Equities

Commodities

| Energy |

| Brent Crude Oil |

+0.20% |

| Ethanol |

-1.97% |

| Heating Oil |

-0.39% |

| Natural Gas |

-8.87% |

| RBOB Gasoline |

+0.56% |

| WTI Crude Oil |

+0.75% |

| Metals |

| Gold 100oz |

-1.28% |

| Copper |

-2.47% |

| Palladium |

-0.91% |

| Platinum |

-3.00% |

| Silver 5000oz |

-2.34% |

| Agricultural |

| Coffee (Arabica) |

-0.51% |

| Orange Juice |

-3.43% |

| Cocoa |

-0.09% |

| Coffee (Robusta) |

-0.85% |

| Cotton |

+1.58% |

| Lean Hogs |

+0.12% |

| Sugar #11 |

-2.60% |

| Wheat |

-7.09% |

| Corn |

-2.43% |

| Feeder Cattle |

+1.33% |

| Cattle |

+0.16% |

| Lumber |

-0.04% |

| Soybean Meal |

+0.72% |

| Soybeans |

+1.00% |

| White Sugar |

-0.43% |

Credit Indices

| Index |

Change |

| Markit CDX EM |

-0.36% |

| Markit CDX NA HY |

+0.04% |

| Markit CDX NA IG |

-0.54% |

| Markit iTraxx Asia ex-Japan IG |

+1.53% |

| Markit iTraxx Australia |

+0.90% |

| Markit iTraxx Europe |

+2.70% |

| Markit iTraxx Europe Crossover |

+4.86% |

| Markit iTraxx Japan |

+0.36% |

| Markit iTraxx SovX Western Europe |

+0.13% |

| Markit LCDX (Loan CDS) |

+0.00% |

| Markit MCDX (Municipal CDS) |

-0.59% |

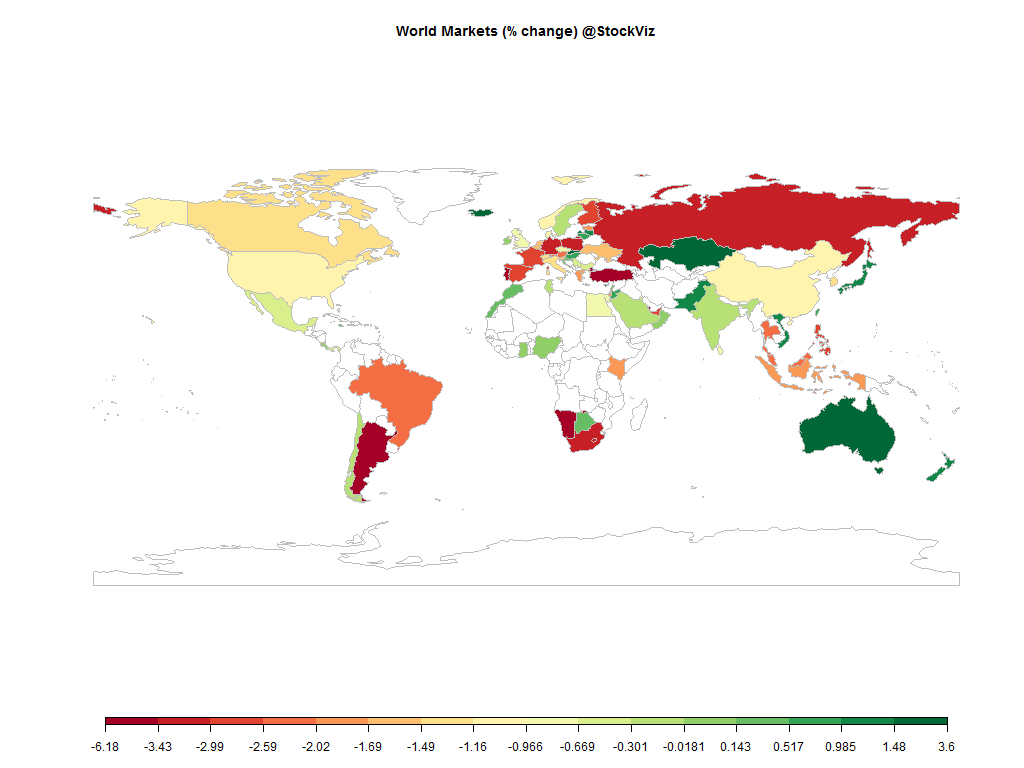

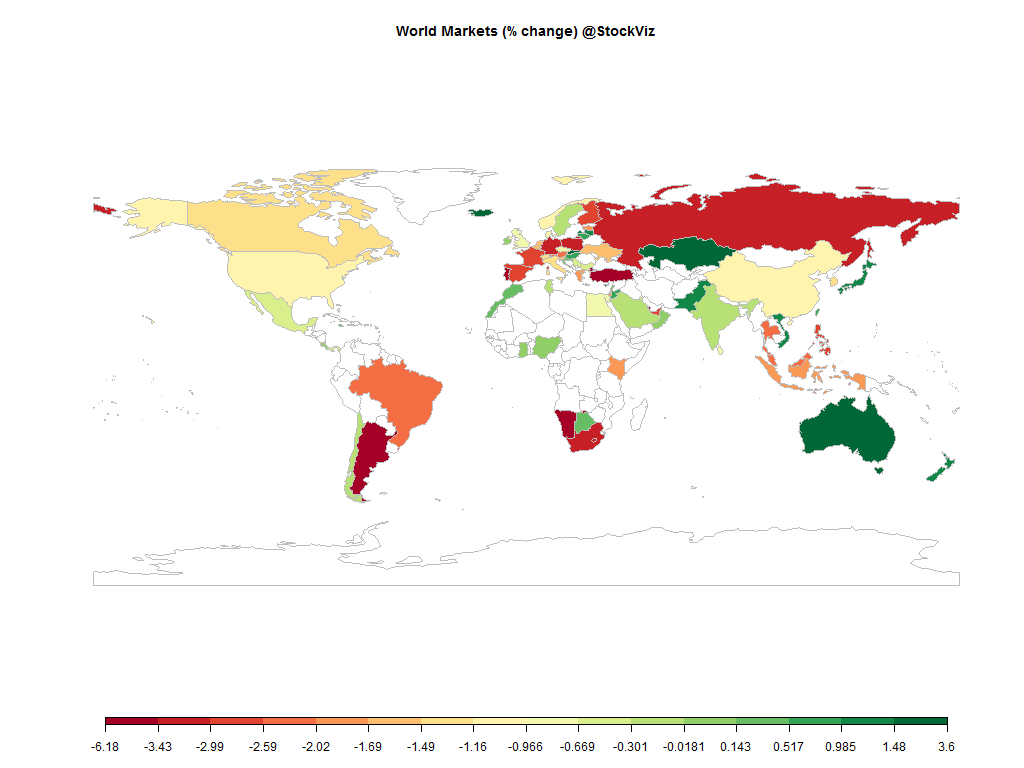

This was not a good week for equity markets. The dollar rallied after taking a spring break and credit spreads widened.

