The contentious issue of gas pricing has evoked strong reactions from all quarters. Not wanting to be left out, everybody is jumping into the fray with his gyan on gas prices, either by dishing out their pricing formula or leveling allegations of scam, favoritism and so on.

Sample this: the Petroleum Ministry, Finance Ministry, Power and Fertilizer Ministries, political parties like Communist Party of India, BJP, Left, explorers like RIL, ONGC, GAIL, Cairn India, Oil India and experts like the Rangarajan Committee, the Vijay Kelkar committee, etc, have all been making statements in recent months about gas prices.

The Rangarajan Committee on production sharing contract has arrived at a price of $8.80/mmBtu for gas from the current $4.2/mmbtu. The panel recommended the 12-month average of US’s Henry Hub, UK’s National Balancing Point and Japan’s liquefied natural gas price along with the average of the price of India’s LNG imports for arriving at the domestic price.

In line with Rangarajan Committee’s recommendations, Mukesh Ambani-led RIL and his partner UK’s BP Plc have also favored linking of domestic gas prices with international prices, seeking prices of around $12.5/mmbtu.

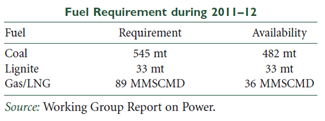

But the Power ministry has opposed the near doubling of gas prices saying it will raise the costs for power plants by over Rs 46,000 crore per annum.

The Finance Ministry has also rejected the formula and, instead, wants the panel to taken into account wellhead prices prevalent in Qatar, Oman, Abu Dhabi and Malaysia.

Sensing the backlash that was brewing over Rangarajan panel’s report, the oil ministry, recently, moved a cabinet note recommending a price of $6.8/mmBtu.

Amidst all this hoopla surrounding the pricing of gas, a key factor to consider is: why should the government be involved in fixing gas prices or for that matter any fuel?

Prices of fuels like gas and coal should be determined by the market based on demand-supply, taxes prevalent in states and levies on imports and exports, rate of inflation, availability of alternate fuels, etc.

On pricing rationale, linking domestically produced gas with international prices makes little sense. While offering adequate incentives for producers in developing gas fields is a priority for recovering investment and a reasonable rate of return, using global prices as a benchmark for arriving at a cost for producing gas in India would be tantamount to exploiting consumers to benefit explorers.

From an economic standpoint, why should lawmakers be fixing prices? Let the explorer and industrial consumers negotiate the prices themselves, sign up long-term agreements for gas supplies? Let the buyers decide for themselves whether the price suits them or not.

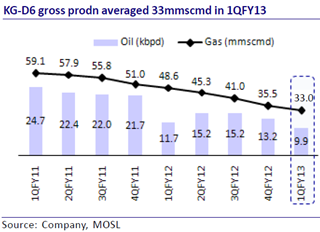

As long as the gas pricing mechanism is controlled by the government, explorers like RIL and Cairn India will have no desire to produce more, forcing the economy to rely on coal and oil, both of which are neither eco-friendly nor available cheaply.

Market-linked price also results in increased government share apart from eliminating unwanted consumption. Some analysts have also called for price discovery through a competitive, transparent bidding process by the contractors wherein all spectrum of buyers of natural gas participate in the process.

Taking about alternatives, the emergence of shale gas has been billed as a game changer. In the US, gas prices are at record lows as a surge in shale gas production coupled with lower demand has led to oversupply and record high gas inventories. The average price of gas at the Henry Hub has reduced from US$8.8 per mmbtu in 2008 to around US$2.9 per mmbtu in July 2012.

In India, shale gas formations are spread over several sedimentary basins such as Cambay, Gondwana, Krishna-Godawari on-land and the Cauvery. By initiating steps to identify prospective areas for exploration, shale gas can emerge as an important new source of energy and also pave the way for lower gas prices.

The country’s dream of energy security may turn into a reality only if its policies are aligned to meet the challenges facing all its stakeholders including the end consumer. But as it stands, everybody is allowed to have an opinion except the market.

[stockquote]CAIRN[/stockquote] [stockquote]GAIL[/stockquote] [stockquote]OIL[/stockquote] [stockquote]ONGC[/stockquote] [stockquote]RELIANCE[/stockquote]