When I was in high school, we were taught about “truth tables.” It is a mathematical table used in logic to tell whether a propositional expression is true for all legitimate input values. Watching pundits speak on TV is makes you wonder how they could ever have passed high school algebra.

The Can’t Lose Argument

Beware those who are never wrong. The “Can’t Lose Argument” goes something like this: A data point will be mentioned, and no matter what the net change in that data — up, down or neutral — it is somehow bad for markets.

Link: If You Can’t Lose,You’re a Loser

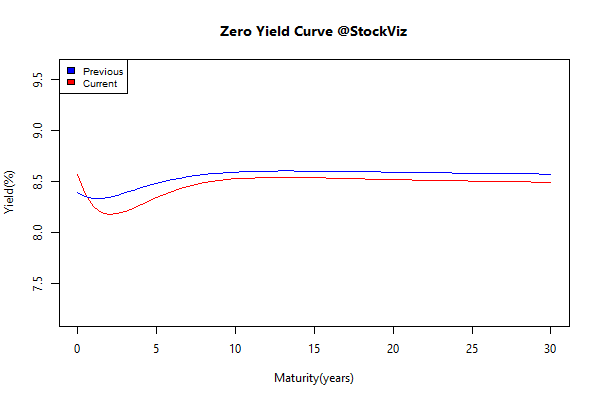

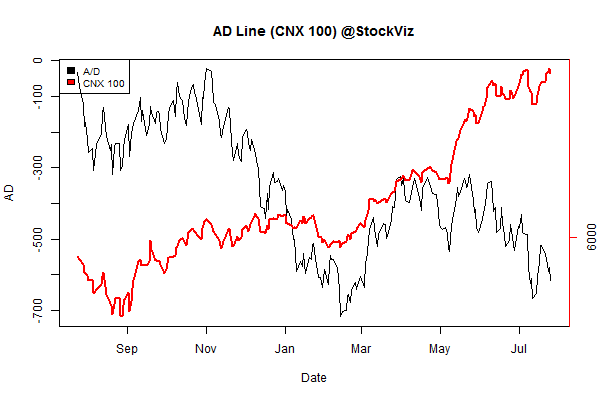

There is always a divergence

Sometimes they matter, sometimes they don’t. Sometimes one key divergence that was extremely important ends up meaning exactly zero the next time around. A single divergence, in and of itself, has all of the reliable predictive power of a bowl of chicken bones spilled out across the table.

Link: There’s ALWAYS a divergence

Macro-tainment

It’s crucial to recognize that macroeconomics is something that even the world’s smartest economists still don’t understand very well, and that political ideology and economic reality don’t mix.

Link: When Entertainment Passes for Investment Advice

Related: Musings on stock-market forecasts

Enjoy this video: