Your world at 9am

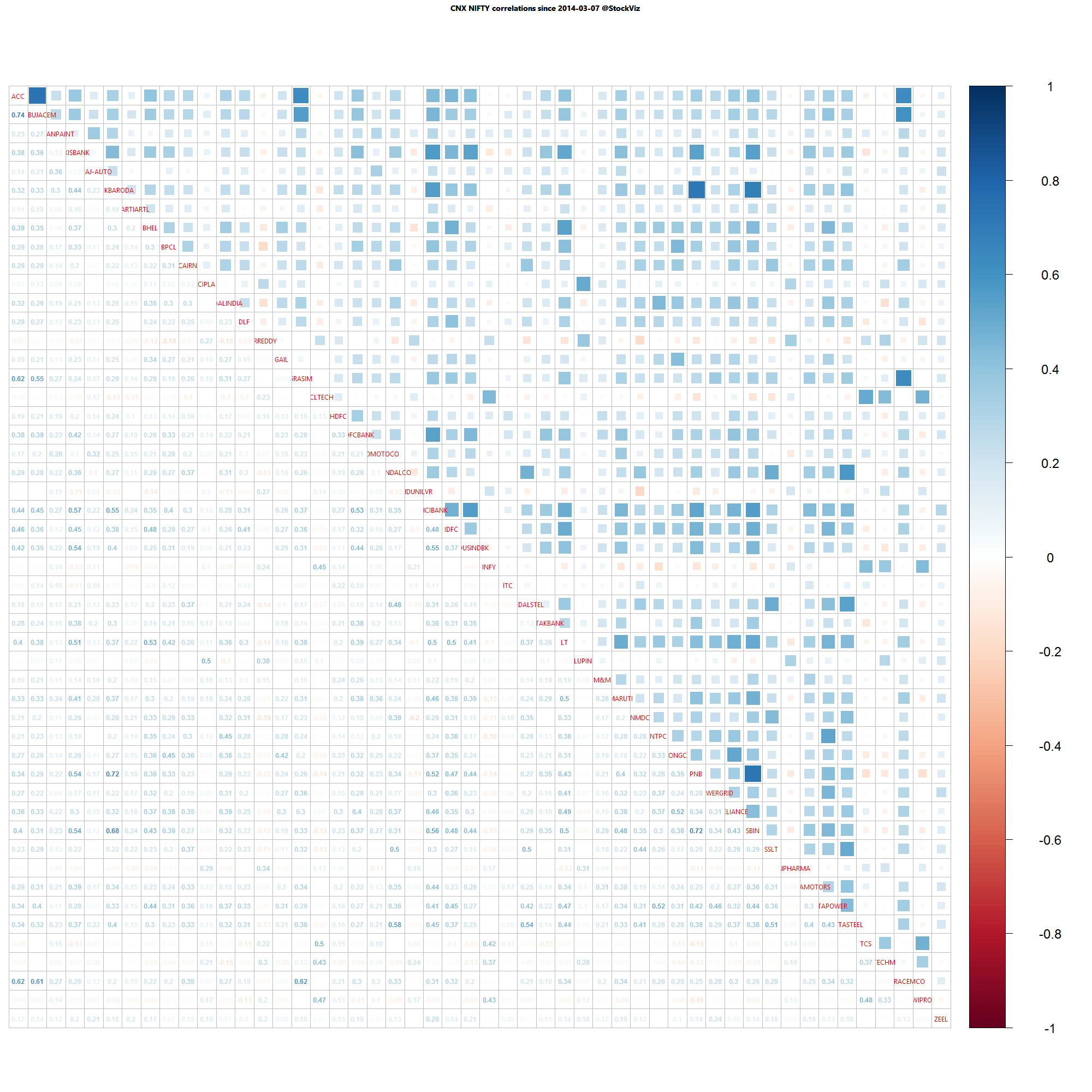

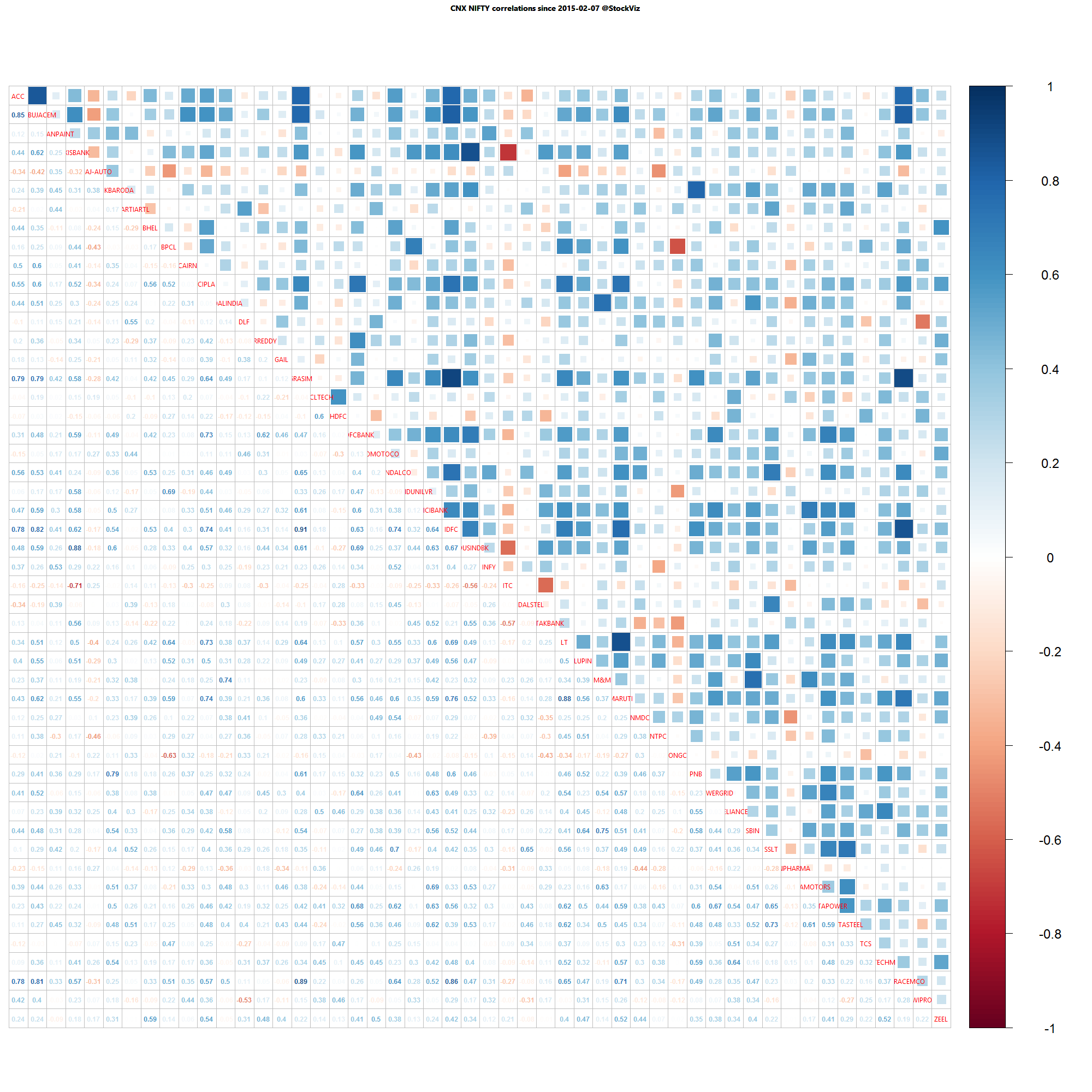

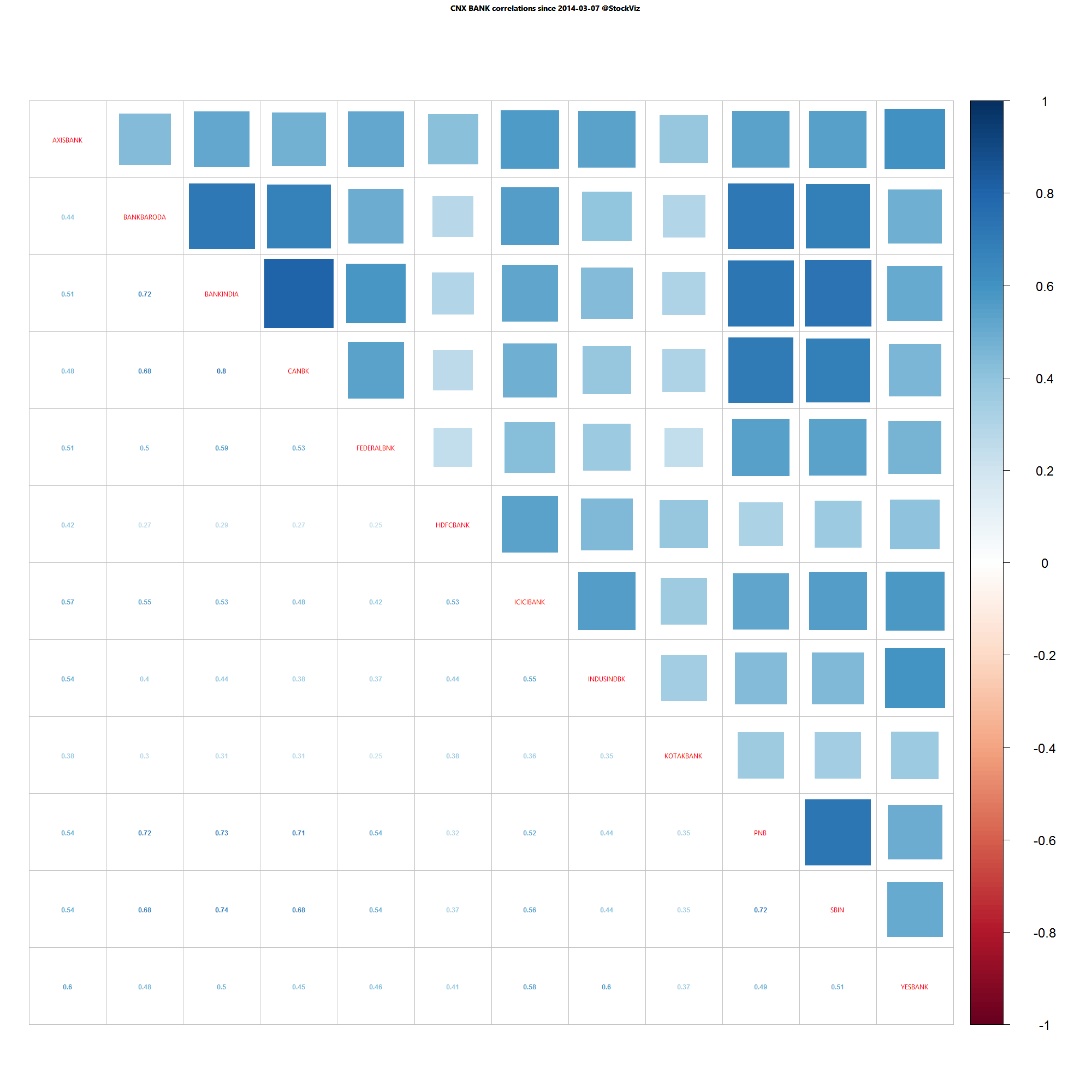

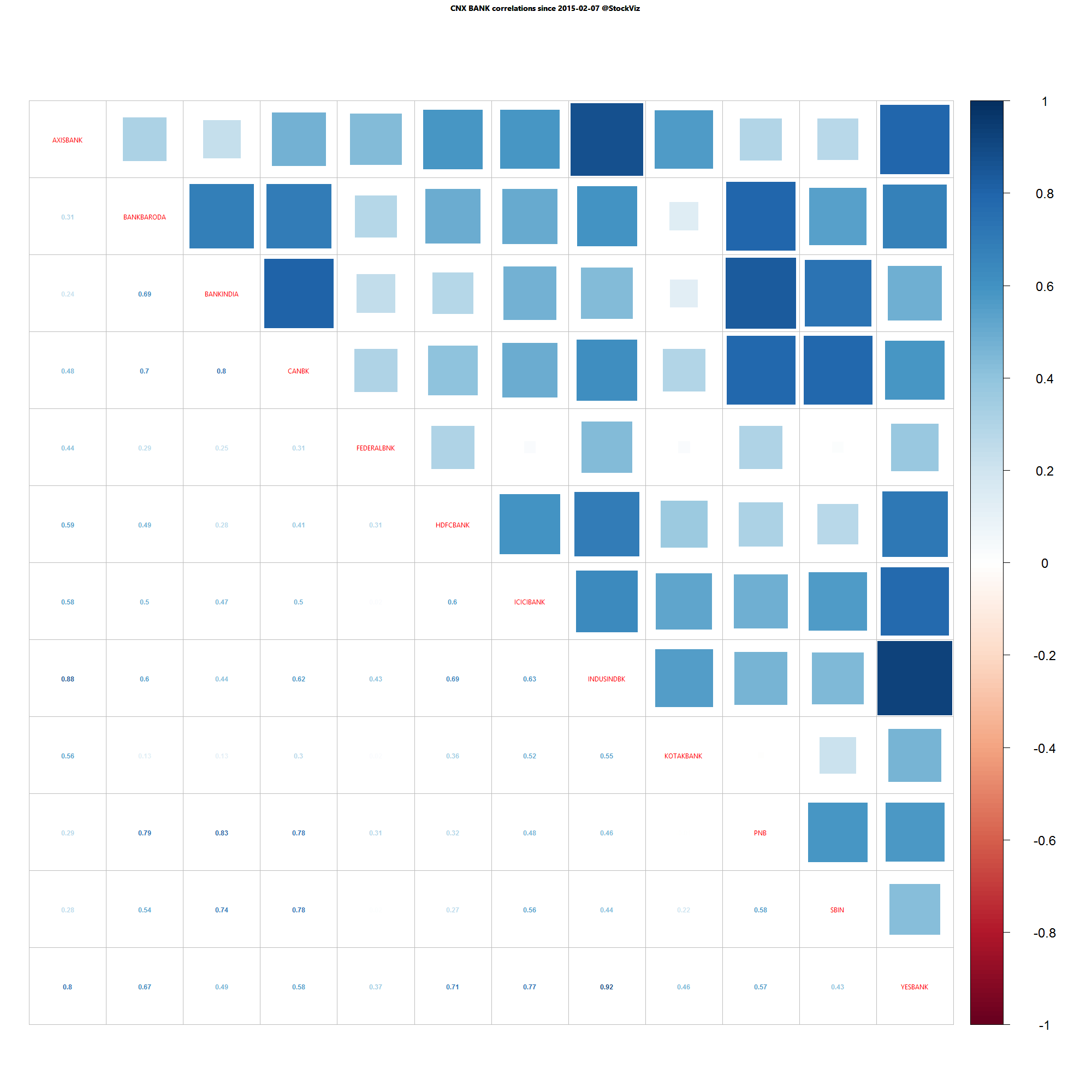

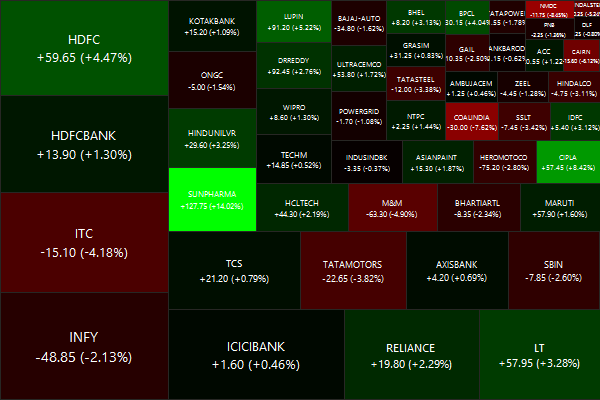

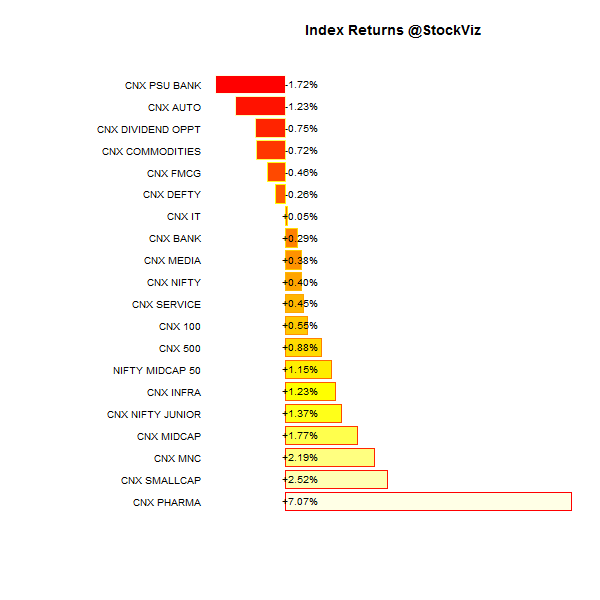

