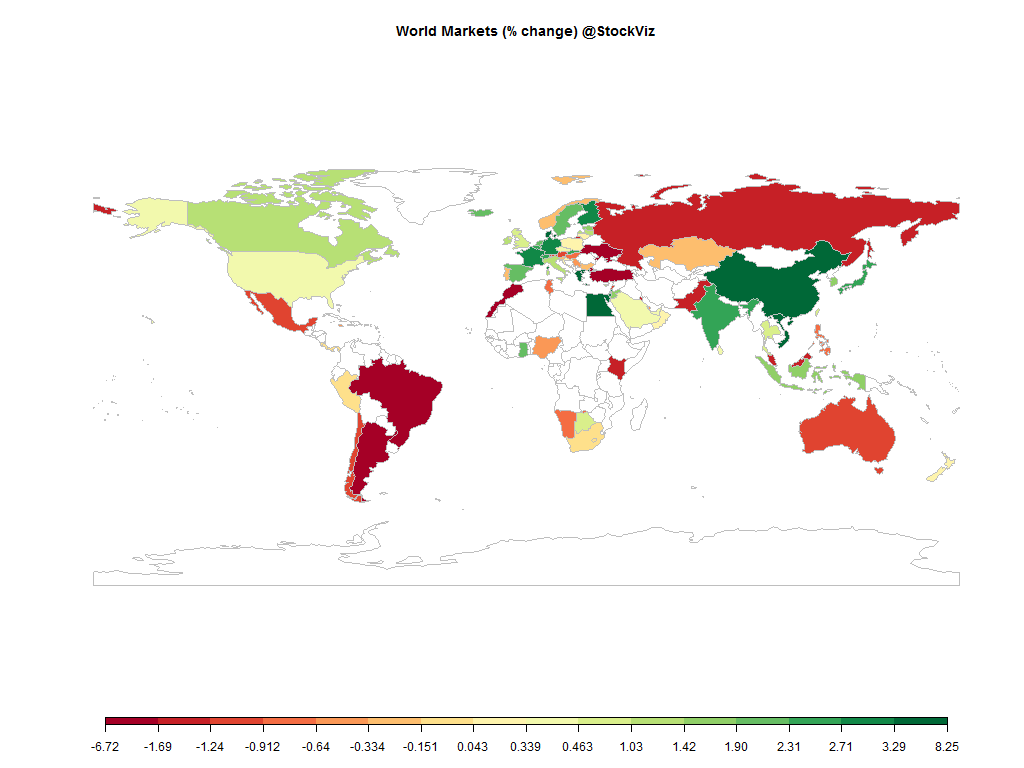

Equities

Commodities

| Energy |

| Ethanol |

-6.26% |

| WTI Crude Oil |

+0.69% |

| Heating Oil |

-2.32% |

| Natural Gas |

-4.60% |

| RBOB Gasoline |

+0.78% |

| Brent Crude Oil |

-1.96% |

| Metals |

| Gold 100oz |

-0.95% |

| Palladium |

-1.45% |

| Platinum |

-1.95% |

| Copper |

-4.41% |

| Silver 5000oz |

-2.29% |

| Agricultural |

| Feeder Cattle |

+0.59% |

| Orange Juice |

+5.82% |

| Soybean Meal |

+0.30% |

| Soybeans |

-2.83% |

| Sugar #11 |

-4.12% |

| Wheat |

+0.98% |

| White Sugar |

-4.33% |

| Cattle |

-0.21% |

| Cocoa |

+2.18% |

| Coffee (Arabica) |

-7.87% |

| Coffee (Robusta) |

-3.06% |

| Corn |

-1.37% |

| Cotton |

-5.07% |

| Lumber |

+14.50% |

| Lean Hogs |

+0.66% |

Credit Indices

| Index |

Change |

| Markit CDX EM |

+0.21% |

| Markit CDX NA HY |

-0.07% |

| Markit CDX NA IG |

+0.44% |

| Markit iTraxx Asia ex-Japan IG |

-3.17% |

| Markit iTraxx Australia |

-0.76% |

| Markit iTraxx Europe |

-0.88% |

| Markit iTraxx Europe Crossover |

-6.29% |

| Markit iTraxx Japan |

-1.17% |

| Markit iTraxx SovX Western Europe |

-0.04% |

| Markit LCDX (Loan CDS) |

+0.00% |

| Markit MCDX (Municipal CDS) |

+1.77% |

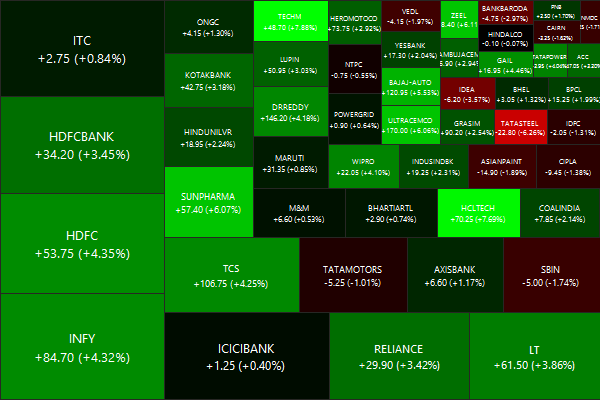

A moment of silence to whoever shorted the market thinking the NIFTY will go to 7600. May your capital rest in peace.

