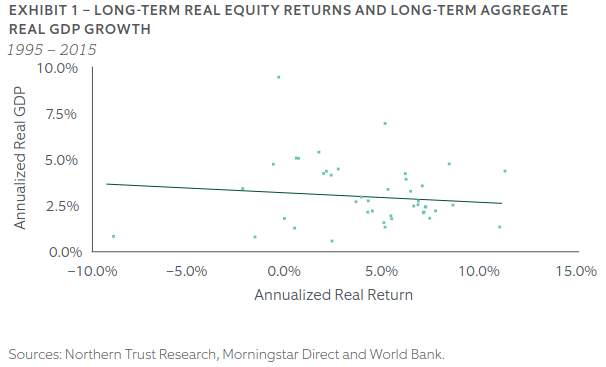

Prior research has shown that there is no correlation between GDP growth and stock market returns (see: The Enigma of Economic Growth and Stock Market Returns).

GDP is a trailing measure. However, does the relationship change if we use leading economic indicators?

To answer this question, we look to the OECD Composite Leading Indicator database. It is a monthly time series of CLIs of different regions. Here’s India’s and the G7’s charted from 1980:

If we scatter India’s CLI with next month’s NIFTY 50 returns, we get:

No correlation whatsoever.

However, we know that the market likes growth. So, what happens if we scatter the diff of the CLI over returns?

Noisy, but not hopeless!

Turns out, if you go long NIFTY 50 only when the CLI is improving, you get a 2% boost over the long run return.

The kicker here is that the drawdowns are a lot less severe.

Code and charts are on github.