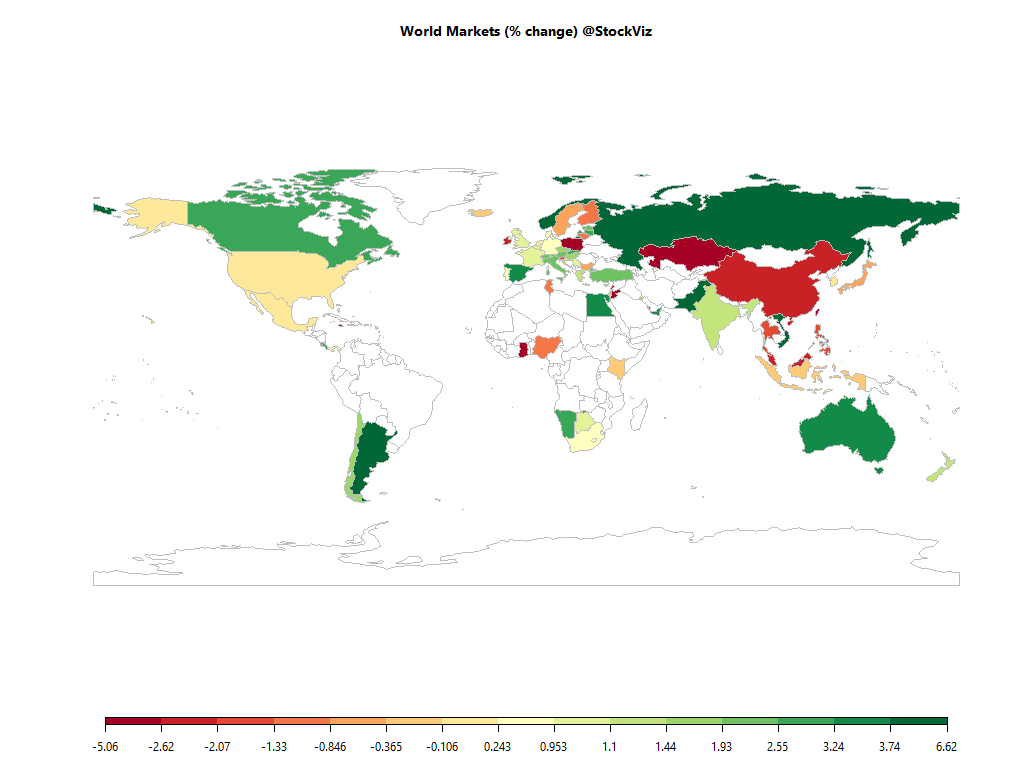

Equities

Commodities

| Energy |

| Natural Gas |

+9.63% |

| Brent Crude Oil |

+19.35% |

| WTI Crude Oil |

+18.78% |

| Ethanol |

+7.67% |

| Heating Oil |

+16.52% |

| RBOB Gasoline |

+12.21% |

| Metals |

| Gold 100oz |

+4.91% |

| Silver 5000oz |

+16.23% |

| Palladium |

+9.91% |

| Copper |

+3.65% |

| Platinum |

+10.43% |

| Agricultural |

| Cattle |

-13.57% |

| Lean Hogs |

+14.21% |

| Soybean Meal |

+22.41% |

| Feeder Cattle |

-10.82% |

| Wheat |

+1.48% |

| Coffee (Arabica) |

-5.56% |

| Coffee (Robusta) |

+5.78% |

| Corn |

+11.55% |

| Cotton |

+8.51% |

| Lumber |

-5.54% |

| Orange Juice |

-12.86% |

| Soybeans |

+12.23% |

