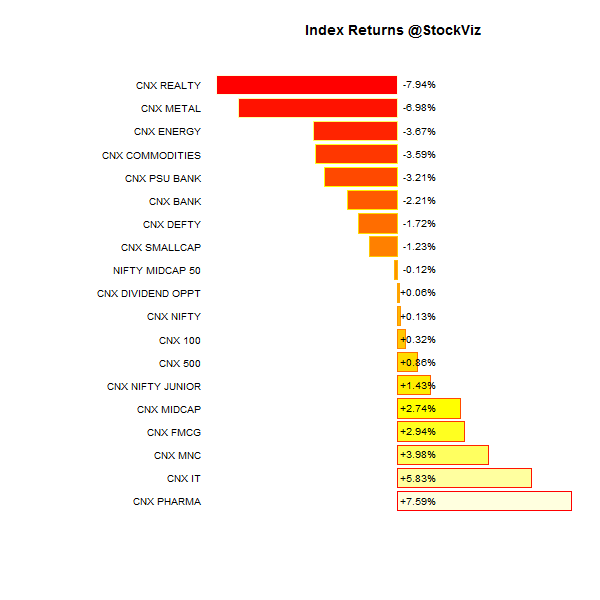

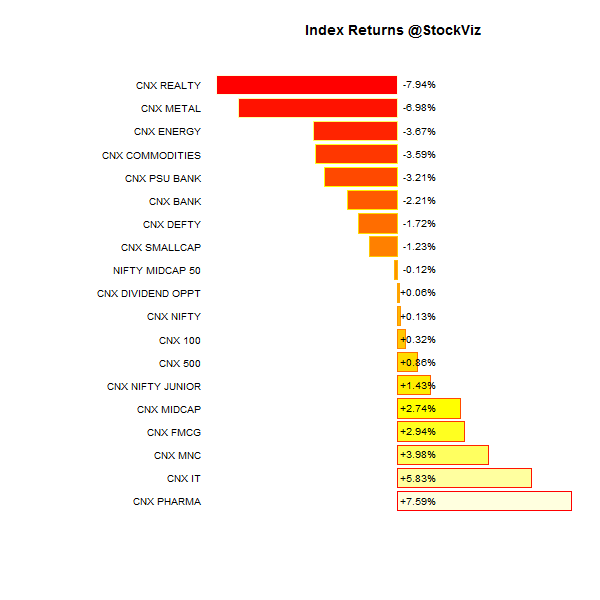

Index Performance

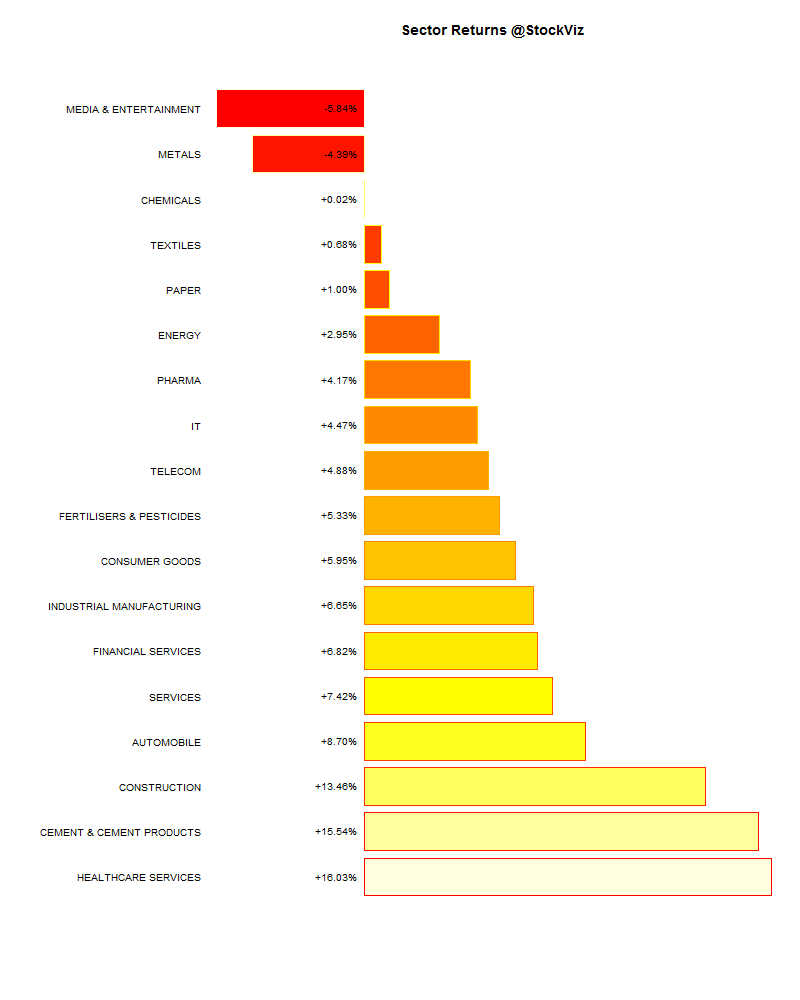

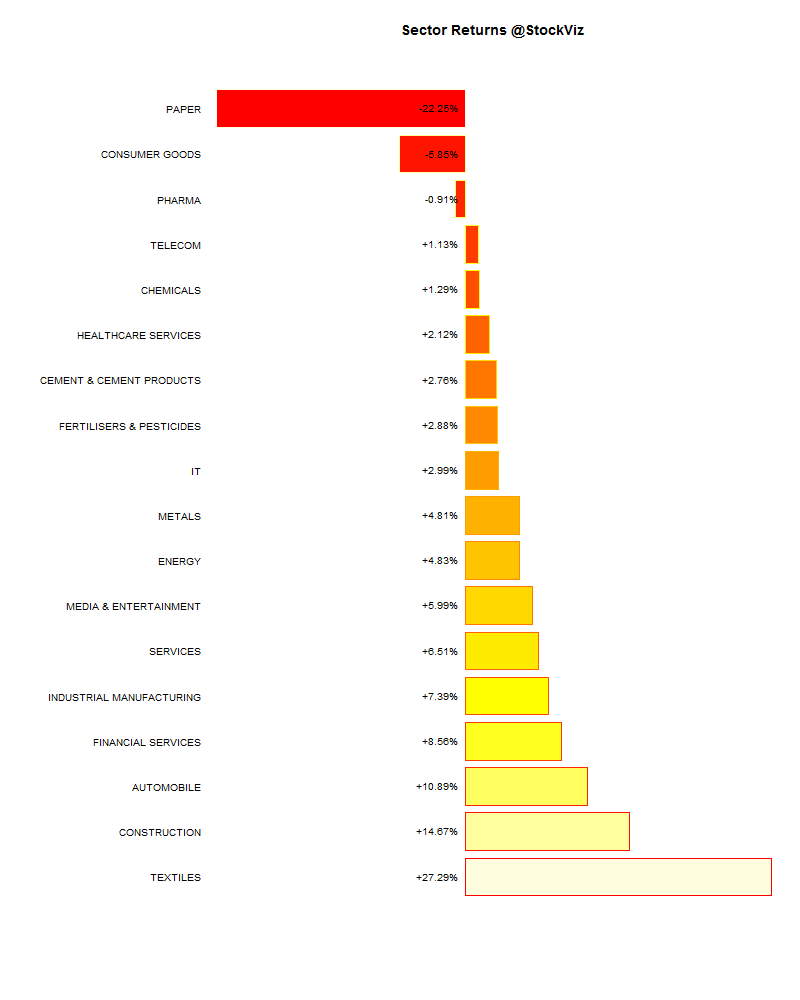

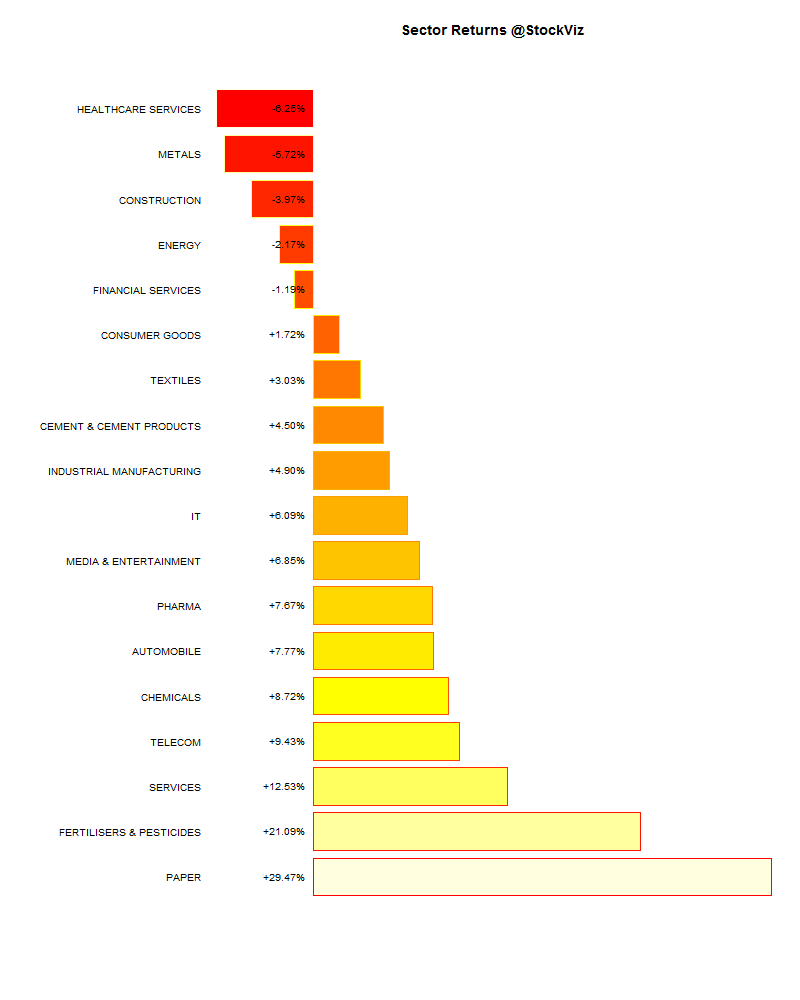

