Mutual funds come in different shapes and sizes. Very often, fund investors end up being exposed to the same set of stocks even if they invest in different funds. And not only can there be significant overlap in mutual fund portfolios, some fund managers could be “hugging” the benchmark index. For example, a mid-cap fund could have too much of an overlap with the mid-cap index, effectively making it a more expensive version of an index fund. Therefore, it makes sense for investors to check the portfolio overlap of funds that they are considering not only with each other but also with index constituents.

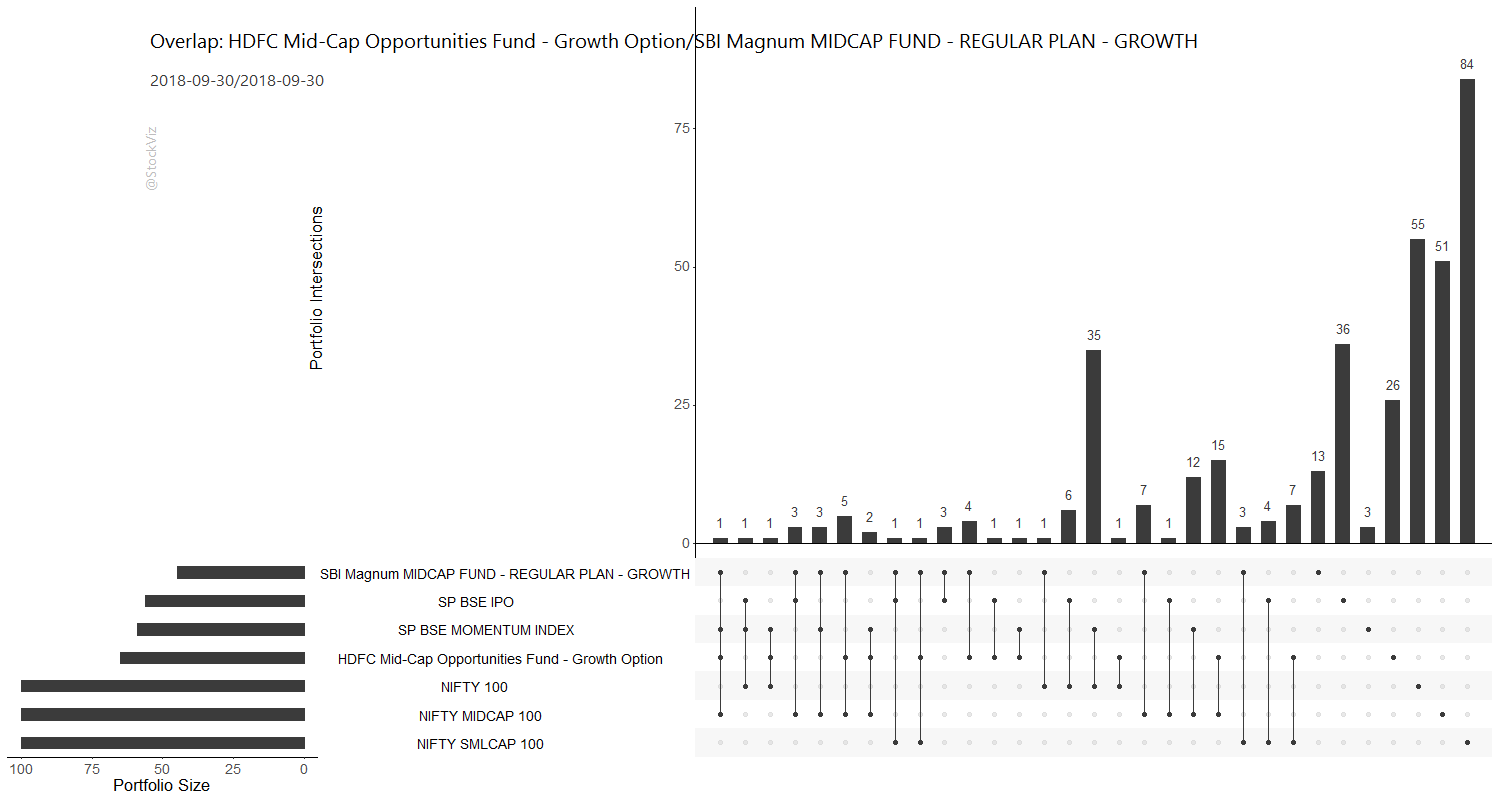

A common way to visualize overlaps is with a Venn diagram. However, when you have more than five sets (portfolios,) a Venn diagram becomes hard to read. Enter UpSet charts. Here is an UpSet chart that our Overlap Tool creates for the HDFC Mid-Cap Opportunities Fund and SBI Magnum Mid-Cap Fund portfolios:

Key regions of the chart:

- Bottom-left: size of each portfolio.

- Bottom-right: the intersection under consideration.

- Top-right: the size of the intersection.

- Titles: Funds being analyzed and their portfolio disclosure dates.

In this example, to see the overlap between the two funds, search for the connection between the 1st and the 4th rows in the bottom-right region and look up – you will see the size of the intersection to be 4. i.e., the funds only have four stocks in common even through each one has more than 50 stocks in its portfolio.

We have included some common indices to help investors identify index-hugging as well. You can run the Overlap Tool here. For an intro to the other tools available on StockViz Tools, please read this post.