| Sugar #11 |

+6.16% |

| Cocoa |

+7.24% |

| White Sugar |

+5.30% |

Credit Indices

| Index |

Change |

| Markit CDX EM |

+0.60% |

| Markit CDX NA HY |

+0.89% |

| Markit CDX NA IG |

-4.40% |

| Markit iTraxx Asia ex-Japan IG |

-6.15% |

| Markit iTraxx Australia |

-9.74% |

| Markit iTraxx Europe |

-1.61% |

| Markit iTraxx Europe Crossover |

-9.50% |

| Markit iTraxx Japan |

-21.20% |

| Markit MCDX (Municipal CDS) |

+0.33% |

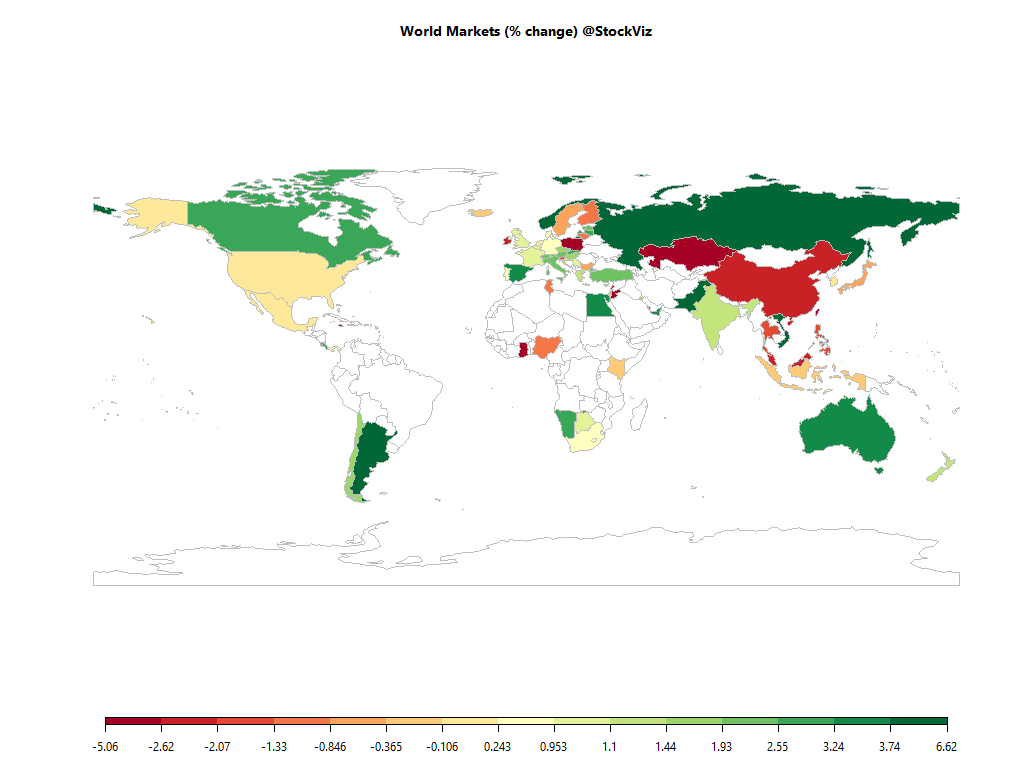

An eventful month with the RBI cutting rates, ICICI dropping a bomb, BOJ holding off on more QE and oil recovering…

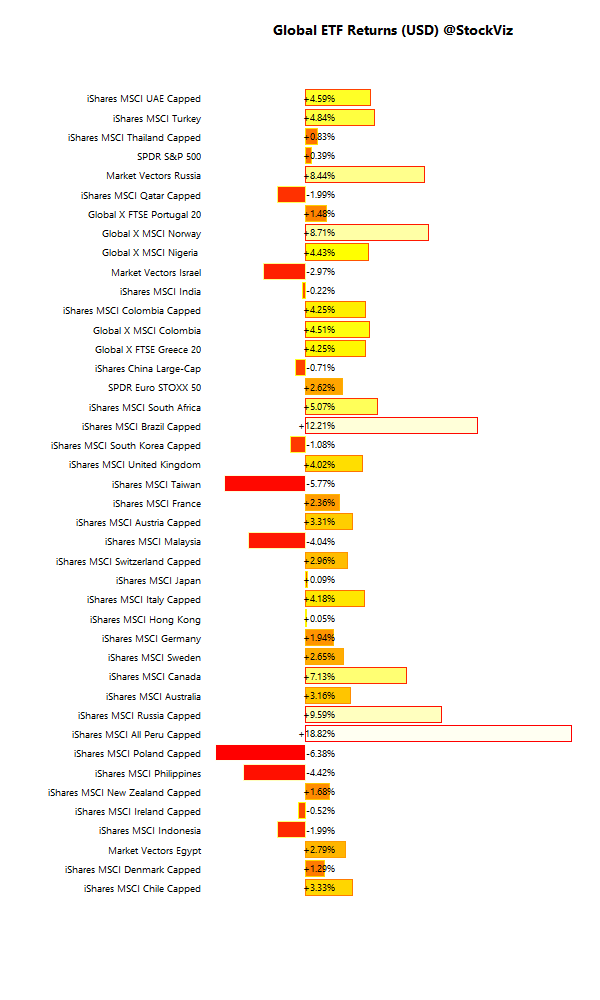

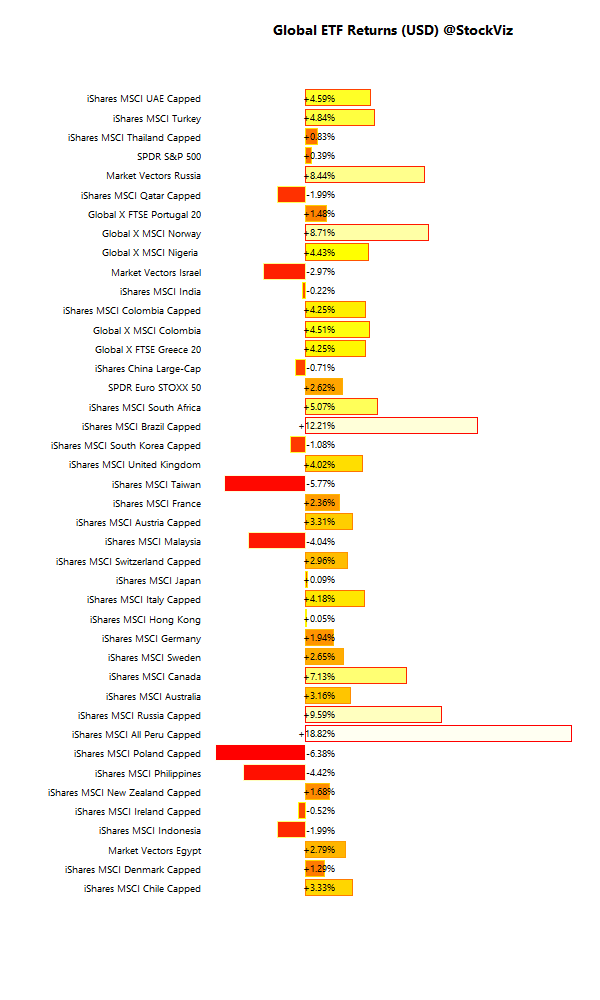

International ETFs (USD)

