Equities

Commodities

| Energy |

| Ethanol |

+0.54% |

| Natural Gas |

-2.30% |

| WTI Crude Oil |

-2.89% |

| Brent Crude Oil |

-4.46% |

| Heating Oil |

-3.15% |

| RBOB Gasoline |

-3.34% |

| Metals |

| Silver 5000oz |

+2.76% |

| Copper |

-0.84% |

| Gold 100oz |

+0.62% |

| Palladium |

-2.60% |

| Platinum |

-0.48% |

| Agricultural |

| Cattle |

+2.45% |

| Orange Juice |

-0.12% |

| Lean Hogs |

+1.09% |

| Wheat |

-2.73% |

| White Sugar |

+1.04% |

| Cocoa |

-0.05% |

| Coffee (Arabica) |

+3.41% |

| Corn |

-5.17% |

| Cotton |

-2.03% |

| Soybean Meal |

+0.31% |

| Soybeans |

-1.19% |

| Sugar #11 |

-0.80% |

| Coffee (Robusta) |

-8.77% |

| Feeder Cattle |

+0.95% |

| Lumber |

-5.54% |

Credit Indices

| Index |

Change |

| Markit CDX EM |

+0.20% |

| Markit CDX NA HY |

+0.10% |

| Markit CDX NA IG |

+0.56% |

| Markit iTraxx Asia ex-Japan IG |

+3.22% |

| Markit iTraxx Australia |

+3.07% |

| Markit iTraxx Europe |

+1.45% |

| Markit iTraxx Europe Crossover |

+6.61% |

| Markit iTraxx Japan |

+1.04% |

| Markit iTraxx SovX Western Europe |

+2.40% |

| Markit LCDX (Loan CDS) |

-0.04% |

| Markit MCDX (Municipal CDS) |

+1.72% |

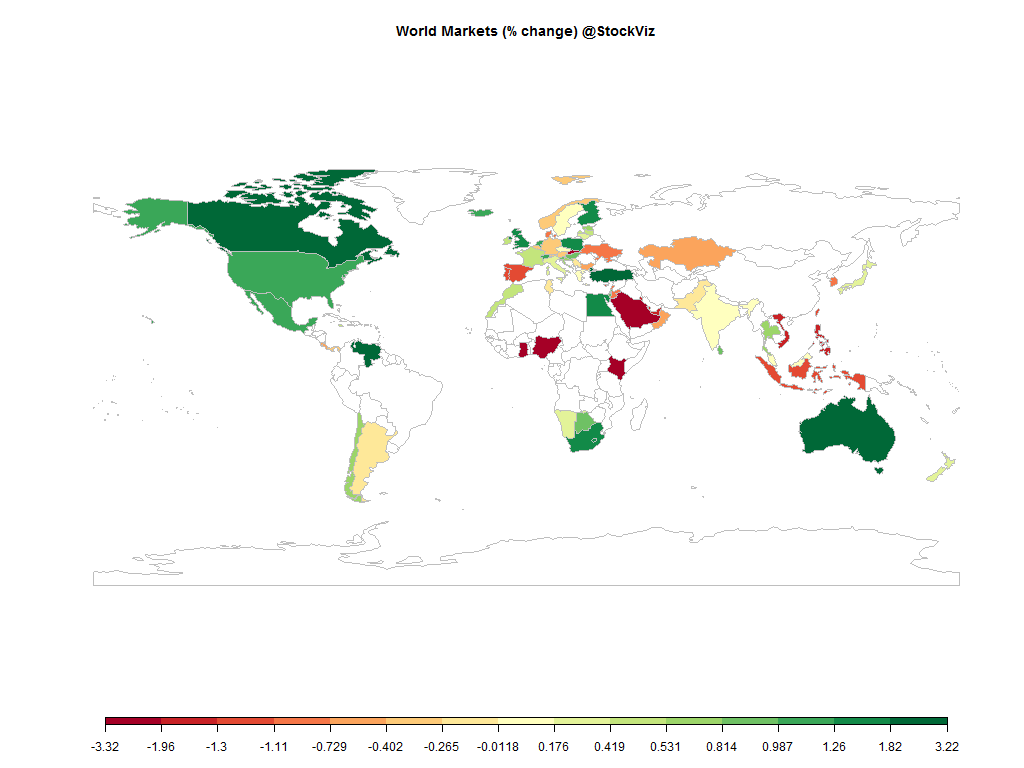

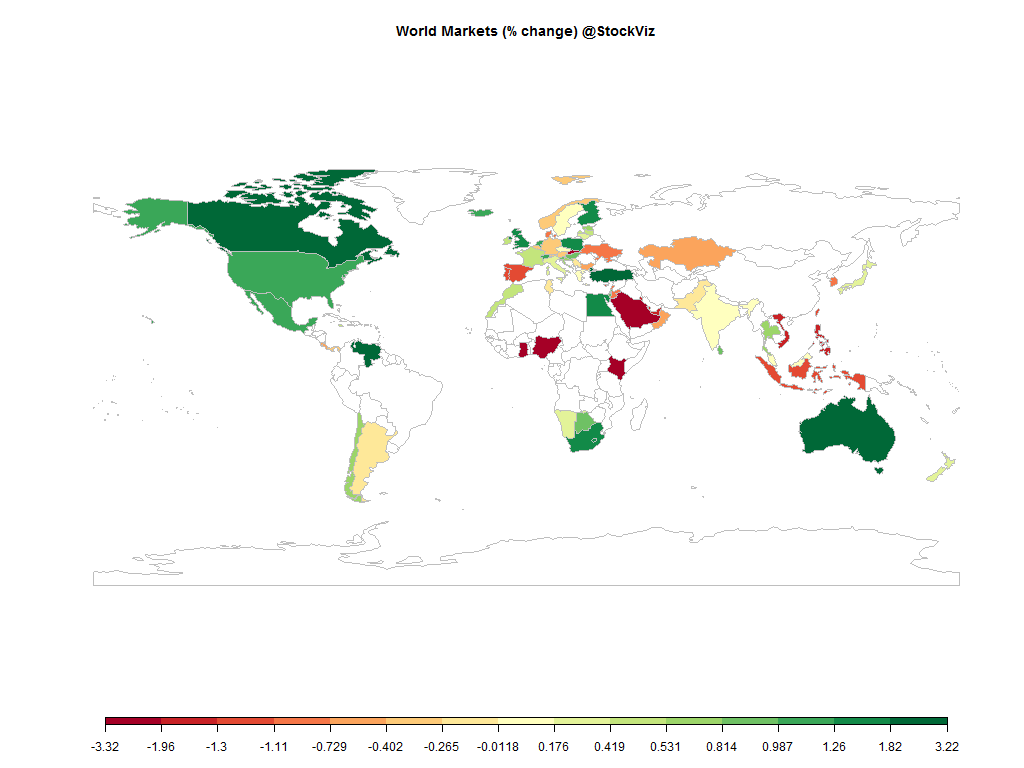

China did its thing and tanked 10%. Overall, not a good week for the commodity complex. Oil took it on the chin. The Nifty managed to end the week in the green.