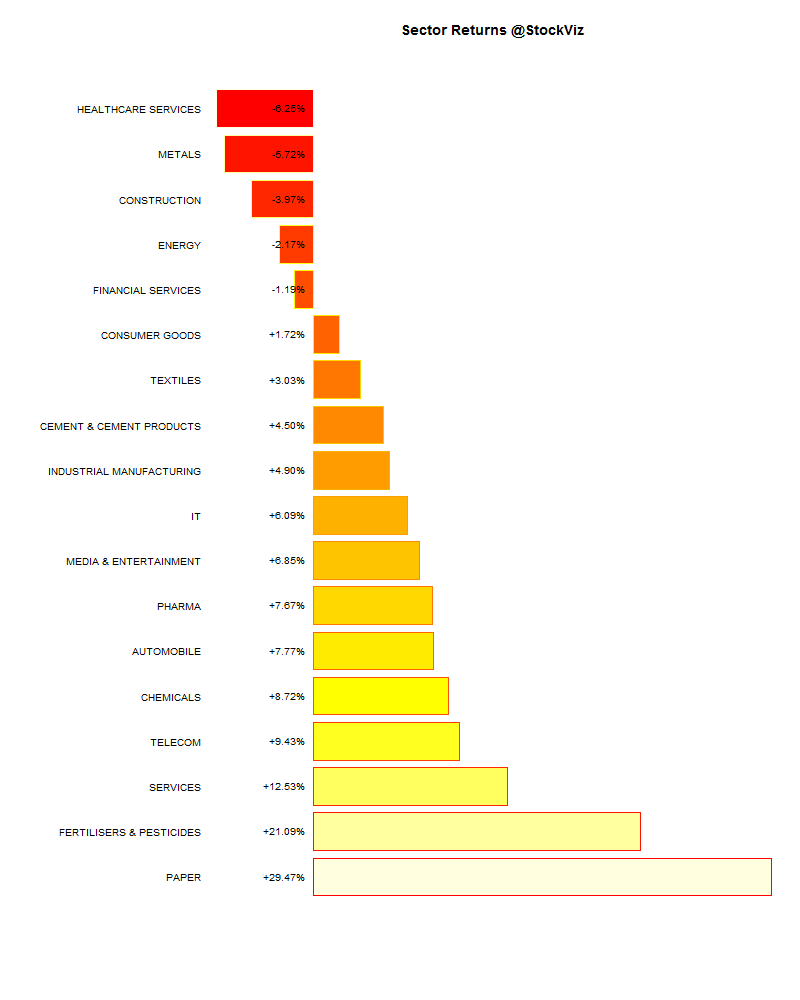

Sector Performance

Market Cap Decile Performance

| Decile |

Mkt. Cap. |

Adv/Decl |

| 1 (micro) |

+4.17% |

79/58 |

| 2 |

+11.38% |

77/59 |