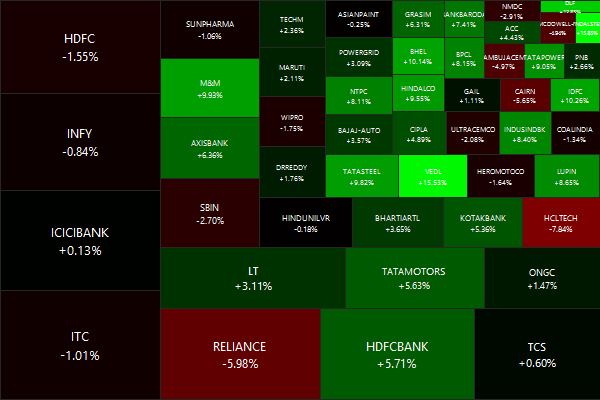

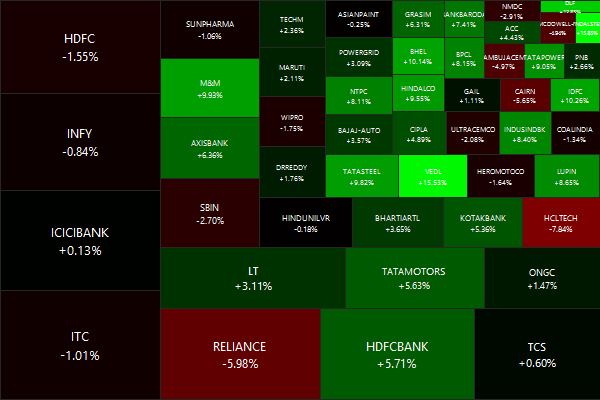

Nifty Heatmap

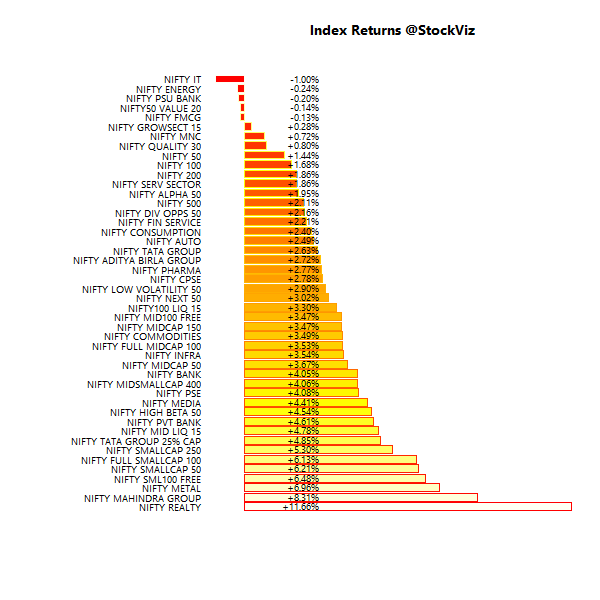

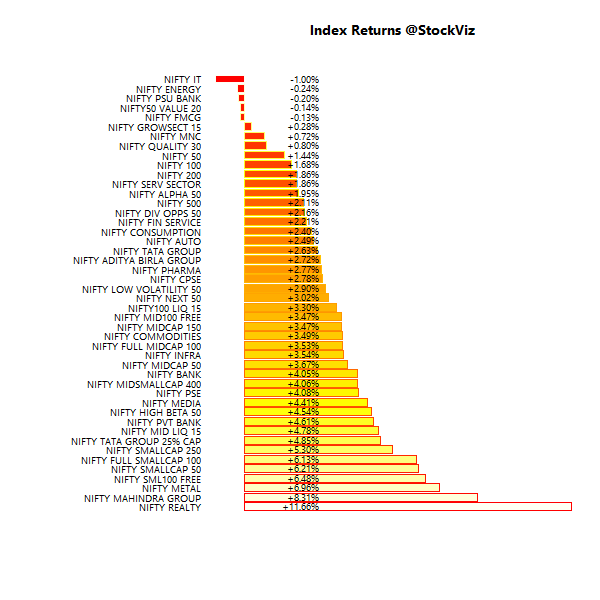

Index Returns

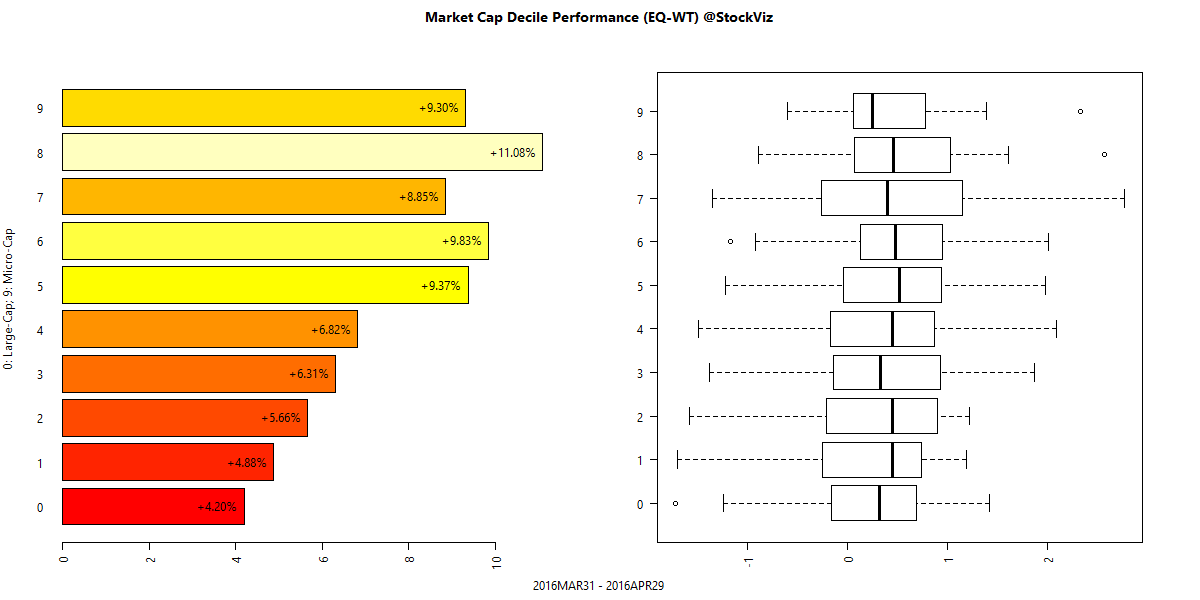

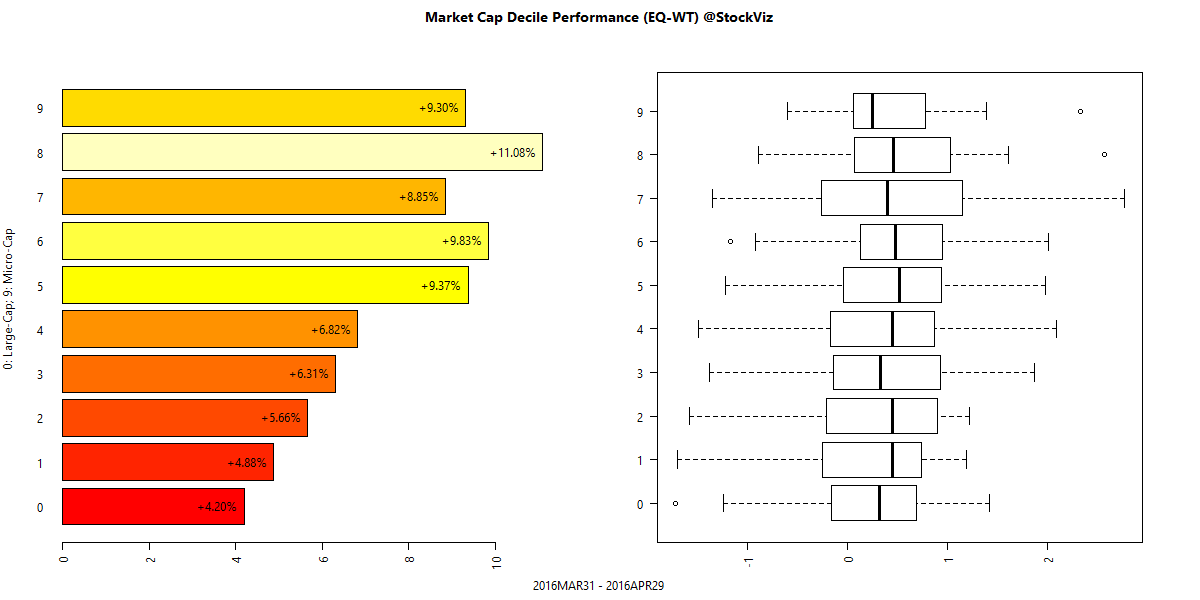

Market Cap Decile Performance

Top Winners and Losers

High beta stocks rebounded from Jan/Feb lows…

