Equities

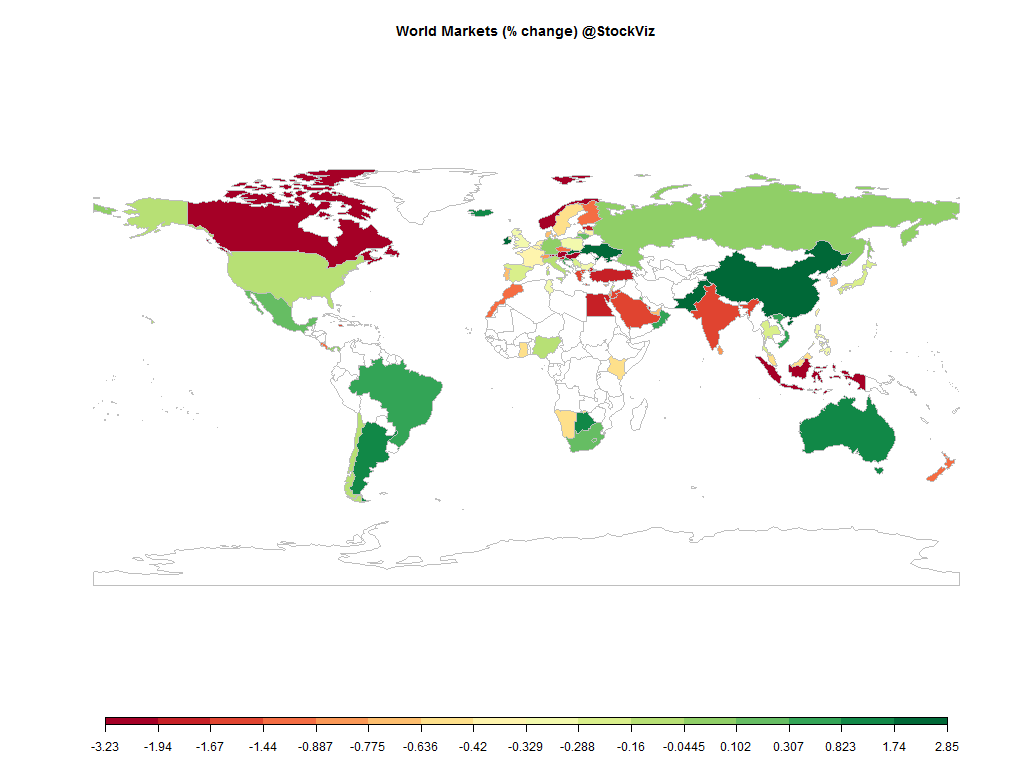

| MINTs | |

|---|---|

| JCI(IDN) | -3.23% |

| INMEX(MEX) | +0.25% |

| NGSEINDX(NGA) | -0.13% |

| XU030(TUR) | -1.88% |

| BRICS | |

|---|---|

| IBOV(BRA) | +0.44% |

| SHCOMP(CHN) | +2.85% |

| NIFTY(IND) | -1.62% |

| INDEXCF(RUS) | +0.01% |

| TOP40(ZAF) | +0.30% |

Commodities

| Energy | |

|---|---|

| Natural Gas | +6.59% |

| Ethanol | -4.26% |

| Brent Crude Oil | +1.08% |

| Heating Oil | +0.94% |

| WTI Crude Oil | +1.64% |

| RBOB Gasoline | +4.58% |

| Metals | |

|---|---|

| Copper | -0.74% |

| Gold 100oz | +1.02% |

| Palladium | -1.90% |

| Platinum | +0.16% |

| Silver 5000oz | -0.63% |

Currencies

| MINTs | |

|---|---|

| USDIDR(IDN) | +0.34% |

| USDMXN(MEX) | -2.04% |

| USDNGN(NGA) | +0.22% |

| USDTRY(TUR) | +1.75% |

| BRICS | |

|---|---|

| USDBRL(BRA) | -1.09% |

| USDCNY(CHN) | +0.09% |

| USDINR(IND) | +0.48% |

| USDRUB(RUS) | -2.13% |

| USDZAR(ZAF) | -1.56% |

| Agricultural | |

|---|---|

| Cattle | -0.28% |

| Cocoa | +0.05% |

| White Sugar | -0.97% |

| Cotton | +0.61% |

| Lumber | +1.45% |

| Orange Juice | +5.35% |

| Corn | -2.15% |

| Feeder Cattle | +0.90% |

| Coffee (Arabica) | -2.01% |

| Coffee (Robusta) | +0.17% |

| Lean Hogs | -0.61% |

| Soybean Meal | +4.00% |

| Soybeans | +0.13% |

| Sugar #11 | -2.98% |

| Wheat | -2.65% |

Credit Indices

| Index | Change |

|---|---|

| Markit CDX EM | -0.48% |

| Markit CDX NA HY | -0.19% |

| Markit CDX NA IG | +0.14% |

| Markit iTraxx Asia ex-Japan IG | +1.99% |

| Markit iTraxx Australia | +1.42% |

| Markit iTraxx Europe | +1.14% |

| Markit iTraxx Europe Crossover | +0.36% |

| Markit iTraxx Japan | +2.32% |

| Markit iTraxx SovX Western Europe | +0.28% |

| Markit LCDX (Loan CDS) | -0.02% |

| Markit MCDX (Municipal CDS) | -0.16% |

A huge wave of volatility consumed pretty much all asset classes this week. Bonds – down, equities – down, rupee – down; euro – up. Are we done yet?

