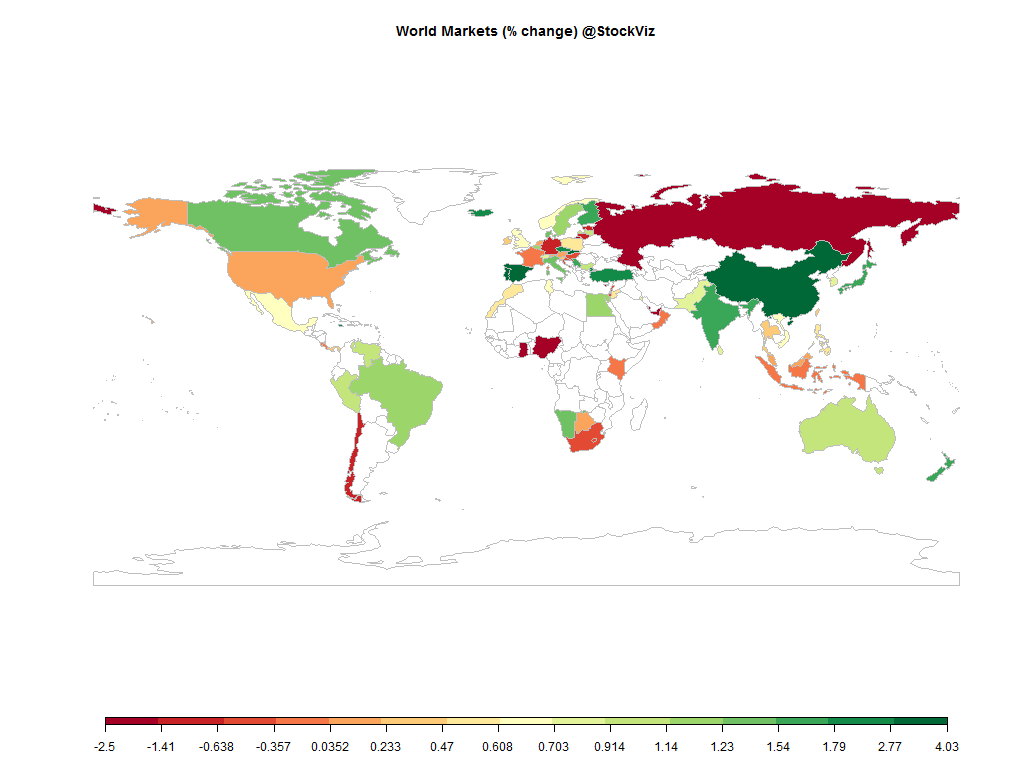

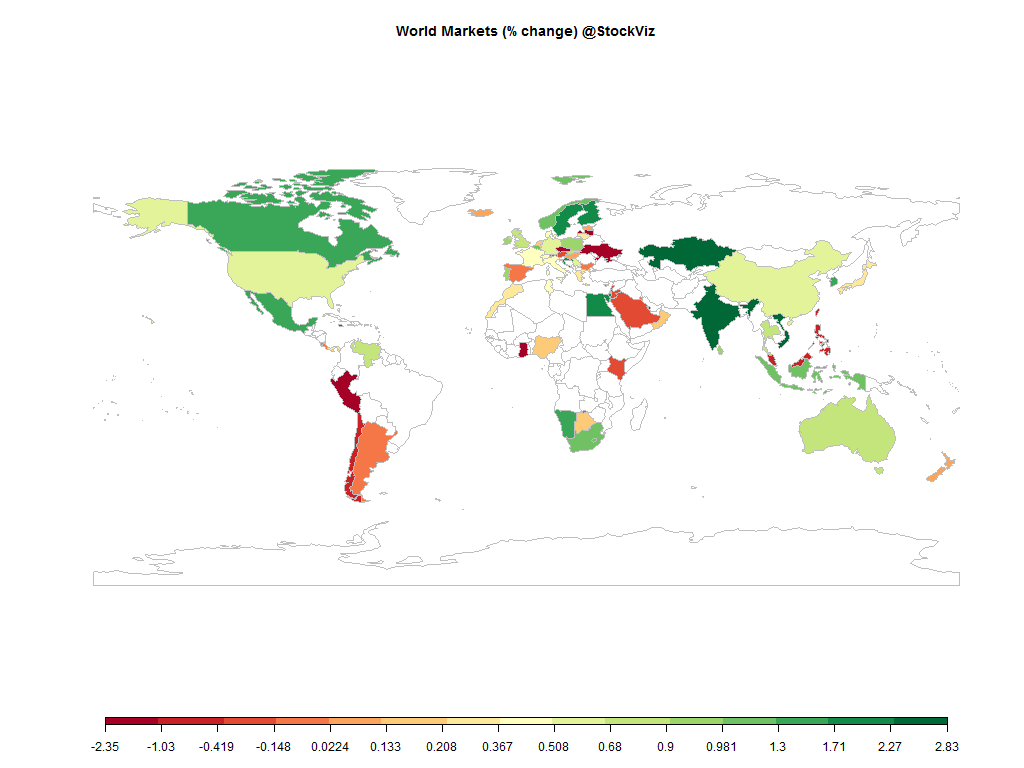

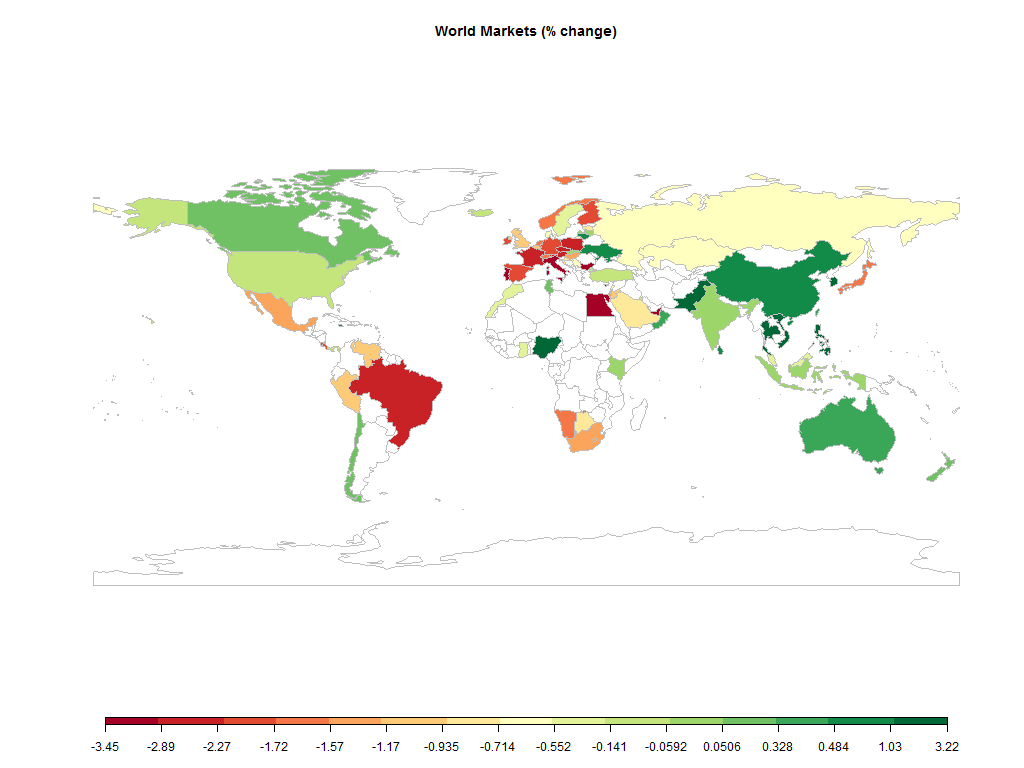

Equities

The Nifty ended flat for the week.