ETF Performance

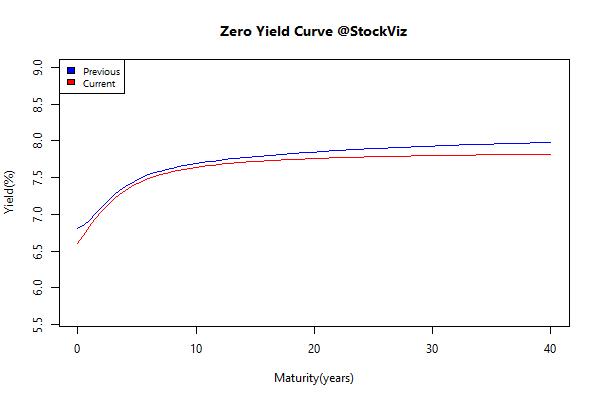

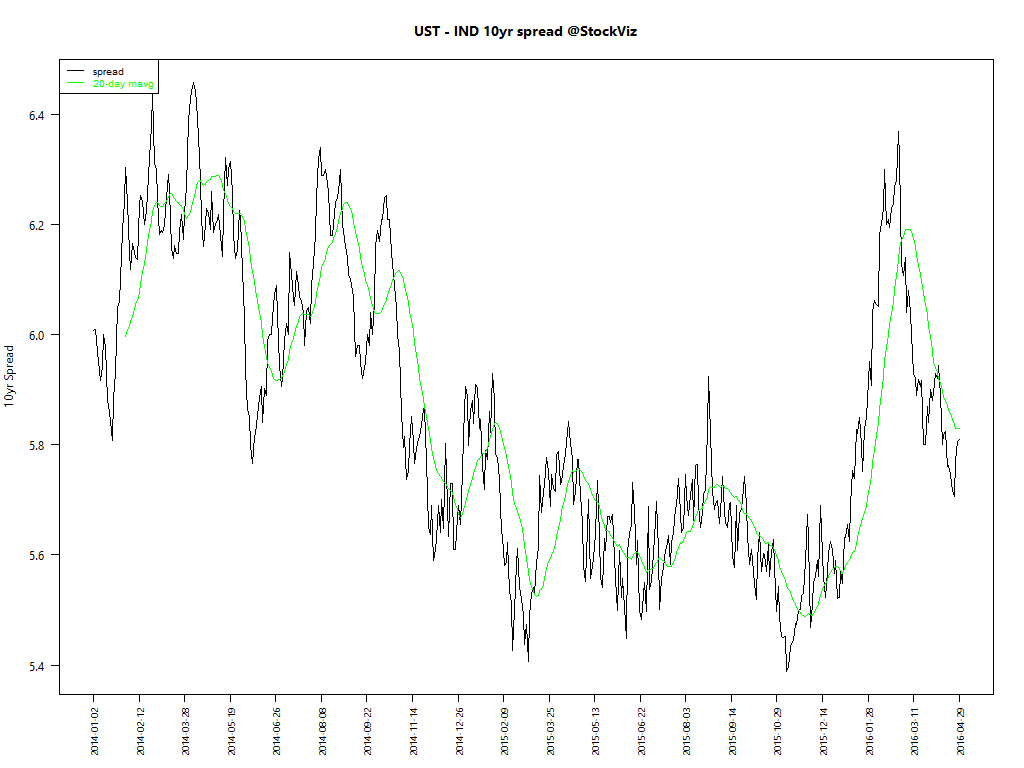

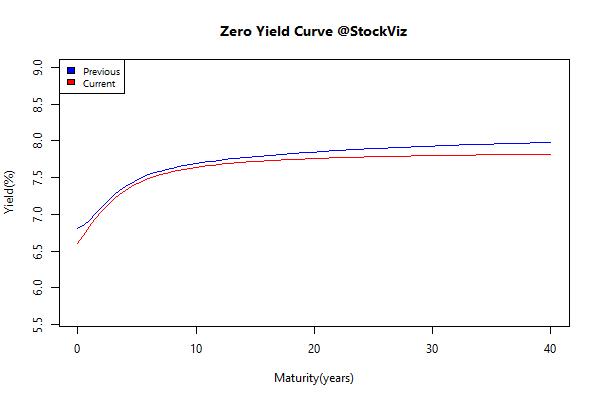

Yield Curve

Bond Indices

| Sub Index |

Change in YTM |

Total Return(%) |

| 0 5 |

-0.05 |

+0.77% |

| 5 10 |

-0.06 |

+0.92% |

| 10 15 |

-0.04 |

+0.94% |

| 15 20 |

-0.12 |

+1.75% |

| 20 30 |

