A quick update to our II Trend report from last month.

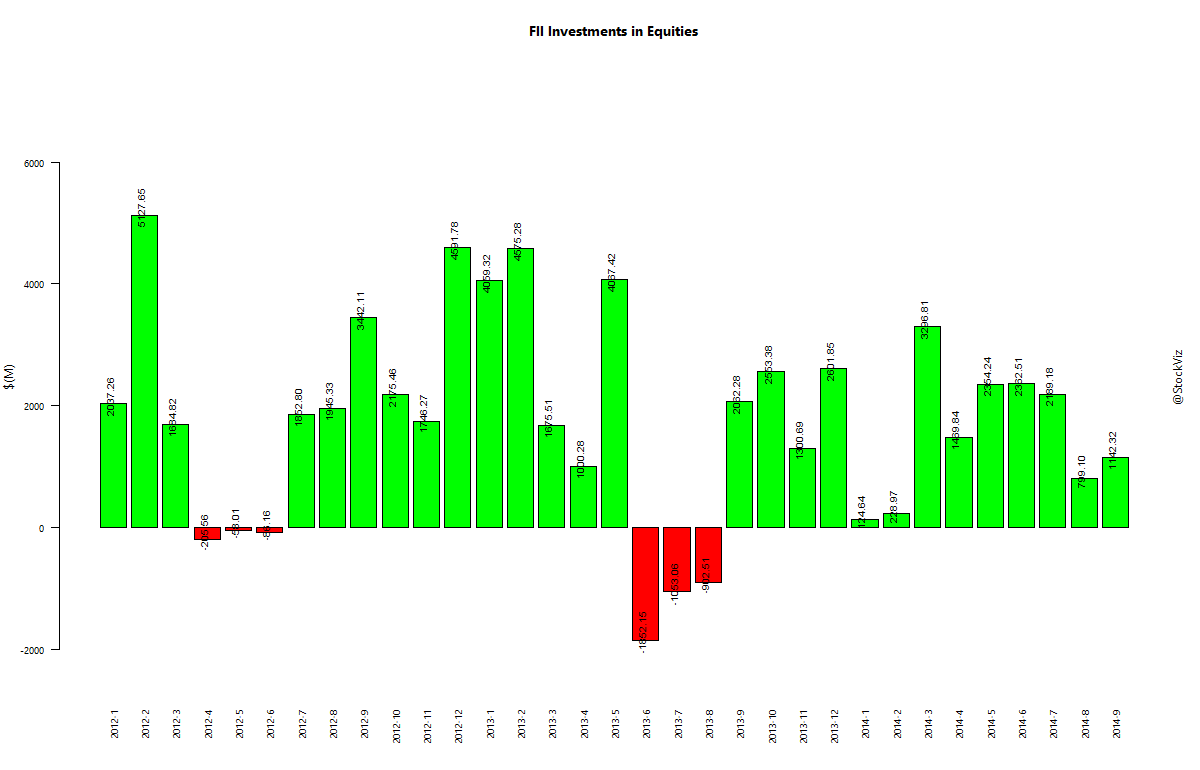

Foreign Institutional Investors keep the faith

FII invested $1742.07 million in debt vs $1221.89 million in equities so far in Septmeber.

