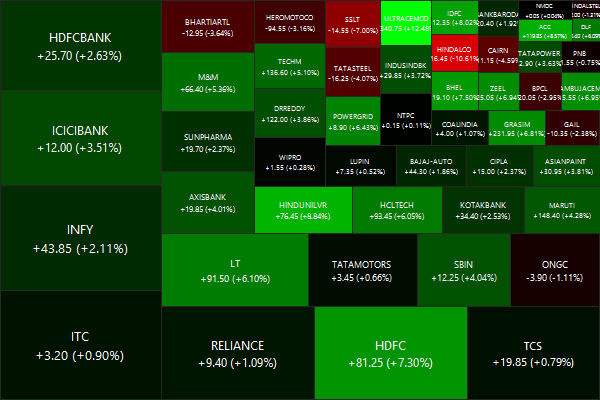

Equities

Commodities

| Energy |

| Ethanol |

+7.34% |

| RBOB Gasoline |

+0.77% |

| Brent Crude Oil |

-1.73% |

| WTI Crude Oil |

-5.25% |

| Natural Gas |

-4.87% |

| Heating Oil |

-1.34% |

| Metals |

| Gold 100oz |

+1.57% |

| Platinum |

-0.02% |

| Copper |

-3.79% |

| Palladium |

+2.81% |

| Silver 5000oz |

+3.95% |

| Agricultural |

| Lean Hogs |

-6.85% |

| Orange Juice |

+0.44% |

| Sugar #11 |

-0.78% |