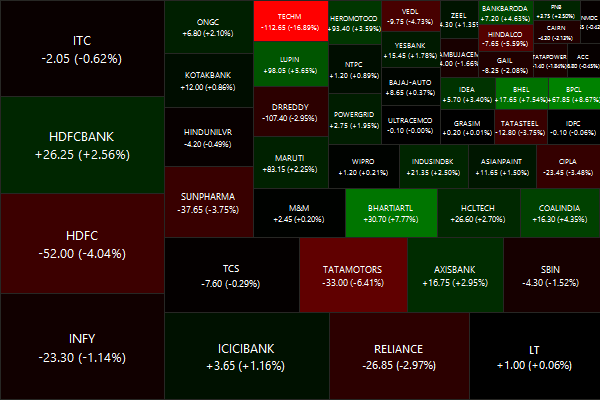

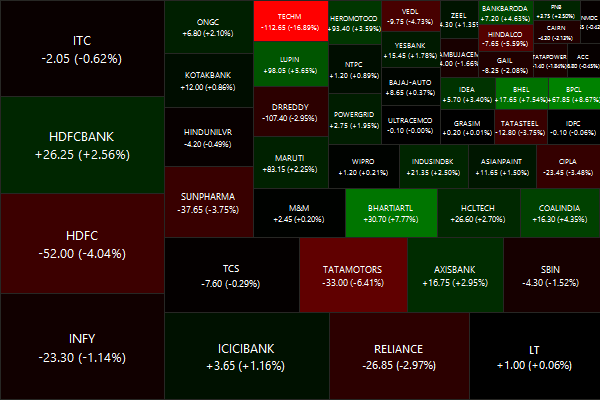

Nifty Heatmap

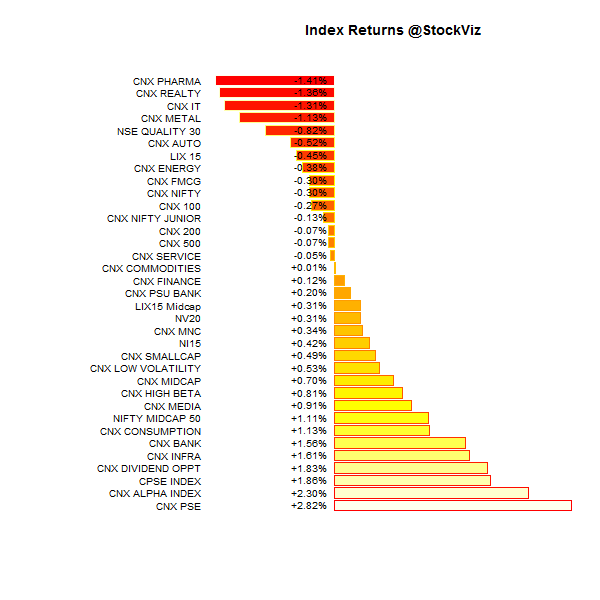

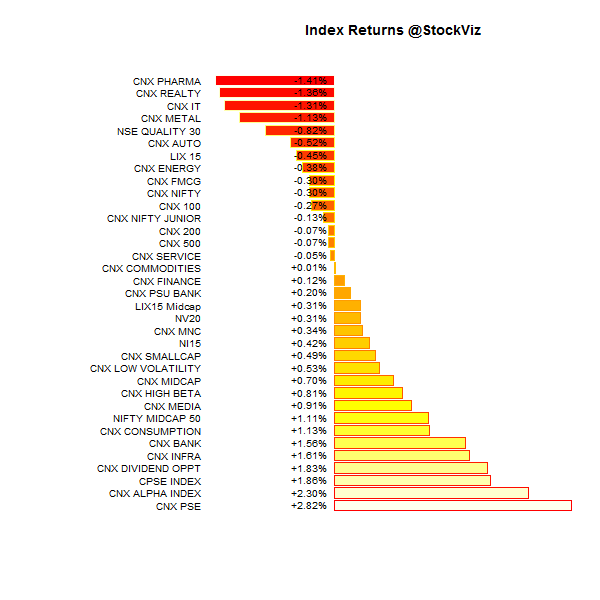

Index Returns

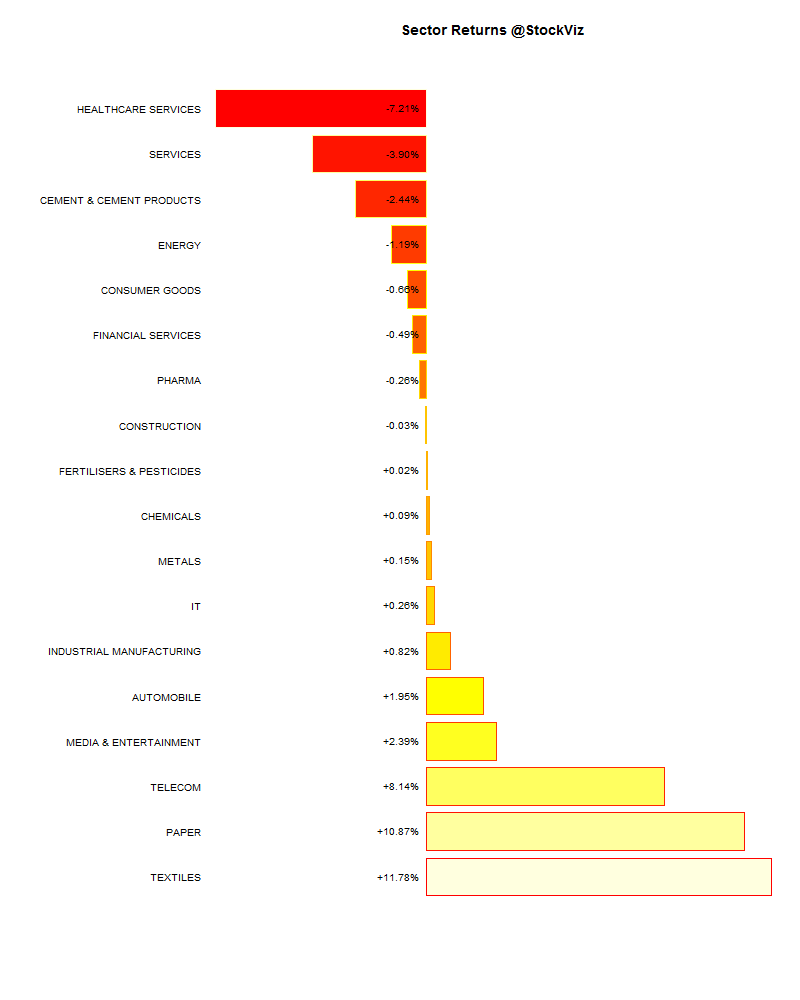

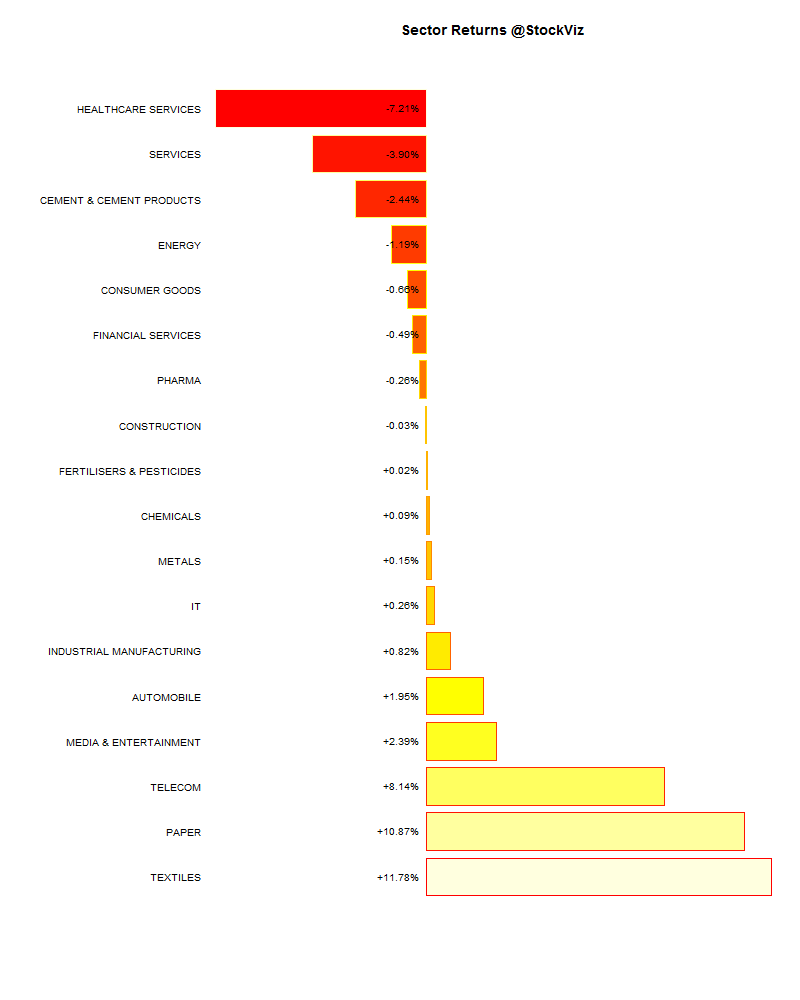

Sector Performance

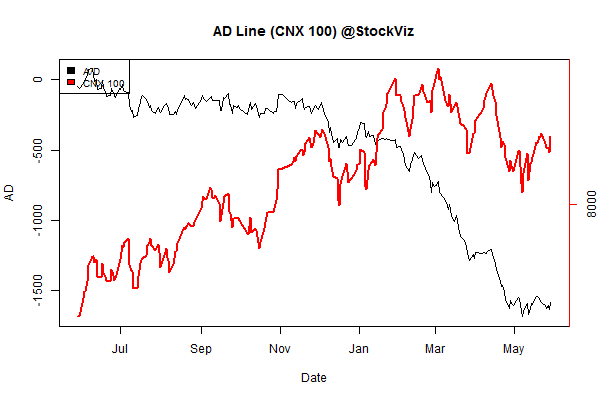

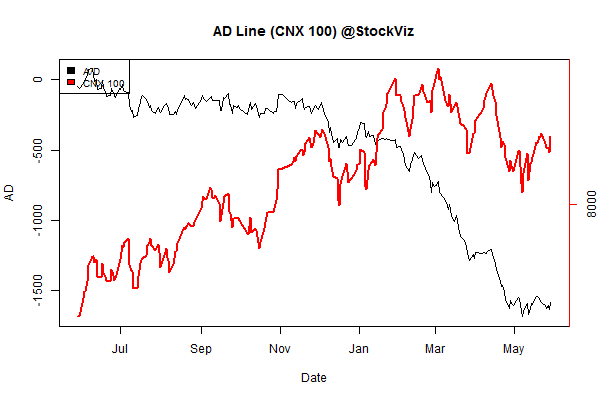

Advance Decline

Market Cap Decile Performance

| Decile |

Mkt. Cap. |

Adv/Decl |

| 1 (micro) |

-2.36% |

67/62 |

| 2 |

-1.83% |

58/71 |

| 3 |

-3.67% |

58/70 |

| 4 |

-0.95% |

63/66 |

| 5 |

-2.40% |

59/69 |

| 6 |

-0.38% |

63/66 |

| 7 |

-2.68% |

58/71 |

| 8 |

-0.33% |

66/62 |

| 9 |

-1.20% |

61/68 |

| 10 (mega) |

