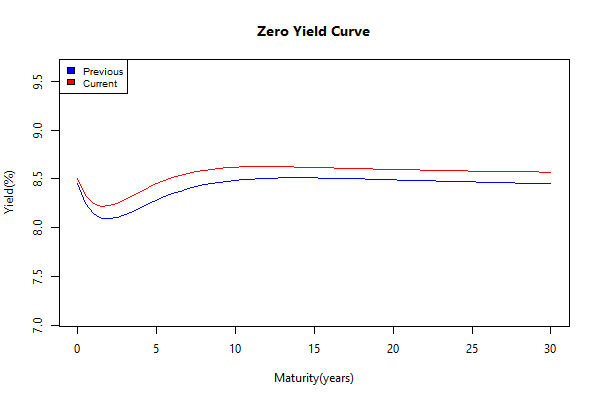

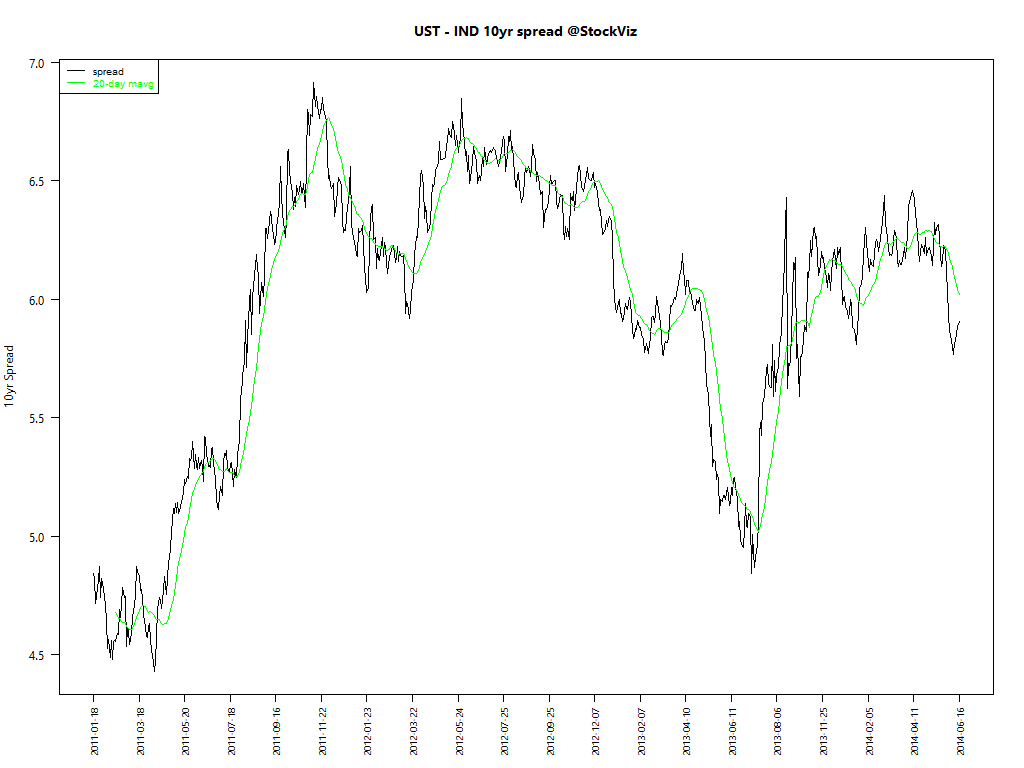

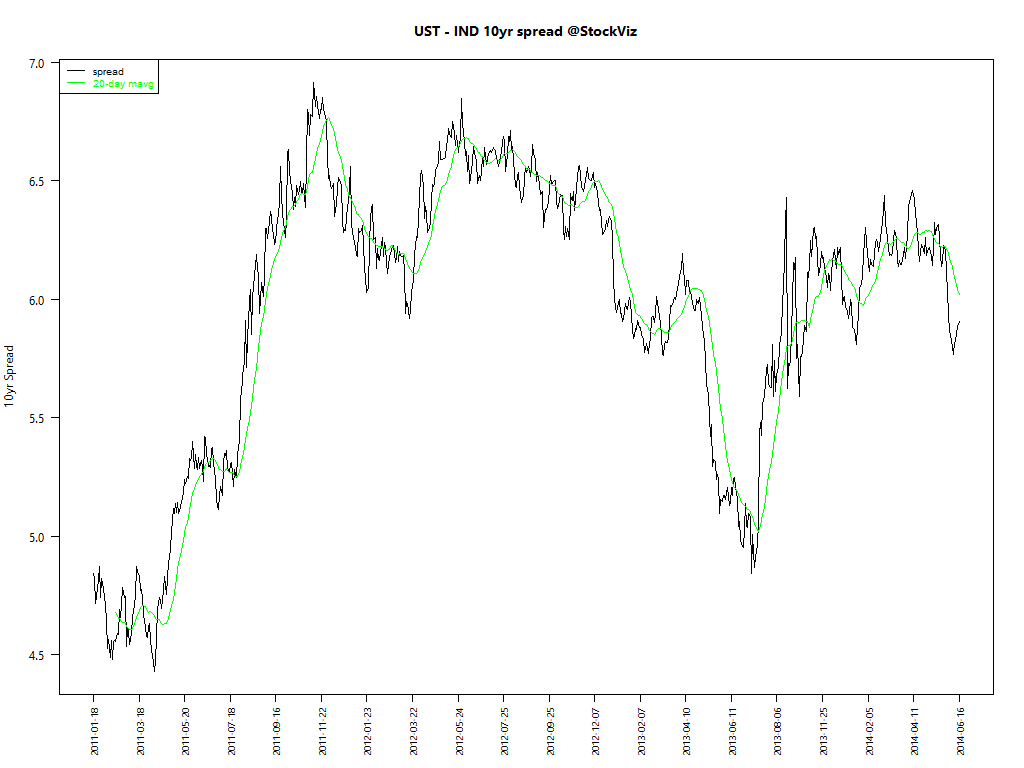

We recently pulled up a chart of Indian 10 year rates to show how the interest rate curve went all bullish on Modi. But given the all around bullishness, we were curious as to how the 10-year rate differential between US Treasuries and Indian GSecs looked.

UST vs. GSecs

The spread compression is nowhere near all-out bullishness and may have more room to run.

