A slice of Dual Momentum

Gary Antonacci created the Global Equities Momentum (GEM) model that applied dual momentum to stock and bond indices. It toggles between stocks and bonds using 12-month trailing returns. And when it toggles to “stocks,” it chooses between US equities and International (ex-US) equities based on whichever posted higher returns in the previous 12-months. The model uses the S&P 500 index as a stand-in for US equities and the WORLD ex USA index for international stocks.

Investors can use the ETFs SPY/VOO for the S&P 500, SCHF for World ex-US DMs and AGG for bonds while replicating this strategy.

The best part about this strategy is its simplicity. It takes just 3 inputs and anybody can set it up on Google Sheets. Execution is as simple as it gets because at any given point in time, it is long just one ETF. Also, given that it uses a 12-month look-back, it is less prone to whiplashes, resulting in a lower trading frequency.

Specifications & Expressions

When you automate systematic strategies, you need to nail down its exact specifications. In this case, they are mainly: inputs, look-back periods and traded instruments.

The original version of the Strategy uses the S&P 500 and World ex-US both for inputs and as proxies for the traded instruments. However, there is no reason why they both should be the same. Also, what is so magical about a 12-month look-back period anyway? Why can’t it be 6 -months, a month or an average of the last 6-months?

The Strategy only describes a broad idea with one set of Specifications and Expressions out of a multitude. It can (and should) be adapted to fit one’s risk profile and investment horizon.

The Momentum Expression

The easiest tweak to the original strategy is to swap out the traded equity instruments with their momentum counterparts.

At the final step, when it comes to executing the trade, you can use MTUM, the US Momentum ETF instead of SPY/VOO and IMTM, the DM ex-US Momentum ETF instead of SCHF.

Long-only momentum ETFs are highly correlated to their market-cap counterparts but have the potential to juice returns in bull-markets. Since we are trend-following anyway, why not go a step further up the risk-curve and embrace momentum as well?

This is the basic idea behind our Global Equities Momentum I strategy.

The Look-Back Specification

Picking a look-back for trend-following strategies is fraught with data-mining bias. One could potentially test 100s of periods and pick one that gave the best results historically. The data-mined look-back could even work in forward tests but inexplicably, and suddenly, fail in real portfolios.

The safest thing to do would be to not change the look-back periods outlined in the original research. However, the world would’ve changed since its first publication. How do you strike a balance between the two?

This is what we’ve tried to do in our Global Equities Momentum II strategy.

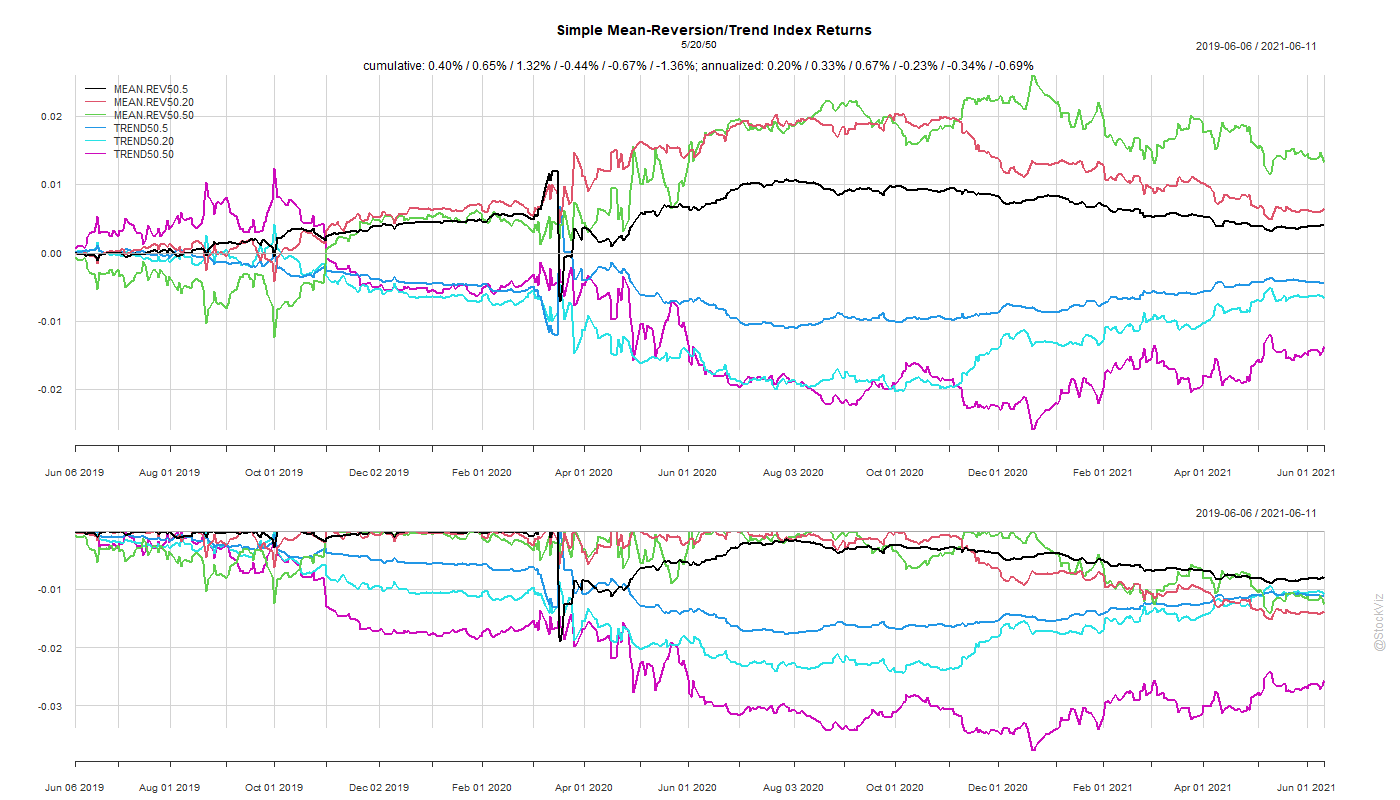

Long look-backs are slow at reacting to rapidly changing markets. Some might say that this is a bug while some might argue that this is a feature. Shorter look-backs, on the the other hand, can react faster but are prone to head-fakes and whiplashes.

The second version of our GEM strategy tries walk the fine line by taking the average of 6- through 12-month returns. It tries to hew close to the original research while acknowledging that the world has gotten faster since it was first published.

No Free Lunch

While the strategy adapts to the broad, slow-moving macro theme of US equity under-performance vis-à-vis rest-of-the-world (were it to occur,) it is not immune to getting whiplashed due to short and steep market dislocations like the COVID crash of March 2020. The strategy got into bonds just when the equity markets were recovering and stayed there until well-after. It is simply not possible to avoid all landmines when it comes to investing.

While we ran our back-tests, we tried a fair amount of permutations and combinations. Some where discarded in spite of having better risk-adjusted returns because they lacked internal consistency. While some slipped into data-mining territory in spite of our best efforts to avoid it. Readers interested in the process and the code can read through our GEM Collection.

Related: ETFs for Asset Allocation