Commodities

| Energy |

| Brent Crude Oil |

-1.19% |

| Ethanol |

+1.34% |

| Heating Oil |

-1.65% |

| Natural Gas |

-2.05% |

| RBOB Gasoline |

-0.79% |

| WTI Crude Oil |

-1.44% |

| Metals |

| Copper |

+0.96% |

| Gold 100oz |

+0.05% |

| Palladium |

+2.27% |

| Platinum |

+1.59% |

| Silver 5000oz |

-0.48% |

| Agricultural |

| Cattle |

+3.71% |

| Cocoa |

+1.17% |

| Coffee (Arabica) |

-2.02% |

| Coffee (Robusta) |

+1.76% |

| Corn |

-1.94% |

| Cotton |

-8.32% |

| Feeder Cattle |

+3.80% |

| Lean Hogs |

+2.27% |

| Lumber |

+3.05% |

| Orange Juice |

-9.38% |

| Soybean Meal |

+3.00% |

| Soybeans |

+1.71% |

| Sugar #11 |

-5.08% |

| Wheat |

-0.21% |

| White Sugar |

-2.30% |

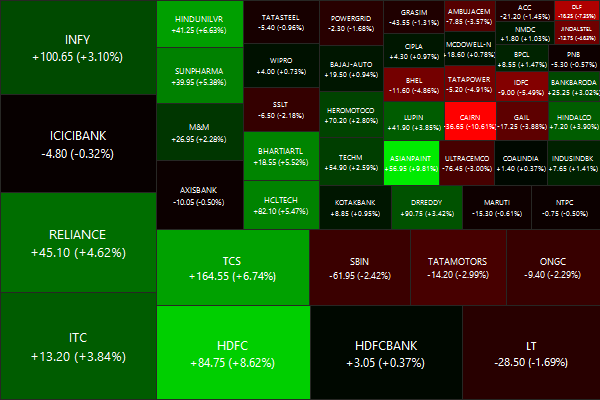

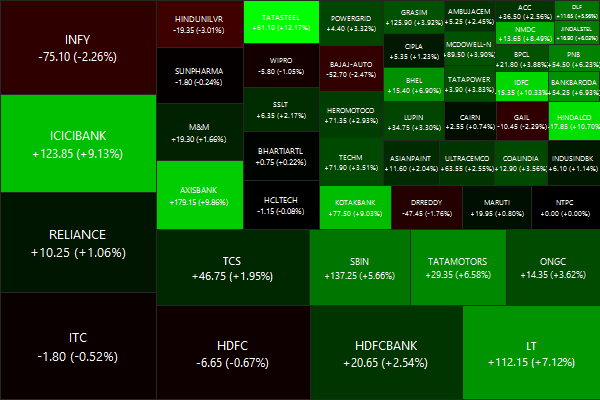

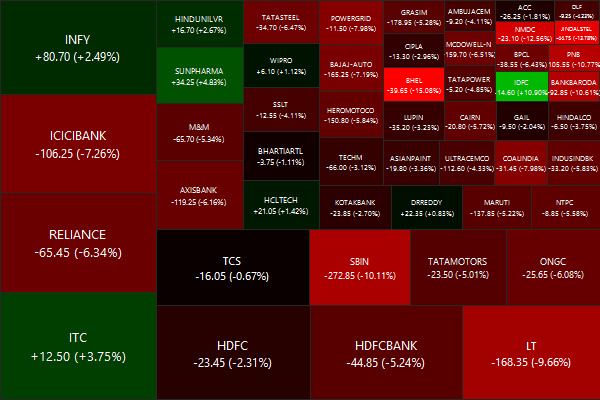

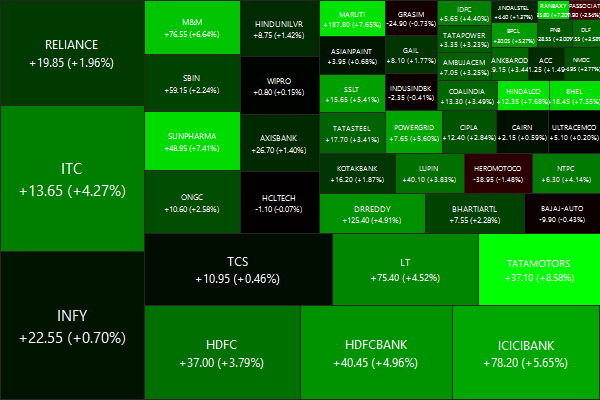

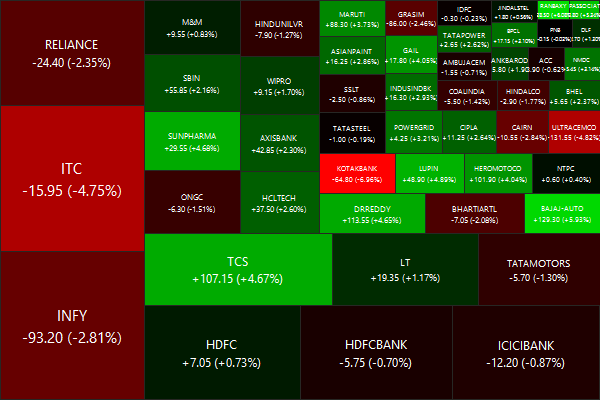

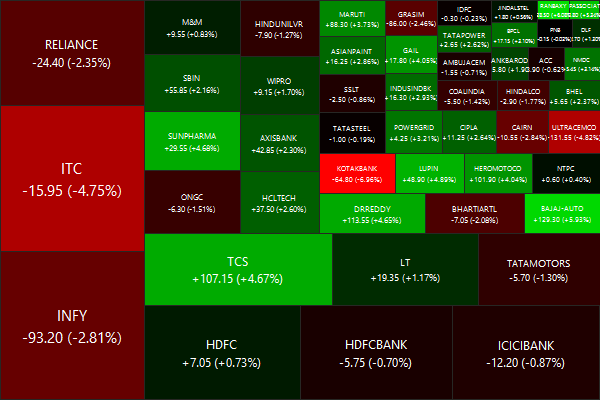

Nifty heatmap

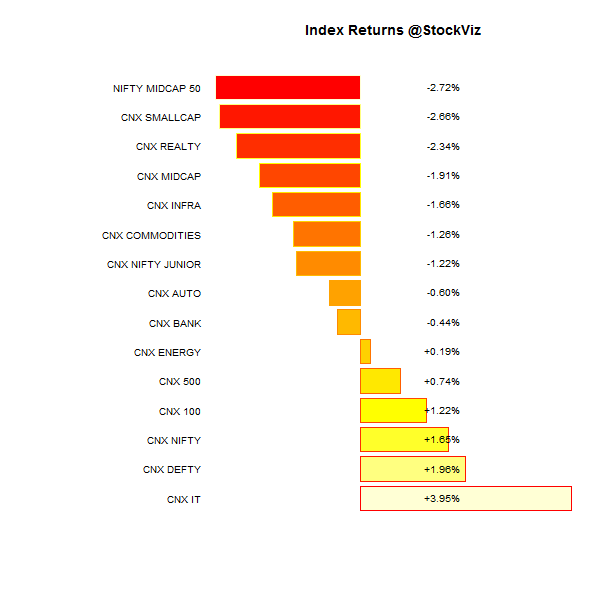

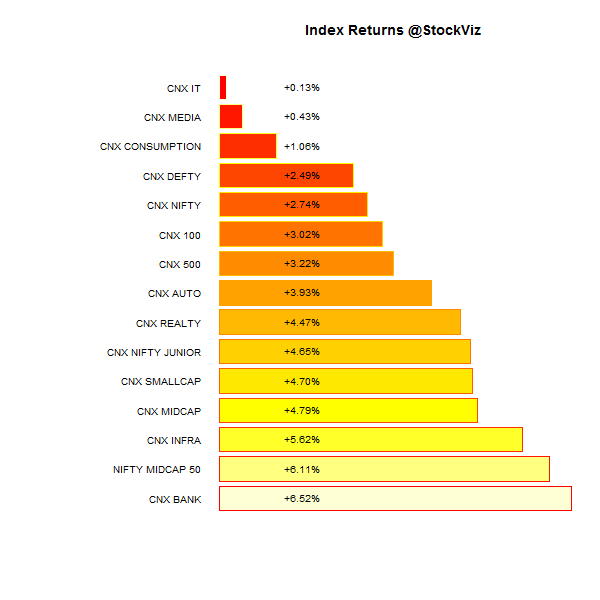

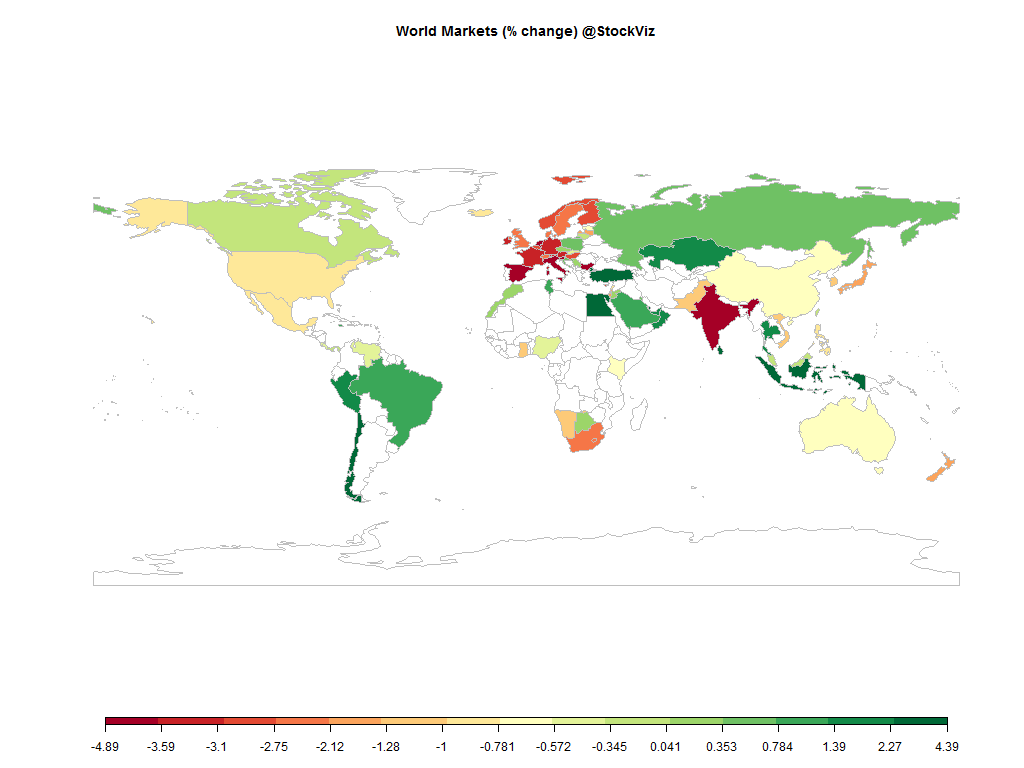

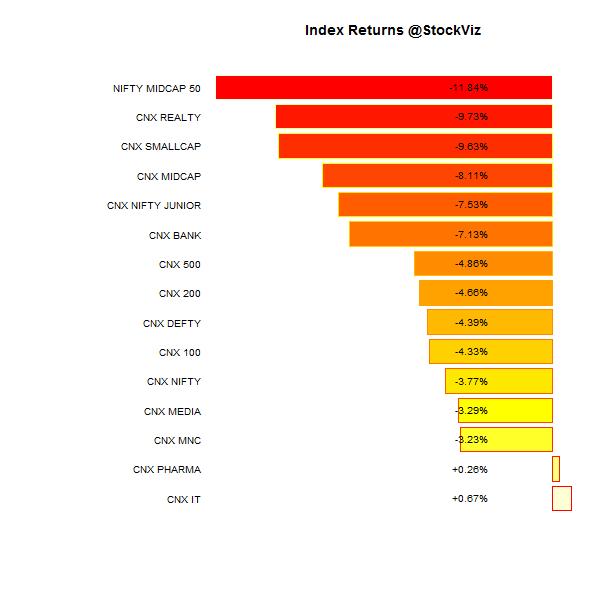

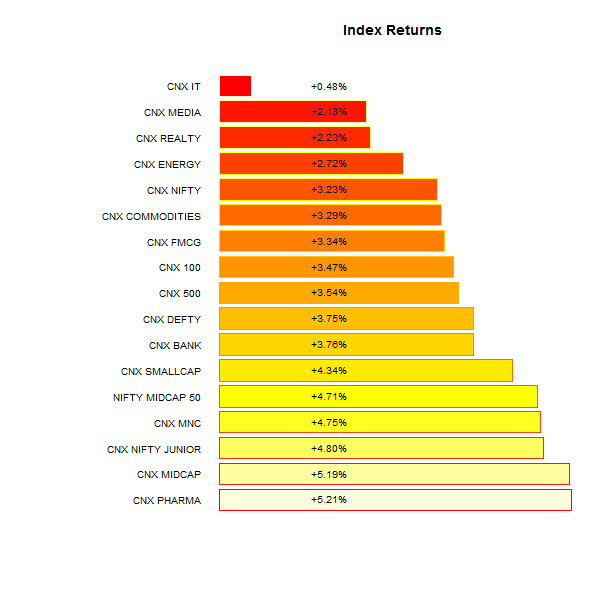

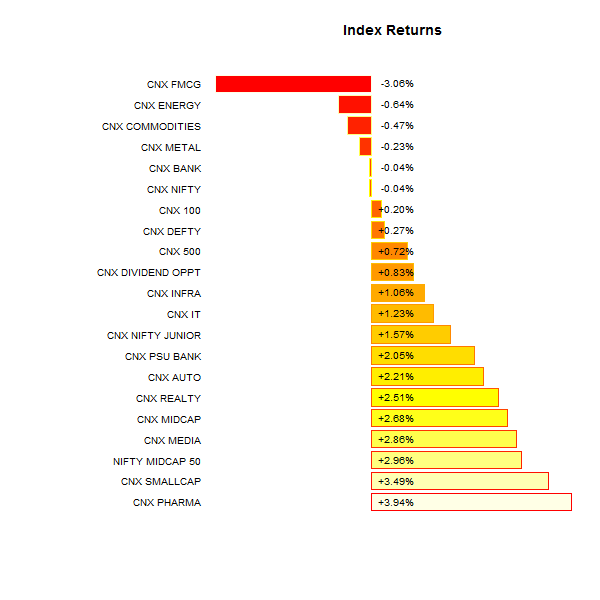

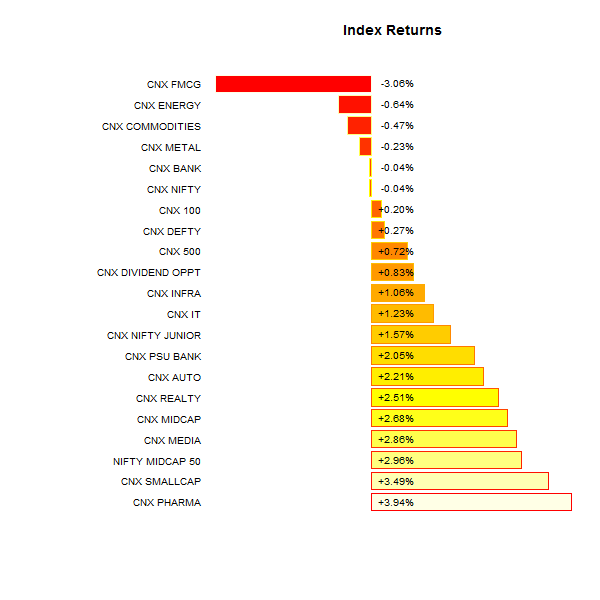

Index returns

Top winners and losers

A mixed bag, but Bosch was on fire this week!