-0.08 |

+1.50% |

Bonds rebounded…

Investment Theme Performance

Midcap recovery under way…

Equity Mutual Funds

Bond Mutual Funds

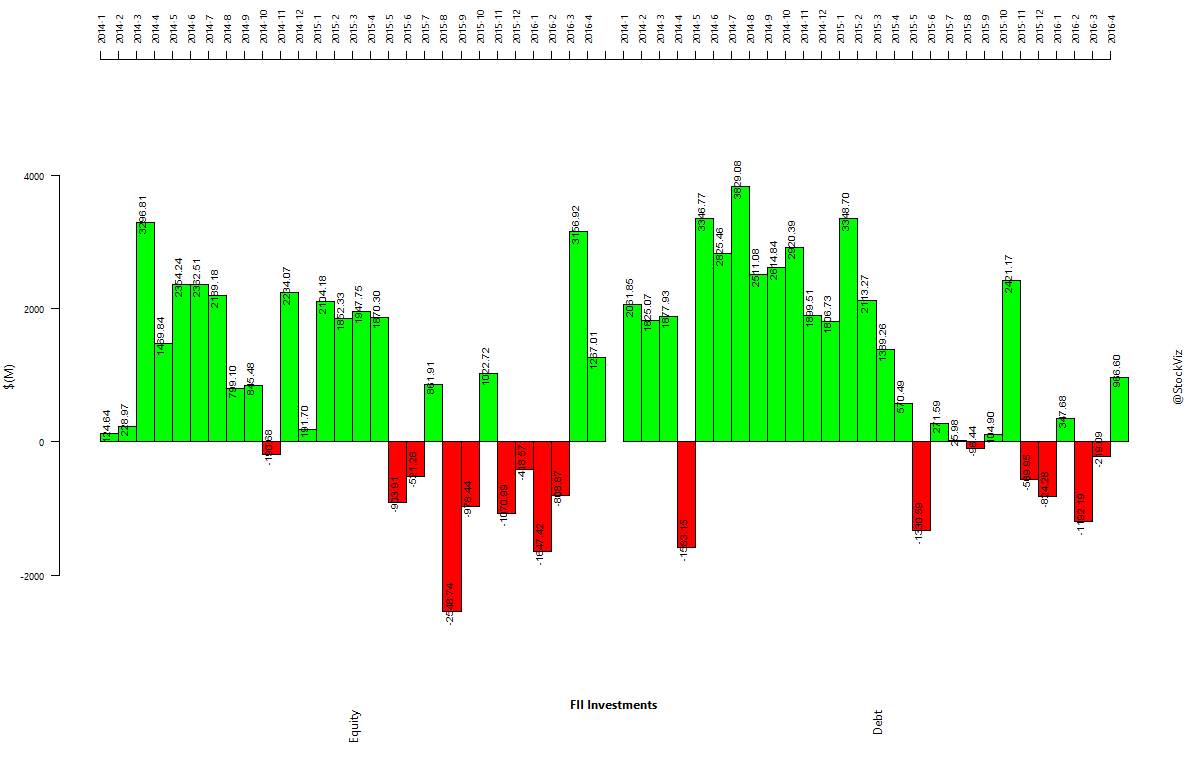

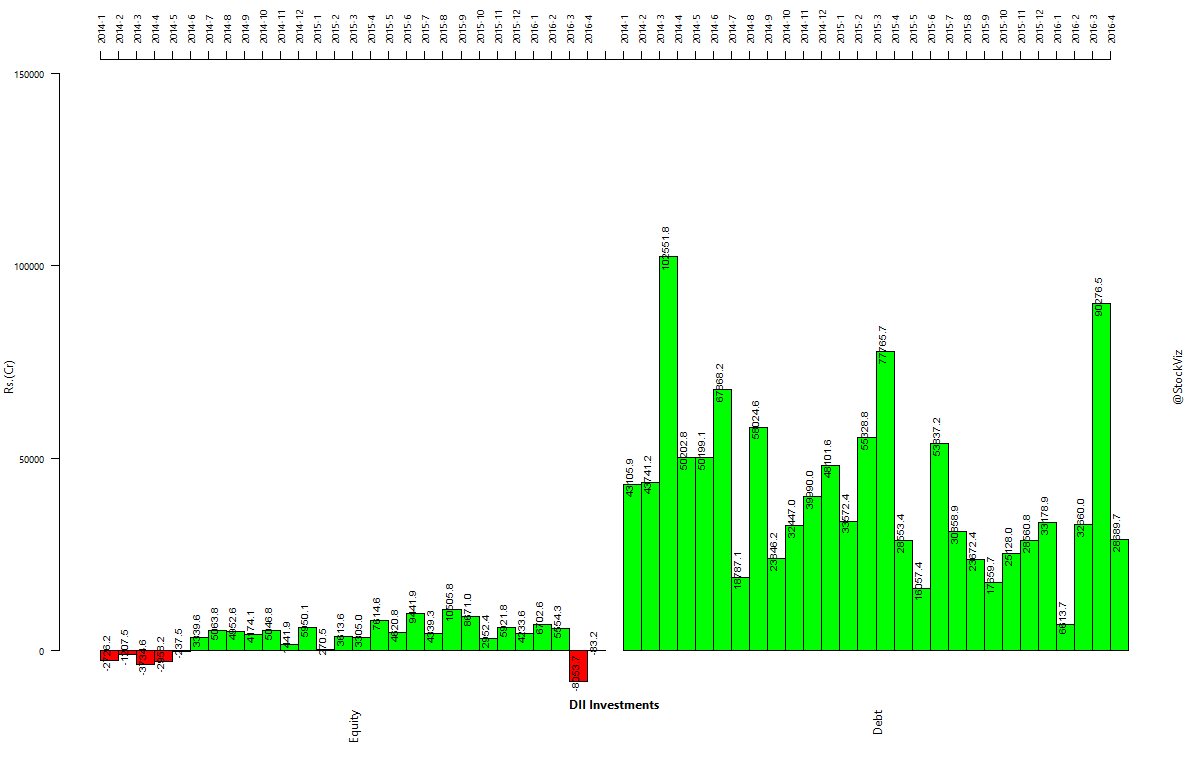

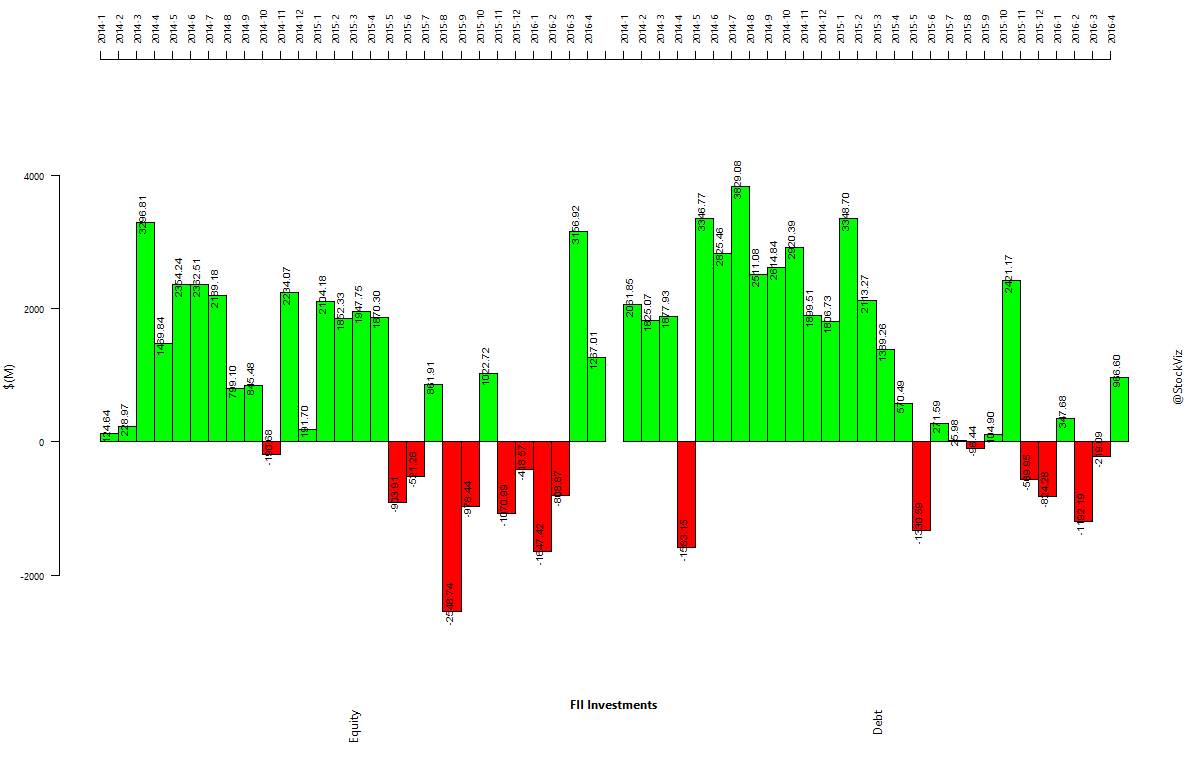

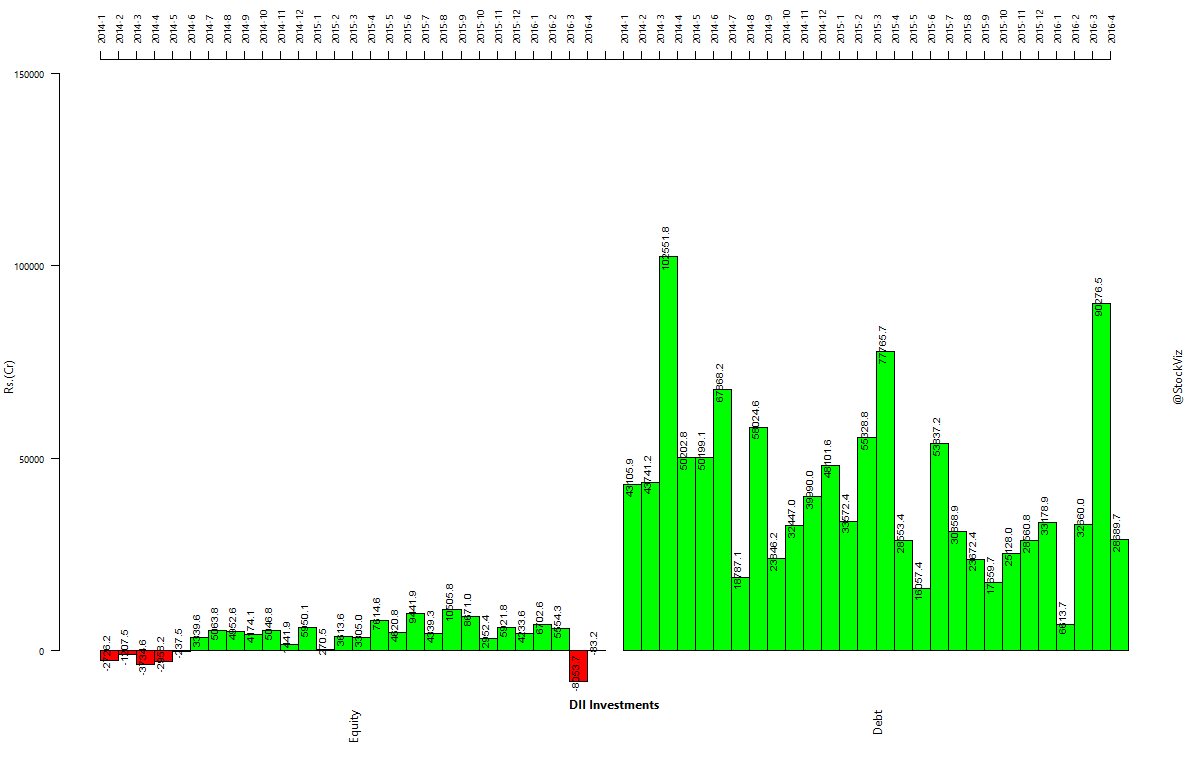

Institutional flows

FII’s seen renewing their love affair with Indian bonds…

