Equities

Commodities

| Energy |

| Heating Oil |

-1.82% |

| Brent Crude Oil |

+0.95% |

| WTI Crude Oil |

+0.96% |

| Natural Gas |

+4.83% |

| RBOB Gasoline |

+3.74% |

| Ethanol |

-8.81% |

| Metals |

| Gold 100oz |

+4.96% |

| Palladium |

-5.39% |

| Platinum |

+3.02% |

| Silver 5000oz |

+8.54% |

| Copper |

-4.66% |

| Agricultural |

| Corn |

-3.20% |

| Feeder Cattle |

-3.05% |

| Lean Hogs |

-4.84% |

| Soybean Meal |

-9.92% |

| Wheat |

-6.01% |

| Cattle |

-3.58% |

| Coffee (Robusta) |

-1.52% |

| Cotton |

-2.49% |

| Lumber |

-3.34% |

| Sugar #11 |

+2.41% |

| Cocoa |

-0.25% |

| Coffee (Arabica) |

-4.38% |

| Orange Juice |

+5.89% |

| Soybeans |

-5.62% |

| White Sugar |

+1.48% |

Credit Indices

| Index |

Change |

| Markit CDX EM |

-0.63% |

| Markit CDX NA HY |

-0.40% |

| Markit CDX NA IG |

+2.89% |

| Markit iTraxx Asia ex-Japan IG |

+3.23% |

| Markit iTraxx Australia |

+2.03% |

| Markit iTraxx Europe |

+0.73% |

| Markit iTraxx Europe Crossover |

+7.83% |

| Markit iTraxx Japan |

+0.75% |

| Markit iTraxx SovX Western Europe |

-0.74% |

| Markit LCDX (Loan CDS) |

-0.43% |

| Markit MCDX (Municipal CDS) |

+2.56% |

Rajan surprised us with a rate cut. But the Swiss central bank surprised a whole bunch of FX brokers and punters by abandoning their peg against the Euro. Most developed country 10-year yields are either at zero or negative. Investors are paying the Swiss for the privilege of lending them money!