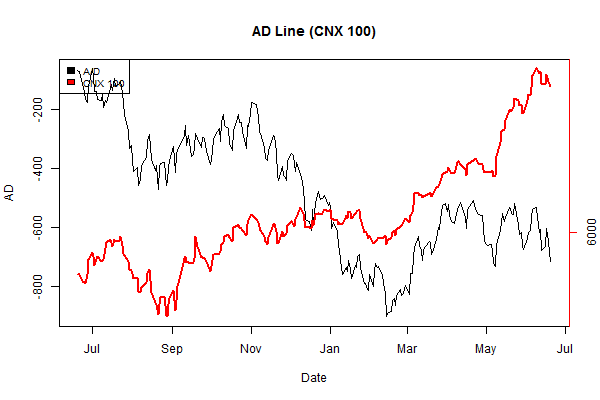

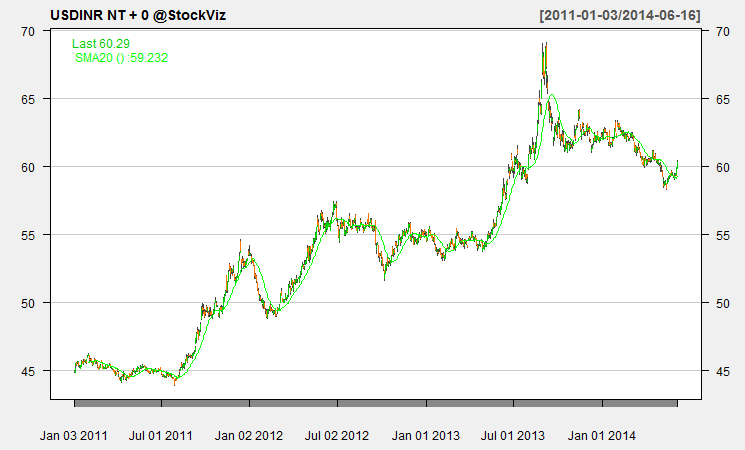

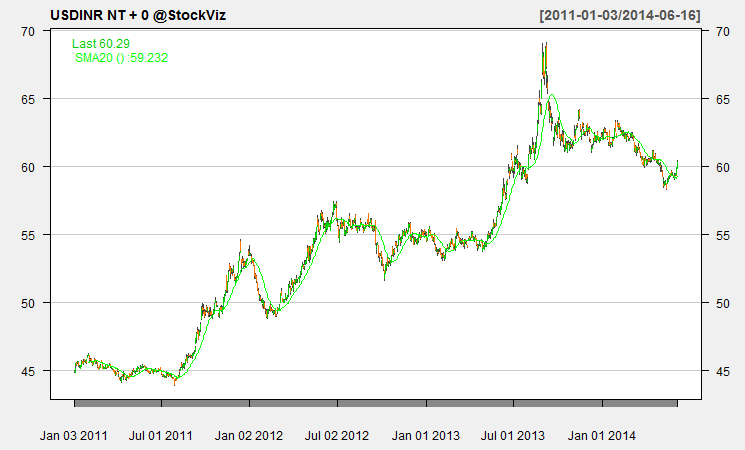

USDINR

The recent ISIS induced flight-to-safety notwithstanding, USDINR has tagged along the spread.

Even if ISIS ends up occupying Iraq, given that their primary source of revenue is going to be oil, they might just decide to pump more of it. Our expectation is that once we get past the current knee-jerk reaction, the above trends will reassert themselves.

