Equities

Commodities

Energy

Brent Crude Oil

-1.87%

Ethanol

+0.88%

Heating Oil

-2.07%

Natural Gas

+2.32%

RBOB Gasoline

-3.63%

WTI Crude Oil

-1.28%

Metals

Palladium

-3.98%

Silver 5000oz

+1.90%

Copper

-3.70%

Gold 100oz

+1.74%

Platinum

-0.96%

Agricultural

Coffee (Arabica)

-4.41%

Coffee (Robusta)

+6.65%

Lean Hogs

-6.93%

Lumber

+1.63%

Orange Juice

-2.23%

Corn

+0.00%

Cotton

-0.84%

White Sugar

+0.40%

Feeder Cattle

-0.04%

Cattle

-0.30%

Cocoa

+0.62%

Soybean Meal

+1.86%

Soybeans

+3.33%

Sugar #11

-5.12%

Wheat

-3.07%

Credit Indices

Index

Change

Markit CDX EM

-0.21%

Markit CDX NA HY

-0.84%

Markit CDX NA IG

+4.06%

Markit iTraxx Asia ex-Japan IG

+2.43%

Markit iTraxx Australia

+3.39%

Markit iTraxx Europe

+9.01%

Markit iTraxx Europe Crossover

+36.53%

Markit iTraxx Japan

+4.22%

Markit iTraxx SovX Western Europe

+2.81%

Markit LCDX (Loan CDS)

+0.00%

Markit MCDX (Municipal CDS)

+0.97%

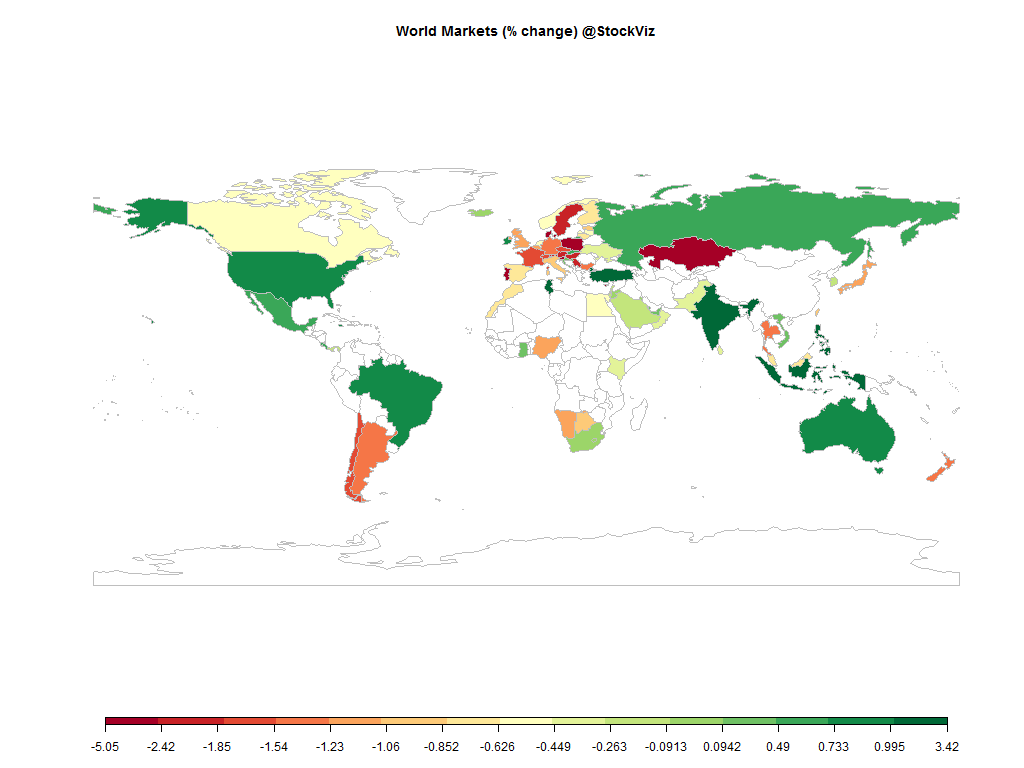

China is going through whatever India went through in the 90’s. Europe is going through their quarterly Greece-related gyrations. And Indian markets woke up…

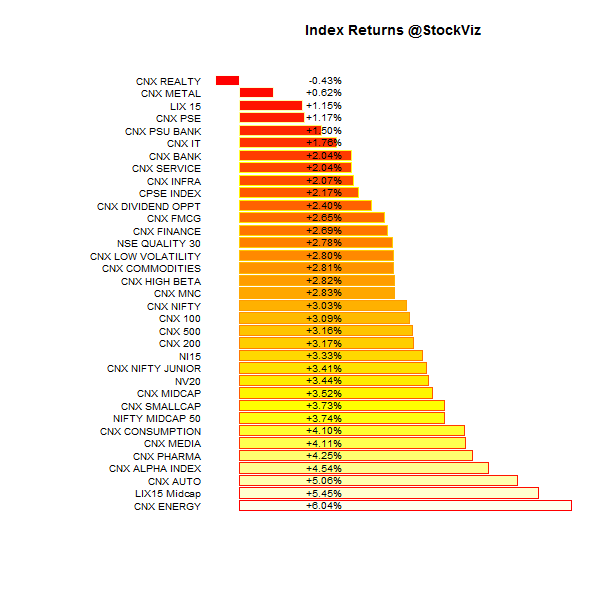

Index Returns

weekly Index Update .

Market Cap Decile Performance

Decile

Mkt. Cap.

Adv/Decl

1 (micro)

+1.32% 68/58

2

+2.63% 64/62

3

+2.92% 67/59

4

+4.06% 65/60

5

+3.86% 67/59

6

+3.84% 76/50

7

+2.58% 66/59

8

+2.74% 63/63

9

+2.69% 68/58

10 (mega)

+2.70% 63/63

Rally across the board…

Top Winners and Losers

This stopped making sense a long time ago…

ETF Performance

There is talk about

#gold #bonds being floated around by the RBI. After the tepid reaction to inflation-linked bonds and gold-deposits, you would think they would approach this topic with a bit more humility…

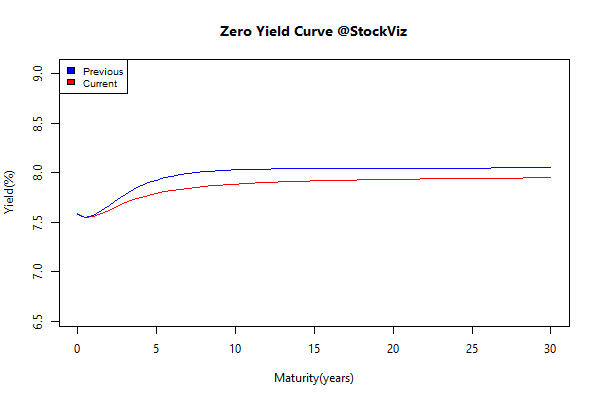

Yield Curve

Bond Indices

Sub Index

Change in YTM

Total Return(%)

GSEC TB

+0.13 +0.11%

GSEC SUB 1-3

+0.07 +0.20%

GSEC SUB 3-8

-0.16 +0.99%

GSEC SUB 8

-0.03 +0.59%

A smart recovery at the middle…

Investment Theme Performance

Guess who’s back? Momentum!

Equity Mutual Funds

Bond Mutual Funds

Thought for the weekend

VIDEO