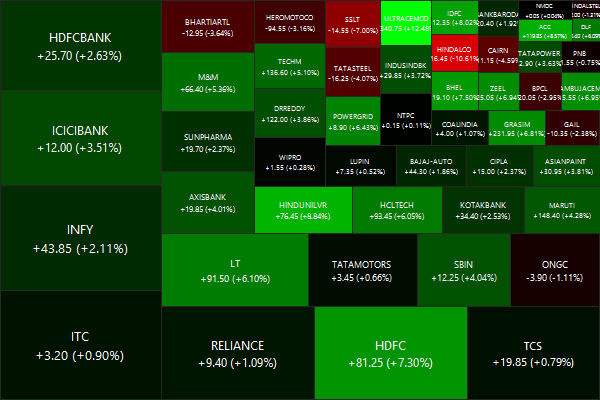

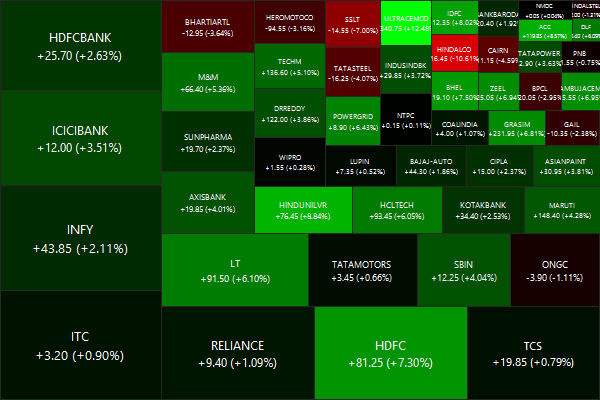

Nifty Heatmap

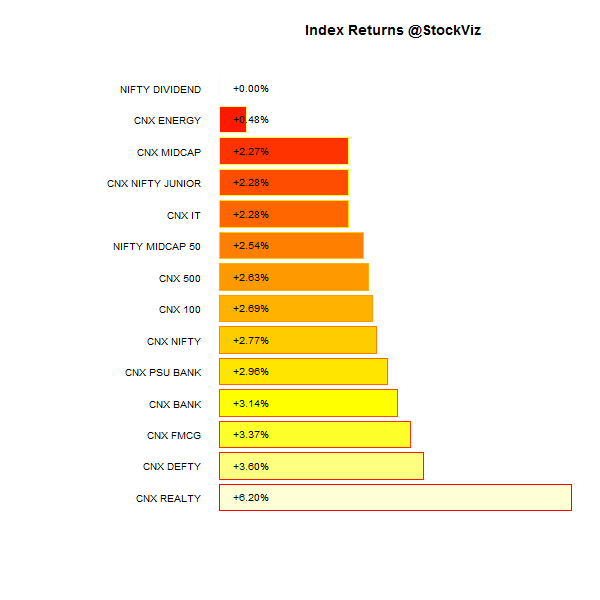

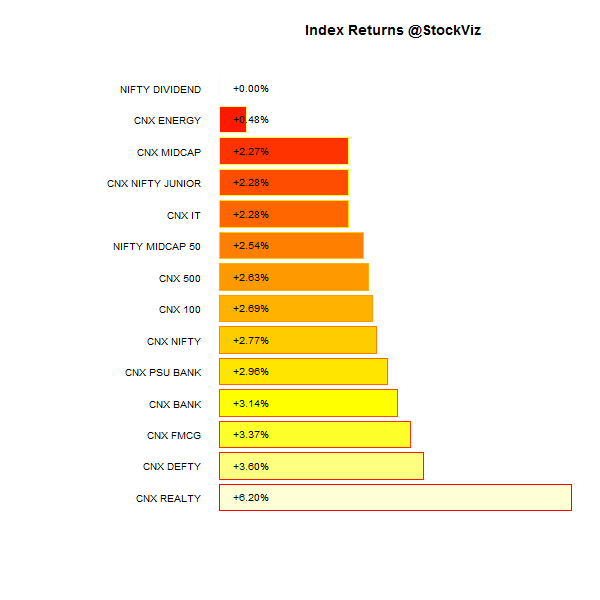

Index Returns

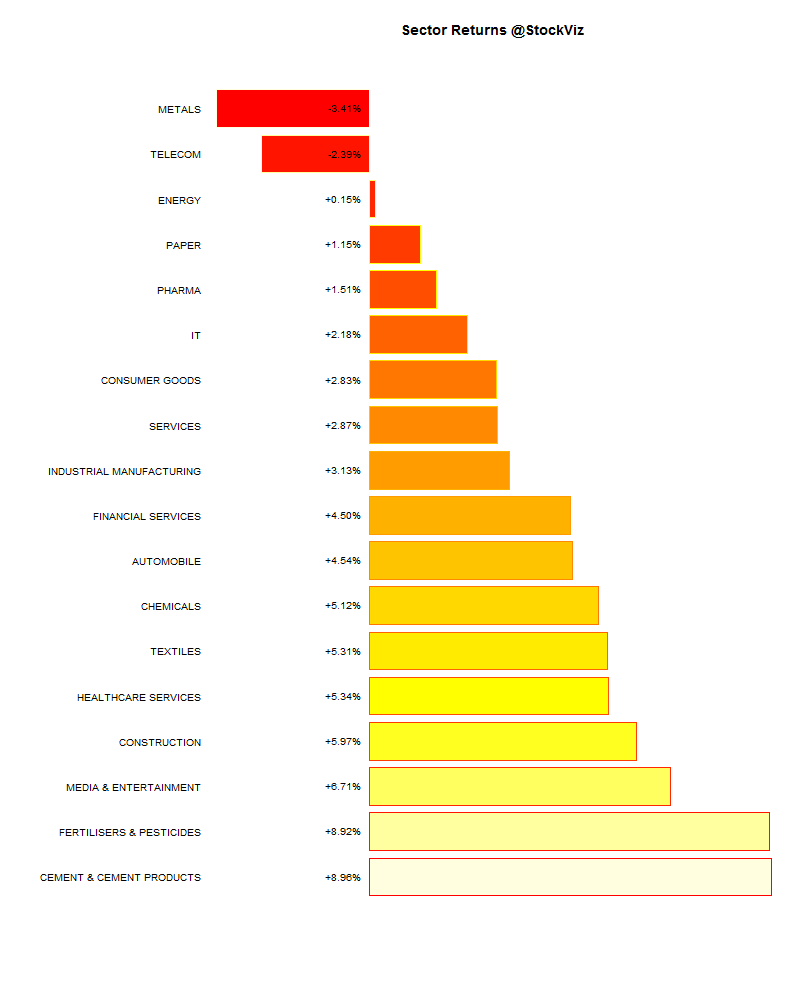

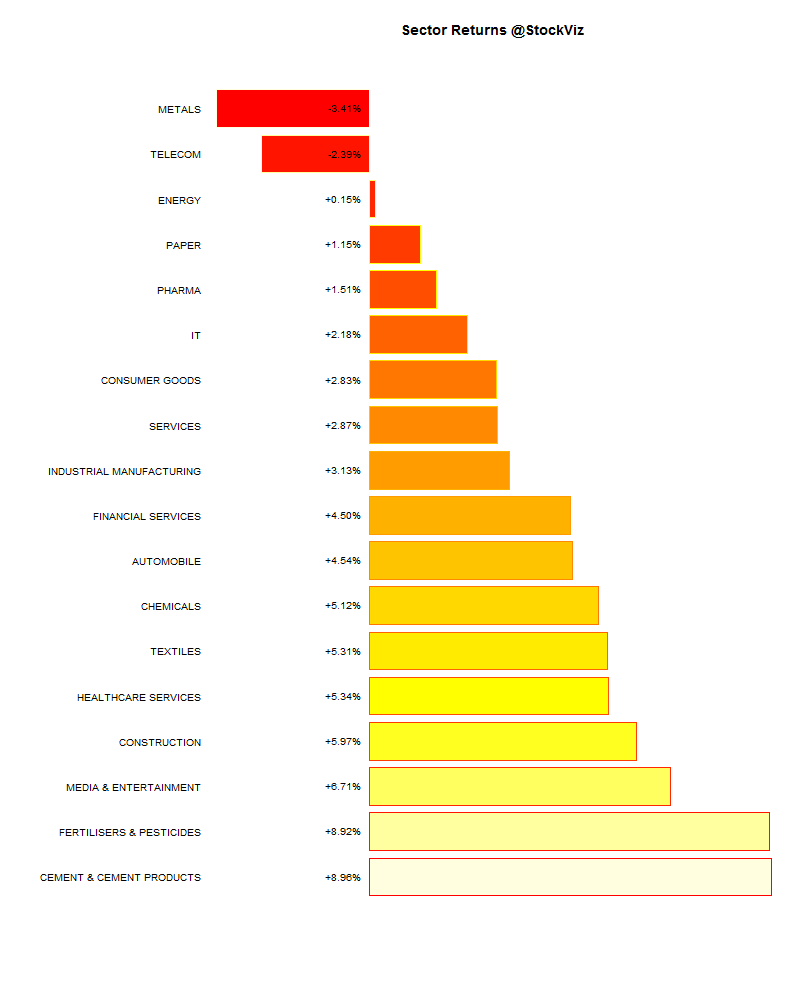

Sector Performance

Advance Decline

Market Cap Decile Performance

| Decile |

Mkt. Cap. |

Adv/Decl |

| 1 (micro) |

+0.74% |

70/65 |

| 2 |

-0.29% |

74/61 |

| 3 |

+1.86% |

73/62 |

| 4 |

+1.33% |

68/67 |

| 5 |

+0.33% |

68/67 |

| 6 |

+1.61% |

73/62 |

| 7 |

+1.28% |

66/69 |

| 8 |

+1.72% |

70/65 |

| 9 |

+2.28% |

71/64 |

| 10 (mega) |

+2.90% |

68/67 |

Large caps outperformed mid and small caps.

Top Winners and Losers

Miners got pummeled. The end of a super-cycle brings many deaths…