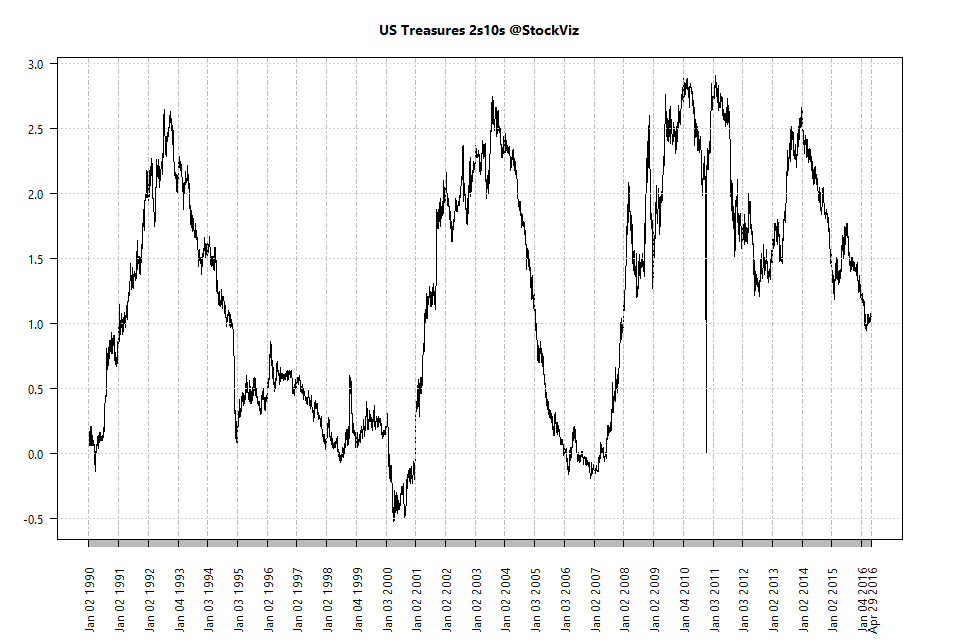

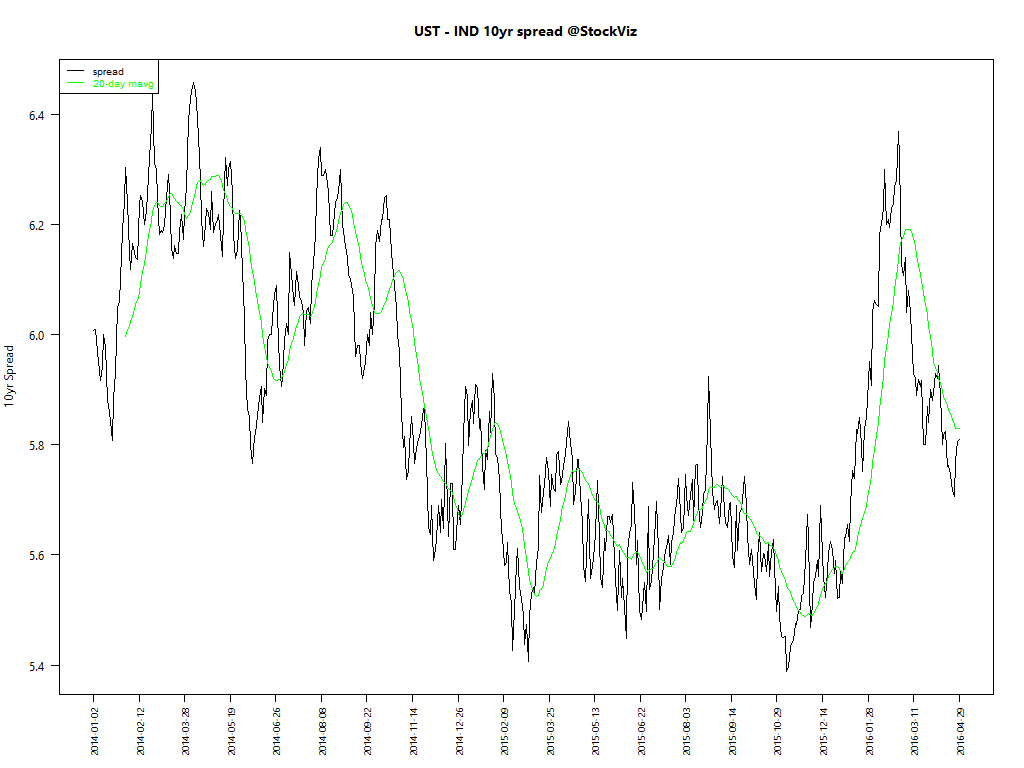

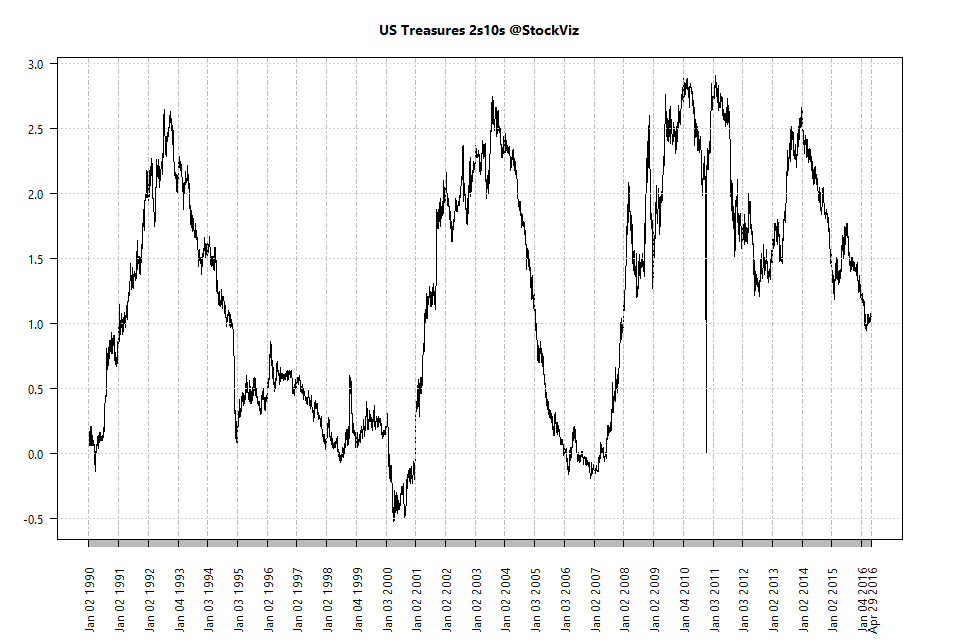

US Treasuries

Gilts are in the process of normalizing.

Is spread between 2s and 10s calling a bluff on a Fed rate hike?

Thought to sum up the month

Chance plays a far larger role in life outcomes than most people