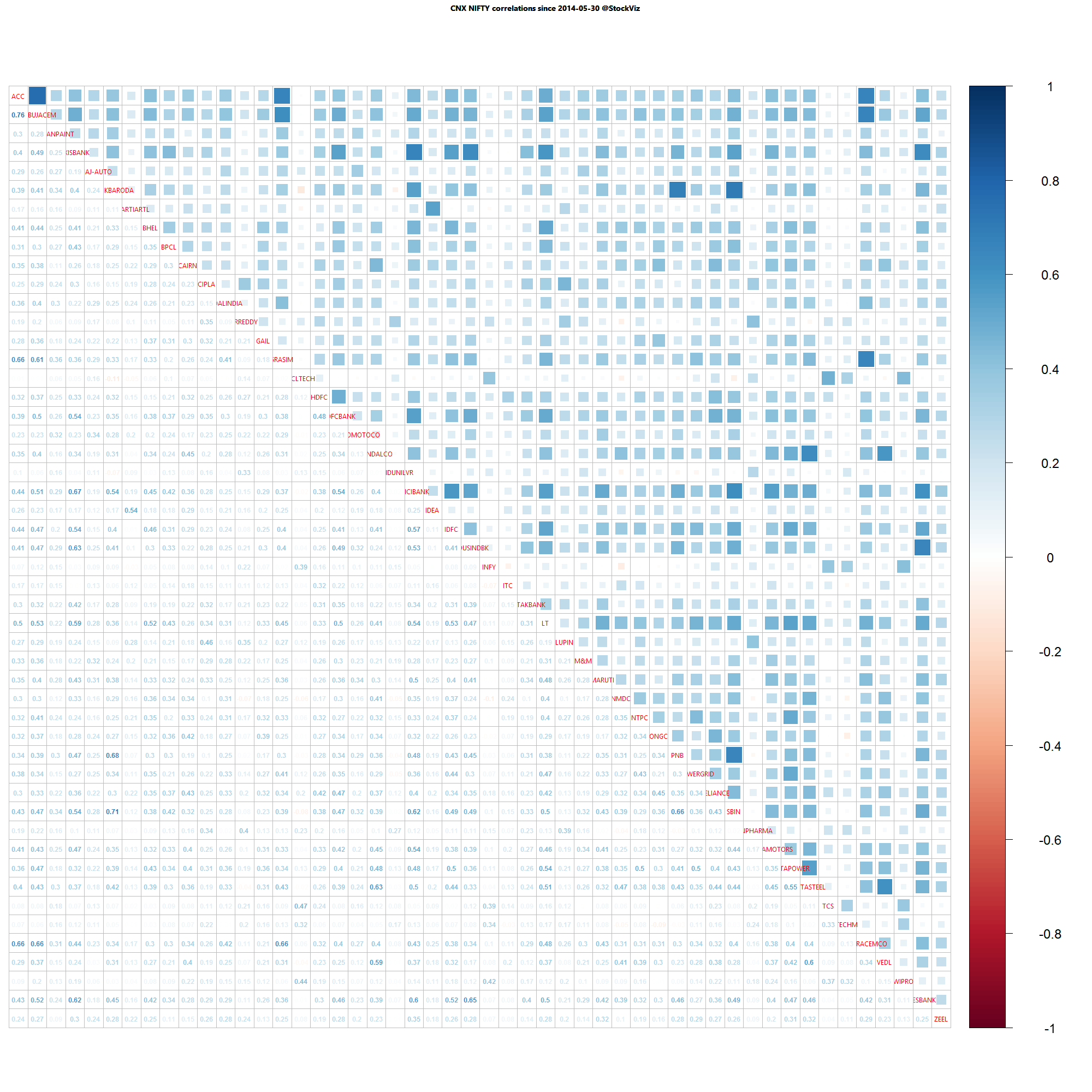

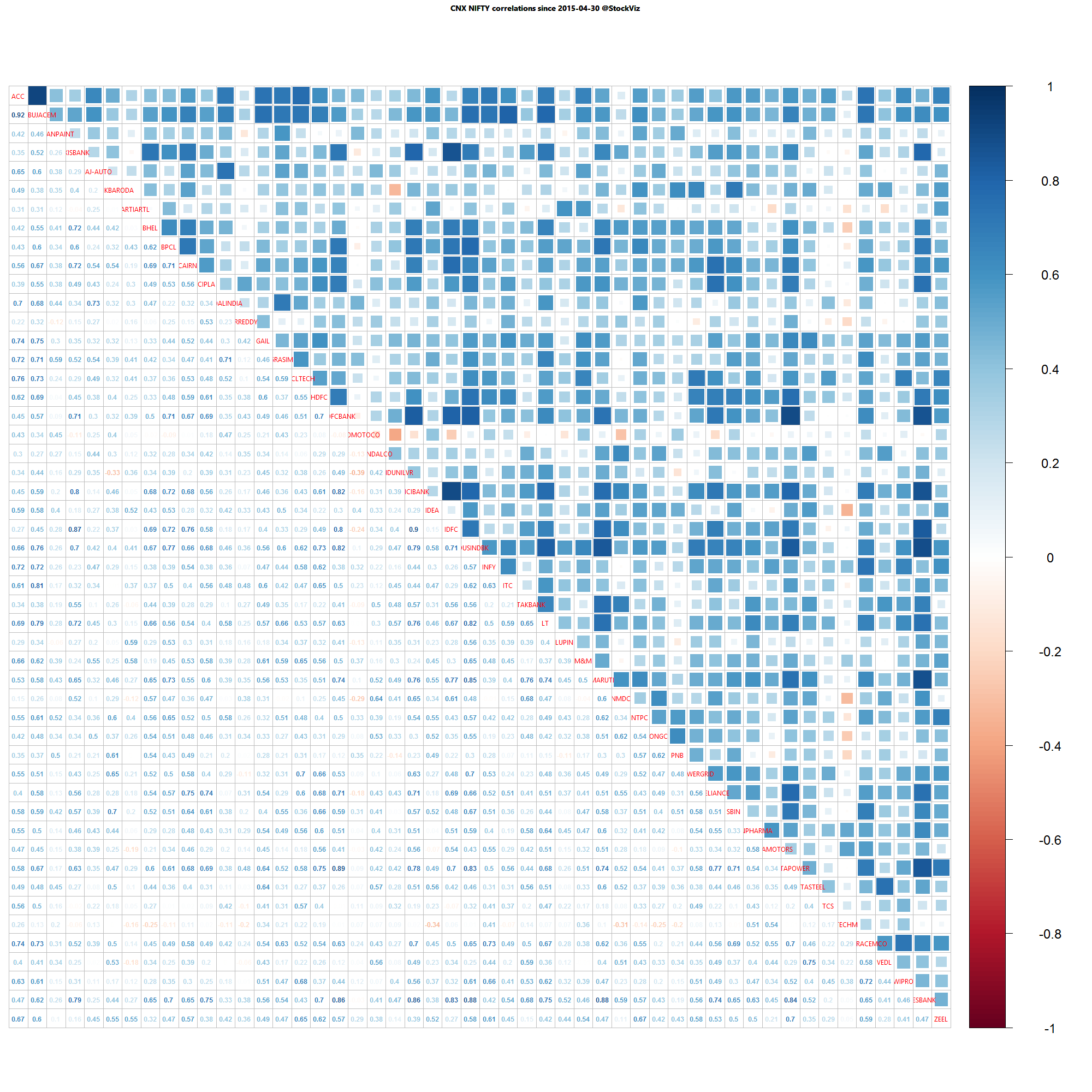

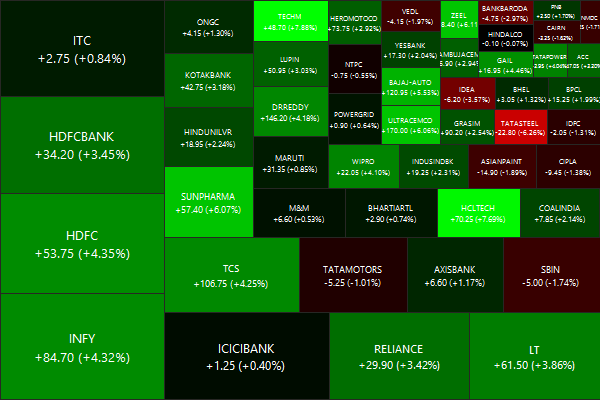

