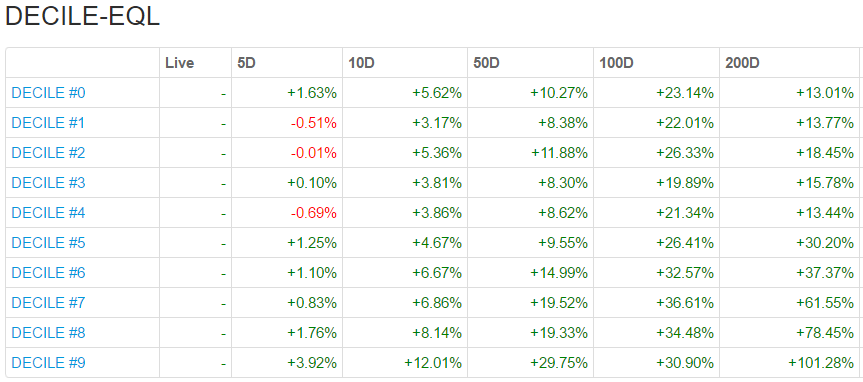

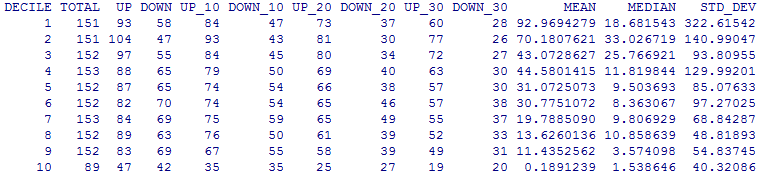

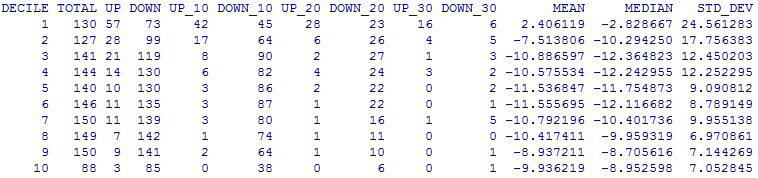

When you sort the universe of stocks in descending order of their free-float market caps and divide them into 10 sets, you end up with StockViz Deciles. If you were to plot the dispersion of market-caps within deciles, here’s how it would look:

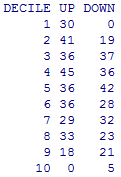

Most of the activity in the markets are in the first 3-4 deciles. Liquidity, as measured by the bid/offer spread, trails off as the float drops:

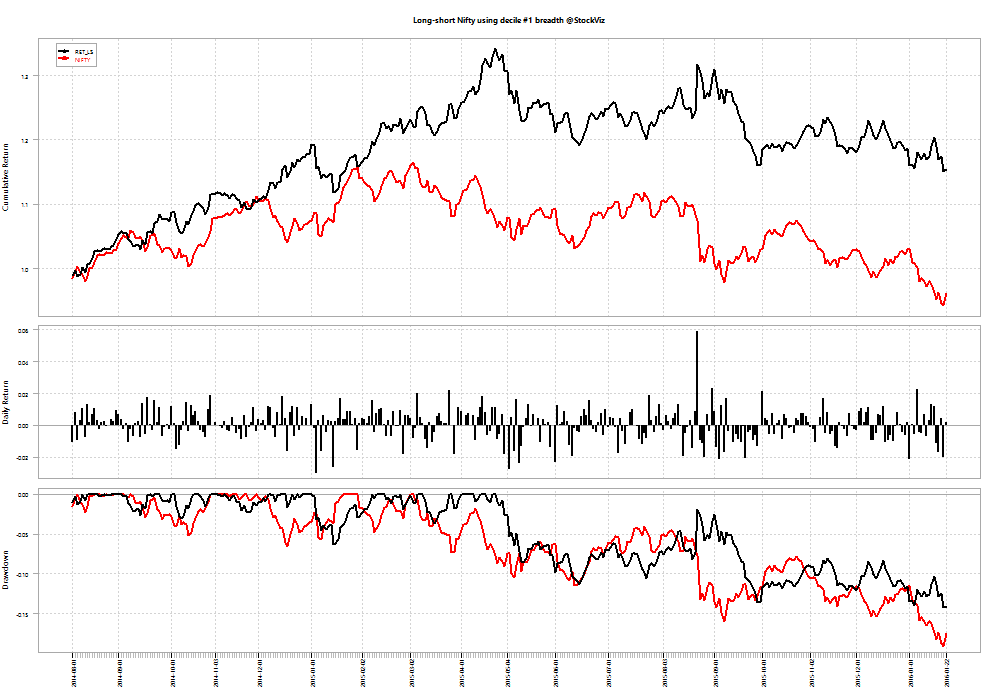

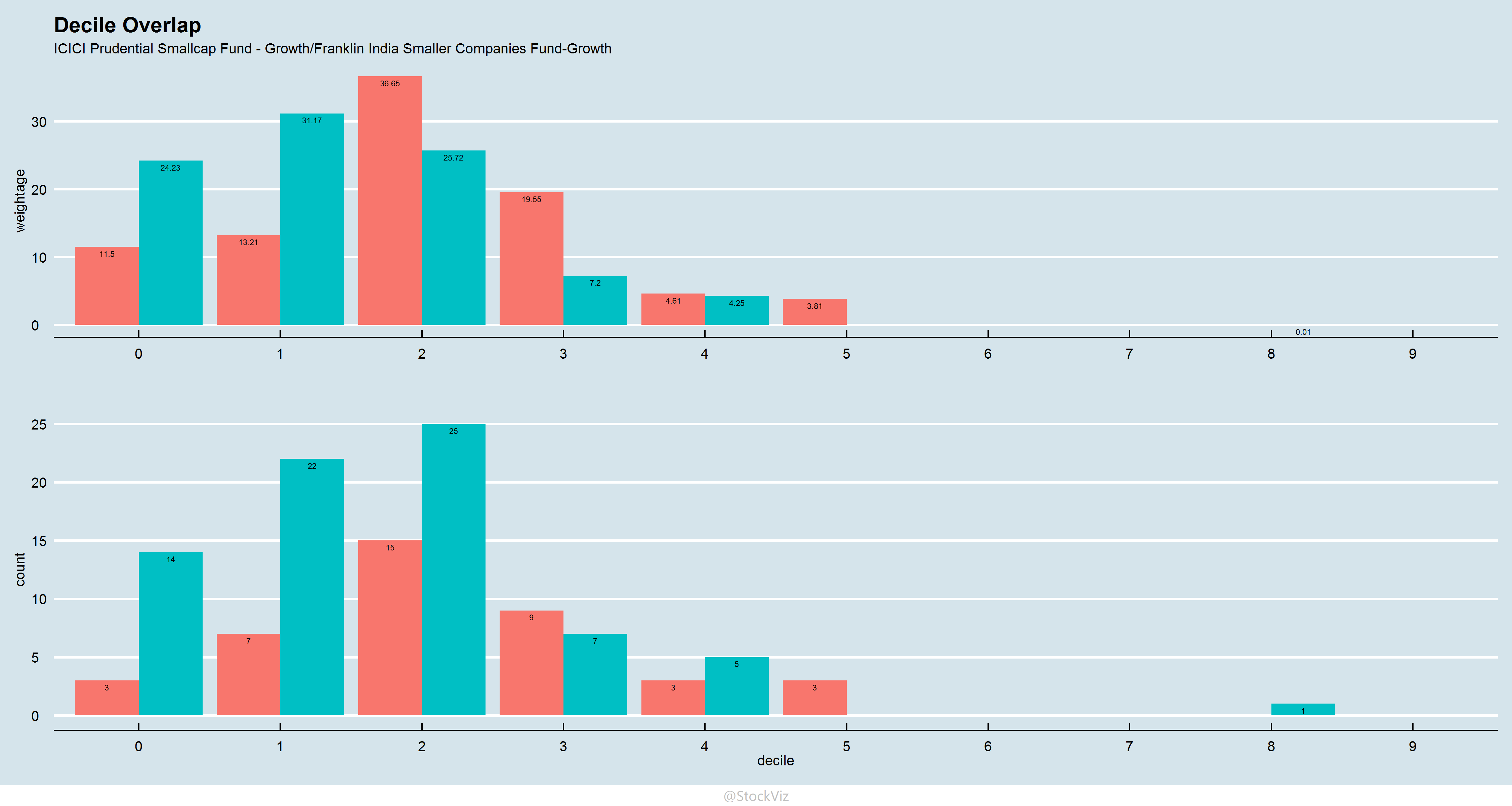

The wide bid/offers presents a scale challenge to small-cap fund managers. The hair-cut to NAV that they will have to take while crossing the spread is just too large. So most small-cap funds pull up:

Notice how most of the portfolios is concentrated above the 4th decile. Now, contrast this to the NIFTY SMALLCAP 250 index:

If the funds were to stay true to their small-cap moniker, they really shouldn’t be holding decile 0 (mega-cap) stocks. However, holding them seems to be the only way to scale AUM.

If you care about whether a fund is sticking to its portfolio mandate, give our Overlap Tool a spin.