The NIFTY ended on a positive note, drifting up +1.47% for the week.

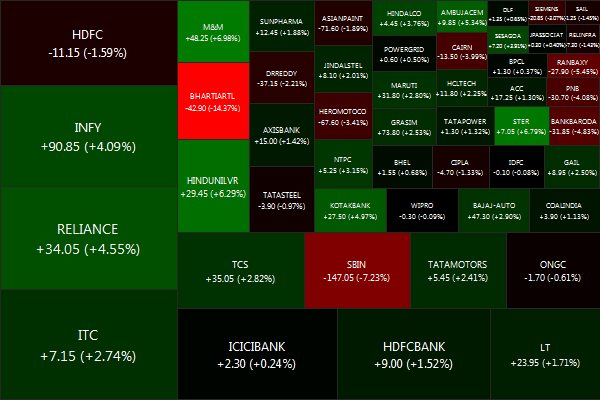

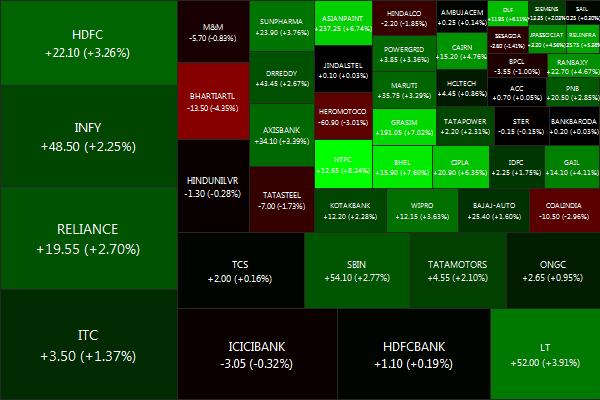

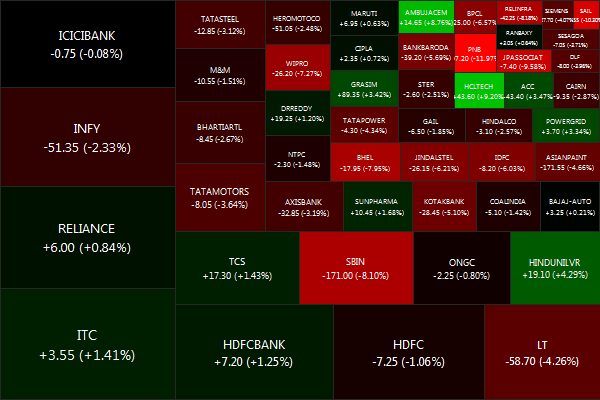

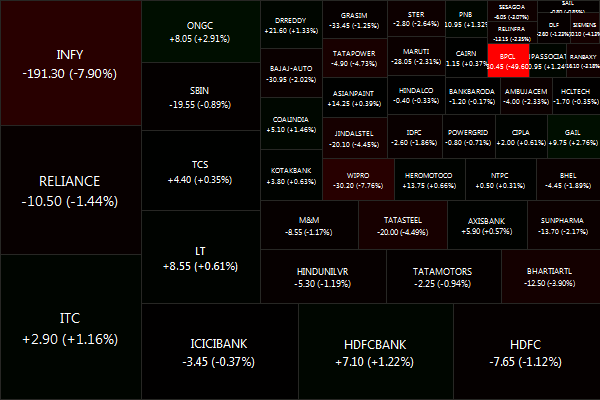

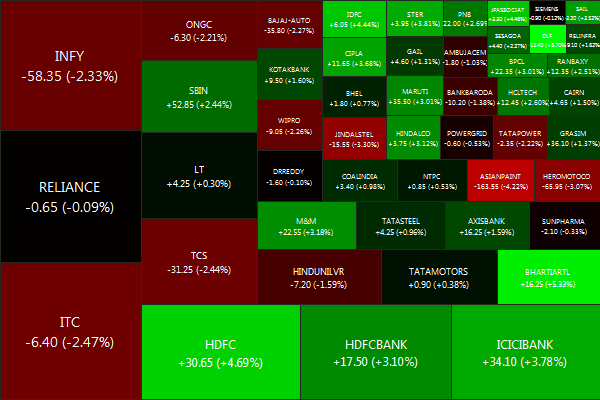

Biggest losers were BHARTIARTL (-13.79%), SBIN (-5.86%) and RANBAXY (-4.91%).

And the biggest winners were STER (+8.61%), M&M (+8.00%) and HINDUNILVR (+6.67%).

Advancers lead decliners 37 vs 13

Gold: +0.07%, Banks: +0.12%. Infrastructure: -0.09%,

IIP numbers that came out this week point to continuing slowdown in investments.

The only bright spot is that FII inflows continue to remain firm. Foreign investors pumped in closed to $2 billion in July. This, combined with hope that the government will announce a slew of fiscal policies to tackle the burgeoning deficits, uncontainable inflation and slowing growth has kept the market drifting higher.

Also, remember that Europe is on summer vacation. Summitry and politics have been postponed to September. If the global macro situation worsens next month, we can no longer rely on FIIs to support the market.

Will we be ready by September to stand on our own two feet?

Daily news summaries are here.