Nifty Heatmap

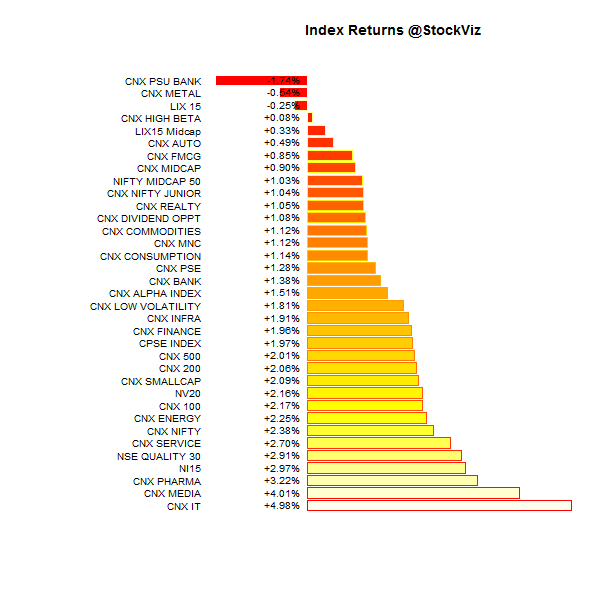

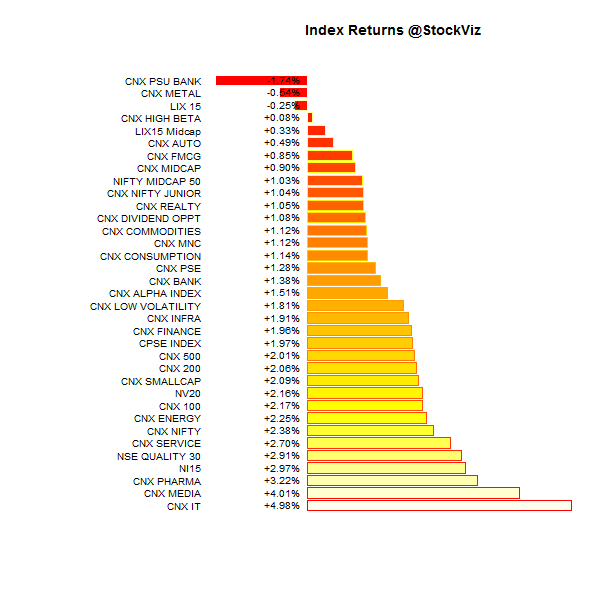