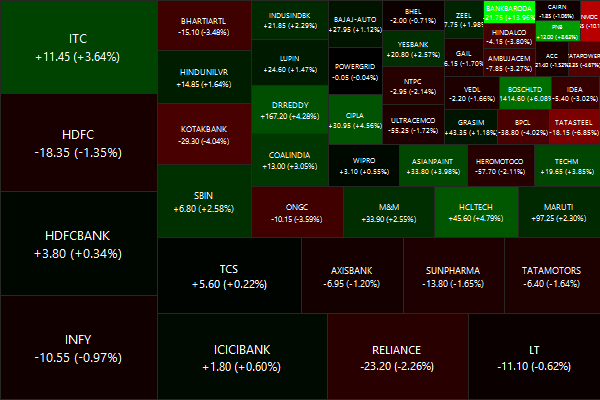

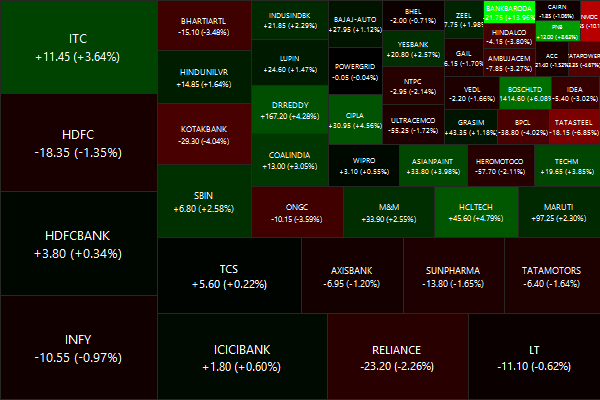

Nifty Heatmap

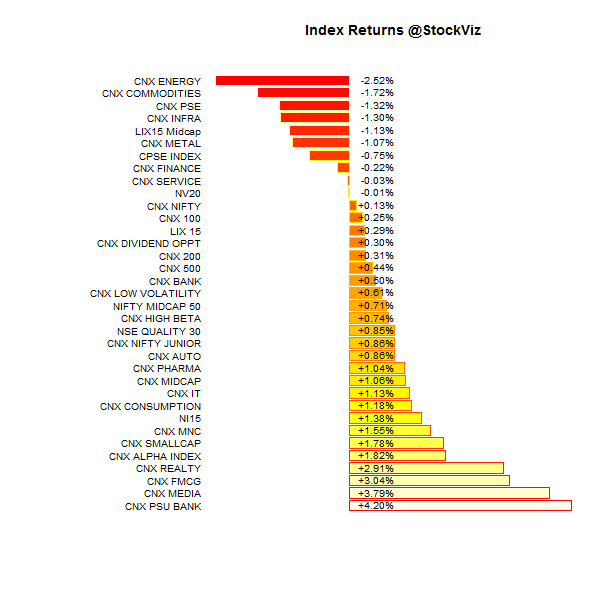

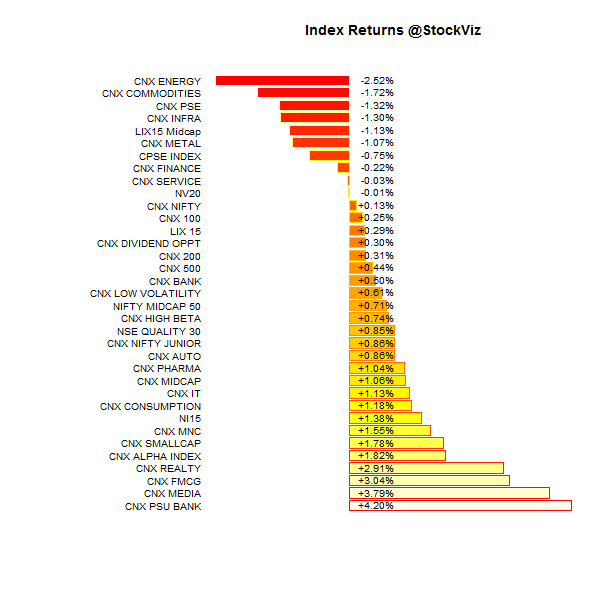

Index Returns

For a deeper dive into indices, check out our weekly Index Update.

