Equities

Commodities

| Energy |

| Heating Oil |

+9.46% |

| Natural Gas |

+6.38% |

| Ethanol |

+8.99% |

| WTI Crude Oil |

+22.10% |

| Brent Crude Oil |

+13.69% |

| RBOB Gasoline |

+14.29% |

| Metals |

| Copper |

-4.73% |

| Gold 100oz |

-0.74% |

| Platinum |

-4.72% |

| Palladium |

-6.21% |

| Silver 5000oz |

-6.02% |

| Agricultural |

| Coffee (Robusta) |

+11.08% |

| Soybeans |

+7.68% |

| Cattle |

-8.30% |

| Cocoa |

+12.52% |

| Coffee (Arabica) |

-1.39% |

| Corn |

+9.44% |

| Feeder Cattle |

-1.47% |

| Lean Hogs |

+22.31% |

| Lumber |

+3.67% |

| White Sugar |

+3.99% |

| Cotton |

+6.00% |

| Soybean Meal |

+9.66% |

| Sugar #11 |

+4.00% |

| Wheat |

+17.70% |

| Orange Juice |

-7.16% |

Credit Indices

| Index |

Change |

| Markit CDX EM |

+3.41% |

| Markit CDX NA HY |

-1.55% |

| Markit CDX NA IG |

+3.77% |

| Markit iTraxx Asia ex-Japan IG |

+9.21% |

| Markit iTraxx Australia |

+11.15% |

| Markit iTraxx Europe |

+16.41% |

| Markit iTraxx Europe Crossover |

+27.41% |

| Markit iTraxx Japan |

+4.29% |

| Markit iTraxx SovX Western Europe |

+0.46% |

| Markit LCDX (Loan CDS) |

-0.19% |

| Markit MCDX (Municipal CDS) |

+5.20% |

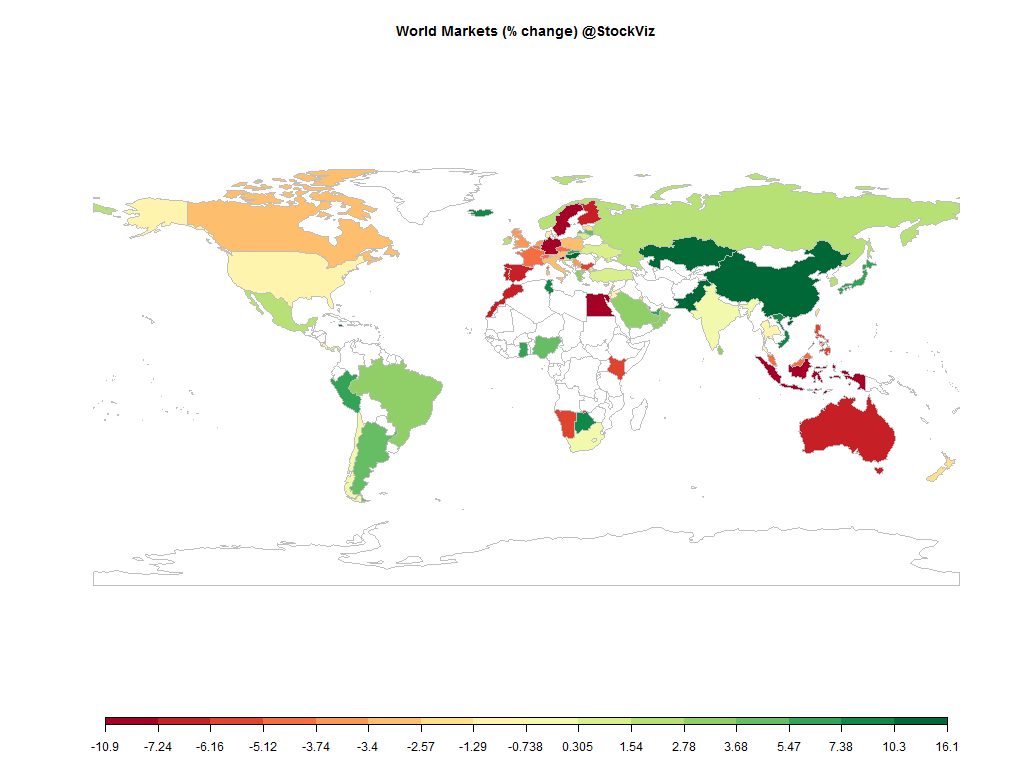

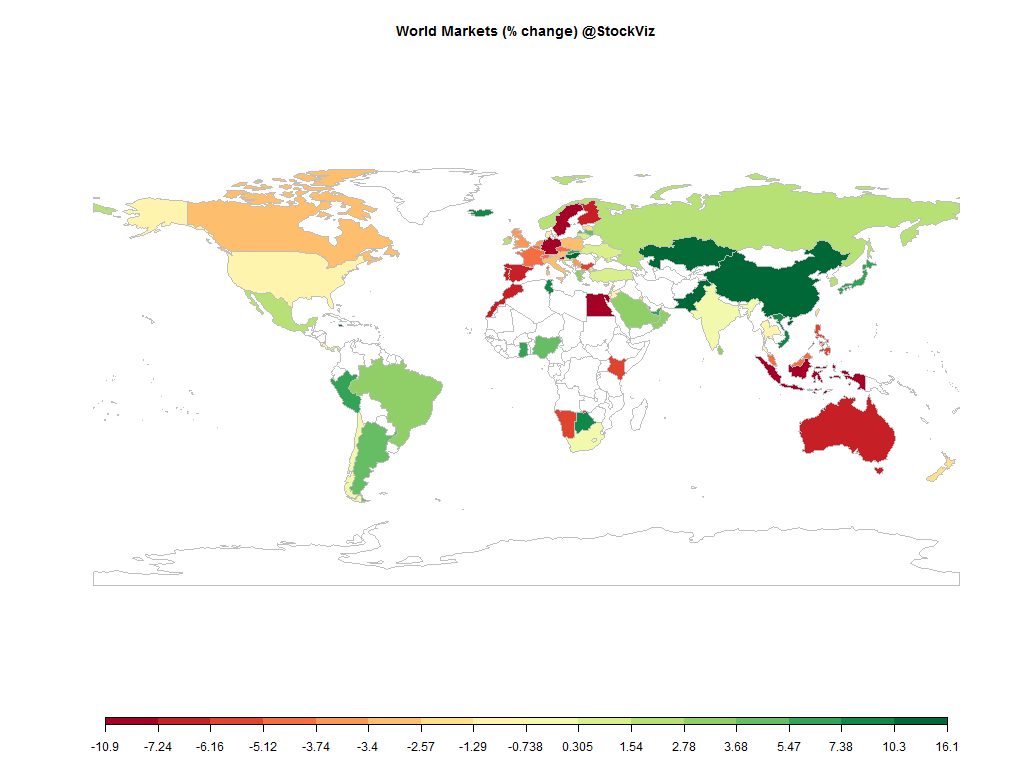

European markets got shellacked and global markets went from obsessing over Fed rate hikes to Grexit. We had our own monsoon scare and bond market turmoil even though the RBI is on an easing path…