ETFs

Banks got back on the saddle…

Investment Theme Performance

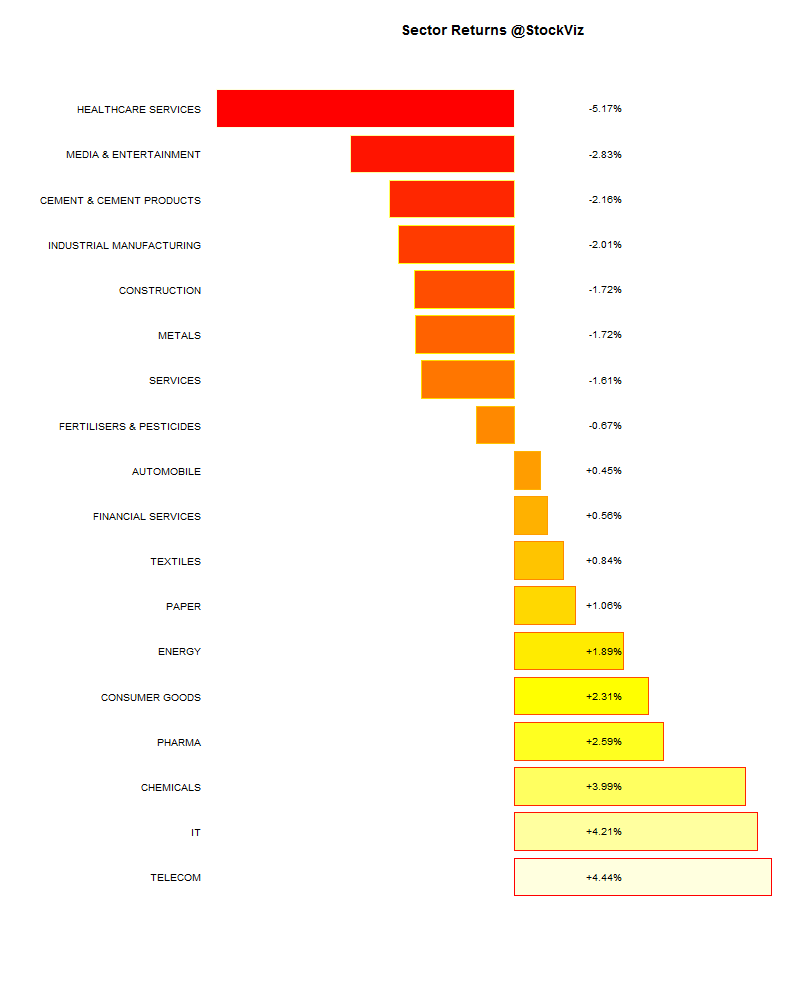

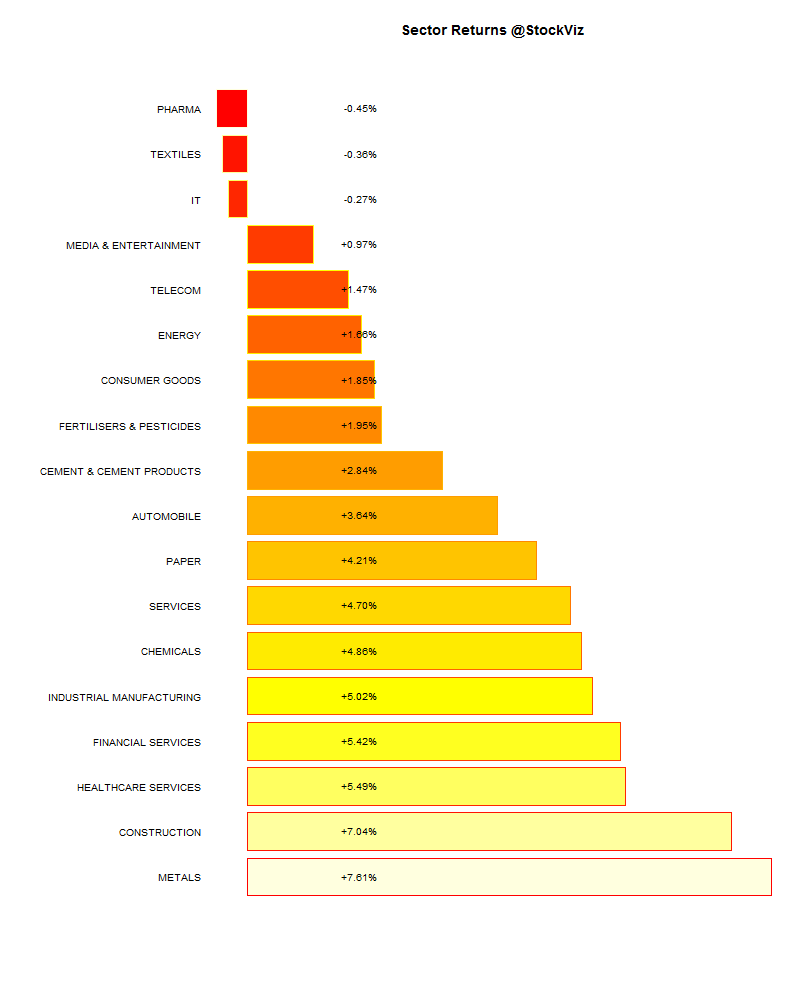

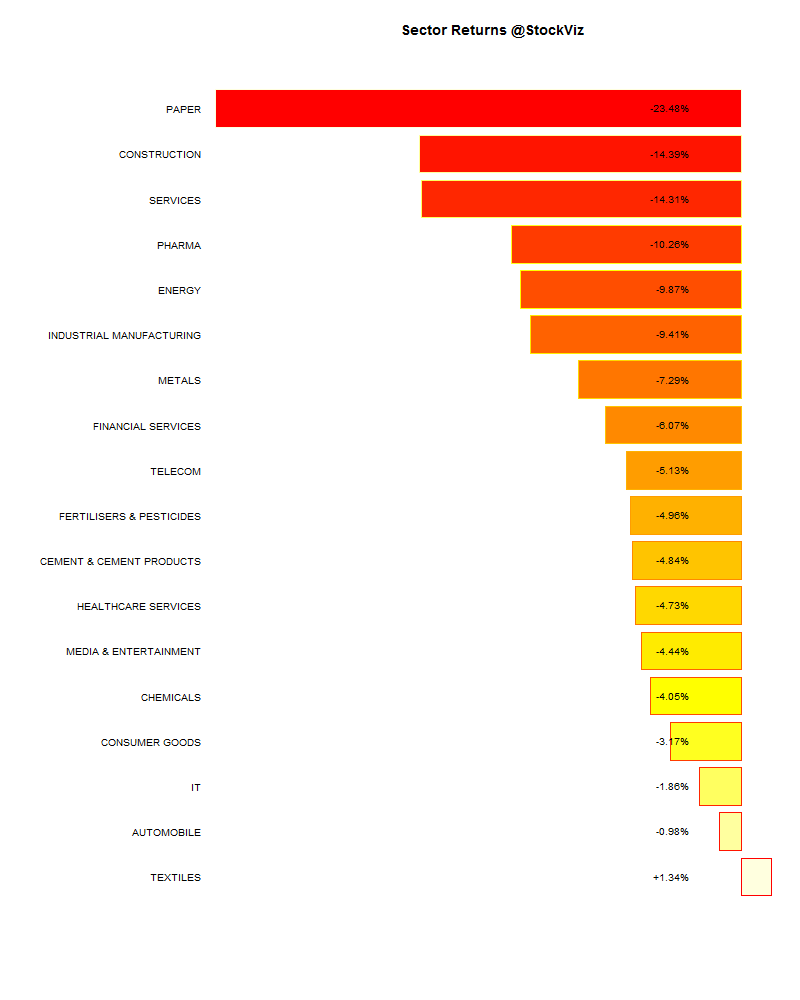

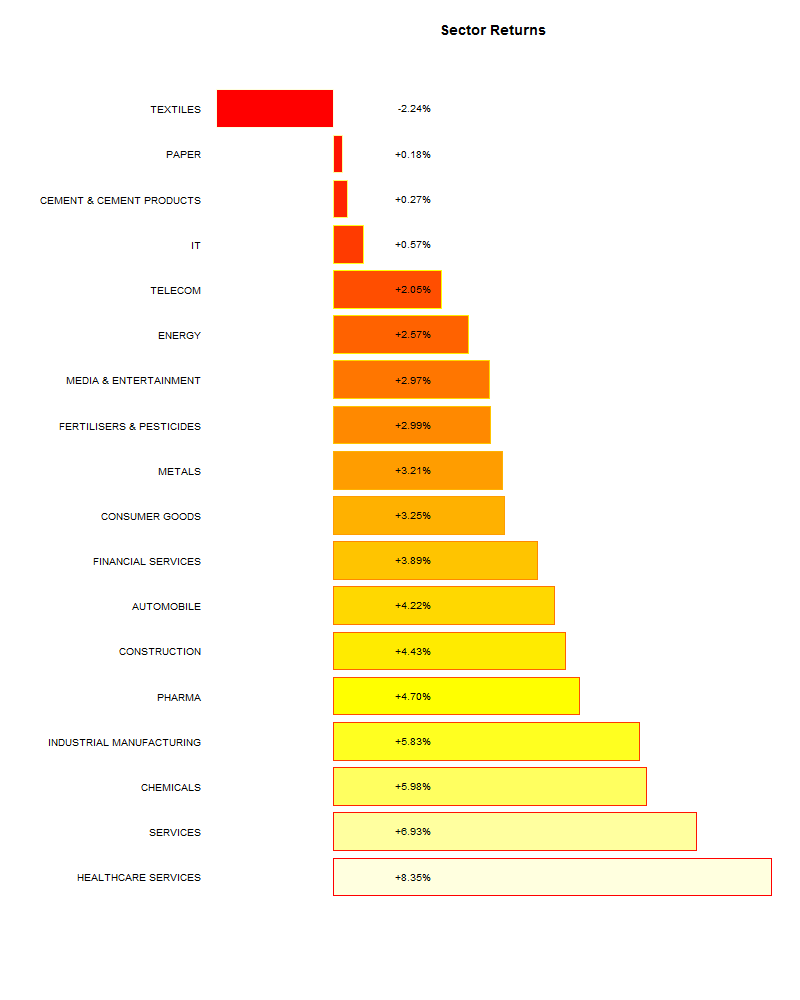

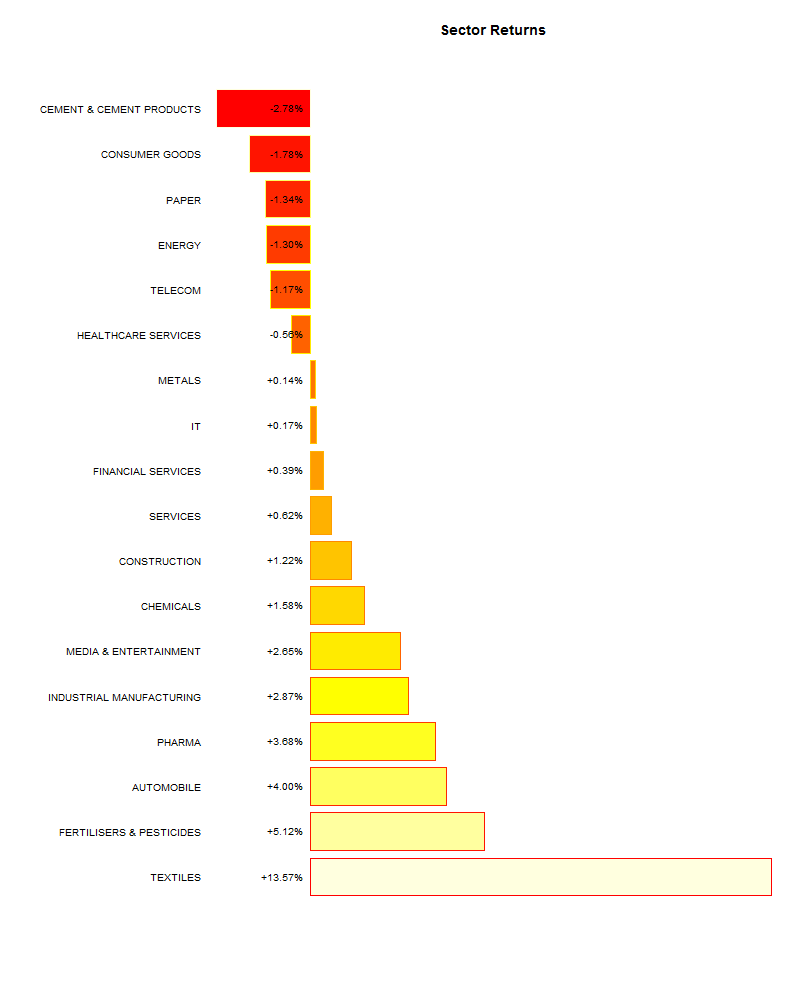