| Wheat |

-1.12% |

| White Sugar |

-1.18% |

| Cattle |

-2.87% |

| Corn |

+0.19% |

| Cotton |

-3.43% |

| Lumber |

-0.03% |

| Coffee (Arabica) |

-5.09% |

| Feeder Cattle |

-0.29% |

| Soybean Meal |

+1.41% |

| Cocoa |

-4.63% |

| Coffee (Robusta) |

-2.63% |

| Soybeans |

-1.82% |

Credit Indices

| Index |

Change |

| Markit CDX EM |

-0.18% |

| Markit CDX NA HY |

+0.60% |

| Markit CDX NA IG |

-2.83% |

| Markit iTraxx Asia ex-Japan IG |

-3.93% |

| Markit iTraxx Australia |

-1.34% |

| Markit iTraxx Europe |

-3.79% |

| Markit iTraxx Europe Crossover |

-22.27% |

| Markit iTraxx Japan |

-1.84% |

| Markit iTraxx SovX Western Europe |

-1.29% |

| Markit LCDX (Loan CDS) |

+0.08% |

| Markit MCDX (Municipal CDS) |

+0.30% |

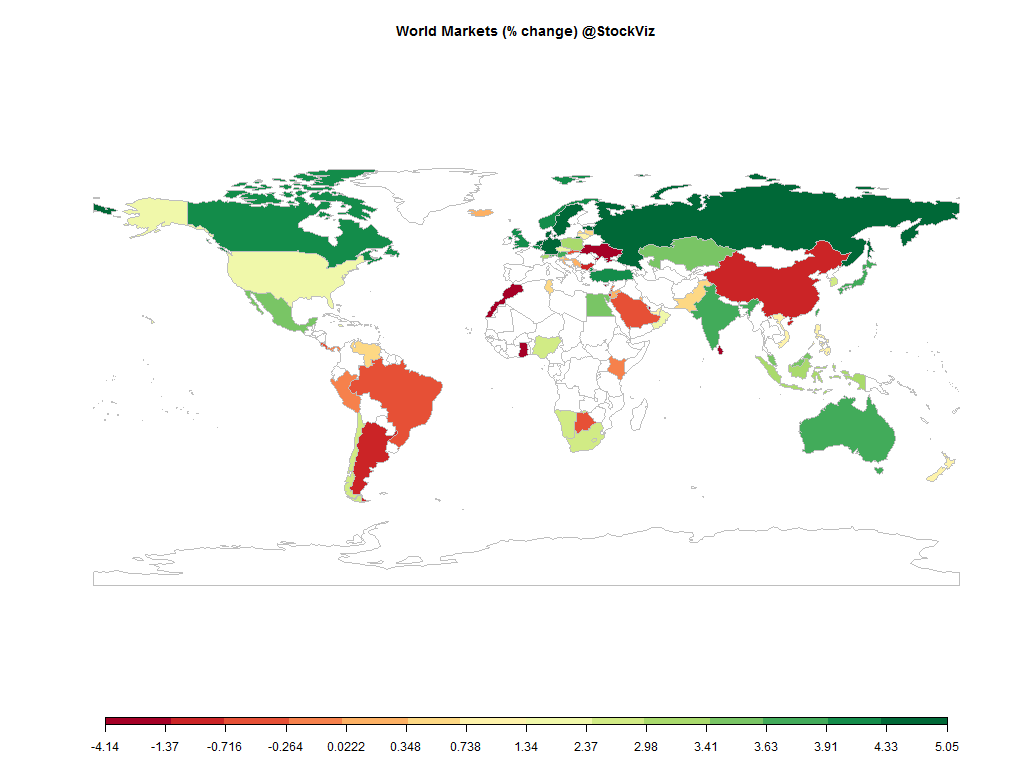

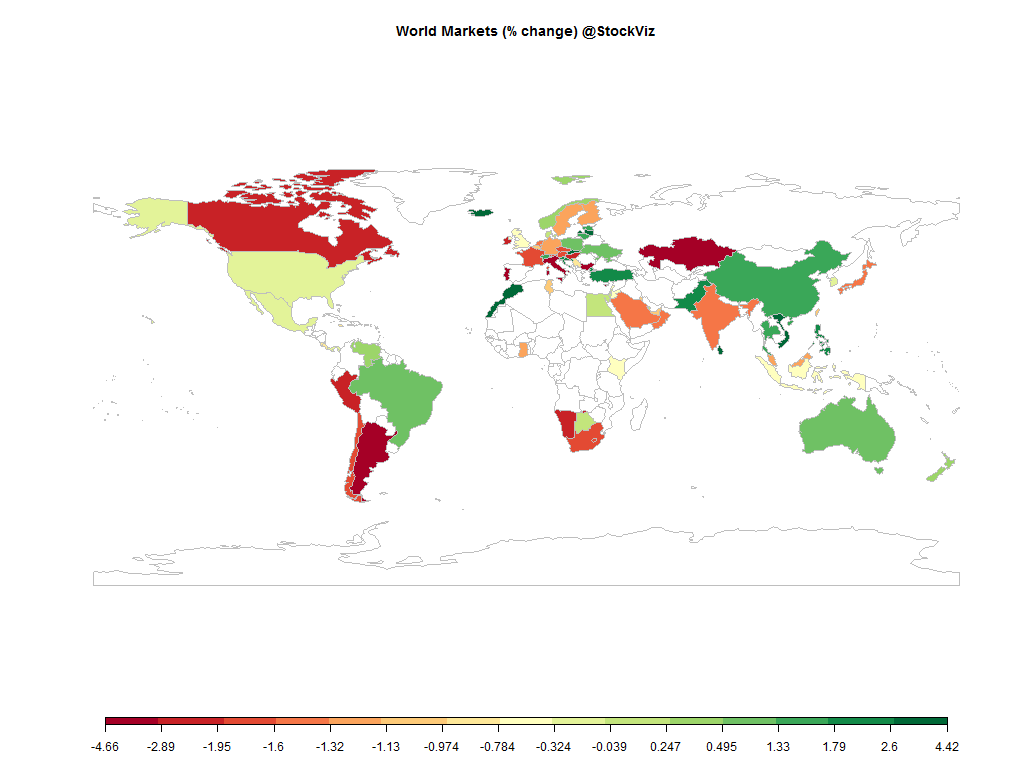

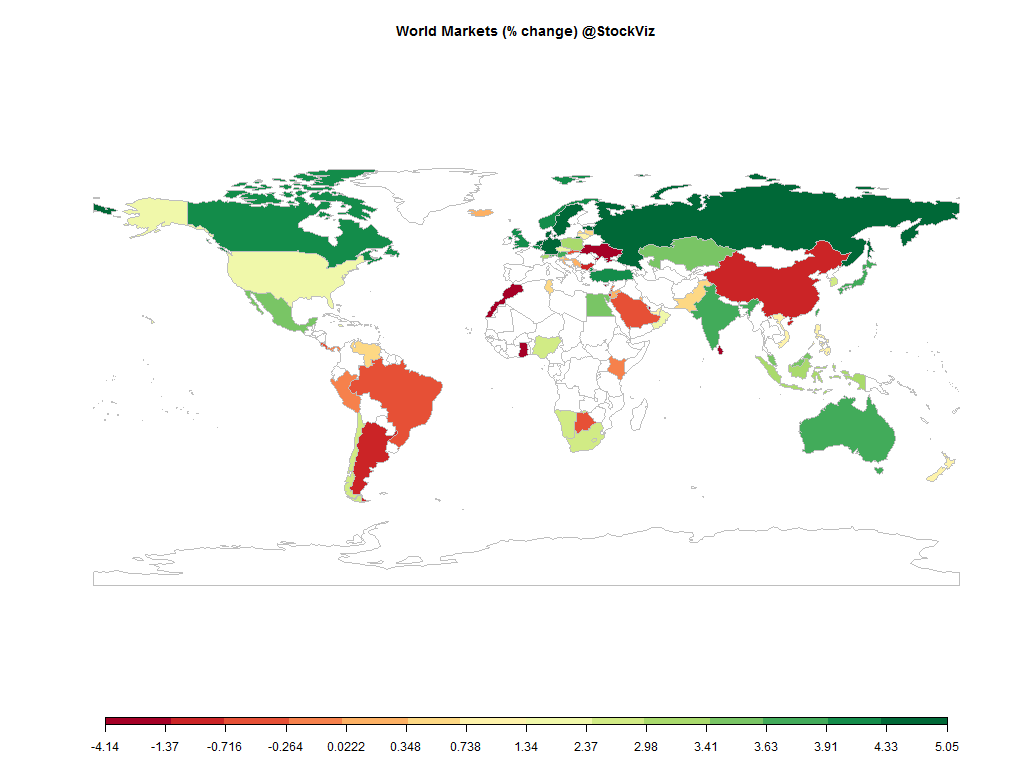

Markets rallied and the Euro tumbled on ECB’s 60bn QE program.

