Predicting is a losers game

We have always maintained that financial prognosticating is harmful to your wealth (see: Prepare – Don’t Predict!) But the lure of prediction is too strong for most investors to ignore.

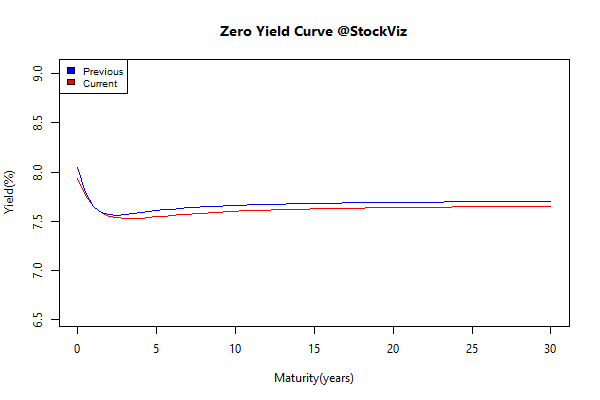

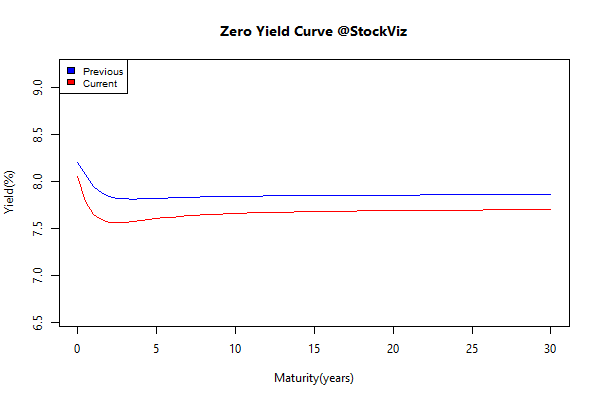

One recent example is the RBI’s “surprise” rate cut. The media went gaga over it, some pundits did a “I told you so” dance and you probably went and subscribed to a newsletter hoping that you too will be clued in when it happens next. The question is: did you make money?

Positioning your portfolio

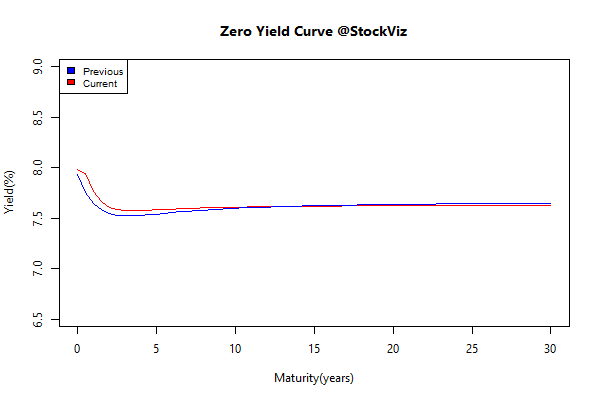

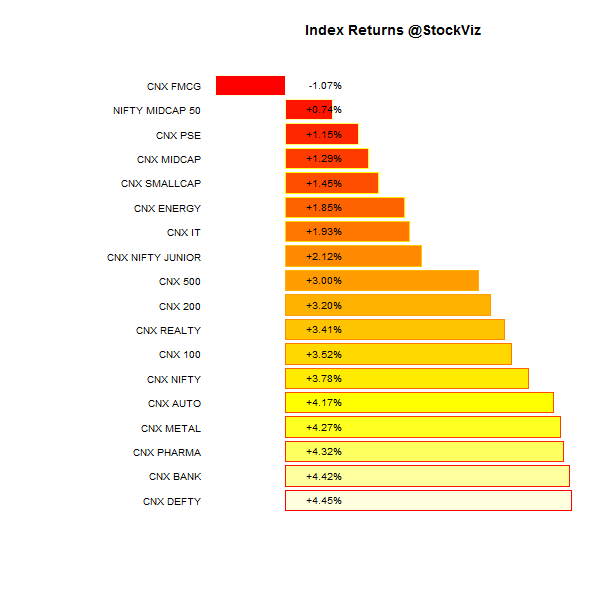

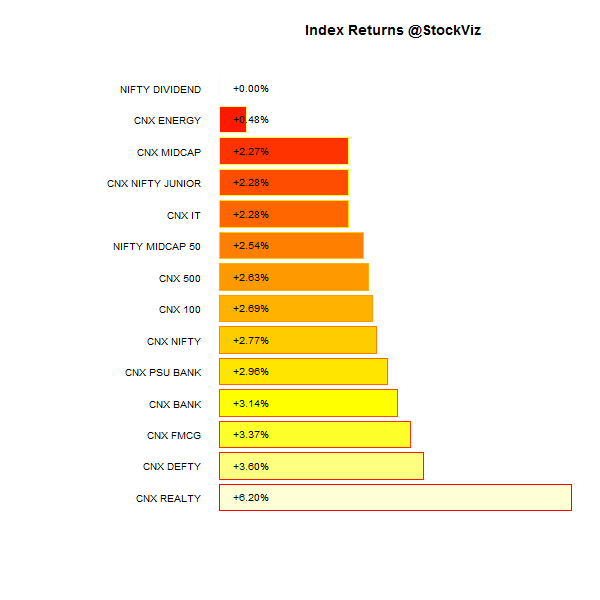

Back in September last year, we had pointed out that with the consensus behind RBI rate cuts happening in early 2015, its time to look at long duration bond funds. We had picked the UTI Gilt Advantage fund as our favorite. Between 2014-10-01 and 2015-01-15, UTI – GILT ADVANTAGE has returned a cumulative 11.08% with an IRR of 43.61% vs. CNX NIFTY’s cumulative return of 6.90% and an IRR of 25.85%.