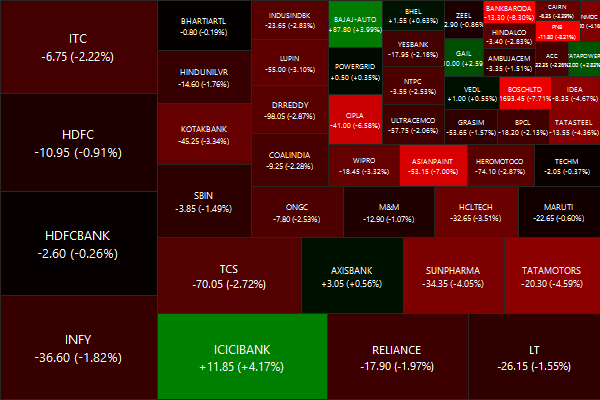

Nifty Heatmap

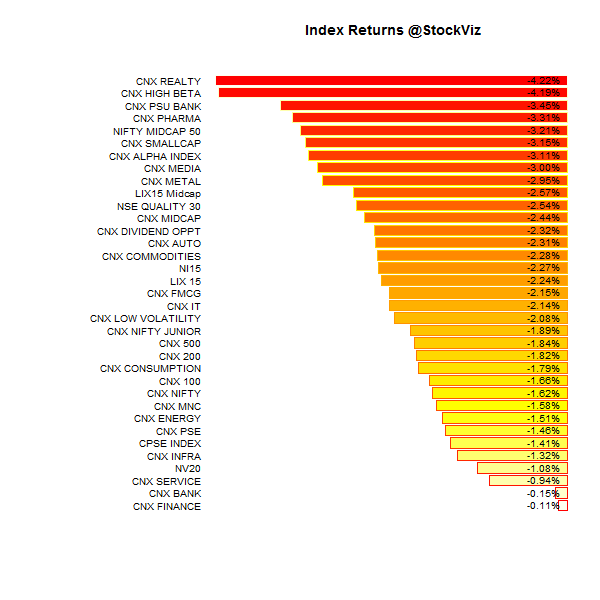

Index Returns

For a deeper dive into indices, check out our weekly Index Update.