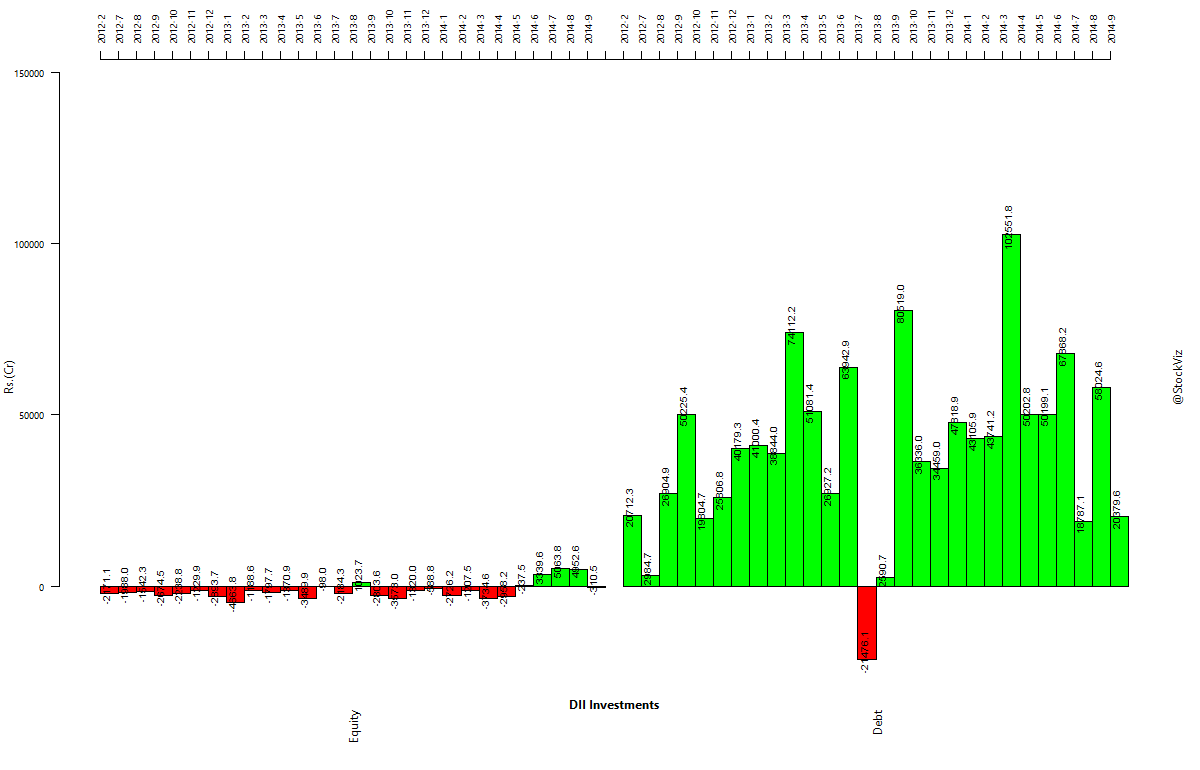

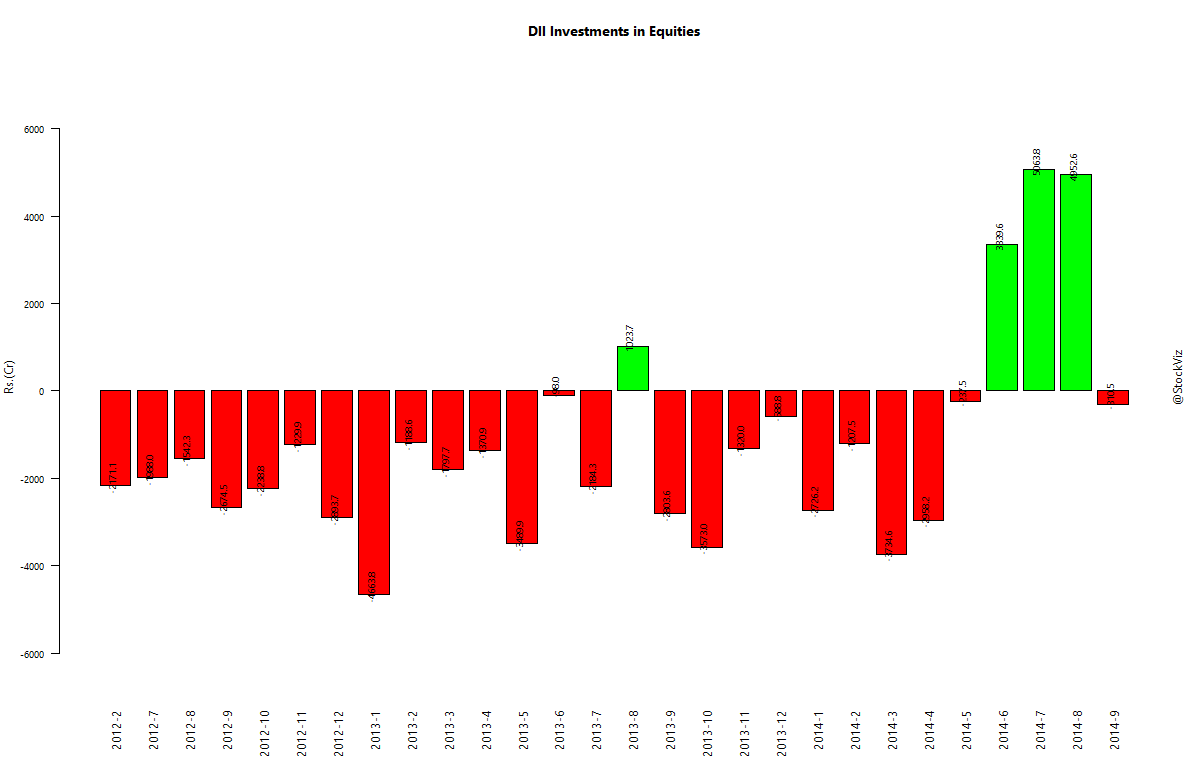

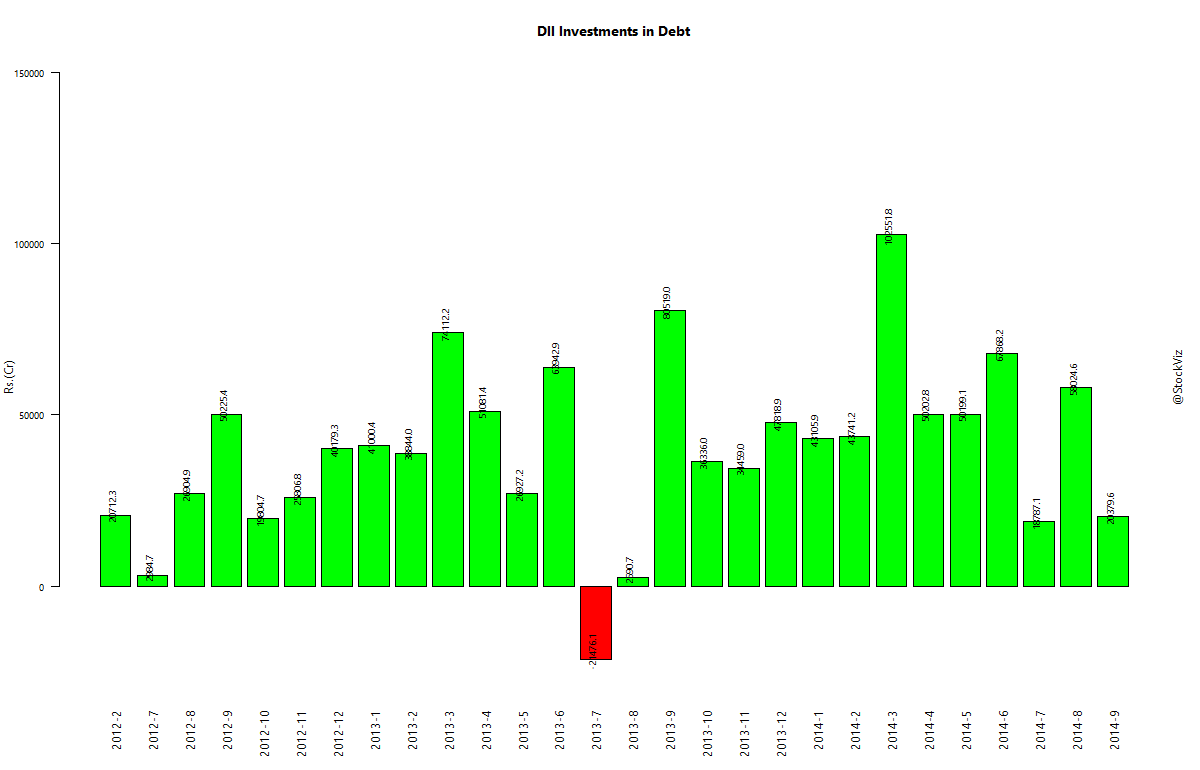

Domestic Institutionals were obsessed with debt

In September, DIIs invested Rs 20,379.6 cr in debt vs. -310.5 cr in equity.

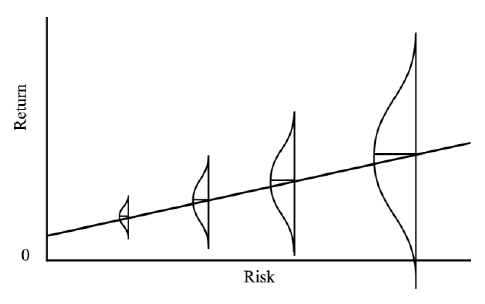

A trade for everyone

Not sure what I like better – debt or equity. Debt investors will benefit from the falling interest rate environment in AAA paper and shrinking defaults in sub-primes. Equity investors will benefit from improving balance-sheets and an improving demand-side equation. Stay tuned…