| 3 |

+9.65% |

78/59 |

| 4 |

+6.86% |

78/59 |

| 5 |

+7.74% |

78/58 |

| 6 |

+4.69% |

78/60 |

| 7 |

+6.04% |

74/63 |

| 8 |

+2.70% |

72/65 |

| 9 |

+2.14% |

66/71 |

| 10 (mega) |

+0.75% |

66/72 |

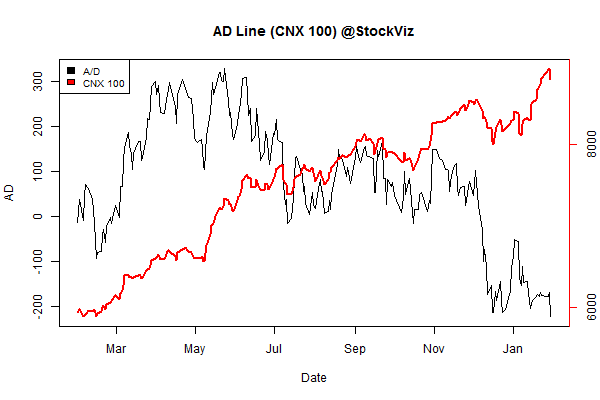

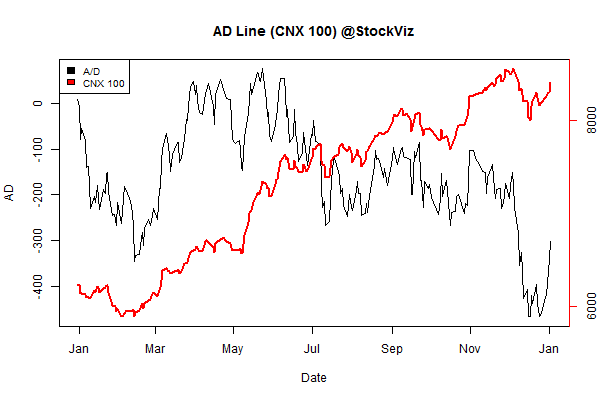

In spite of market jitters towards the end of September, small and mid-caps managed to come out way ahead of the large caps…

