Equities

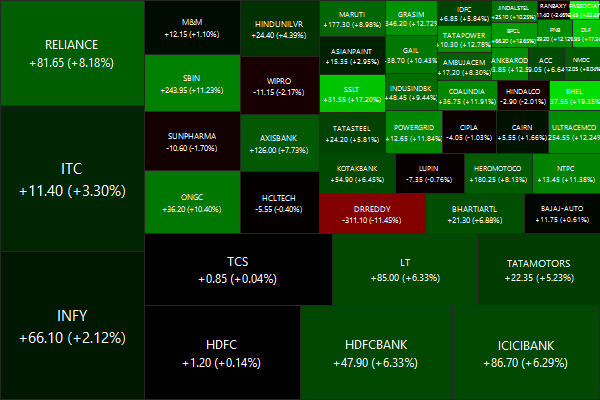

The Nifty rocketed up almost 3% on Friday, ending the week +2.45% (+2.74% in USD terms.)

Commodities

| Energy |

| Brent Crude Oil |

-0.68% |

| Ethanol |

+0.47% |

| Heating Oil |

-0.50% |

| Natural Gas |

-3.14% |

| RBOB Gasoline |

-1.66% |

| WTI Crude Oil |

+0.27% |

| Metals |

| Copper |

+0.65% |

| Gold 100oz |

-1.05% |

| Palladium |

-1.39% |

| Platinum |

-0.52% |

| Silver 5000oz |

-2.55% |

| Agricultural |

| Cattle |

+0.36% |

| Cocoa |

-1.99% |

| Coffee (Arabica) |

-8.94% |

| Coffee (Robusta) |

-3.15% |

| Corn |

+2.18% |

| Cotton |

-1.51% |

| Feeder Cattle |

+0.72% |

| Lean Hogs |

-2.14% |

| Lumber |

-1.51% |

| Orange Juice |

+3.03% |

| Soybean Meal |

+1.08% |

| Soybeans |

+1.37% |

| Sugar #11 |

-1.38% |

| Wheat |

+1.20% |

| White Sugar |

-0.28% |

Nifty Heatmap

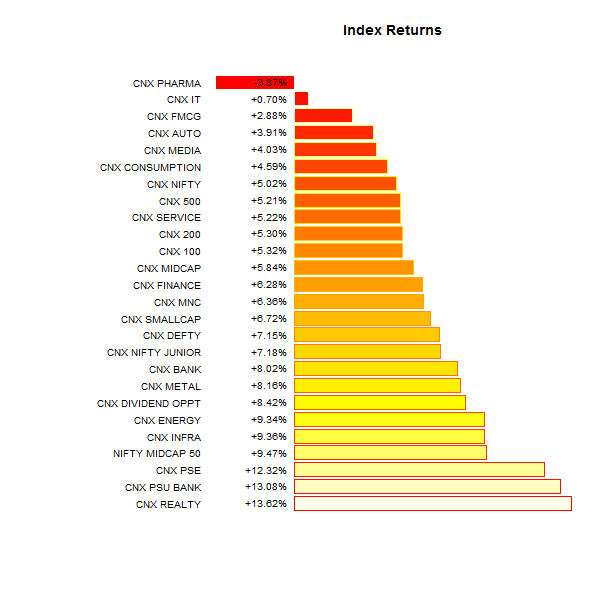

Index Returns

Top winners and losers

Is Adani Ports finally catching up with Adani Enterprises in the Modi hopium rally?

ETFs

Banks are back! Infra is back! Modi will solve everything!