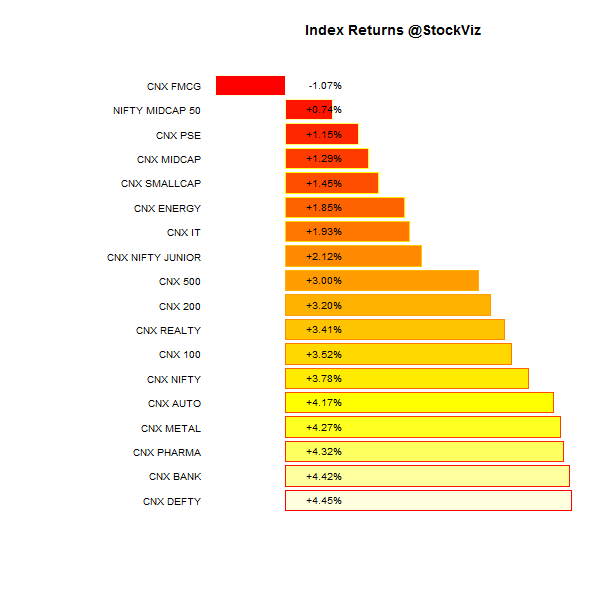

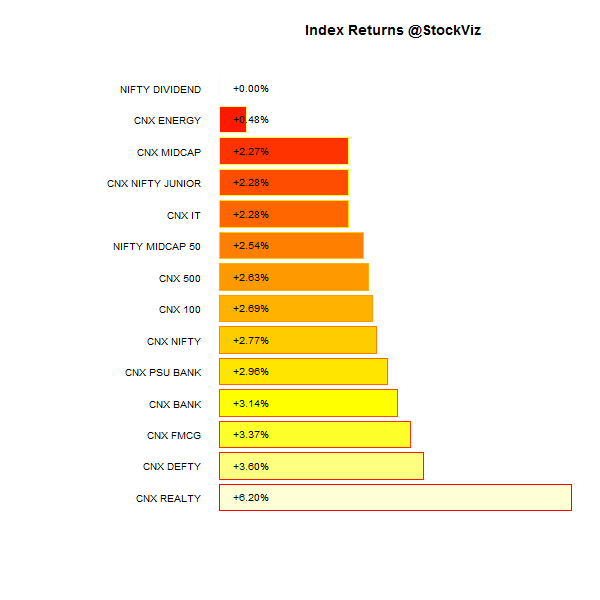

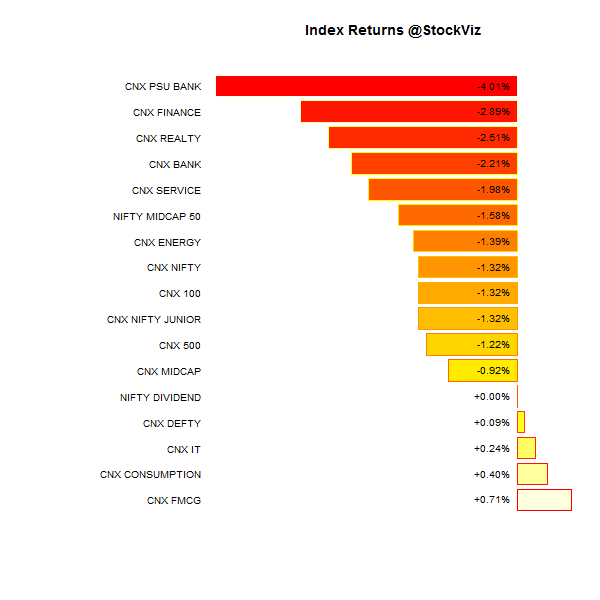

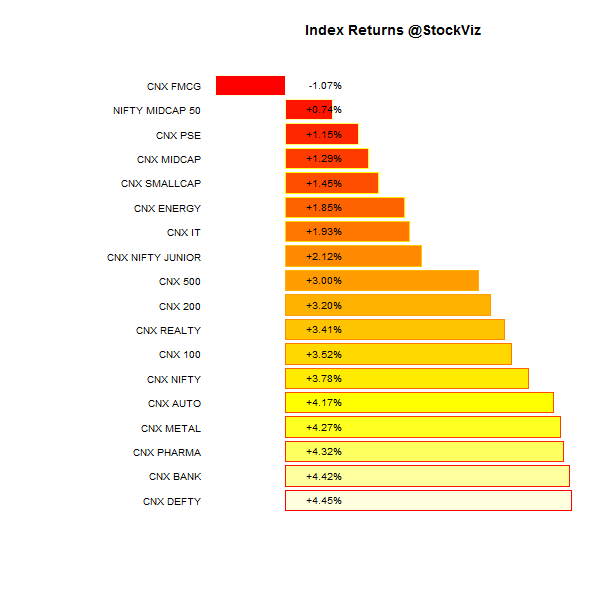

Index Returns

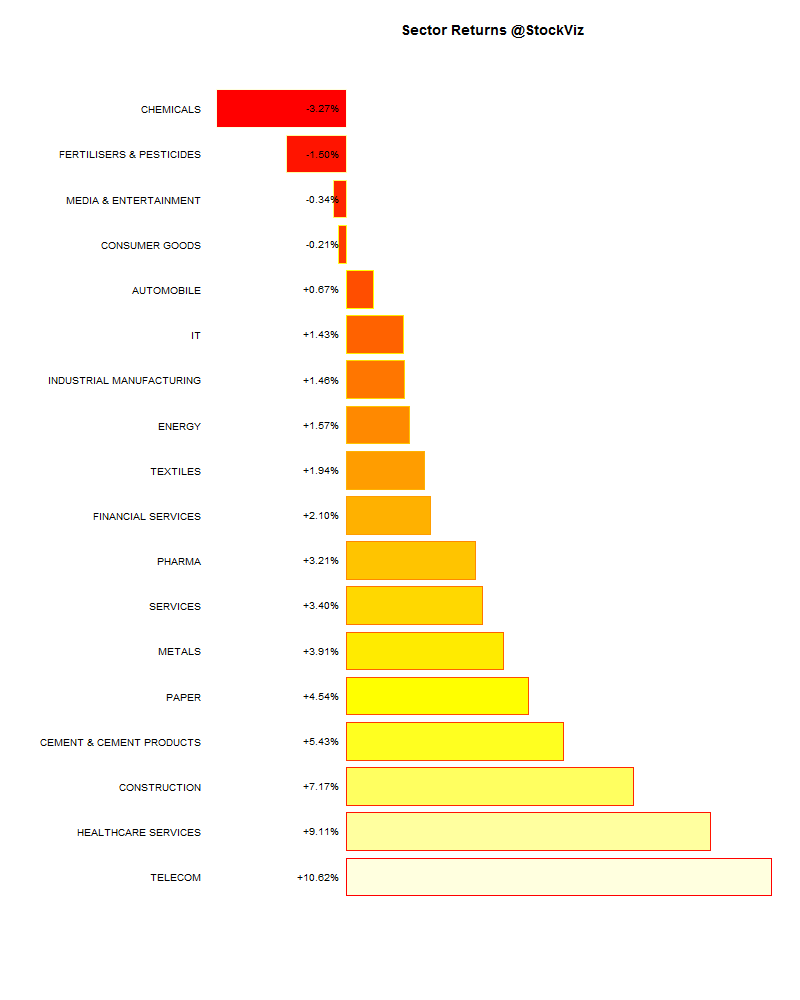