realize. And yet, the luckiest among us appear especially unlikely to appreciate our good fortune. Wealthy people overwhelmingly attribute their own success to hard work rather than to factors like luck or being in the right place at the right time.

That’s troubling, because seeing ourselves as self-made—rather than as talented, hardworking, and lucky—leads us to be less generous and public-spirited. It may even make the lucky less likely to support the conditions (such as high-quality public infrastructure and education) that made their own success possible.

Source: Why Luck Matters More Than You Might Think

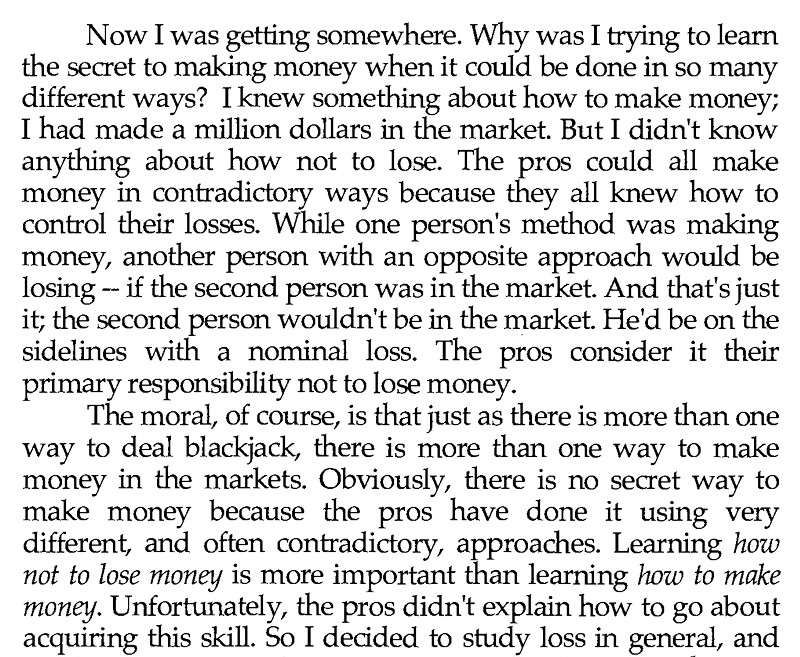

What I read this month

What I Learned Losing a Million Dollars:

Amazon