The first part of this series discussed how SMA strategies can help manage draw-down risk while investing in indices. However, index investing doesn’t cover the whole breadth of strategies that investors typically run. Managing risk in a portfolio of stocks is quite different from managing risk on an index as a whole. One of the most basic strategies one can employ on a portfolio is that of a trailing stop loss on component stocks.

Trailing Stop Loss

In a TSL, a high watermark is tracked from the purchase price and an exit is triggered if the price falls below a certain percentage from it. You can read more about the mechanics here.

Some of the things that need to be thought through when using a TSL on a portfolio of stocks:

- What is the exit criteria? Should it be 5%, 10%… 15%? If you set it to low then you end up trading a lot; too high, and it may not make a difference.

- What is the re-entry criteria? Suppose you exit a stock today but it still checks all the boxes for inclusion in the portfolio, will you re-purchase it tomorrow?

- Are you going to replace an exited stock with another one that fits the inclusion criteria or are you going to hold cash?

A TSL only considers price to decide on an exit. So the most obvious place to apply it is in momentum portfolios.

Momentum

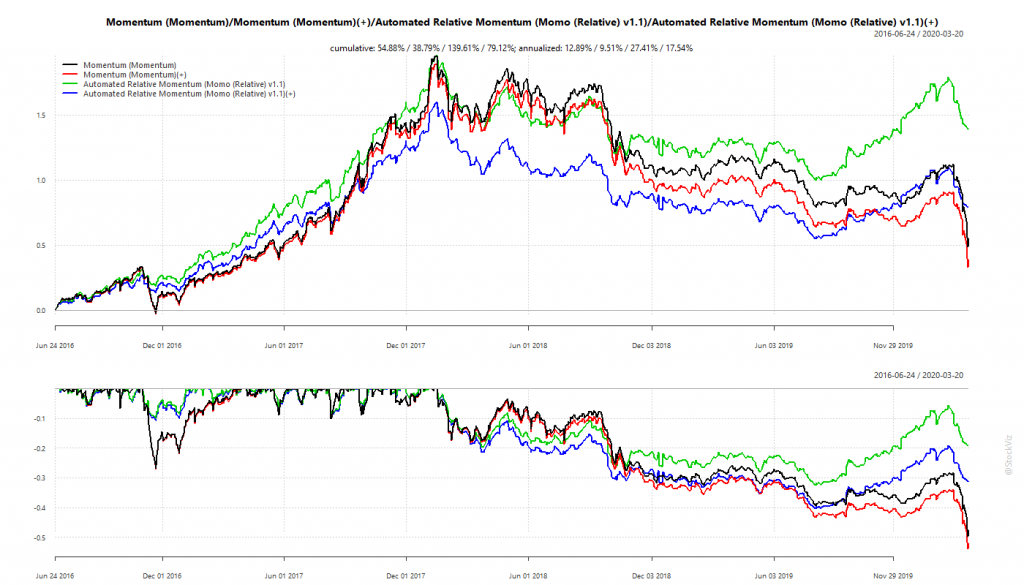

Momentum stocks are prone to cliff risk. Back in 2016, we setup a momentum portfolio that has a 5% TSL on each of its components to see if we can reduce the severity of drawdowns of our more basic Momentum strategy. We called it Momo 1.1. Here are the cumulative returns and drawdowns of Static and Momo strategies, with and without considering transaction costs:

The red line is Static Momentum and the blue line is the Momo version of it, after considering an STT of 0.1% and brokerage of 0.05%.

As you can see, the after-cost returns of Momo trailed that of Static’s for quite some time. If you are a regular investor who has to pay capital gains tax (not someone who’s main business is stock trading,) then it is really painful to watch most of the notional gains evaporate into taxes.

This is because Risk Management Is Not Free. It involves trading off near-term profit to reduce potential risk in the future.

It took the sudden plunge in equities this year to bring out the value of having a risk-management process in place. The after-cost, annualized returns of Momo, since late June 2016, comes in at 17.54% while that of Static’s is at 9.5%. Moreover, because of the dynamic nature of Momo, it is currently 75% in cash, while Static is 100% in stocks.

Momo on US stocks

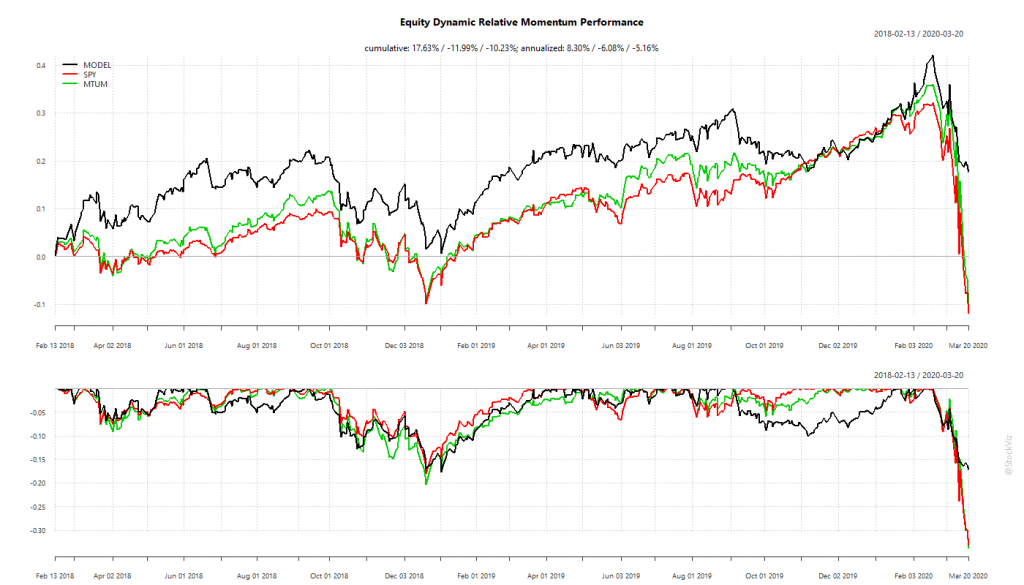

In early 2018, we ported the Momo strategy discussed above to US stocks.

Once again, we see trailing stop losses saving our hides and, more importantly, preserving our returns. Momo comes in at an annualized 8.30% vs. S&P 500’s -6.08% during the same period. Its portfolio is currently 75% in cash. At zero brokerage and no STT in the US, you pretty much get to eat all of those returns.

Investment Horizon

When we looked at the performance of Momo back in May 2019, we had concluded that, maybe, investors were better off with the Static version (see Part I, Part II.) We had traced the subsequent performance of stocks that were thrown out because of a stop loss and had found that:

During the bull phase, when the whole market was shooting higher, stop-lossed positions recovered from their losses.

During the bear phase, it does look like stop-losses helped – the subsequent returns of stop-lossed positions were skewed left.

However, in aggregate, they did not add value after taking costs into account.

It boils down to the kind of risk you are trying to avoid and the time-horizon involved. If we were to add subsequent performance of these strategies to the above data-set, we may have reached a different conclusion.

Take-away

- Risk management is not free. You pay upfront to mitigate risks in the future that may not befall.

- It is not always obvious if the risk management strategy is “working” and whether is is “worth it.”

- It makes sense to add a trailing stop loss to the components of a momentum portfolio given the high cliff risk of the strategy. However, the timing of these cliffs cannot be predicted.

- Taxes form a large chunk of costs when using a TSL based risk-management strategy.