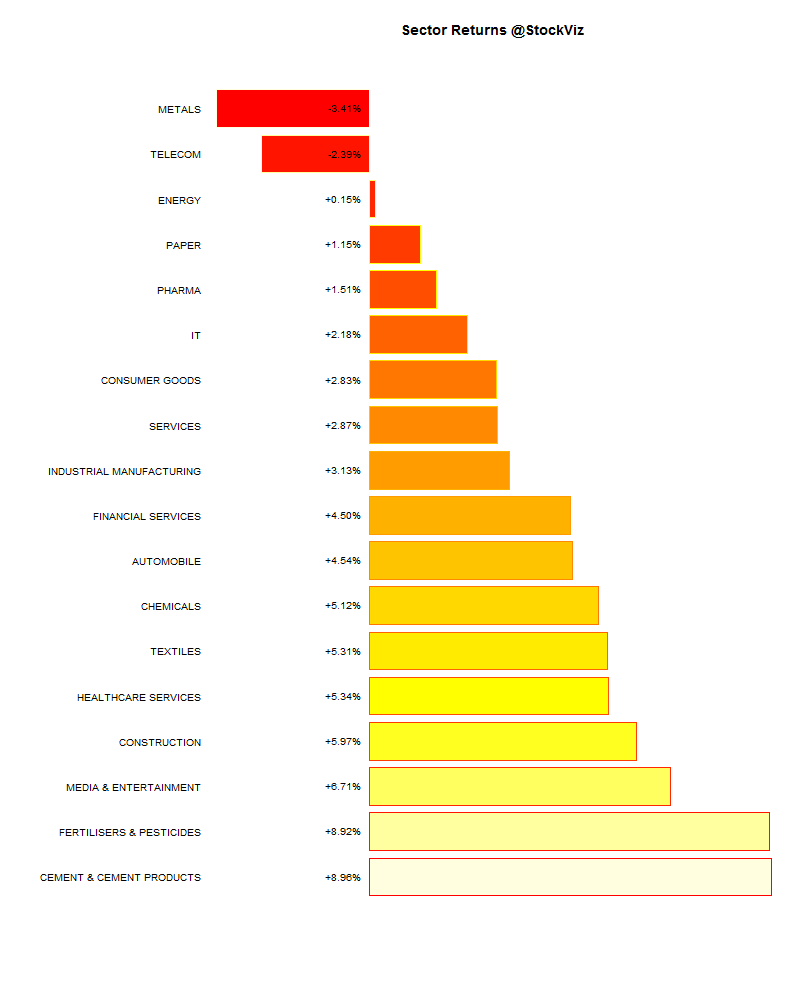

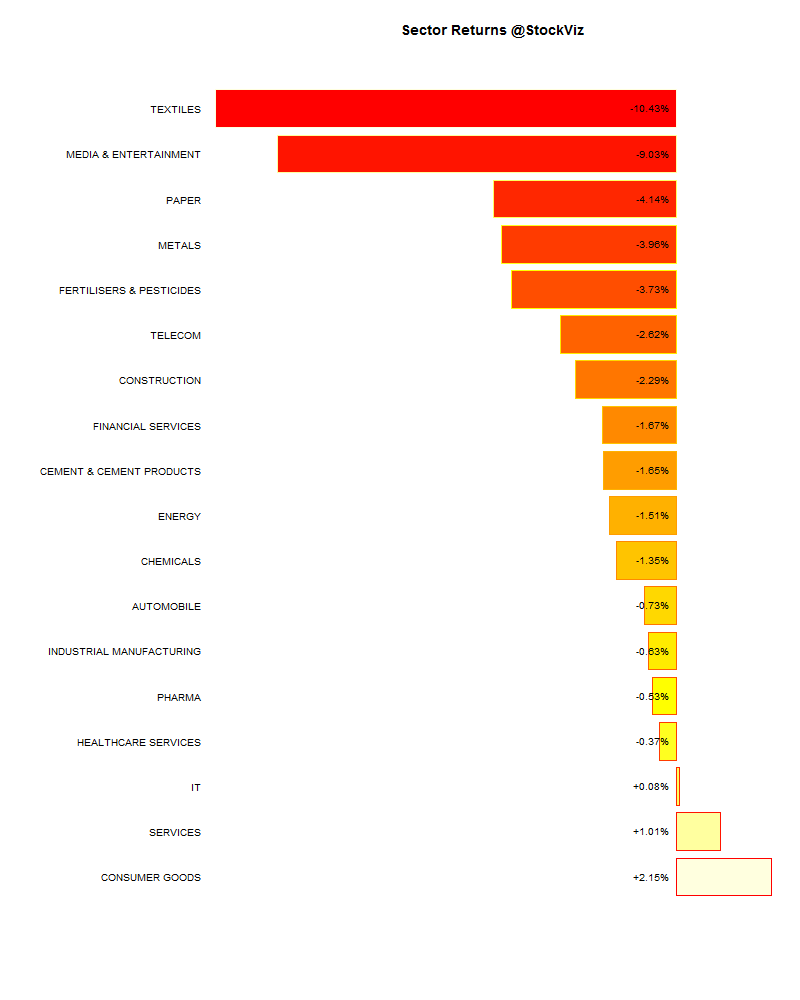

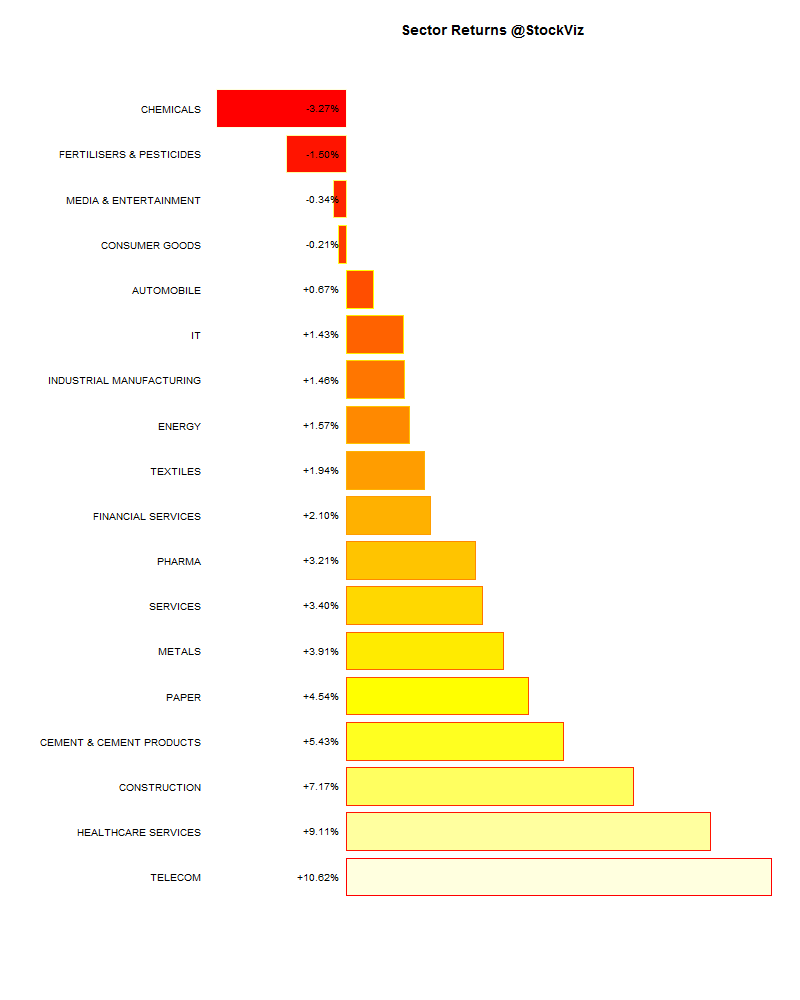

Sector Performance

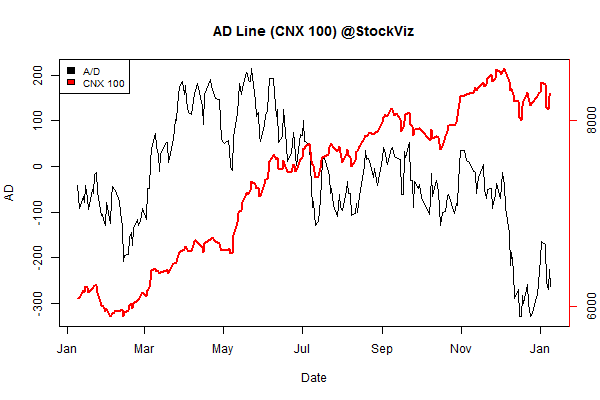

Advance Decline

Market Cap Decile Performance