Heck, with the RBI getting serious about trampling down inflation, bonds have been rallying for almost the whole of 2014. Between 2014-01-01 and 2015-01-15, UTI – GILT ADVANTAGE has returned a cumulative 21.90% with an IRR of 21.01% vs. CNX NIFTY’s cumulative return of 34.79% and an IRR of 33.31%.

Good investing is boring

From the Wolf of Wall Street:

Mark Hanna: Nobody knows if a stock is going to go up, down, sideways or in circles. You know what a Fugazi is?

Jordan Belfort: Fugazi, it’s a fake.

Mark Hanna: Fugazi, Fugazi. It’s a wazy. It’s a woozie. It’s fairy dust.

The difference between trying to predict market events and positioning your portfolio is in the level of excitement you feel. If you feel very smart while putting your money to work, then you are doing something wrong. If you feel that your investments are a “sure thing”, then you are doing something wrong. Good investing will feel like a boring routine that you keep doing – like flossing your teeth – because it is good for you.

Process vs. Outcome

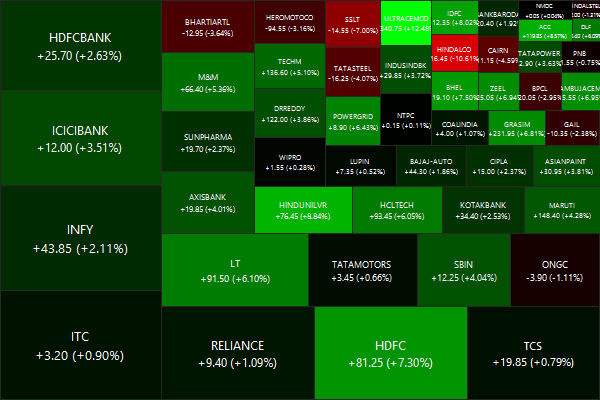

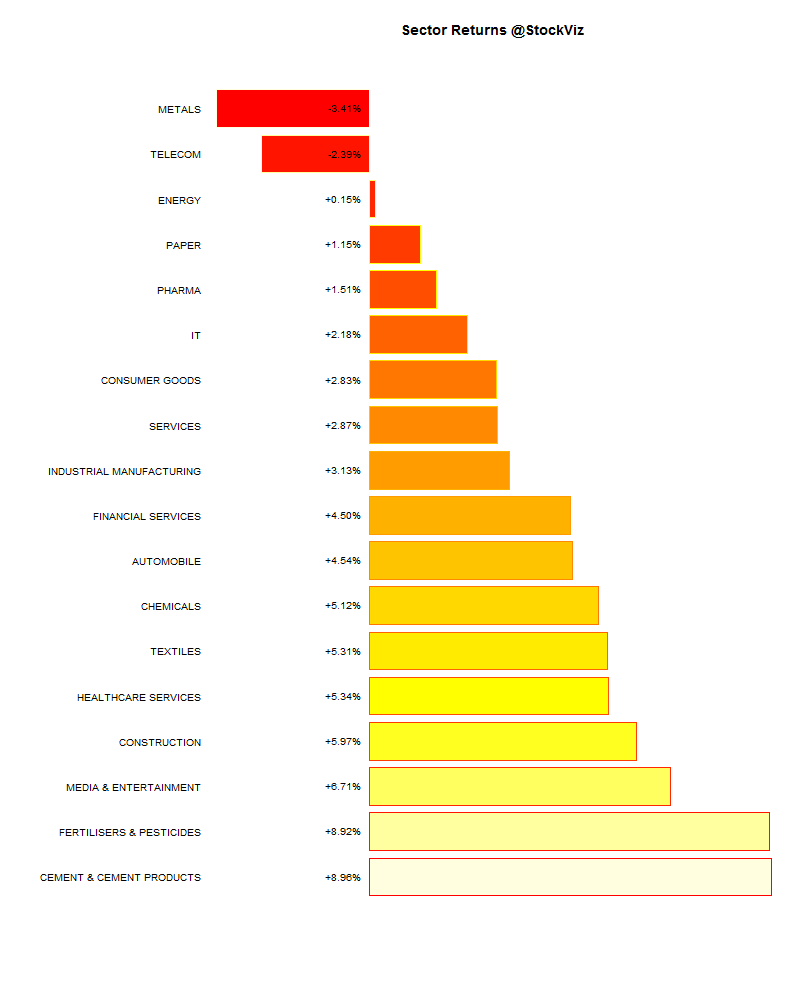

The end result of process oriented investing is a well positioned portfolio. Investors should give up on trying to figure out what the outcome is going to be. Who knows what the NIFTY IRR is going to be this year? Who knew that plain old bonds will give 20% returns in 2014? What is the one-day price target for anything?

Positioning your portfolio would have allowed you to actually realize the returns that the market gave. The alternative is all Fugazi.