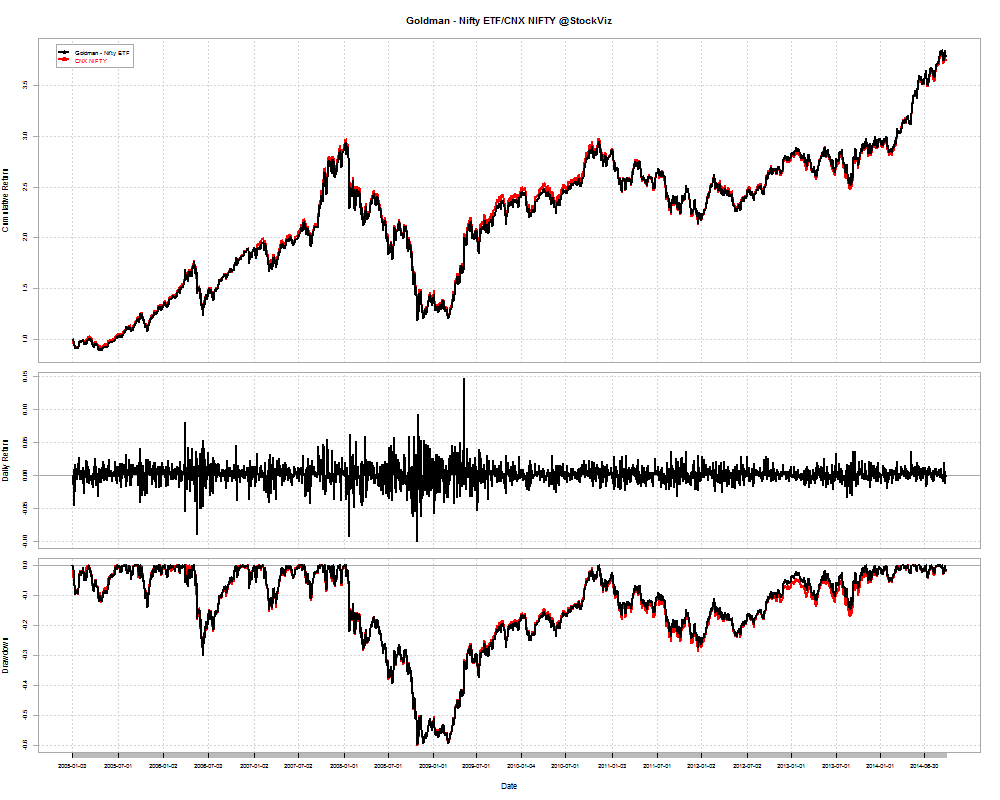

Ideally, Index Funds should just track an index. Its the holy-grail of passive indexing – don’t try to be smart picking stocks, just invest in an index tracking fund and let the market work for you. Index Funds are supposed to only focus on reducing tracking error and fees. The NIFTYBEES ETF does the job pretty well:

Since 2005-01-03, Goldman – Nifty ETF has returned a cumulative 275.22% vs. CNX NIFTY’s cumulative return of 278.36%. Chalk up the difference to asset management fees. But the story with Index Funds offered by leading AMCs is a head scratcher.