| Decile |

Mkt. Cap. |

Adv/Decl |

| 1 (micro) |

-0.90% |

68/68 |

| 2 |

+0.87% |

71/63 |

| 3 |

+2.38% |

74/61 |

| 4 |

+0.11% |

75/61 |

| 5 |

+1.42% |

70/65 |

| 6 |

+1.20% |

71/64 |

| 7 |

+3.52% |

74/62 |

| 8 |

+1.50% |

72/63 |

| 9 |

+2.00% |

73/62 |

| 10 (mega) |

+2.91% |

62/74 |

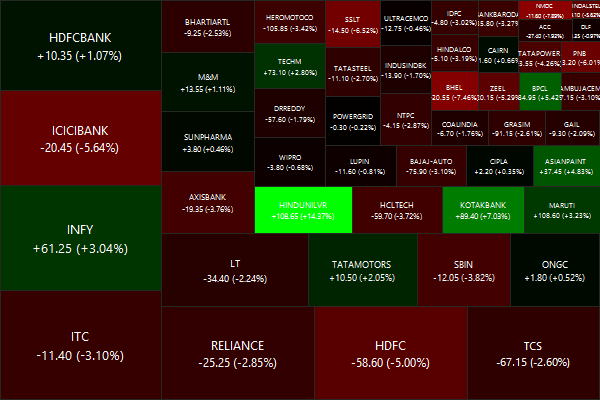

A broad-based rally driven by Eurozone EQ, falling oil, rate cuts, budget… Oh my!