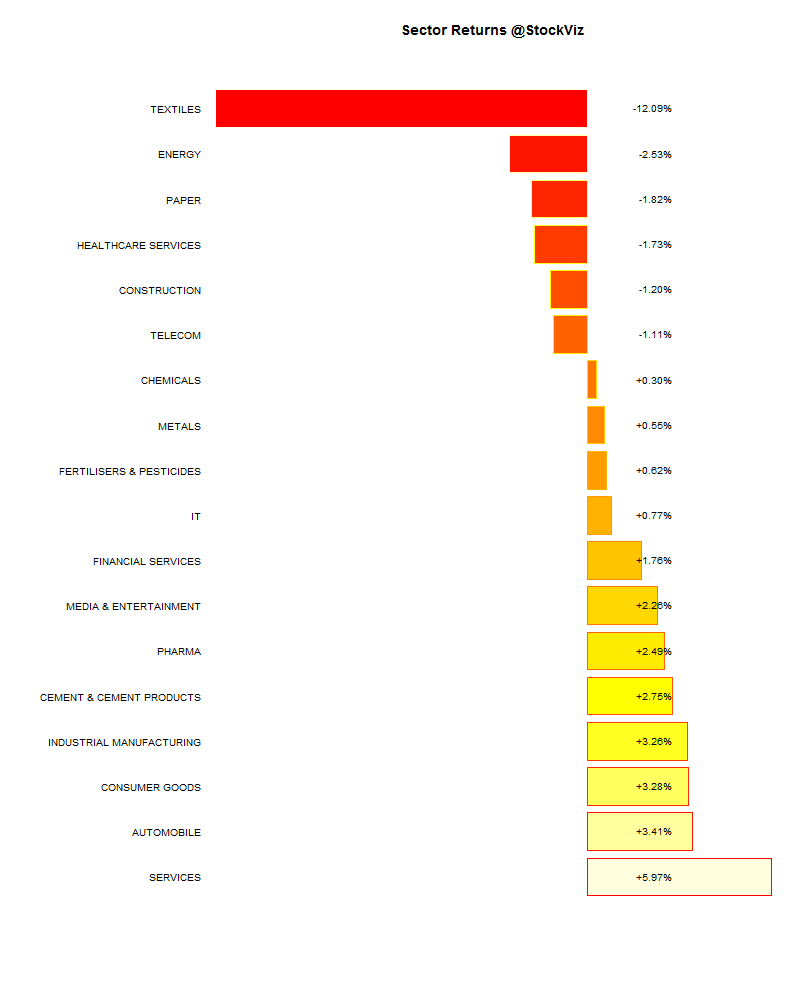

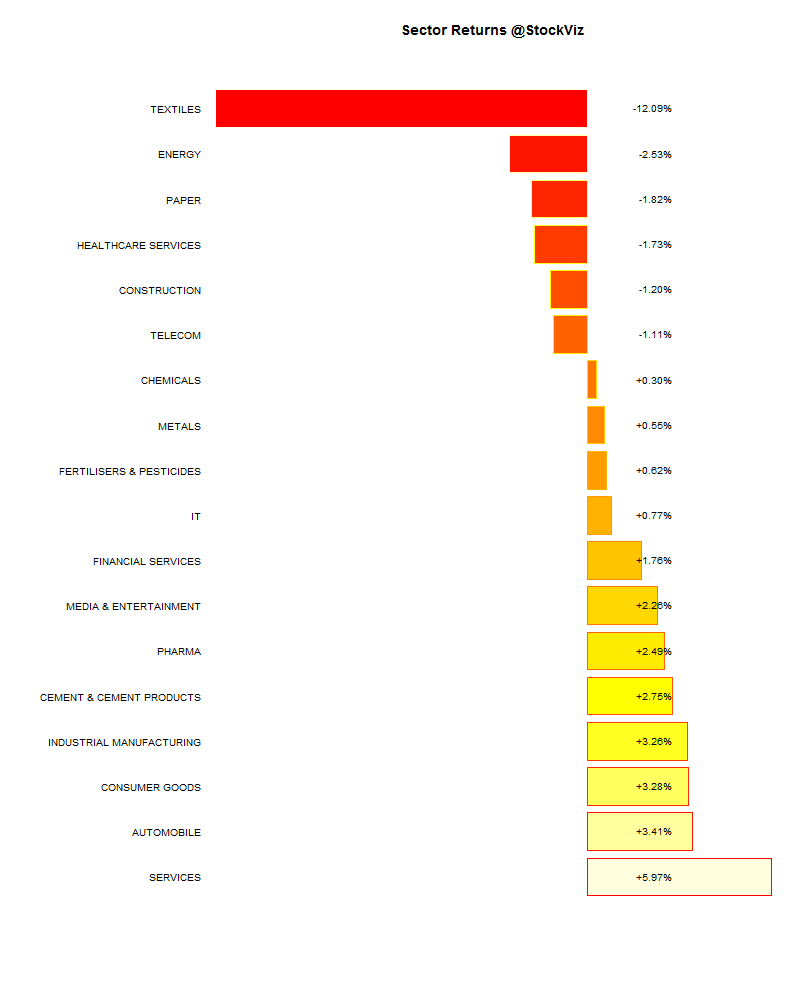

Sector Performance

Market Cap Decile Performance

| Decile |

Mkt. Cap. |

Adv/Decl |

| 1 (micro) |

+1.11% |

71/64 |

| 2 |

+3.05% |

72/63 |

| 3 |

+3.66% |

69/66 |

| 4 |

+2.07% |

72/63 |

| 5 |

+1.11% |

73/62 |

| 6 |

+0.12% |

68/67 |

| 7 |

+1.81% |

70/65 |

| 8 |

-0.45% |

66/69 |

| 9 |

-0.42% |

67/68 |

| 10 (mega) |

-1.64% |

64/71 |

Not a good week for large-caps.

Top Winners and Losers

Eicher Motors got dinged with a downgrade.

ETF Performance

A truck filled with free tax-payer cash just rammed into PSU banks. Party on…

Yield Curve

Bond Indices

| Sub Index |

Change in YTM |

Total Return(%) |

| 0 5 |

-0.06 |

+0.26% |

| 5 10 |

-0.04 |

+0.33% |

| 10 15 |

-0.03 |

+0.36% |

| 15 20 |

-0.03 |

+0.42% |

| 20 30 |

-0.03 |

+0.49% |

Not a bad week for bonds…

Investment Theme Performance

Equity Mutual Funds

Bond Mutual Funds

Thought for the weekend

No strategy is magic; none work all the time. Don’t give up during the periods where it doesn’t seem to work, or when it occasionally blows up. The best time for any strategy typically come after a lot of marginal players give up because losses exceed their pain point.

Source: Pick a Valid Strategy, Stick With It