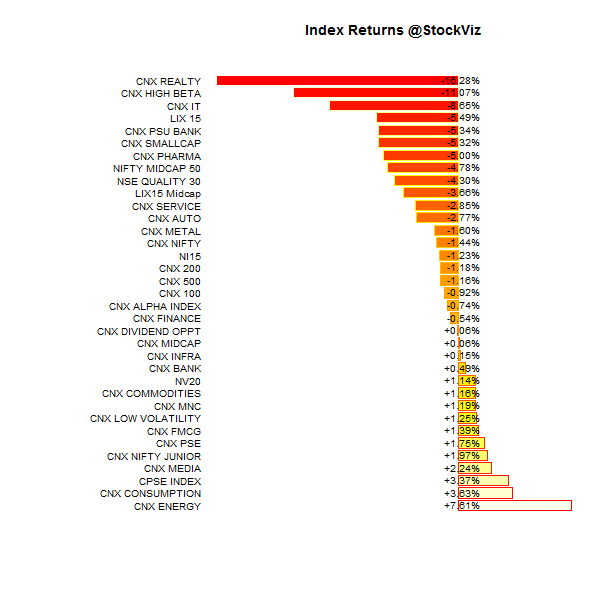

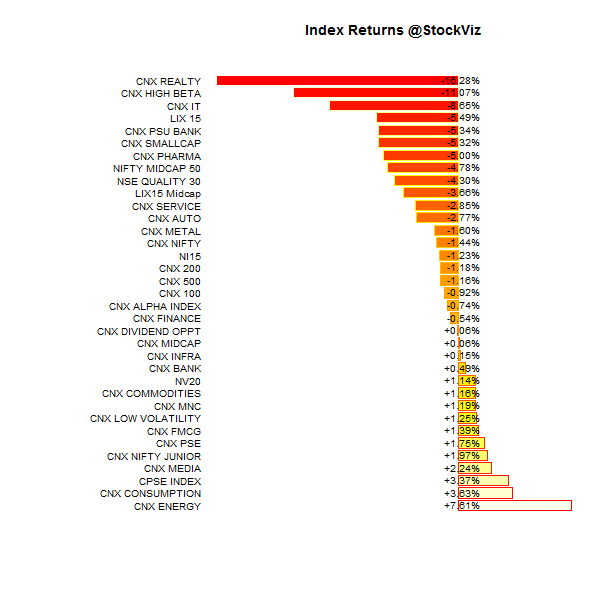

Index Returns

Market Cap Decile Performance

| Decile |

Mkt. Cap. |

Adv/Decl |

| 1 (micro) |

+4.17% |

68/64 |

| 2 |

+9.23% |

69/62 |

| 3 |

+6.79% |

73/58 |

| 4 |

+5.28% |

71/61 |

| 5 |

+2.42% |

62/69 |

| 6 |

+0.91% |

61/70 |

| 7 |

-1.04% |

57/75 |

| 8 |

-1.14% |

60/71 |

| 9 |

-5.65% |

59/72 |

| 10 (mega) |

-0.60% |

58/74 |

Large-caps held steady…

Top Winners and Losers

Looks like Bajaj Auto finally turned the corner…

ETF Performance

PSU Banks were the most despised asset class…

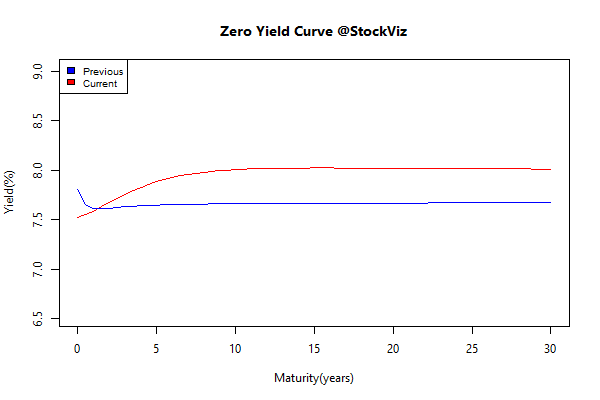

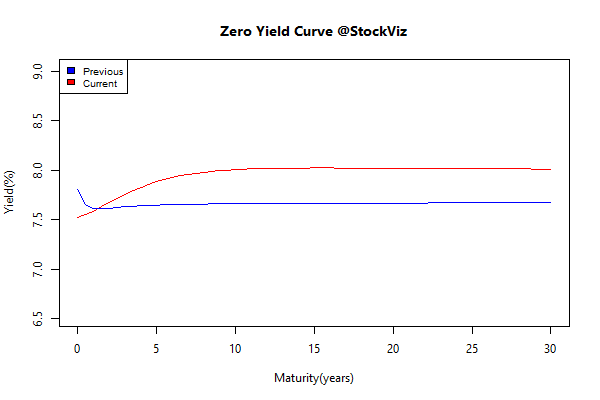

Yield Curve

Bond Indices

| Sub Index |

Change in YTM |

Total Return(%) |

| GSEC TB |

-0.36 |

+2.06% |

| GSEC SUB 1-3 |

+0.07 |

+1.73% |

| GSEC SUB 3-8 |

+0.07 |

+0.10% |

| GSEC SUB 8 |

+0.39 |

-1.09% |

Yields went up…

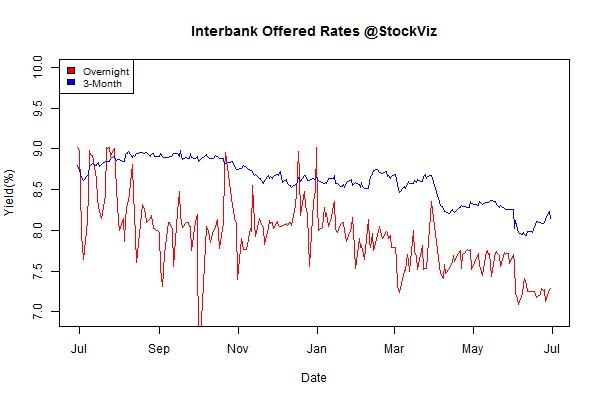

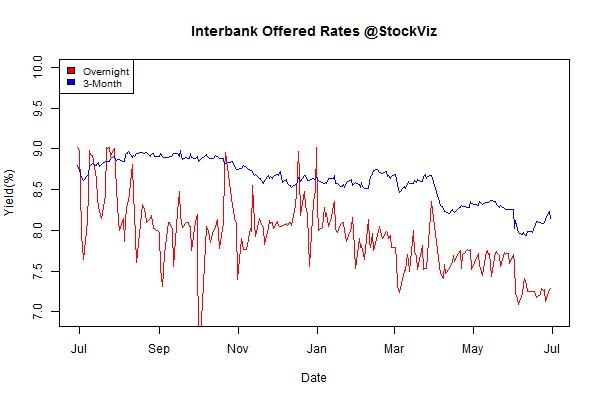

Interbank lending rates

Investment Theme Performance

Momentum managed to eke out a positive…

Equity Mutual Funds

Bond Mutual Funds