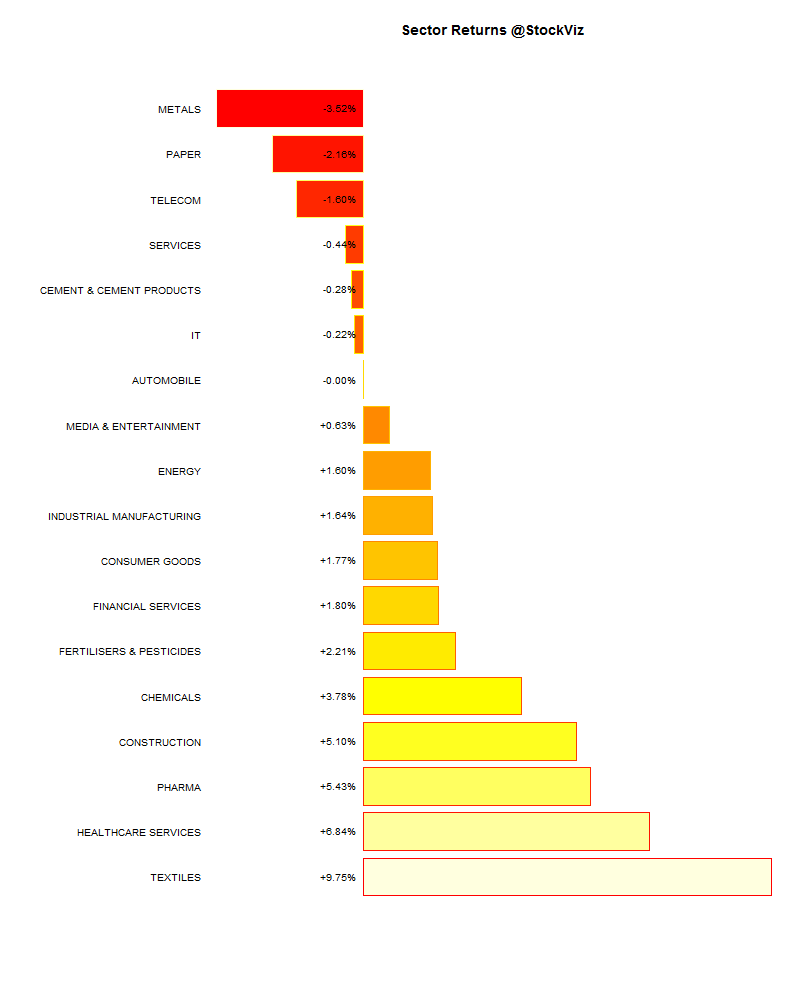

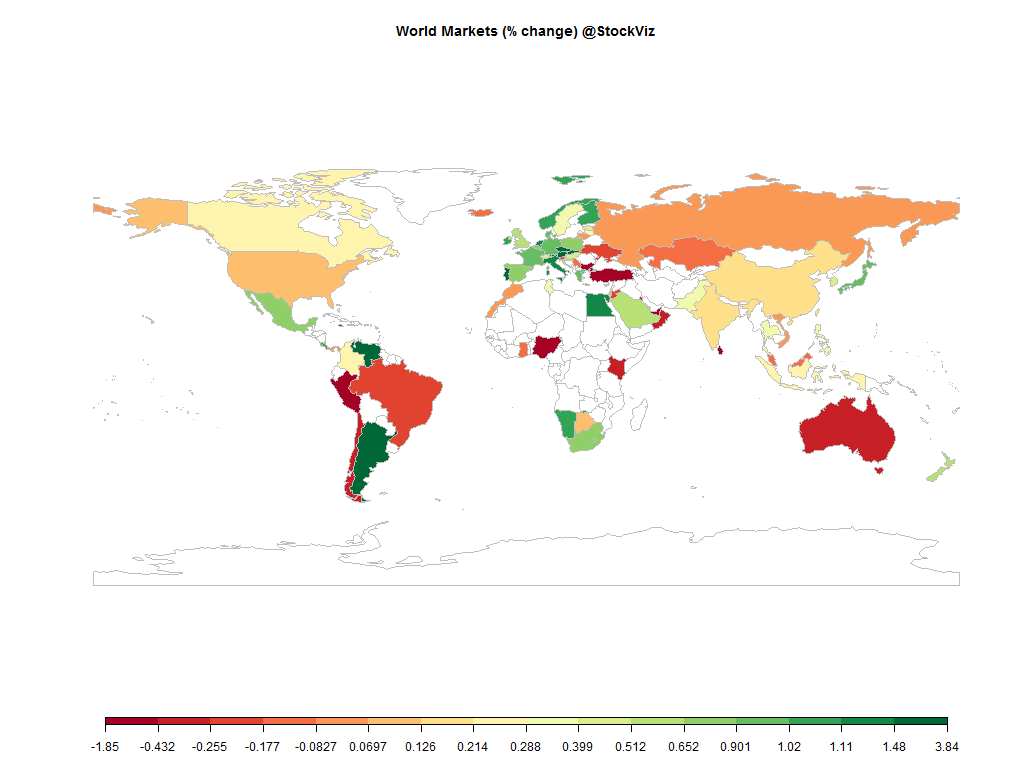

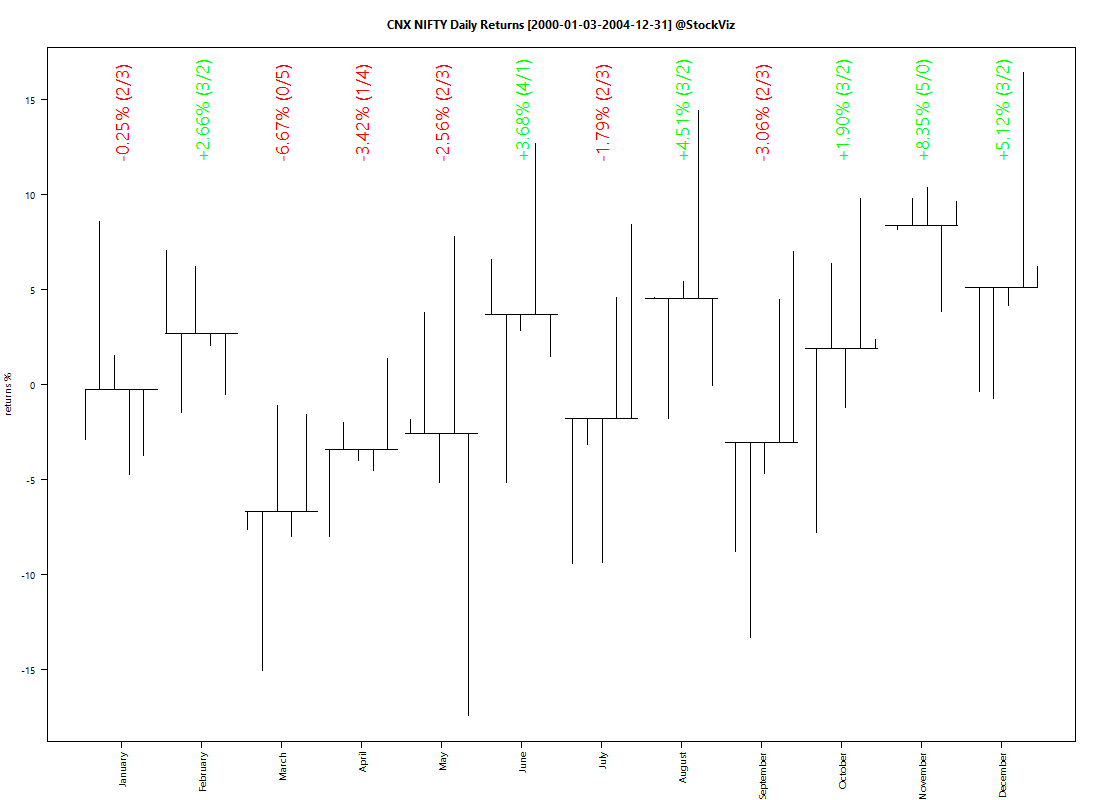

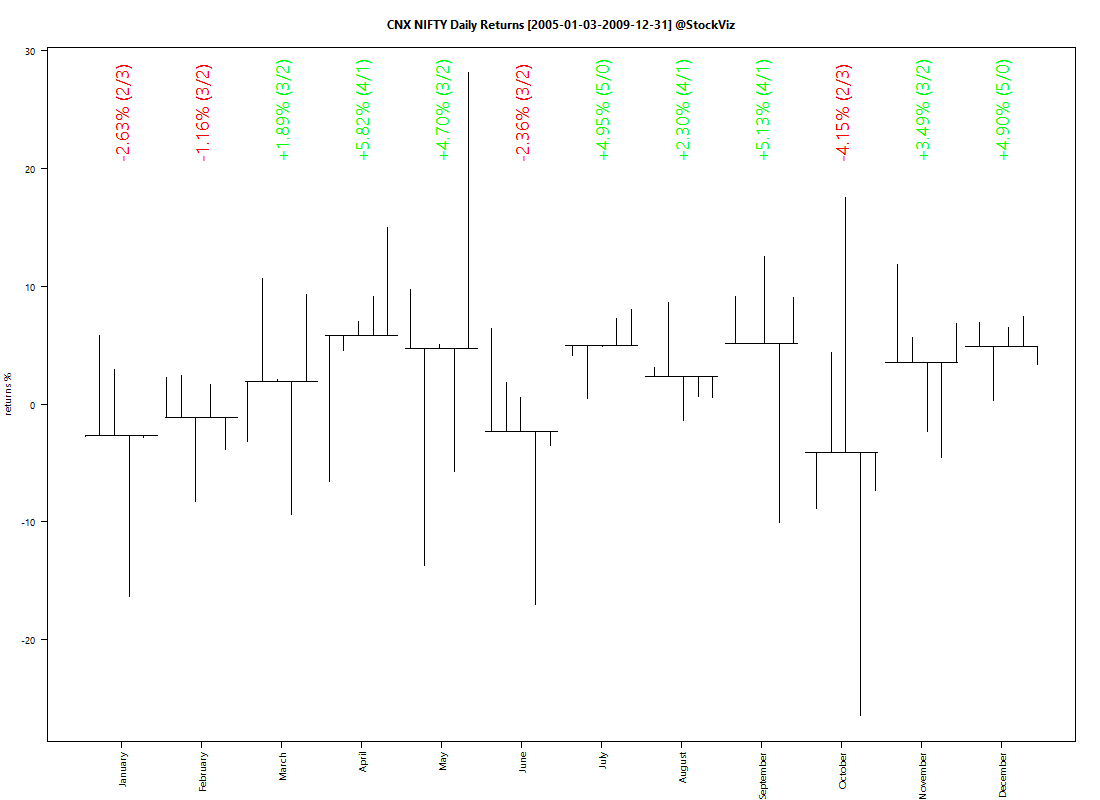

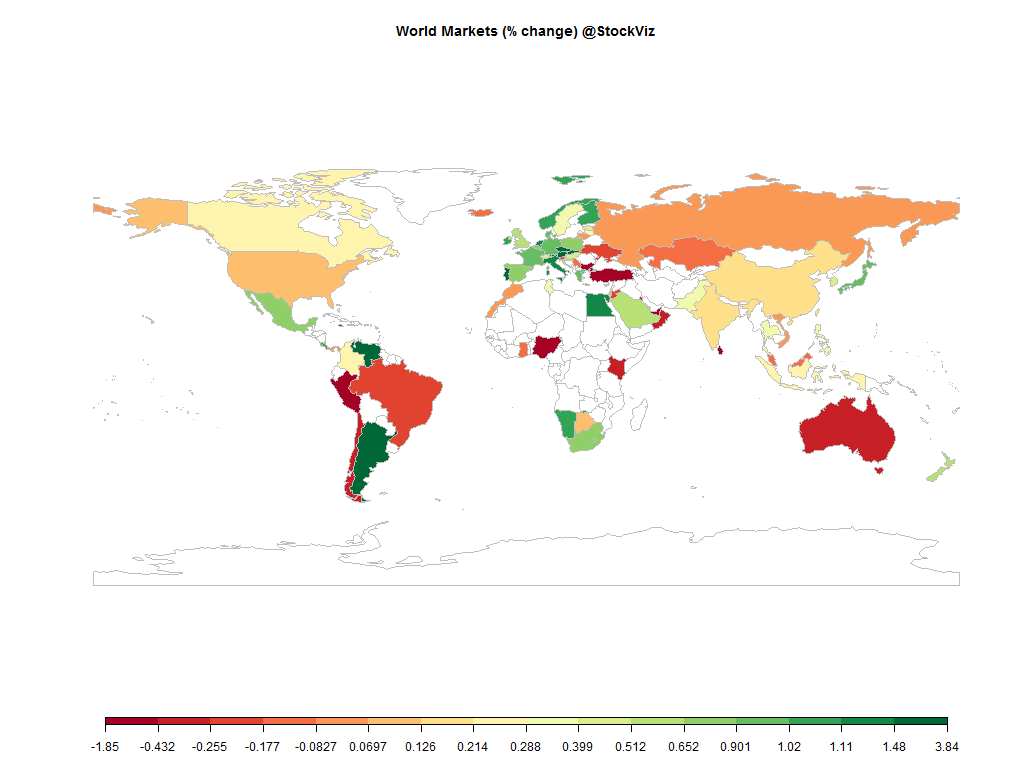

Equities

Commodities

| Energy |

| Brent Crude Oil |