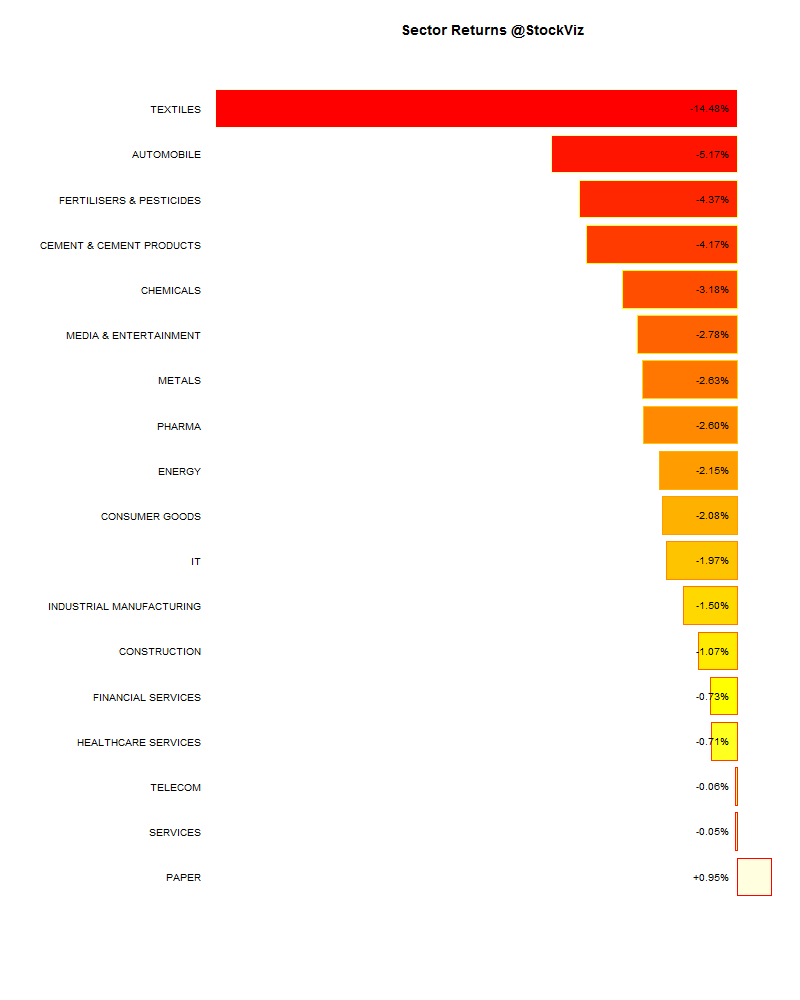

Sector Performance

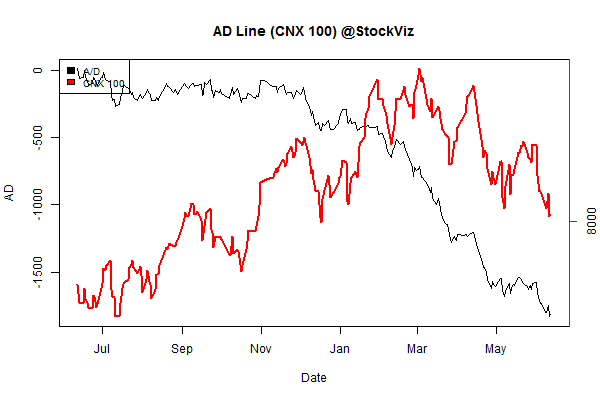

Advance Decline

Market Cap Decile Performance

| Decile | Mkt. Cap. | Adv/Decl |

|---|---|---|

| 1 (micro) | -8.21% | 59/68 |

| 2 | -2.71% | 58/70 |

| 3 | -2.35% | 58/70 |

| 4 | -3.39% | 61/67 |

| 5 | -2.31% | 58/70 |

| 6 | -2.26% | 61/67 |

| 7 | -2.15% | 57/71 |

| 8 | -3.77% | 58/70 |

| 9 | -2.61% | 58/70 |

| 10 (mega) | -1.82% | 60/68 |

A total bloodbath across market caps…

Top Winners and Losers

Bosch was once a boring old manufacturing company but they had to go and include it in the Nifty and ruin it for everyone…

ETF Performance

| INFRABEES | +0.43% |

| BANKBEES | +0.21% |

| GOLDBEES | +0.01% |

| JUNIORBEES | -1.45% |

| CPSEETF | -1.58% |

| NIFTYBEES | -1.58% |

| PSUBNKBEES | -2.63% |

PSU banks back to being kicked around…

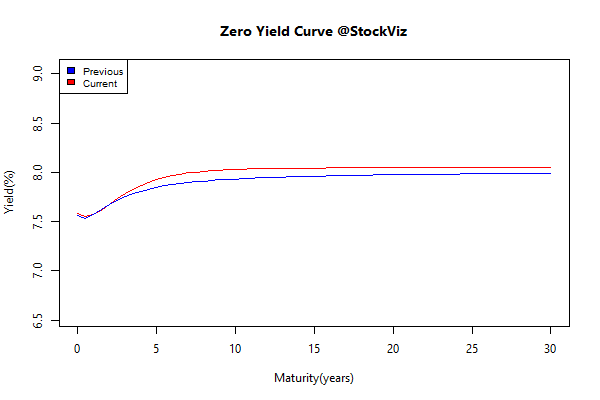

Yield Curve

Bond Indices

| Sub Index | Change in YTM | Total Return(%) |

|---|---|---|

| GSEC TB | -0.63 | +0.33% |

| GSEC SUB 1-3 | -0.29 | +0.84% |

| GSEC SUB 3-8 | -0.07 | +0.17% |

| GSEC SUB 8 | +0.29 | -2.69% |

Are long bonds reflecting global liquidity jitters or are they signalling higher inflation?

Investment Theme Performance

| Tactical CNX 100 | +0.00% |

| CNX 100 Enterprise Yield | -0.79% |

| PPFAS Long Term Value | -1.34% |

| Balance Sheet Strength | -1.79% |

| The RBI Restricted List | -1.95% |

| Textile, Metals, Chemicals, Paper and Energy Quality to Price | -2.12% |

| Magic Formula | -2.31% |

| Low Volatility | -2.51% |

| Media, Health, IT, Telecom, Services, Pharma Quality To Price | -2.71% |

| Next Trillion | -3.20% |

| ADAG stocks | -3.42% |

| Financial Strength Value | -3.43% |

| ASK Life | -3.45% |

| Momentum | -4.48% |

| Auto and Consumer Goods Quality to Price | -4.60% |

| High Beta | -5.04% |

| Quality to Price | -9.51% |

Basically, nothing worked…

Equity Mutual Funds

Bond Mutual Funds

Thought for the weekend

We may have entered a great period of profit destroying innovation where the benefits accrue more and more to the customers and not the providers.

For instance, for almost every SaaS company that charges for features there are now new companies being built that give the features away with the goal of charging for some activity in the network that they are looking to build.

Source: Valuations, Profit Destroying Innovation and Winner’s Curse