Please read Part I for an introduction.

Earlier, we saw that a 3rd degree polynomial kernel produced the best results on the test set. In this post, we explore if we can we get better results by tuning the degree parameter.

Outline

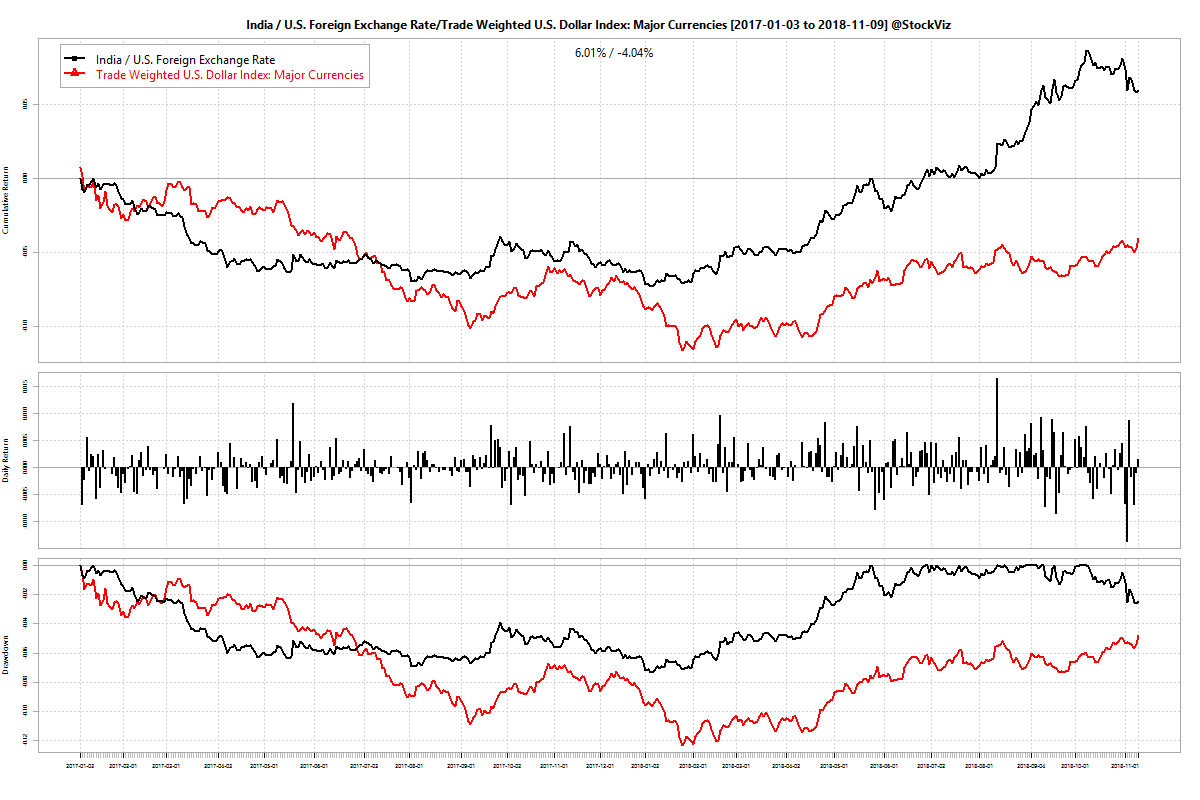

- Use 1-, 2-, 5- and 10-week returns of DTWEXM to train an SVM using a polynomial kernel on subsequent 1-week returns of the NIFTY 50

- Consider two datasets: one between the years 2000 and 2018 and the other between 2005 and 2018

- Divide the dataset into training/validation/test sets in a 60/20/20 ratio

- Use the validation test to tabulate out-performing degree parameters

- Plot the cumulative return of a long-only, long-short and buy&hold NIFTY 50 strategy based on SVM predictions on the test set

Results

We find that there is no single degree parameter between the two datasets (#2 above) that consistently outperforms.