Top Winners and Losers

The Adani stable was on fire this week…

ETF Performance

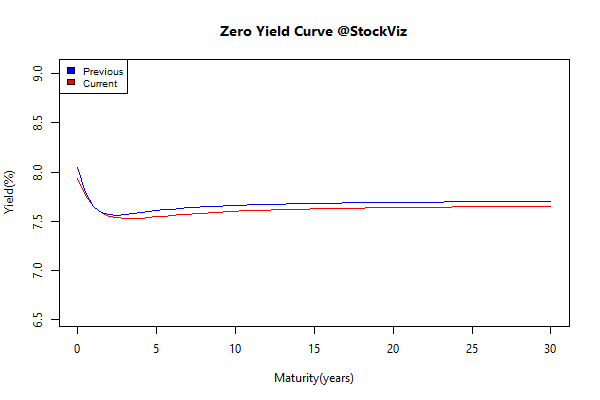

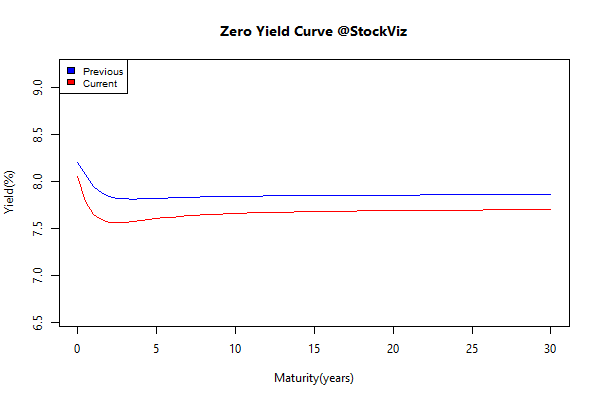

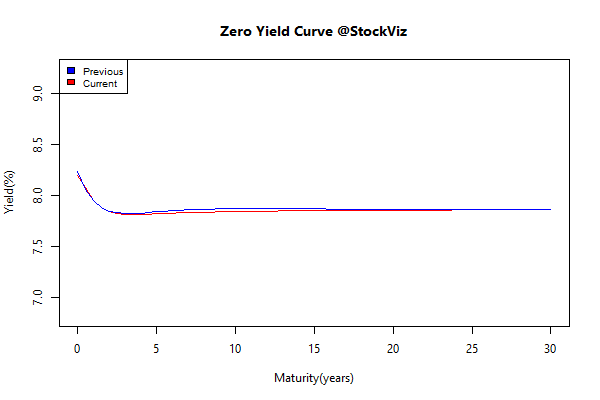

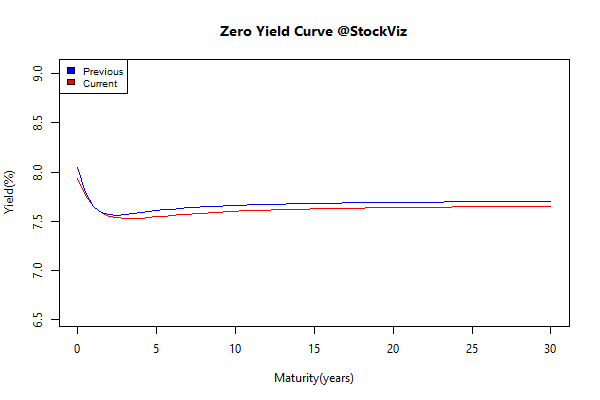

Yield Curve

Bond Indices

| Sub Index |

Change in YTM |

Total Return(%) |

| GSEC TB |

-0.11 |

+0.18% |

| GSEC SUB 1-3 |

+0.06 |

+0.21% |

| GSEC SUB 3-8 |

+0.08 |

-0.05% |

| GSEC SUB 8 |

+0.04 |

-0.11% |

Weird that the long end of the curve ended the week in the red.

Investment Theme Performance

Large-cap dominance drove CNX 100 Tactical this week. Momentum was not far behind…

Thought for the weekend

Research:

Study participants from a range of ages generally did not enjoy spending even brief periods of time alone in a room with nothing to do but think, ponder or daydream. The participants, by and large, enjoyed much more doing external activities such as listening to music or using a smartphone. Some even preferred to give themselves mild electric shocks than to think.

Source: Most people are just not comfortable in their own heads