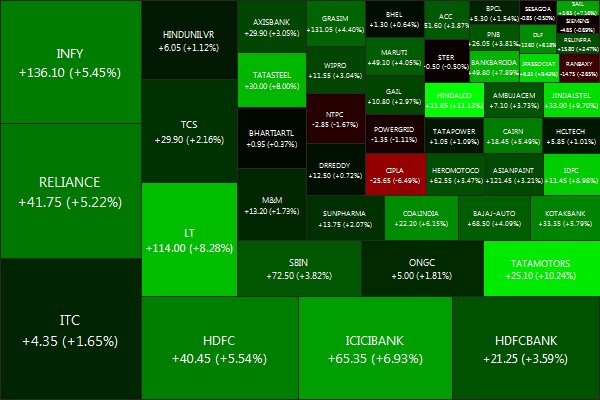

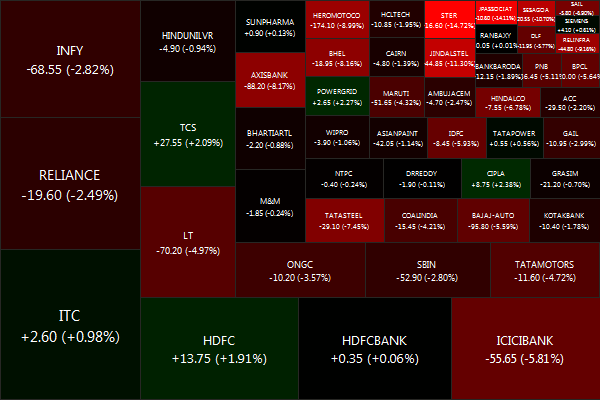

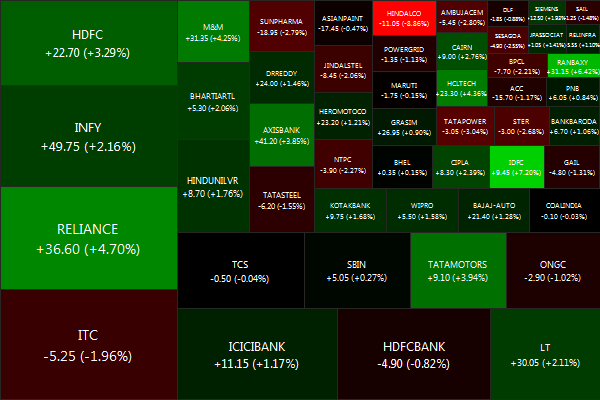

The NIFTY ended on a bullish note, shooting up +1.99% for the week.

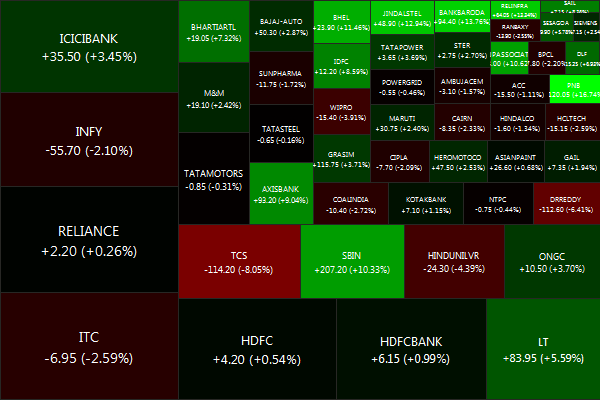

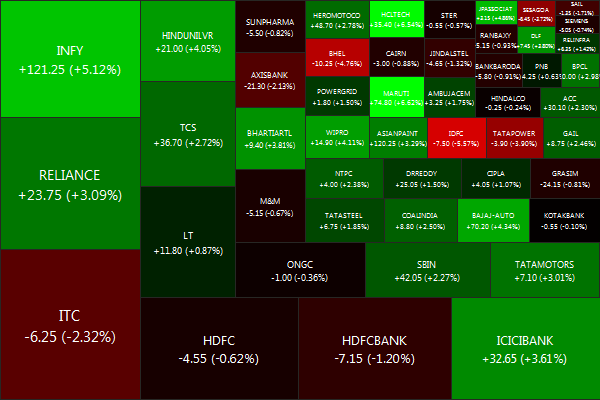

Biggest losers were TCS (-7.72%), DRREDDY (-5.94%) and WIPRO (-3.46%).

And the biggest winners were PNB (+18.08%), RELINFRA (+15.50%) and BANKBARODA (+14.62%).

Advancers lead decliners 34 vs 16

Gold: -1.77%, Banks: +8.66%. Infrastructure: +5.12%

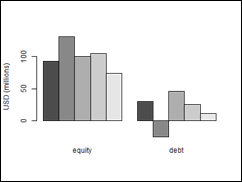

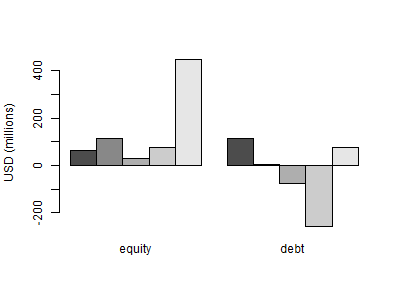

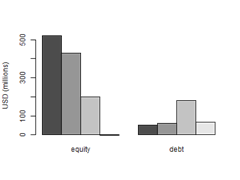

Net FII flows for the week: $1,151.58 mm (Equity) and $360.31 mm (Debt)

Net FII flows for the week: $1,151.58 mm (Equity) and $360.31 mm (Debt)

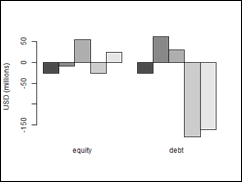

Net domestic institutional flows for the week: -$1,162.00 mm (Equity) and $9,178.20 mm (Debt)

We award the quote of the week to Scott Price, Wal-Mart’s Asia chief executive: “… this idea that the gates have been opened and there’s going to be a flood (of investment) is overwrought.” Didi, are you listening?

Daily news summaries are here.