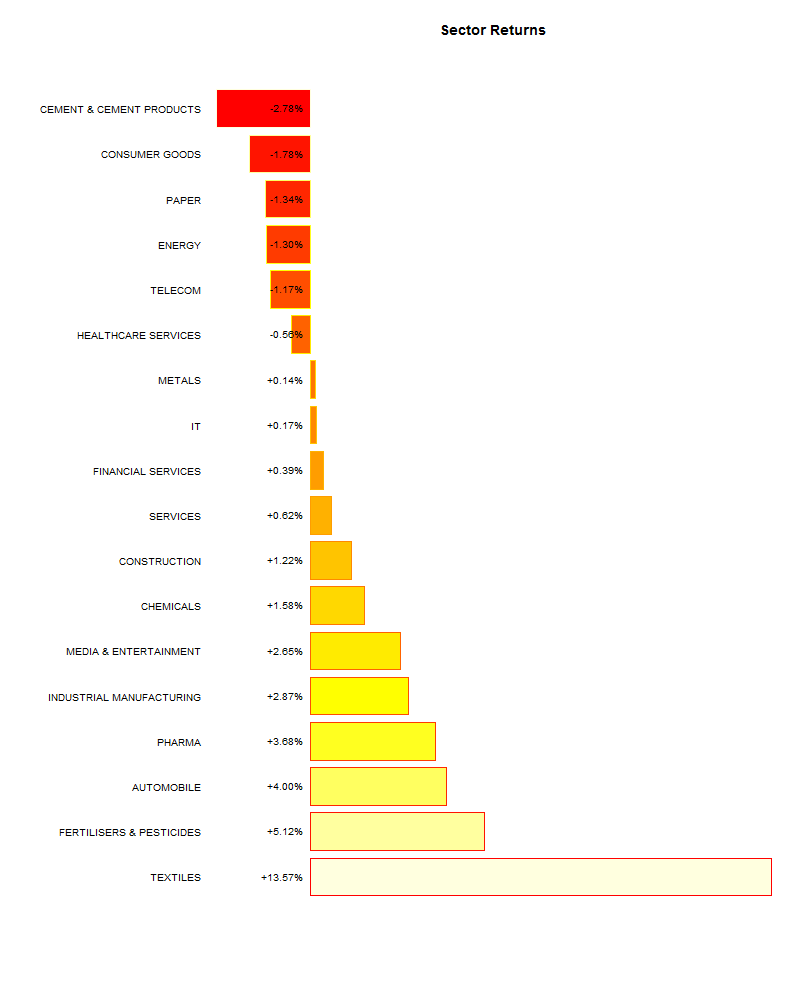

Sector Performance

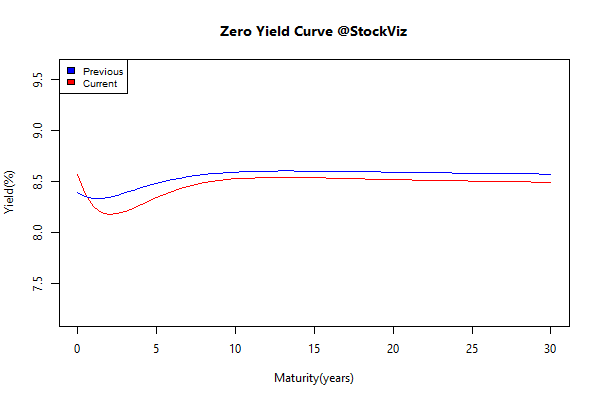

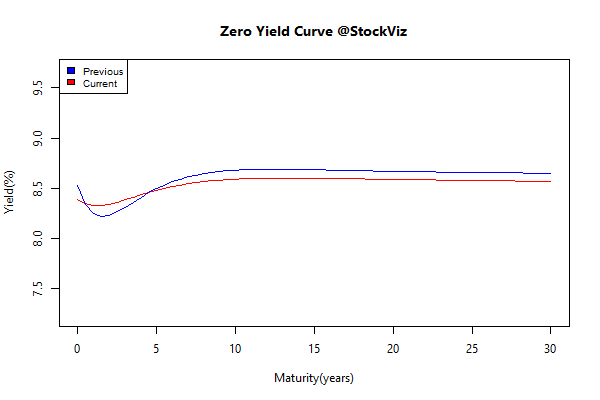

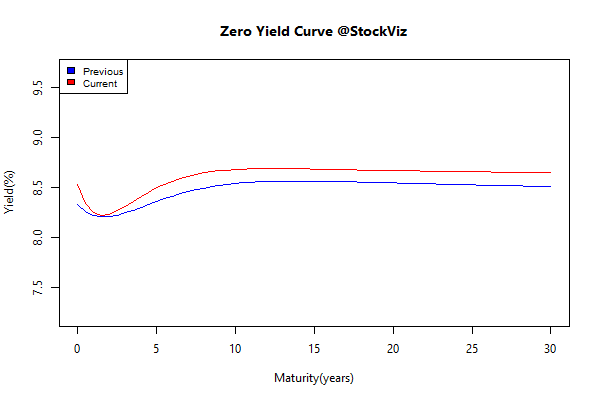

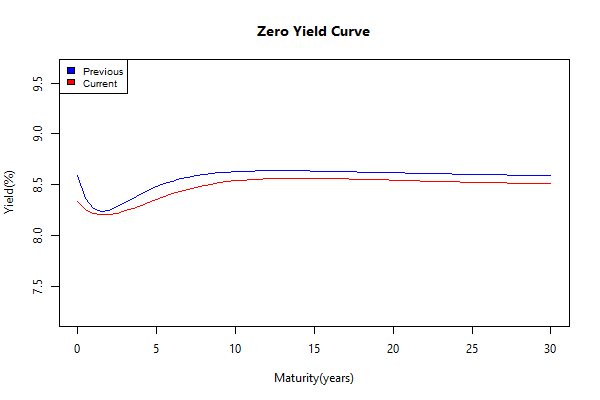

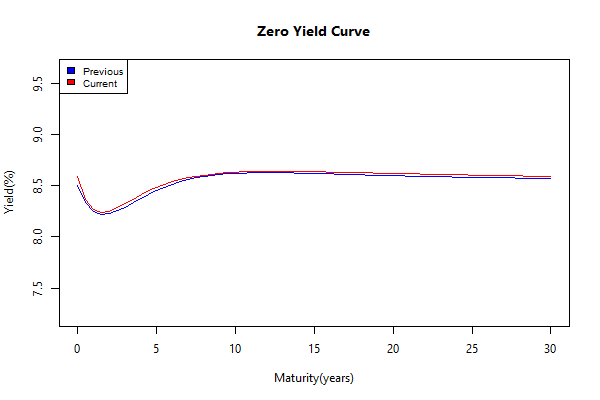

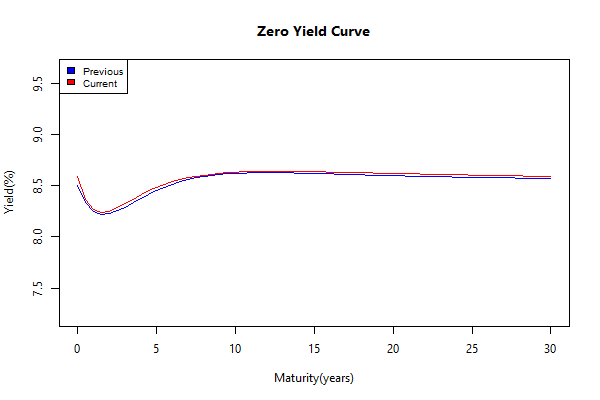