Index Returns

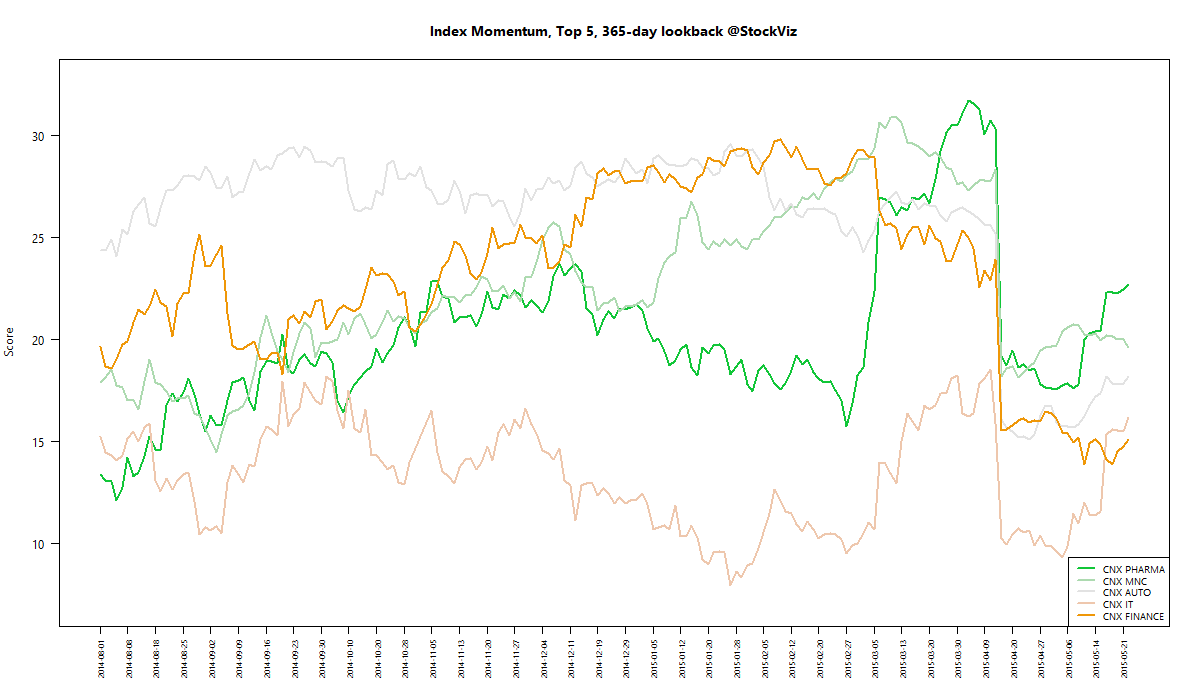

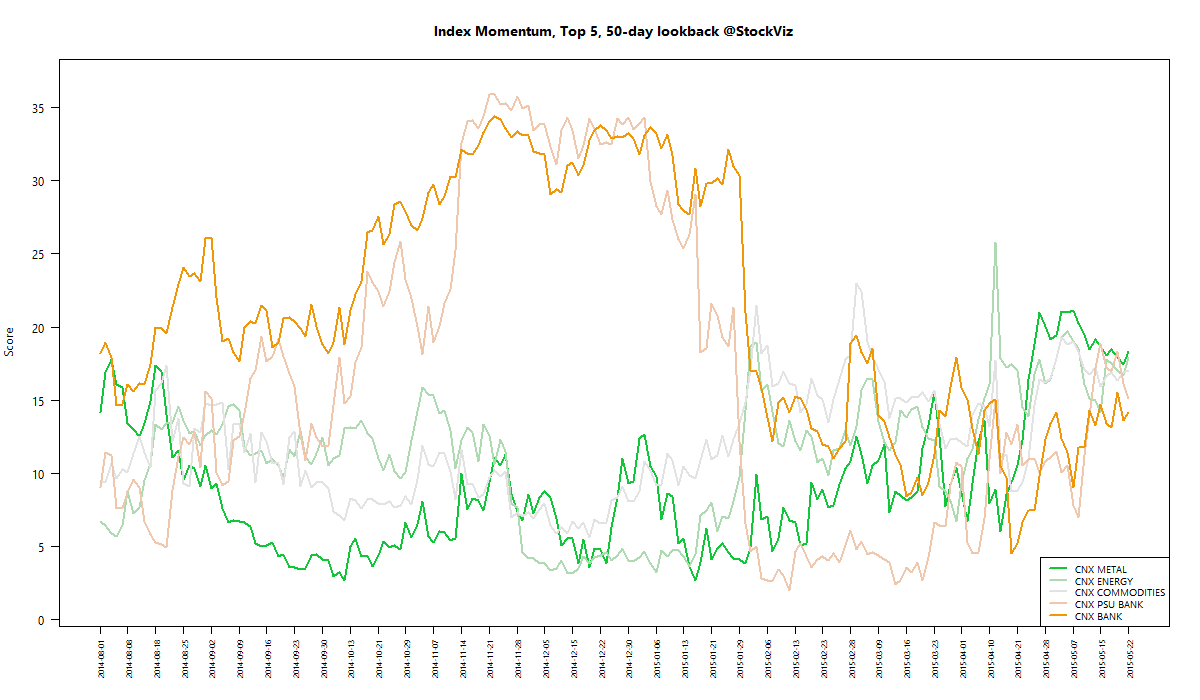