Investment Theme Performance

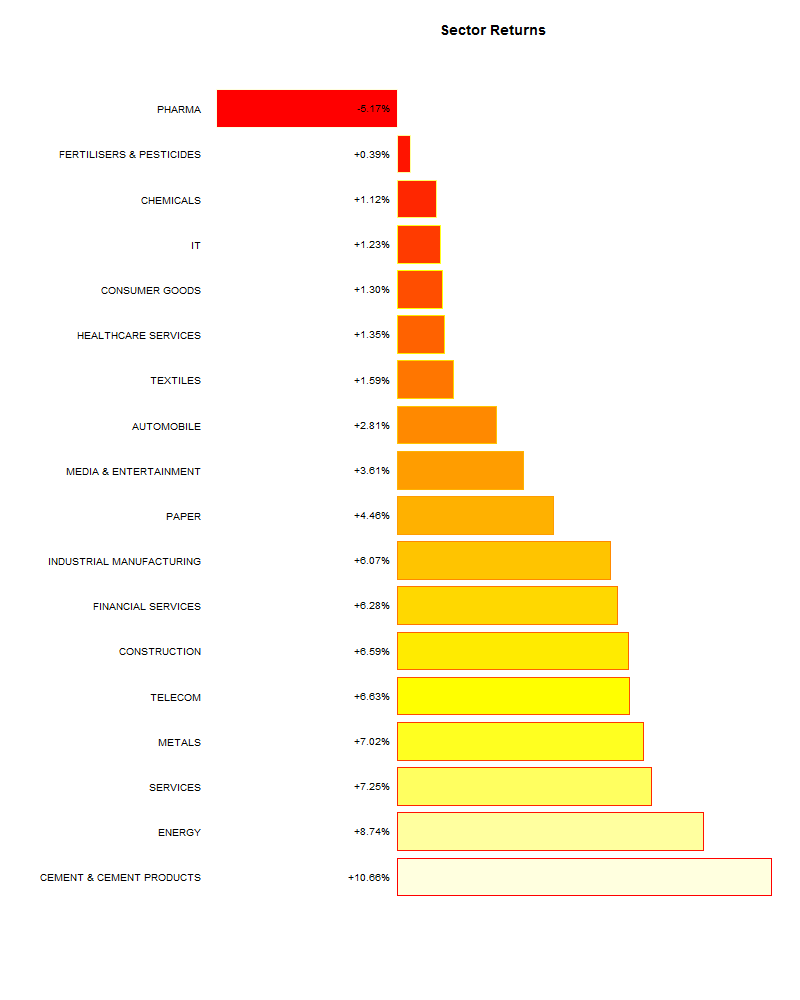

High beta and mid-cap value outperformed this week. IT was sh*t out of luck.

Sector performance

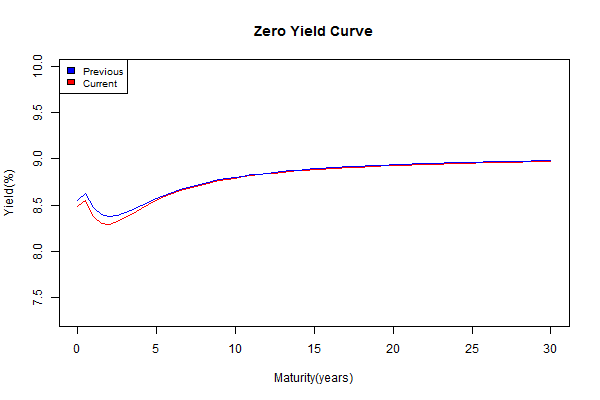

Yield Curve

Thought for the weekend

Grove, Zald, Lebow, Snitz and Nelson (2000), Clinical Versus Mechanical Prediction: A Meta-Analysis, University of Minnesota, Twin Cities Campus (pdf):

The process of making judgments and decisions requires a method for combining data. On average, mechanical-prediction techniques were about 10% more accurate than clinical predictions. Depending on the specific analysis, mechanical prediction substantially outperformed clinical prediction in 33%-47% of studies examined. Superiority for mechanical-prediction techniques was consistent, regardless of the judgment task, type of judges, judges’ amounts of experience, or the types of data being combined. These data indicate that mechanical predictions of human behaviors are equal or superior to clinical prediction methods for a wide range of circumstances.

Basically: Models beat experts.