Top Winners and Losers

So much for the recovery trade. The market re-discovered FMCG, Pharma and IT…

ETFs

Gold turning out to be terrible investment…

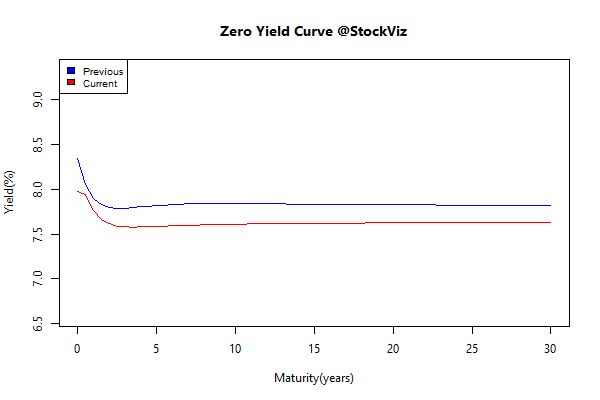

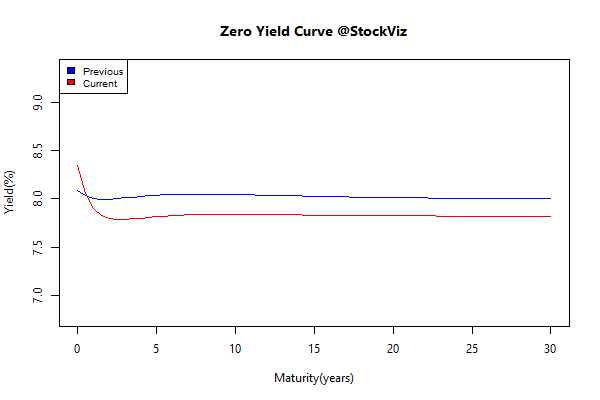

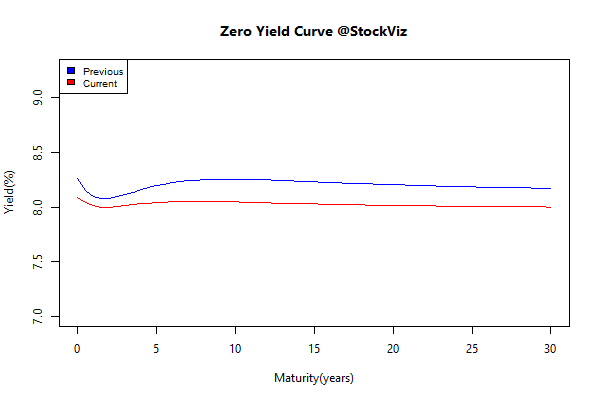

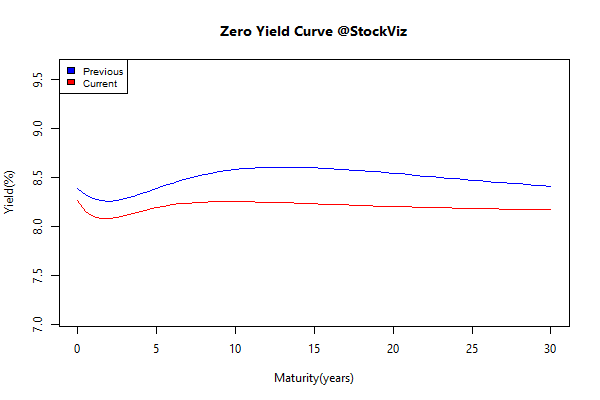

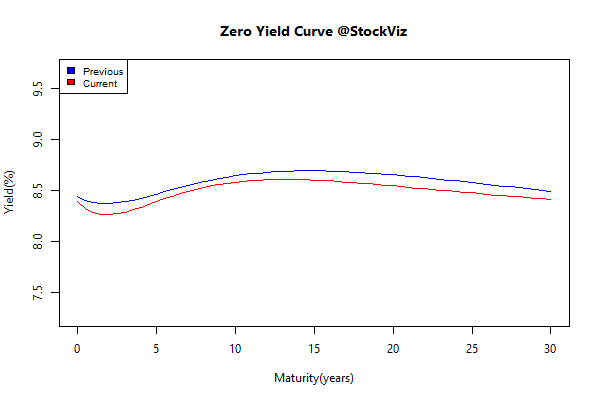

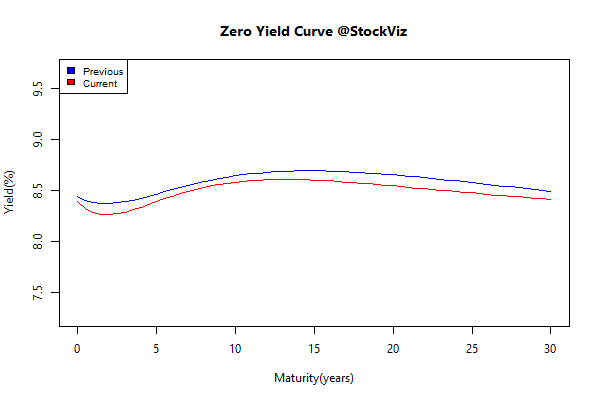

Yield Curve

The whole curve shifted down… lower inflation and rate-cut expectations can do that. But the curve might get steeper, given Rajan’s 6% inflation target for 2016.