Related

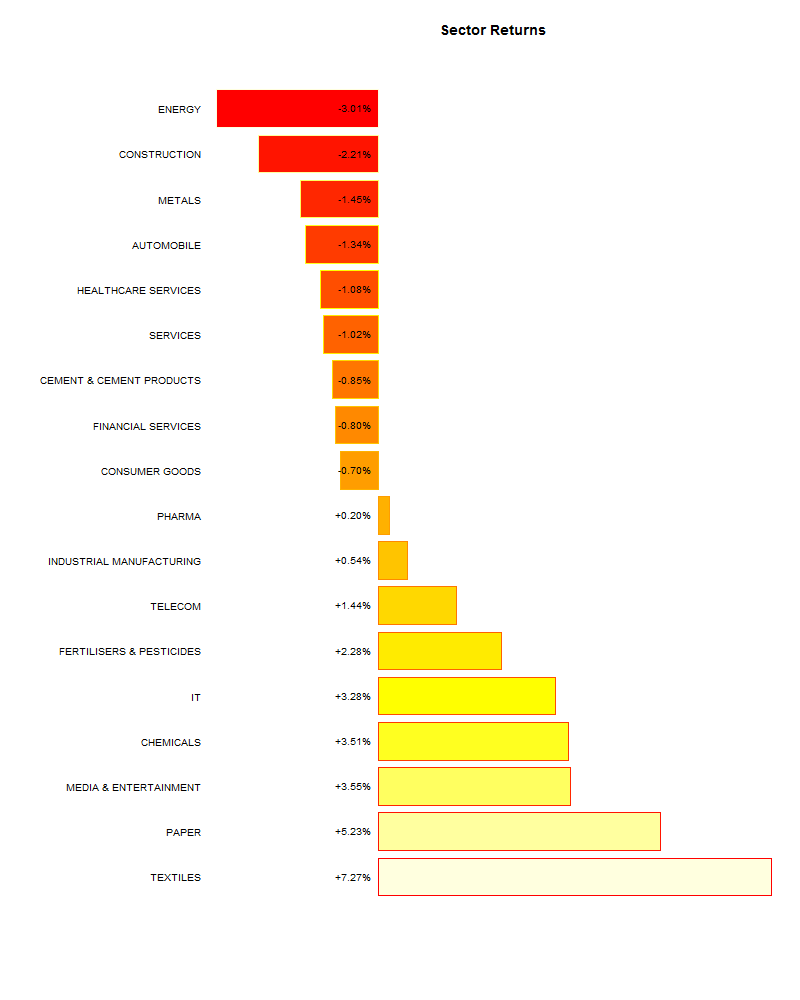

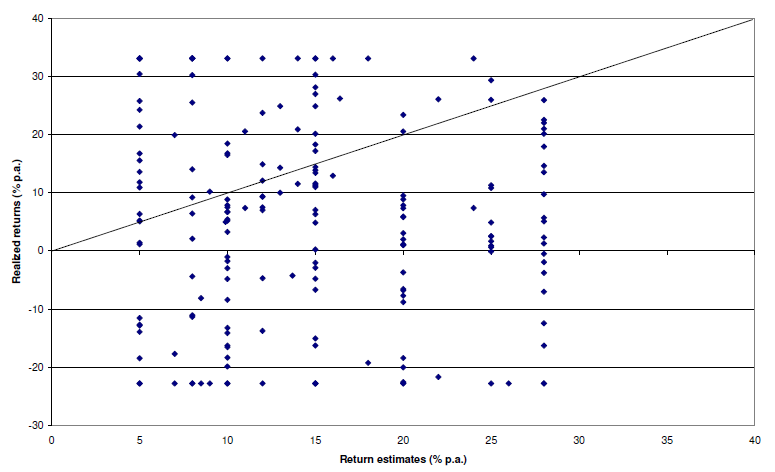

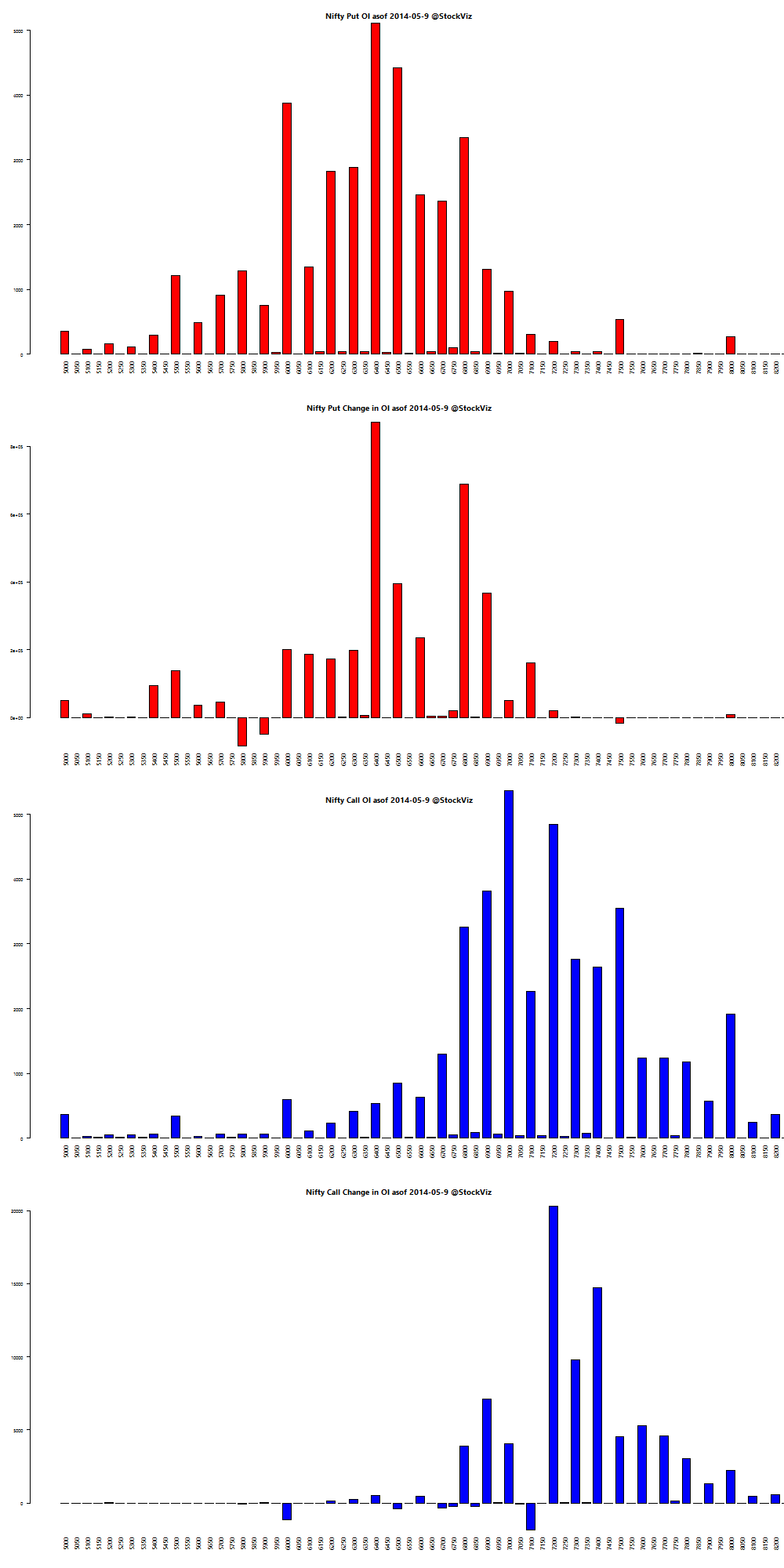