ETF Performance

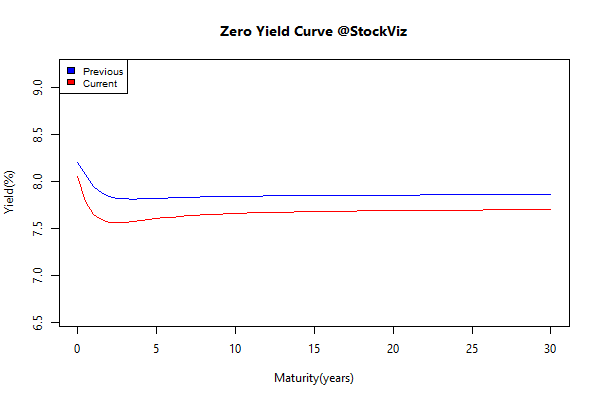

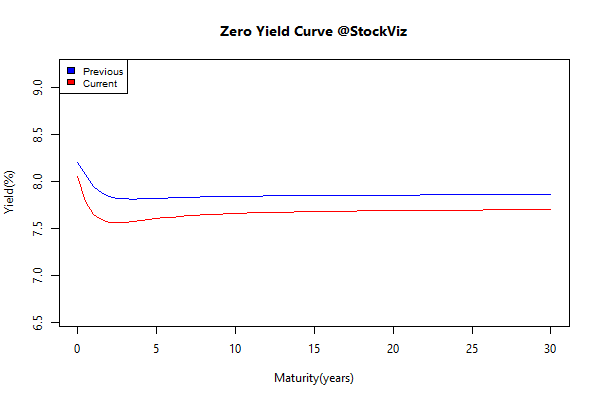

Yield Curve

Bond Indices

| Sub Index |

Change in YTM |

Total Return(%) |

| GSEC TB |

-0.10 |

+0.18% |

| GSEC SUB 1-3 |

-0.48 |

+0.49% |

| GSEC SUB 3-8 |

-0.32 |

+1.36% |

| GSEC SUB 8 |

-0.28 |

+2.57% |

The long-end continues to rock investor returns…

Investment Theme Performance

Green for the most parts…

Thought for the weekend

Concentration produces wealth. Diversification protects it.

Concentration produces innovation. Diversification produces mediocrity.

Make big bets, do fewer things, concentrate your resources.

Don’t hedge, commit.

Source: Making Big Bets

Comments are closed, but trackbacks and pingbacks are open.