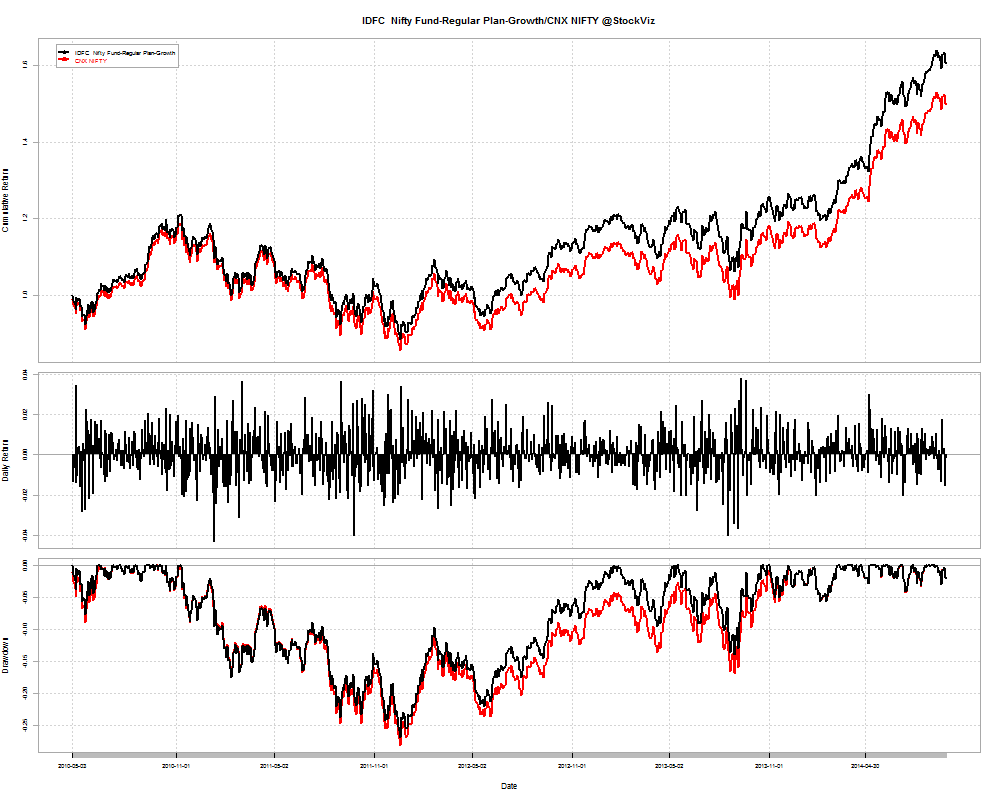

IDFC Nifty Fund

Since 2010-05-03, IDFC Nifty Fund-Regular Plan-Growth has returned a cumulative 61.17% vs. CNX NIFTY’s cumulative return of 51.62%.

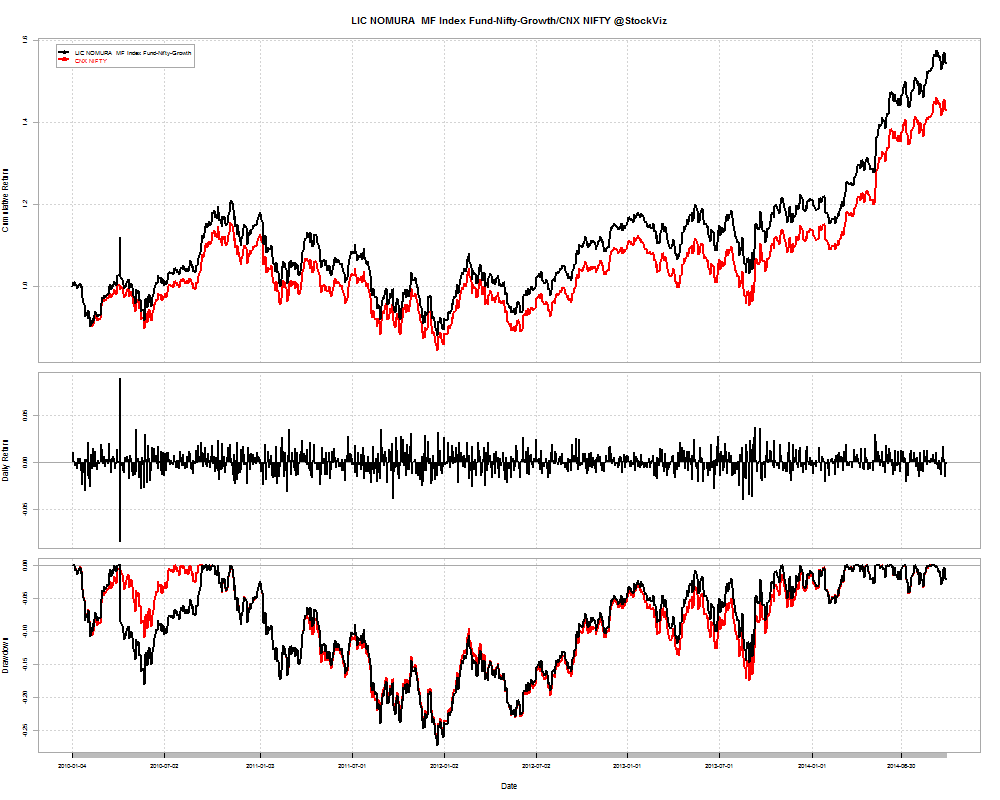

LIC NOMURA MF Nifty Index Fund

Since 2010-01-04, LIC NOMURA MF Index Fund-Nifty-Growth has returned a cumulative 54.78% vs. CNX NIFTY’s cumulative return of 52.95%.

