pluto is our compute cloud for exploratory financial data analysis (intro). We built it, in part, to scratch our own itch and to offer an intuitive platform for financial market research that abstracts away most of the drudge work involved in data acquisition, storage and maintenance. The end goal is the increase the speed at which reproducible and shareable research occurs. Here’s a recent example.

VIX-Adjusted Momentum

On 10:13 AM · Jul 11, 2019, Darren (@ReformedTrader) tweeted out a link to CSSA that discussed a momentum strategy on the S&P 500 index. It divided the daily returns of the index by the day’s VIX – a poor man’s volatility adjustment, if you will. The back-test result was interesting and we wanted to reproduce it.

We started work on it at 2 PM. Using pluto’s Indices data-set, we could quickly setup the code and reproduce the results within the hour. See the github history of vix-adjusted-momentum-US.R notebook if you don’t believe it.

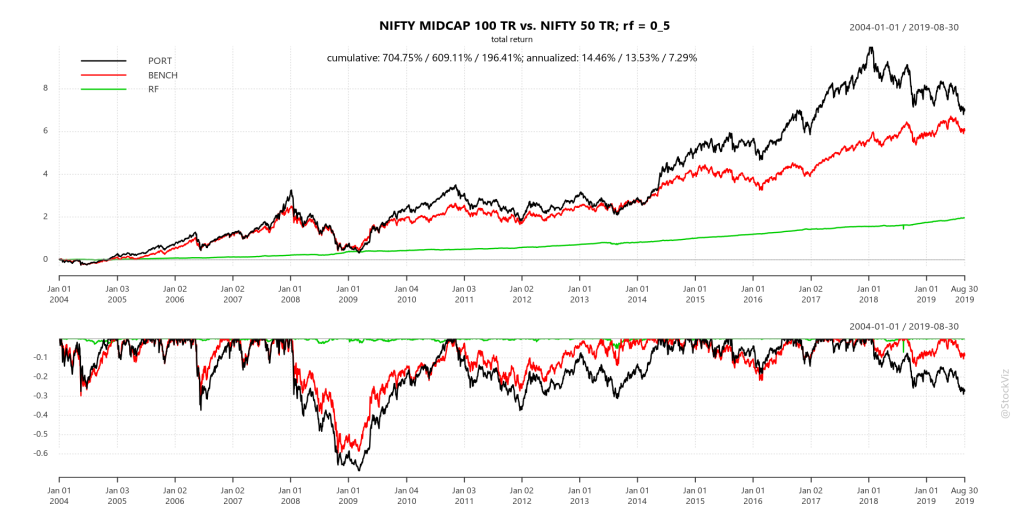

Next: if it worked for S&P 500, could it work for NIFTY 50? We fired up pluto again at 5:15 PM and quickly ran the strategy for different look-back periods (vix-adjusted-momentum-INDIA.R.md) before concluding that it doesn’t. Time taken: 15 minutes.

A quick glance at the annual return chart of the S&P 500 back-test showed that the out-performance occurs in periods of persistent high-volatility, like in 2008. But regimes change and signals fade. If you removed 2008 from the back-test, the strategy’s overall out-performance degrades considerably.

Next: does it beat a simple SMA system? vix-adjusted-momentum-and-SMA-INDIA.R answers that question in 20 minutes.

So basically, within an hour, anybody who had a passing interest in systems trading/investing could reproduce a strategy, check for applicability and extend it.

We will continue to add more data-sets to pluto and make it easier to use so that you can increase your research velocity.