Yield Curve

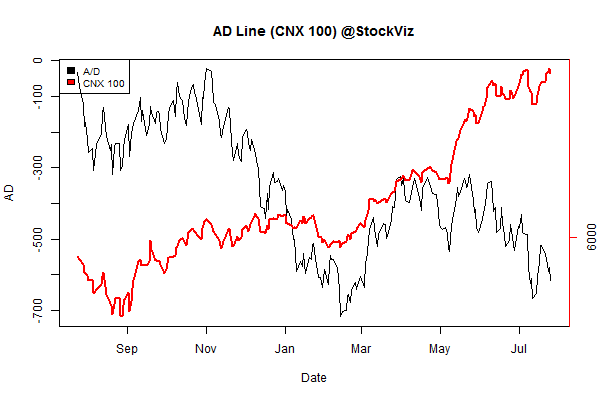

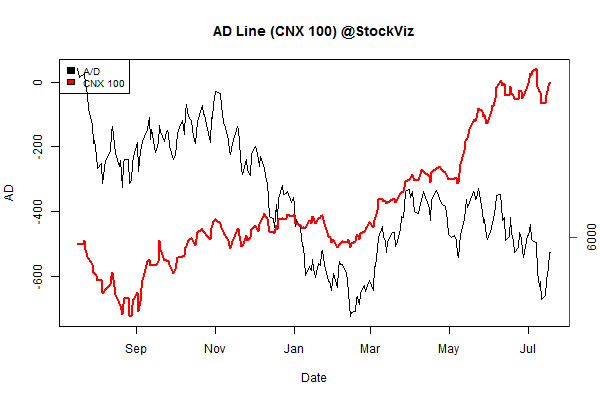

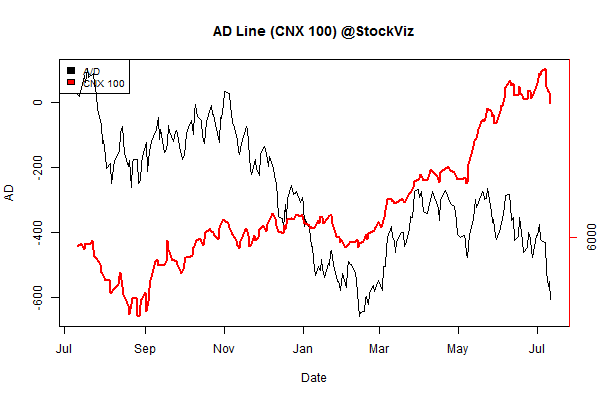

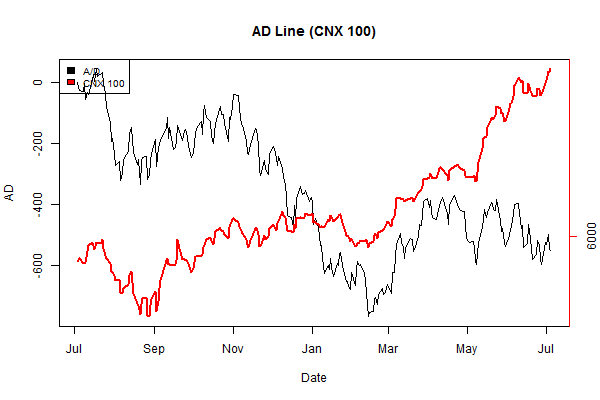

Advance Decline

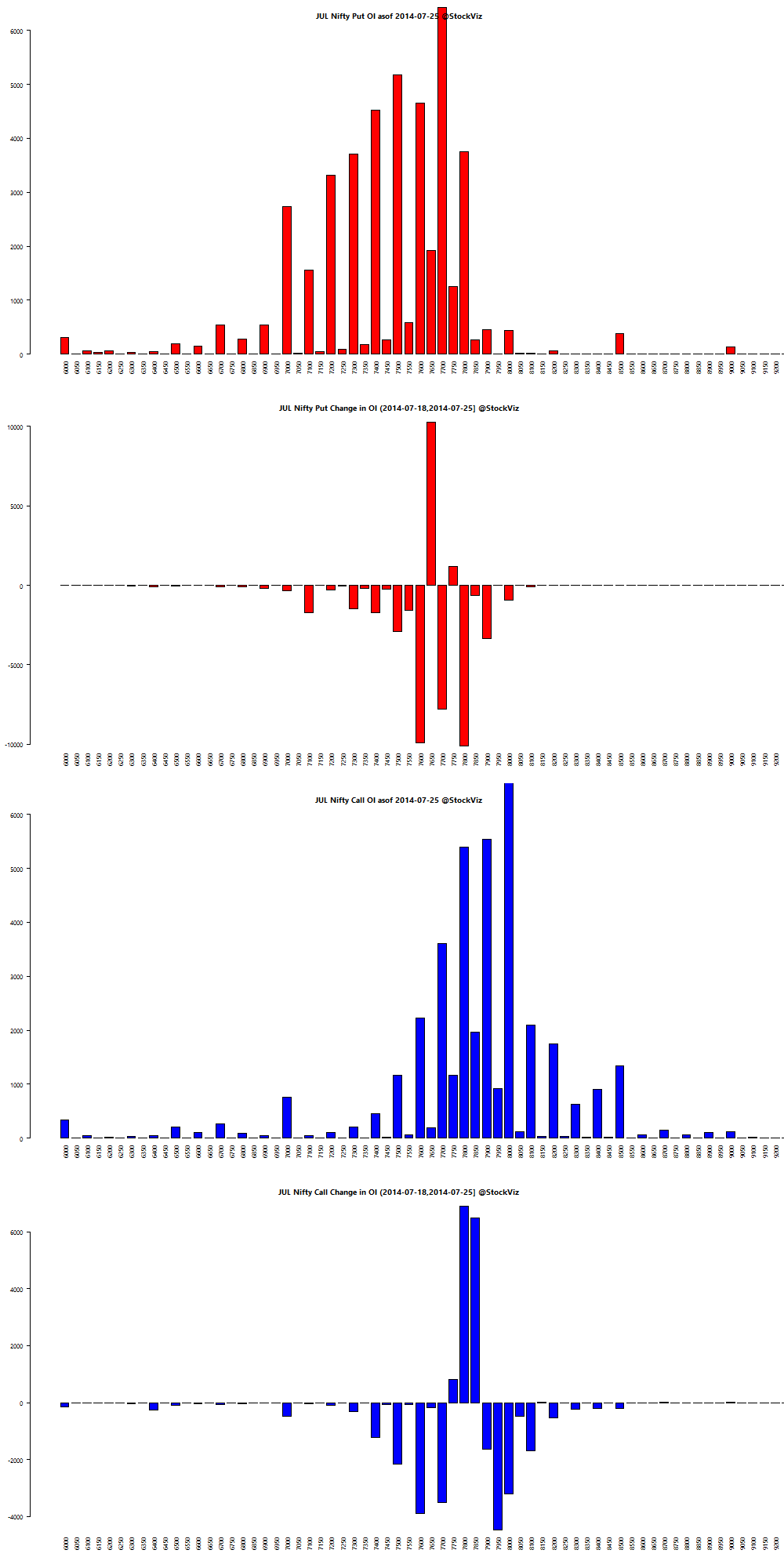

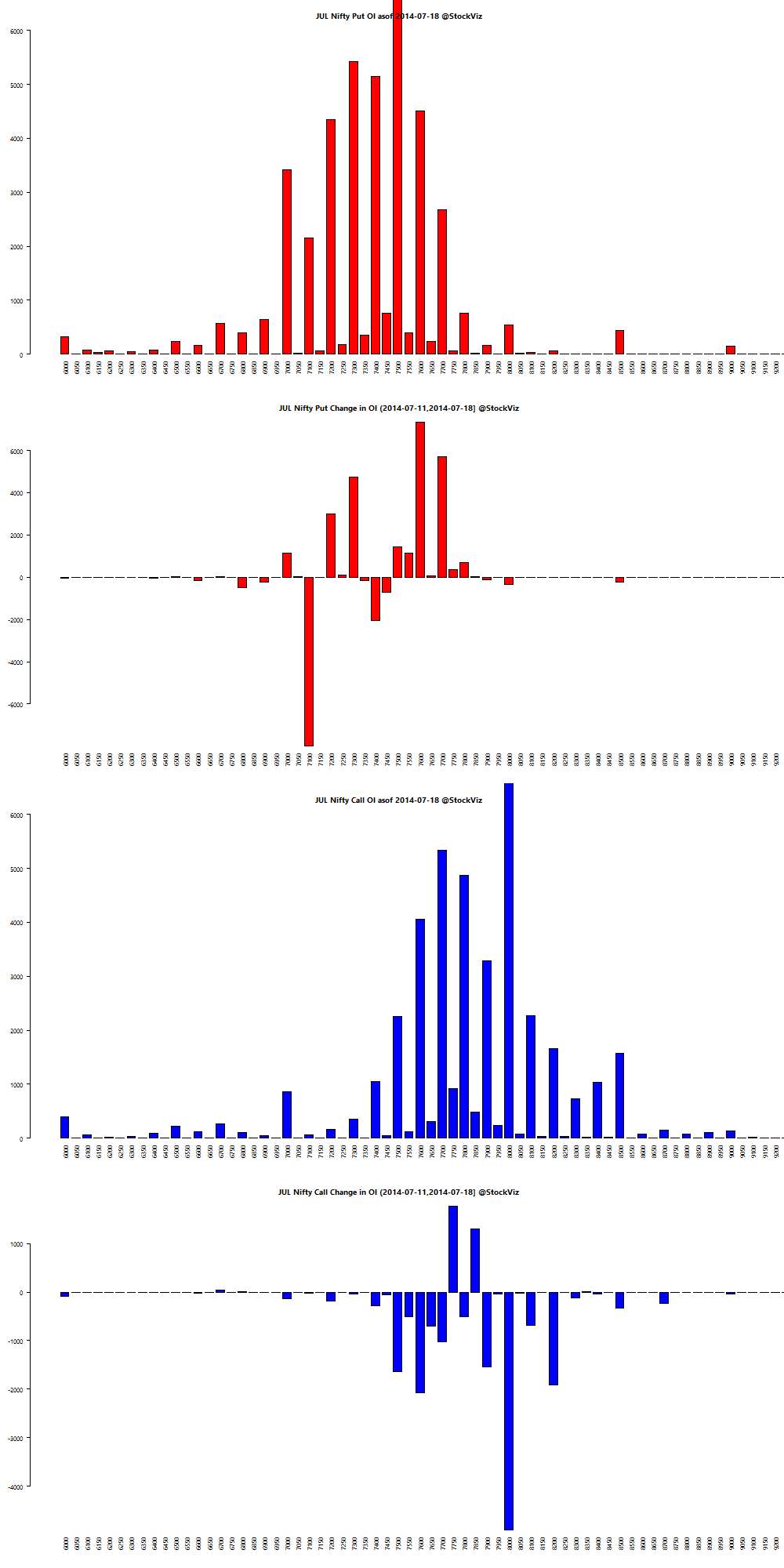