Bond Indices

| Sub Index |

Change in YTM |

Total Return(%) |

| GSEC TB |

-0.05 |

+0.76% |

| GSEC SUB 1-3 |

+0.09 |

+0.68% |

| GSEC SUB 3-8 |

+0.27 |

-0.16% |

| GSEC SUB 8 |

+0.04 |

+0.17% |

No big moves…

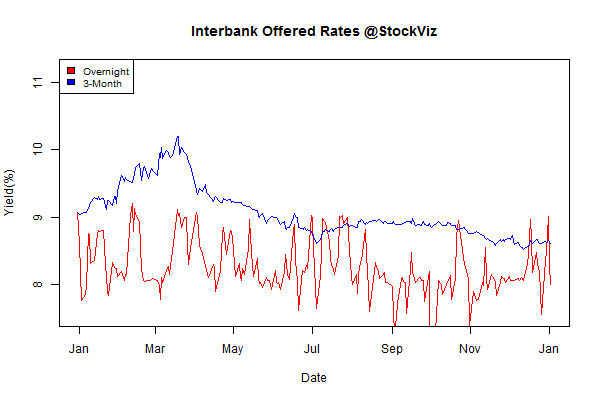

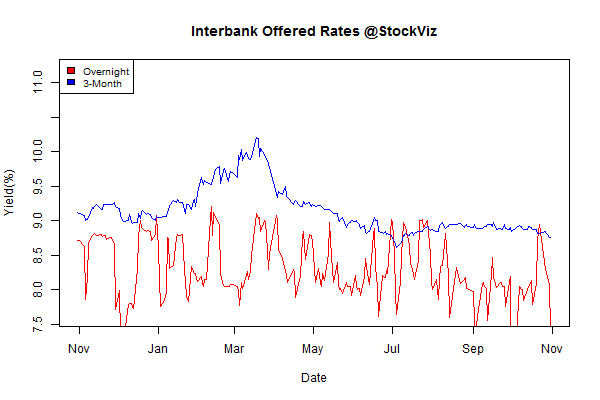

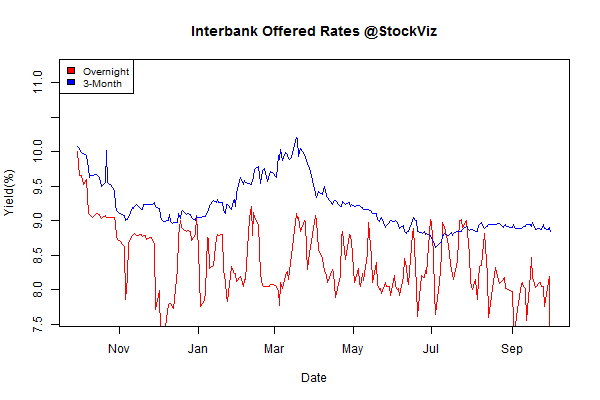

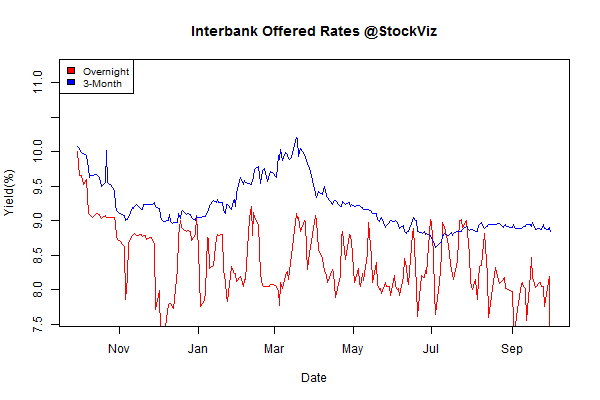

Interbank Lending

Theme Performance

Has been a good month for most investment strategies. However, high beta continued to get pummeled.

Thought to sum up the month

The Dornbusch Rule:

The Dornbusch rule is that your calculations of fundamentals may be accurate, and you may have high confidence in them, but nothing requires that the market has to have high confidence in your beliefs about fundamentals. Thus markets can remain far away from equilibrium for far longer than you, who understand and are dazzled by your analytical insights, think possible.

As the spouse of one senior hedge-fund official put it: your theory of the world is that the market is inefficient when you put a trade on but will rapidly become efficient thereafter — where “rapidly” means “before your clients lose their patience with you”.

Source: PIMCO: How to Lose (Lots of) Money and Still Influence People