+0.86% |

| Ethanol |

+0.00% |

| Heating Oil |

+0.54% |

| Natural Gas |

-0.32% |

| RBOB Gasoline |

+0.66% |

| WTI Crude Oil |

+0.61% |

| Metals |

| Copper |

+0.00% |

| Gold 100oz |

+0.00% |

| Palladium |

+0.42% |

| Platinum |

+0.07% |

| Silver 5000oz |

+0.24% |

| Agricultural |

| Cattle |

+0.00% |

| Cocoa |

+0.00% |

| Coffee (Arabica) |

-0.48% |

| Coffee (Robusta) |

+0.00% |

| Corn |

-0.26% |

| Cotton |

+0.00% |

| Feeder Cattle |

+0.00% |

| Lean Hogs |

+0.00% |

| Lumber |

+0.00% |

| Orange Juice |

+0.00% |

| Soybean Meal |

-0.12% |

| Soybeans |

+0.10% |

| Sugar #11 |

+0.60% |

| Wheat |

+0.00% |

| White Sugar |

+0.00% |

Must reads

ECB will buy bonds that carry a negative yield, as long as that doesn’t fall below the rate it charges banks on deposits, which is -0.20%. (WSJ)

Infosys and Wipro in fight to renew Rs 12,000 crore outsourcing contract that will expire this year. Last time around, HCL Tech ate their lunch. (ET) [stockquote]HCLTECH[/stockquote] [stockquote]INFY[/stockquote] [stockquote]WIPRO[/stockquote]

Will we soon have FDI in retail? (LiveMint)

Indian GDP numbers: did bureaucrats take something that was not broken and fix it until it was? (FT)

EPFO will once again consider diversifying its investment pattern to park 5-15% of its corpus in equity and infrastructure trusts. (ET)

Goldman: “The twin forces of regulation and technology are opening the door for an expanding class of competitors to capture profit pools long controlled by banks.” (FT)

Good luck and have a nice long weekend!