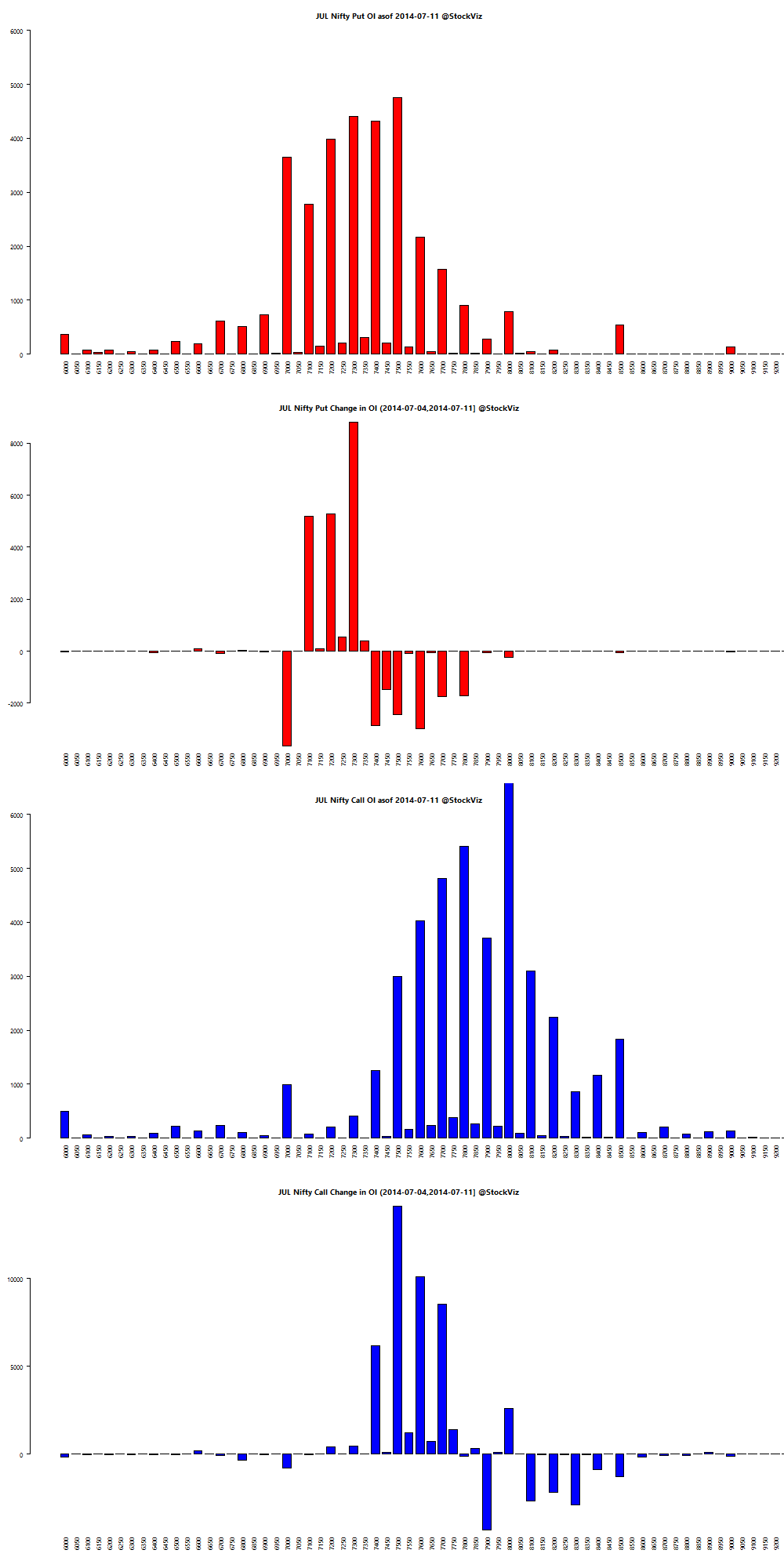

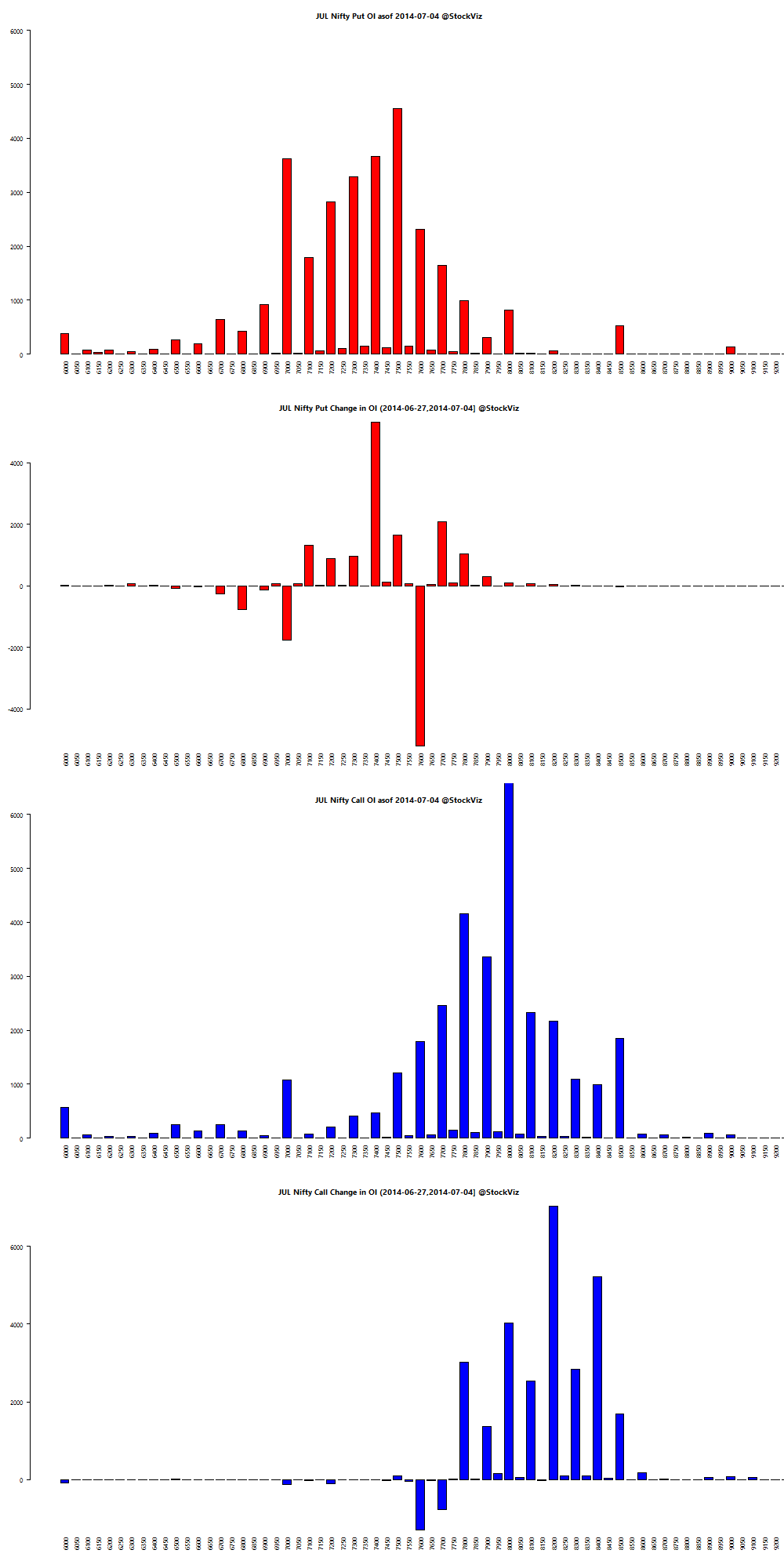

Nifty OI

Thought for the Weekend

The behavior of markets or economies simply can’t be explained by looking at just one thing. conomies and markets are extremely complex. They have a variety of different inputs, including earnings, interest rates, psychology, economic activity, fund flows, taxes, sentiment, momentum, geopolitics, etc. The relevant significance of all of these inputs varies over time.

Source: When Correlations Lie

Related: Musings on stock-market forecasts