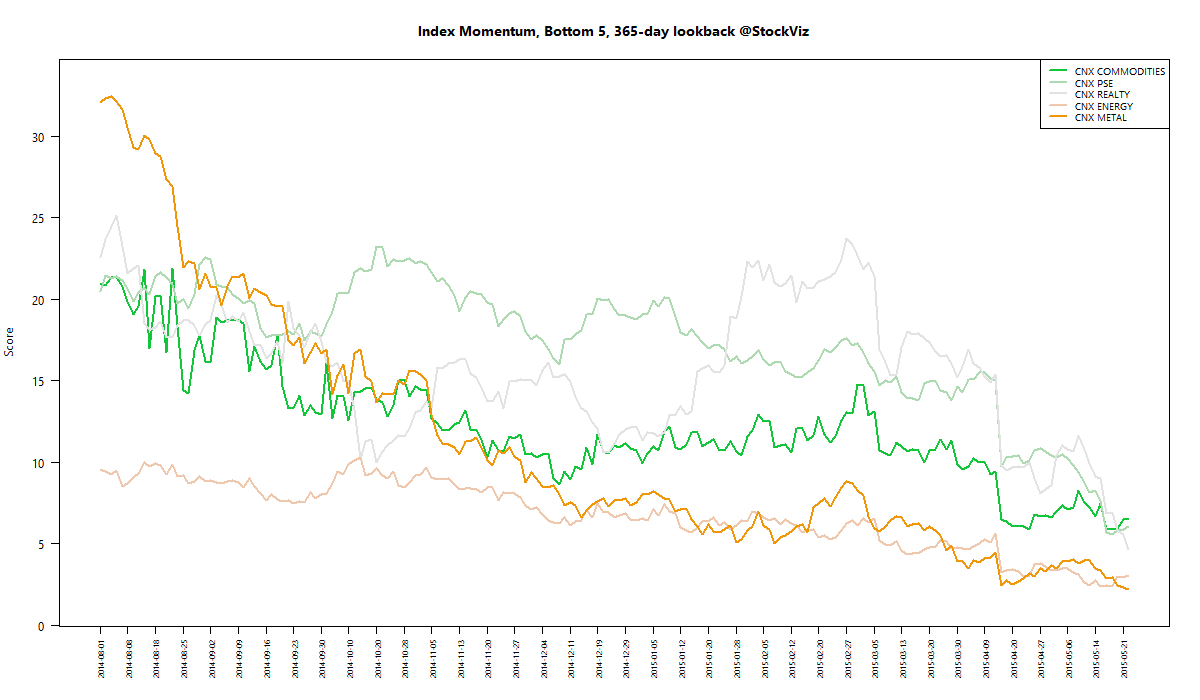

For a deeper dive into indices, check out our weekly Index Update.

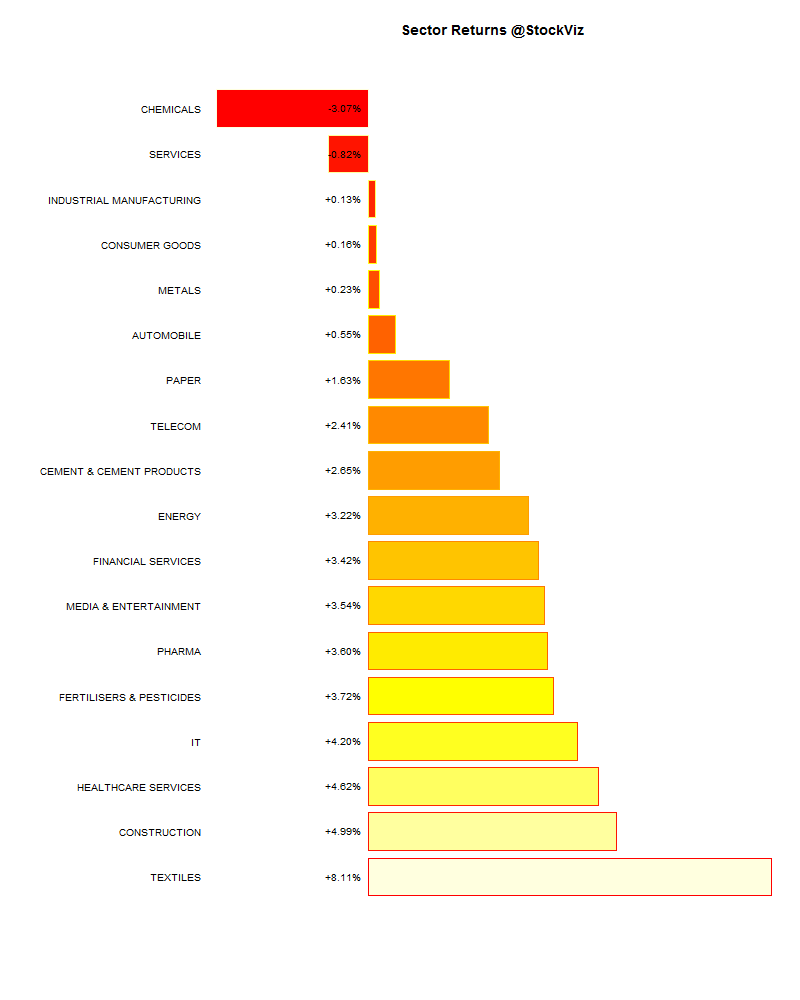

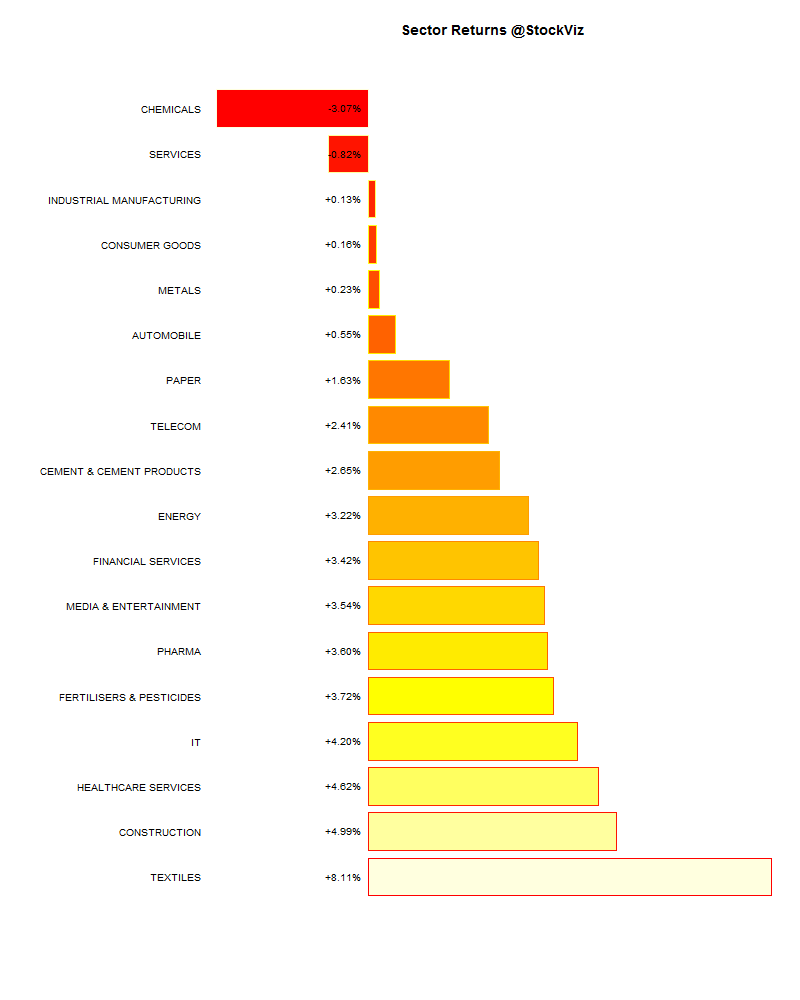

Sector Performance

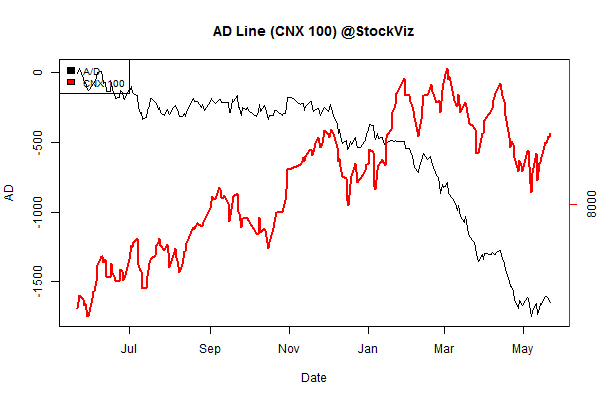

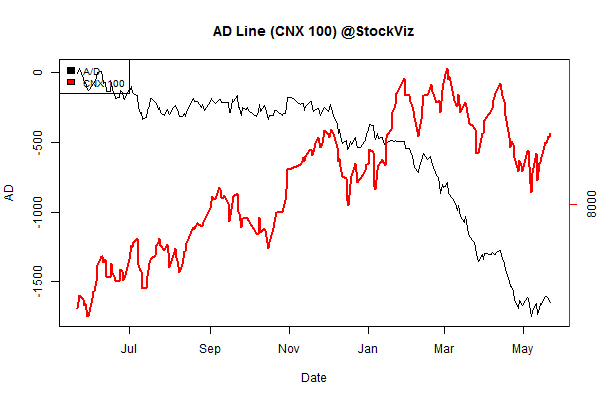

Advance Decline

Market Cap Decile Performance

| Decile |

Mkt. Cap. |

Adv/Decl |

| 1 (micro) |

-1.51% |

66/62 |

| 2 |

-0.05% |

69/59 |

| 3 |

+2.14% |

76/51 |

| 4 |

+2.33% |

73/55 |

| 5 |

+2.22% |

72/55 |

| 6 |

+1.23% |

69/59 |

| 7 |

+2.07% |

62/66 |

| 8 |

+2.42% |

68/59 |

| 9 |

+1.44% |

68/60 |

| 10 (mega) |

+2.14% |

61/67 |

Ob-La-Di, Ob-La-Da…

Top Winners and Losers

Tech broke through disappointing results while investors were served a reminder of the problems plaguing old-economy stocks…