-1.04% |

68/61 |

Not really sure what will replace the Modi rally. Are we back to reality?

Top Winners and Losers

Looks like the market really hated Tech Mahindra’s results…

ETF Performance

Public sector banks remain a bane on Indian society. PSUBNKBEES lets you measure how much of a bane they are…

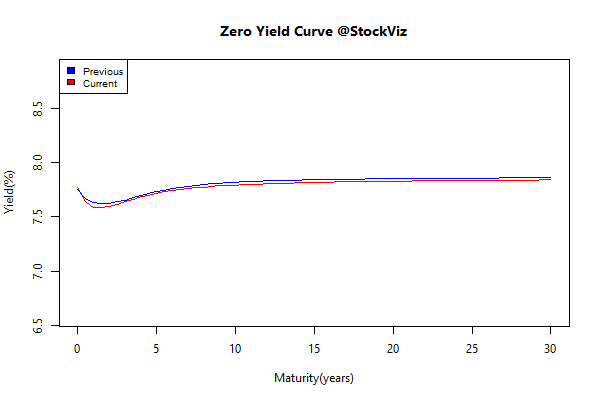

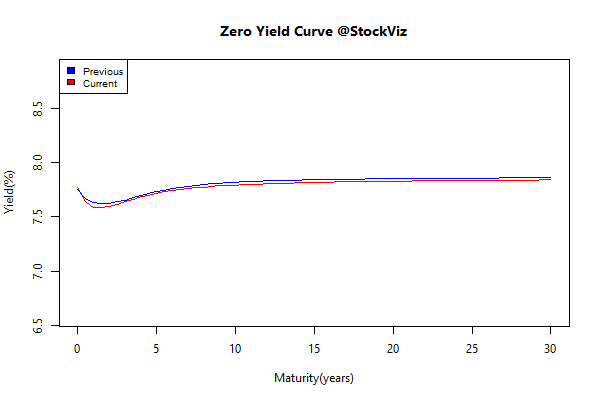

Yield Curve

Bond Indices

| Sub Index |

Change in YTM |

Total Return(%) |

| GSEC TB |

+0.26 |

+0.08% |

| GSEC SUB 1-3 |

+0.26 |

-0.16% |

| GSEC SUB 3-8 |

+0.01 |

-0.30% |

| GSEC SUB 8 |

-0.01 |

+0.22% |

Everybody and their grandmother is expecting a rate cut on June 2nd…

Investment Theme Performance

50/50 on investment strategies. Momentum out-performed…

Equity Mutual Funds

Bond Mutual Funds

Thought for the weekend

This is what Ajay Banga, CEO of Master Card had to say in a recent conference about India:

And only idiots like me pay taxes there…not paying taxes is a bloodsport in India, right. And that’s going to be, that’s one of the biggest reasons why acceptance in India is poor, acceptance is probably less than a million merchants, there is probably 10 million merchants and 1 million take cards and even they say the take cards, you show up with your card and the first thing will be told is, do you pay cash instead and it’s just the whole way it works, right. That’s going to take time to change.

Source (audio): talkpoint.com