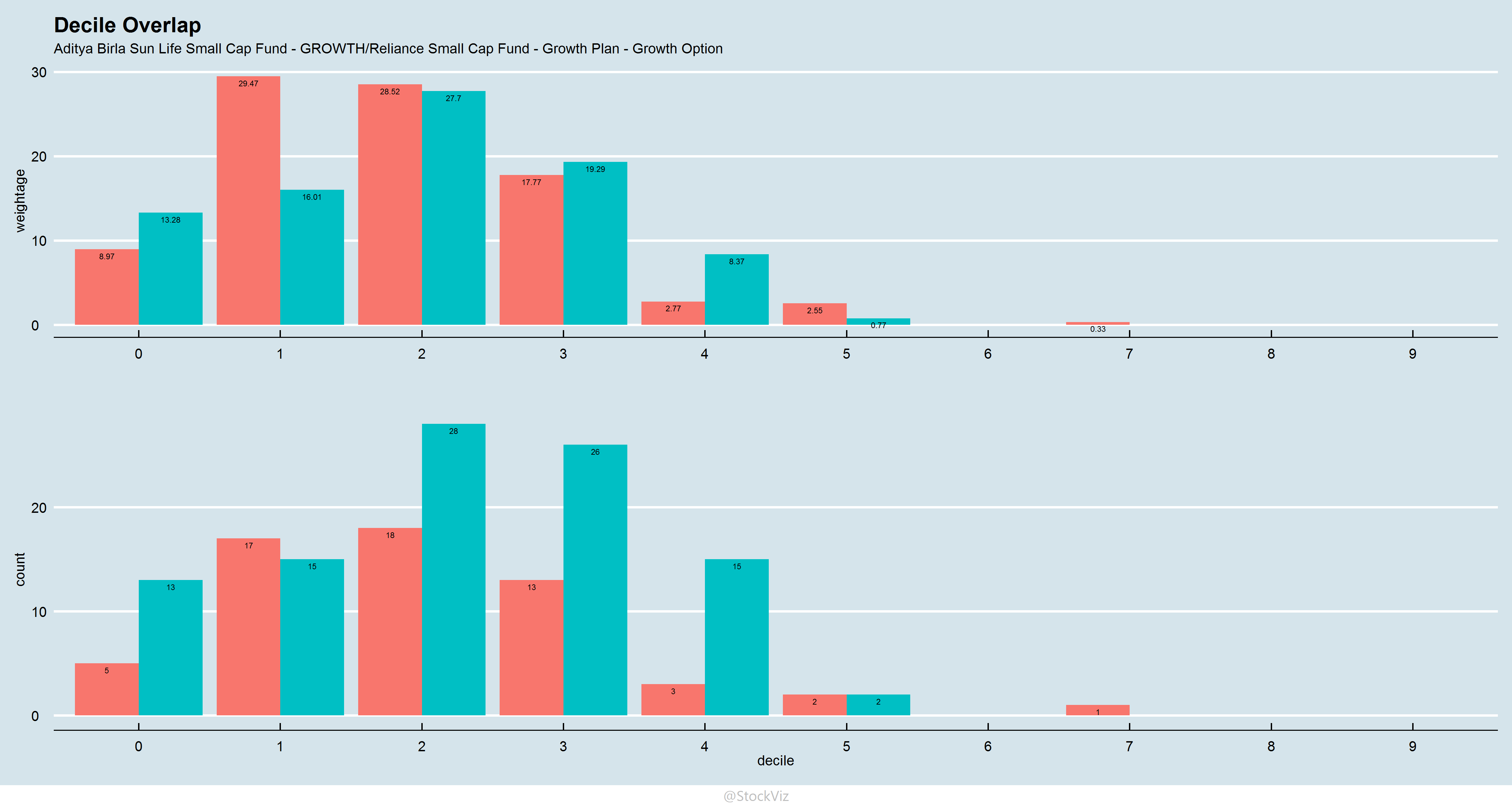

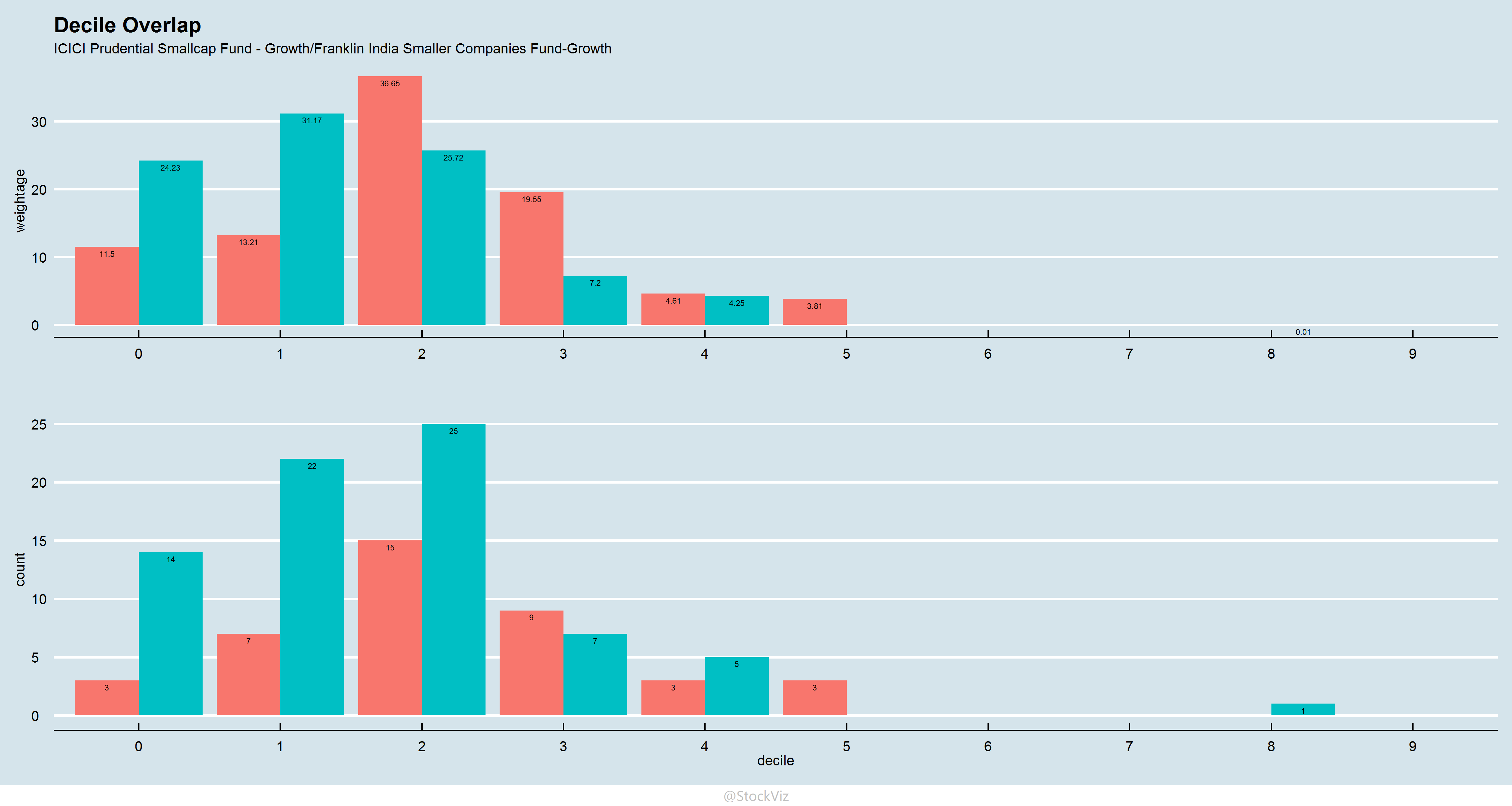

Here are the cumulative return charts for the best performing parameter:

2000-2018 dataset (8)

2005-2018 dataset (4)

While the first model (using the 2000-2018 dataset, 8th degree polynomial) failed to “predict” the 2018 correction in the NIFTY 50, the second one (2005-2018 dataset, 4th degree polynomial) seems to be able to side-step it. However, an SVM tuned with the 4th degree polynomial on the 2000-2018 dataset again failed to side-step the 2018 correction, indicating that we need to look more closely on how we choose our dataset – sometimes going too far back in time is counter-productive because the world changes.

Next Steps

In the next post, we will train a polynomial SVM with the other dollar indices (DTWEXB and DTWEXO) and USDINR (DEXINUS) and tabulate their predicted returns over different degrees.

Code and charts for this post are on github.