ETF Performance

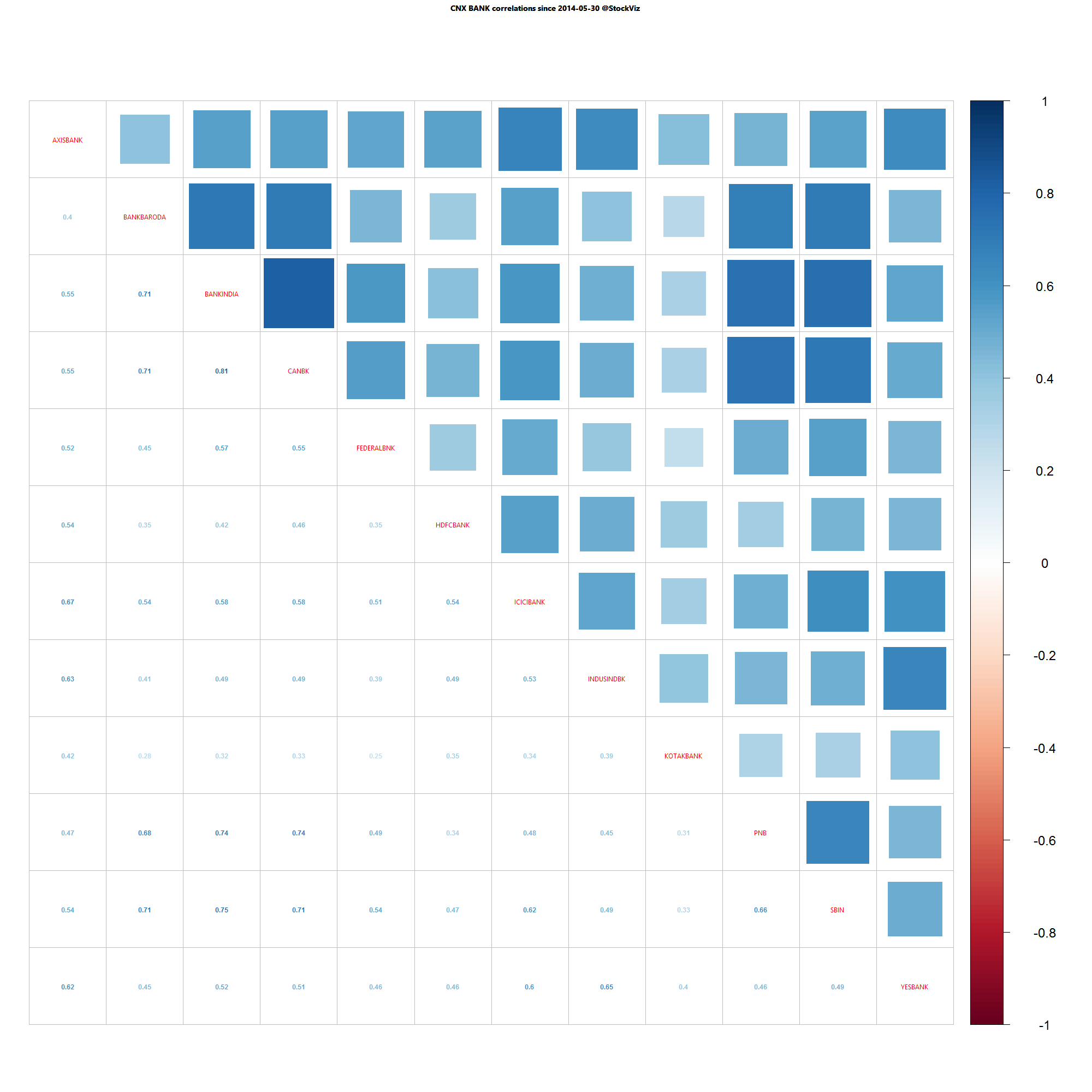

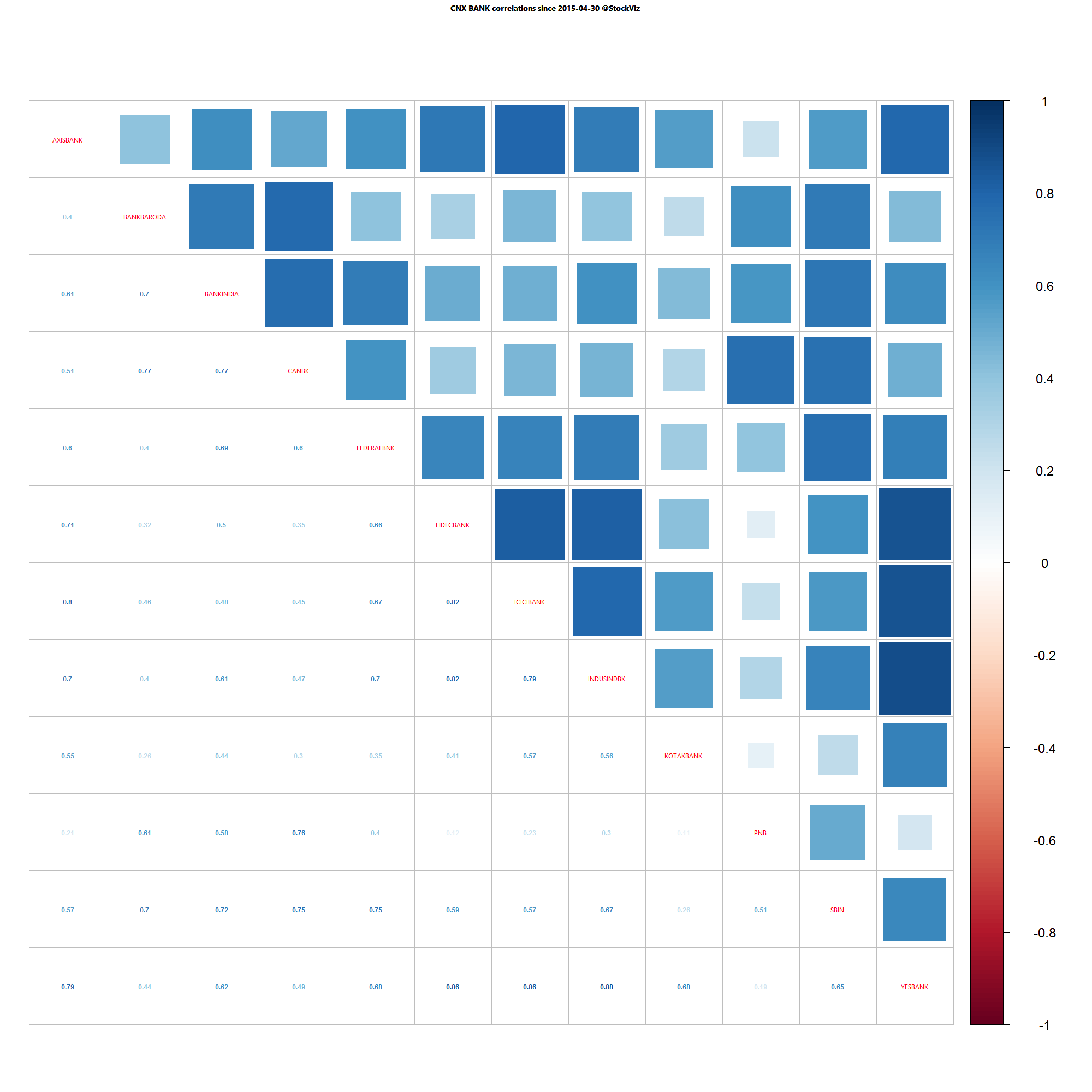

Look at the divergence between BANKBEES and PSUBNKBEES…

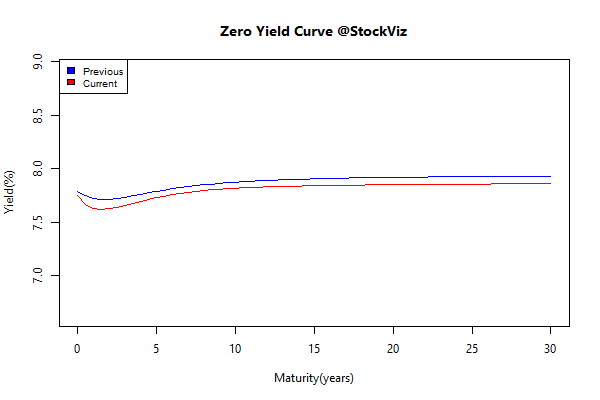

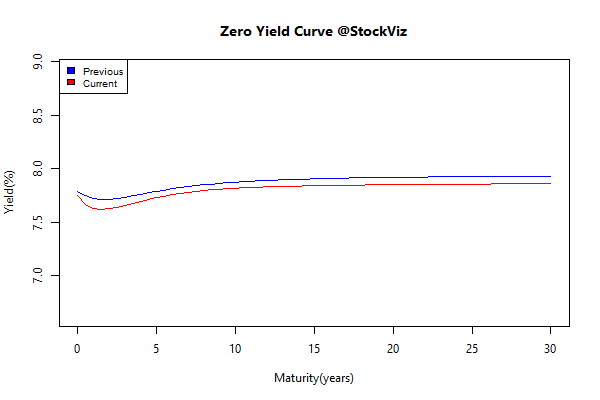

Yield Curve

Bond Indices

| Sub Index |

Change in YTM |

Total Return(%) |

| GSEC TB |

-0.18 |

+0.20% |

| GSEC SUB 1-3 |

-0.01 |

+0.33% |

| GSEC SUB 3-8 |

-0.04 |

+0.42% |

| GSEC SUB 8 |

-0.04 |

+0.56% |

Lower inflation + tepid economy = rate cut?

Investment Theme Performance

Equity Mutual Funds

Bond Mutual Funds

Thought for the weekend

From the mid-1980’s when PC’s and other hi-tech products first started being assembled in Asia, in places like Taiwan, Hong Kong, Singapore, Thailand and Malaysia, through 2010, after China had achieved the dominant manufacturing position it holds, the airfreight markets became increasingly reliant on the market for getting hi-tech goods built and assembled in Asia to North America and also to Europe.

…

The iPads and other Android-based and Windows-devices both usurped and combined many of the functions previously reserved for the PC platform or other dedicated electronic devices. Emerging from the Great Recession, these increasingly smaller, more powerful, alternative devices with their myriads of “apps” began to offer multiple capabilities on one platform that delivered capabilities which had previously taken multiple devices to deliver. This factor also significantly changed the dynamics of the airfreight markets.

Source: Avondale Asset Management