Open sourced by Meta back in 2017, Prophet is a procedure for forecasting time series data. How does it compare to GARCH(1,1) and locf (last one carried forward) for forecasting VIX 20 days out?

We fit 500-days of rolling VIX data using Prophet and GARCH(1,1) and forecast forward 20-days. We then calculate the RMSE (Root Mean Squared Error) of the forecast vs. actual of both the models and locf. Plot RMSE of all three.

Ideally, you want the error to be low and the tail of errors to be as short as possible. GARCH(1,1) looks worse than Prophet. However, locf beat both?

When in doubt, take the average.

Code on github.

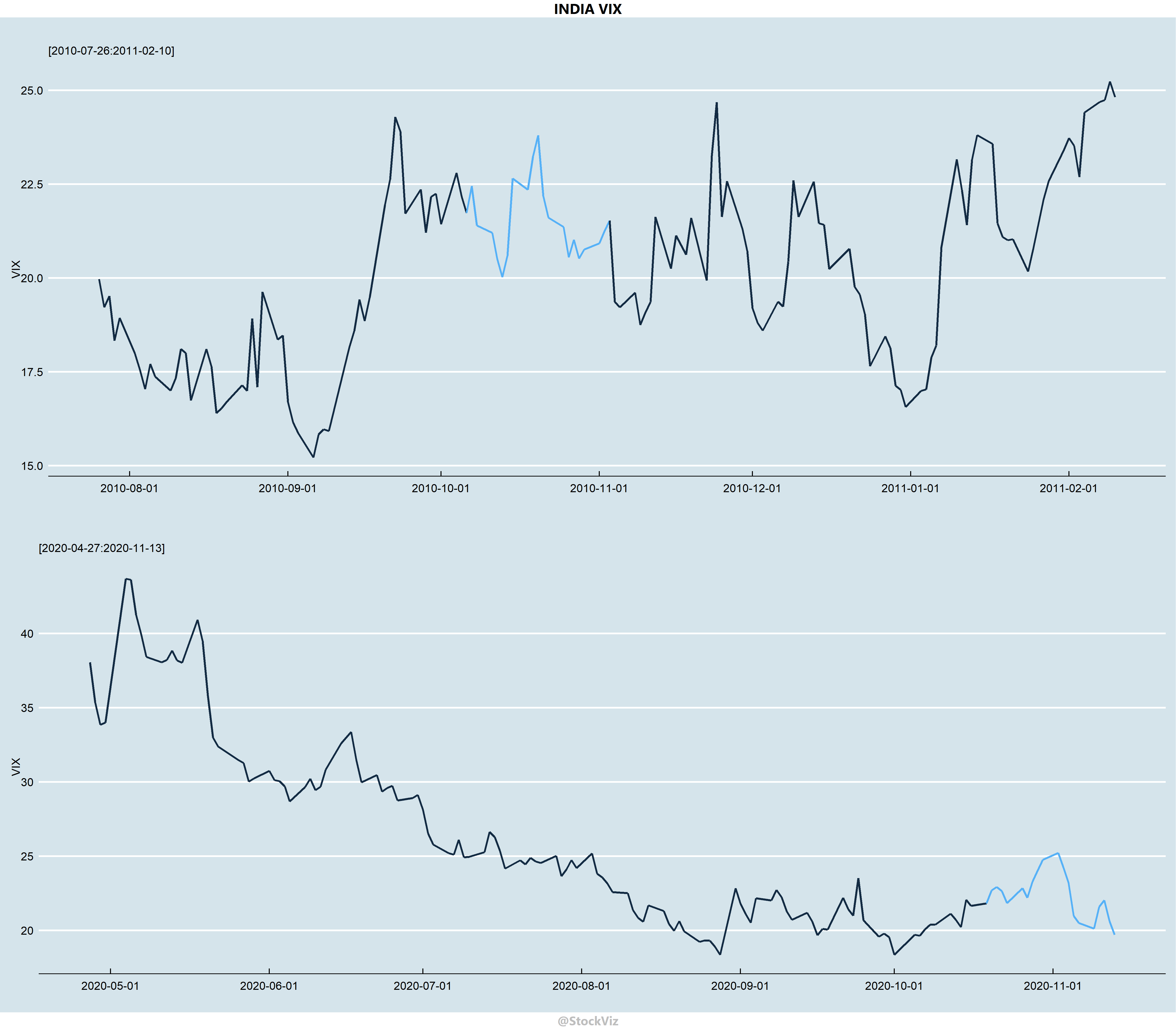

Also: VIX Seasonality