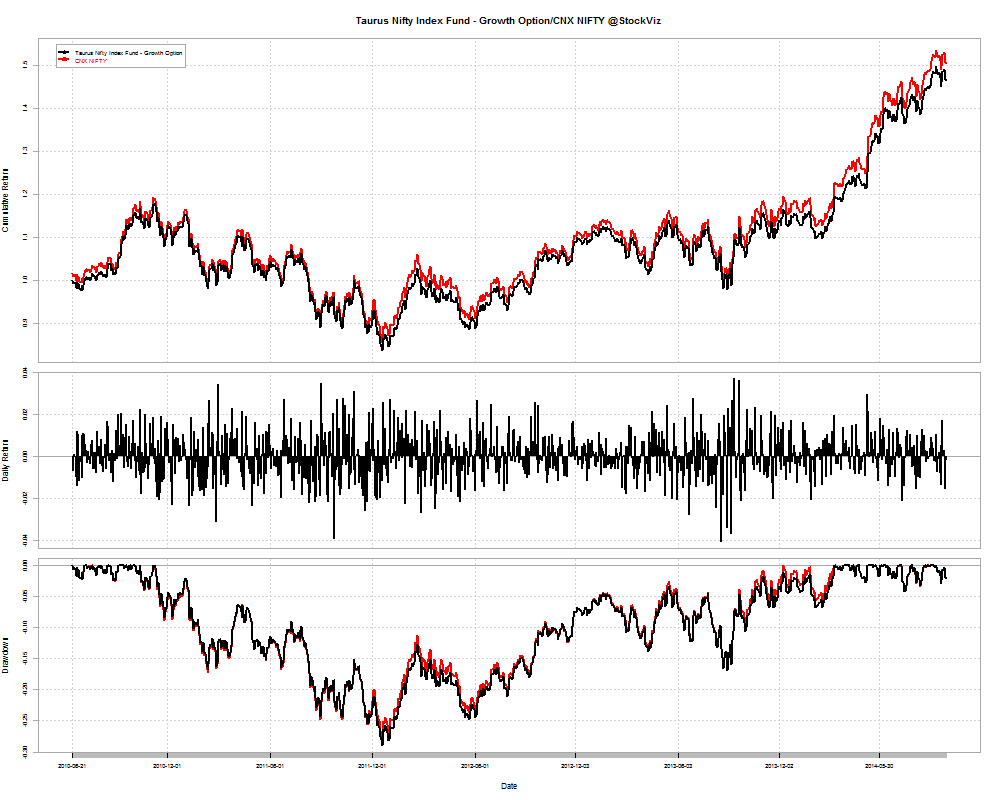

Taurus Nifty Index Fund

Since 2010-06-21, Taurus Nifty Index Fund – Growth Option has returned a cumulative 46.82% vs. CNX NIFTY’s cumulative return of 52.06%. Oops!

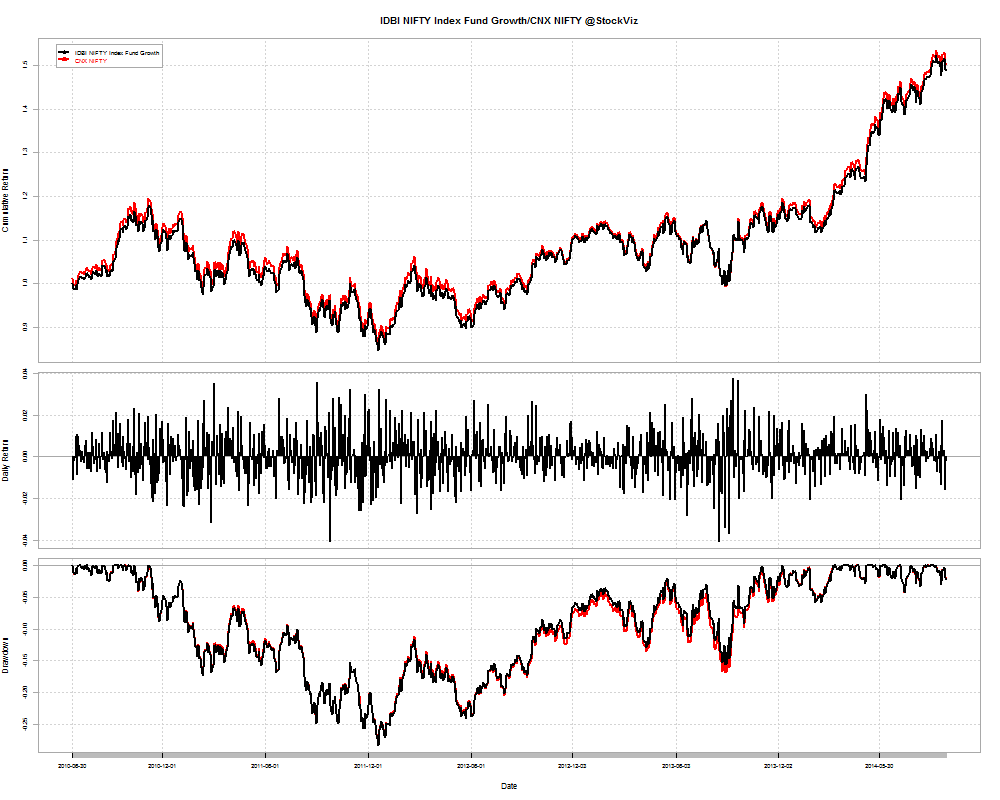

IDBI NIFTY Index Fund

Since 2010-06-30, IDBI NIFTY Index Fund Growth has returned a cumulative 49.48% vs. CNX NIFTY’s cumulative return of 52.25%.

Question

If the NIFTYBEES ETF can track the index with a 0.09% tracking error and an expense ratio of 0.5%, why would anybody invest in any of the NIFTY Index Funds?

You can run the comparison tool here: FundCompare

If you want advice on investing in mutual funds, please get in touch with Shyam.

You can either WhatsApp him or call him at 080-2665-0232.

He is an AMFI registered IFA who can advice you on HDFC, ICICI Pru, UTI and Birla Sun Life funds.