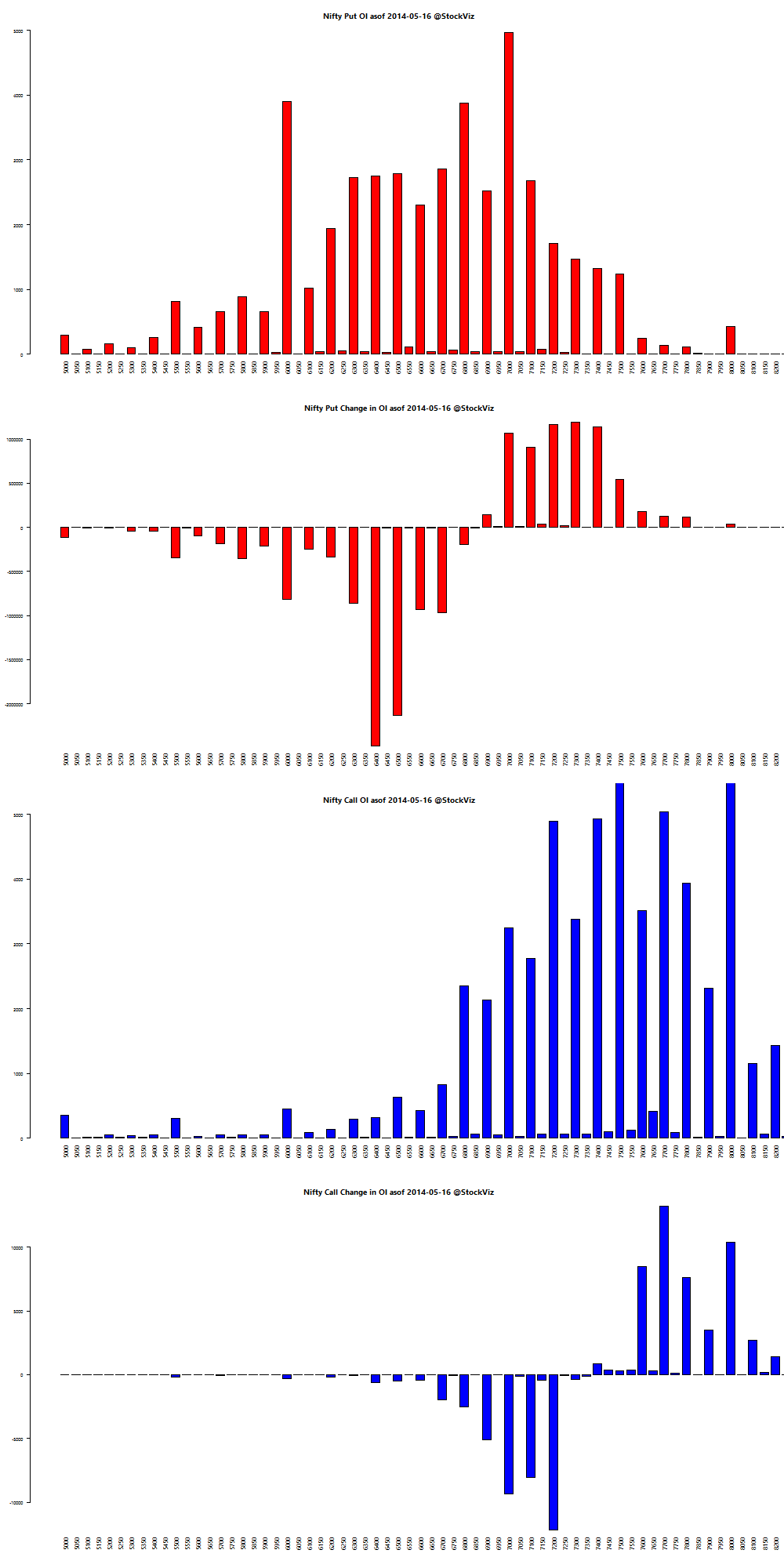

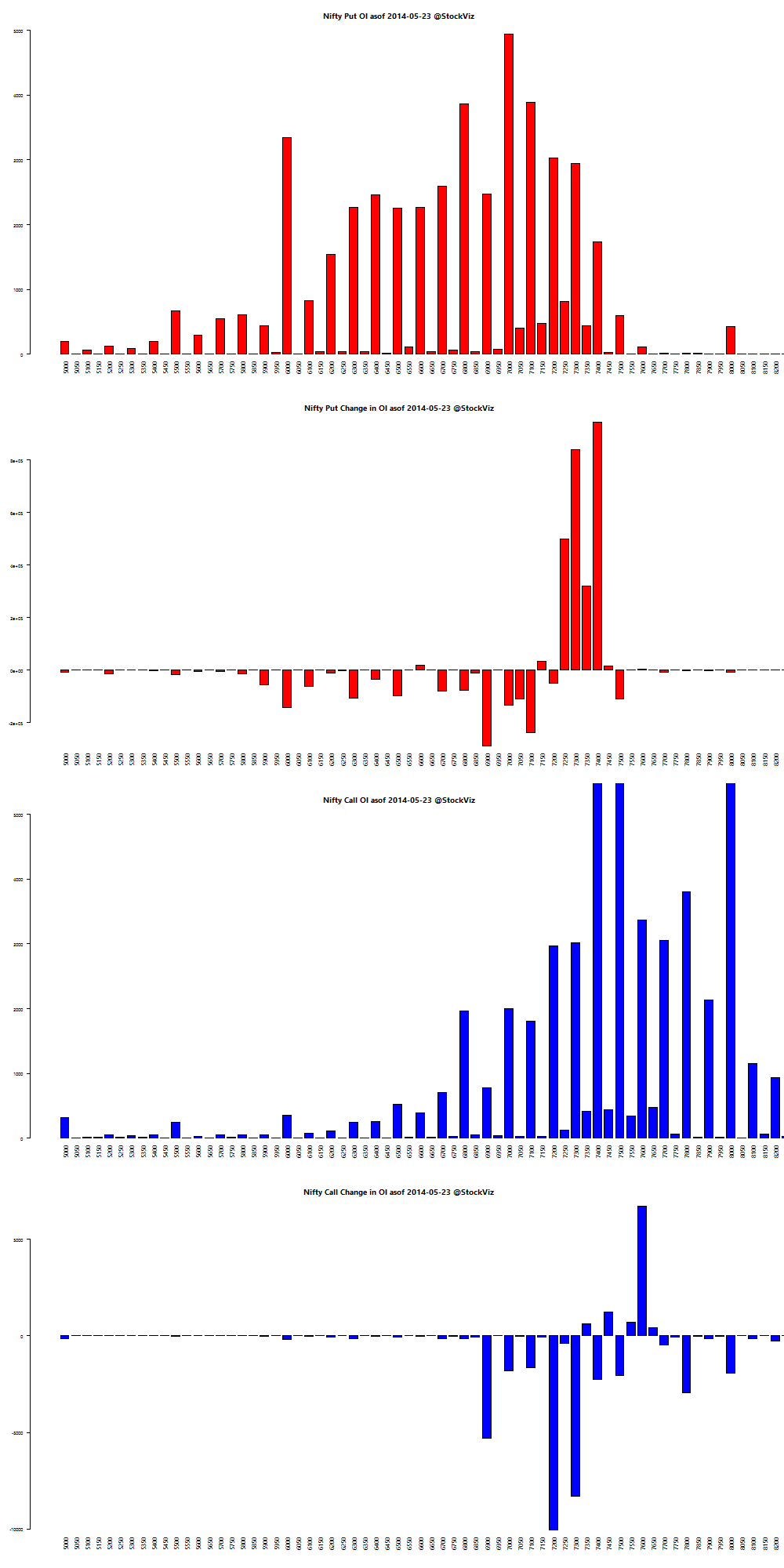

It’s important to be politically agnostic and think about the potential market impact of the event. There are three sources of event risk that could cause the markets to swoon:

- Iraq

- Russia-Ukraine

- Chinese financial crisis

“My conclusion is that the so-called tail-risk are wrong and the immediate threat posed by tail-risk is lower than the market thinks.”

Source: Apocalypse Later