Paper from the brain-trust at AQR Capital Management: Covered Calls and Their Unintended Reversal Bet is a must read for anybody trading options.

Simply put, a covered call is when you own the underlying stock and you sell a call on it. If the stock doesn’t go beyond the strike at which you sold the call, then you pocket the premium. Otherwise, your upside on owning the stock is capped at the strike.

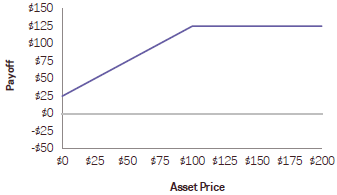

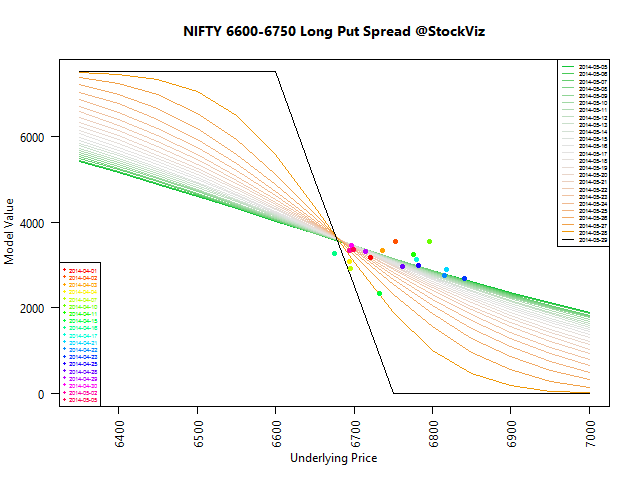

The payoff diagram of a covered call looks like this:

The authors claim that over a quarter of a covered call’s risk may be attributed to market timing and investors are ignoring its effect on returns.

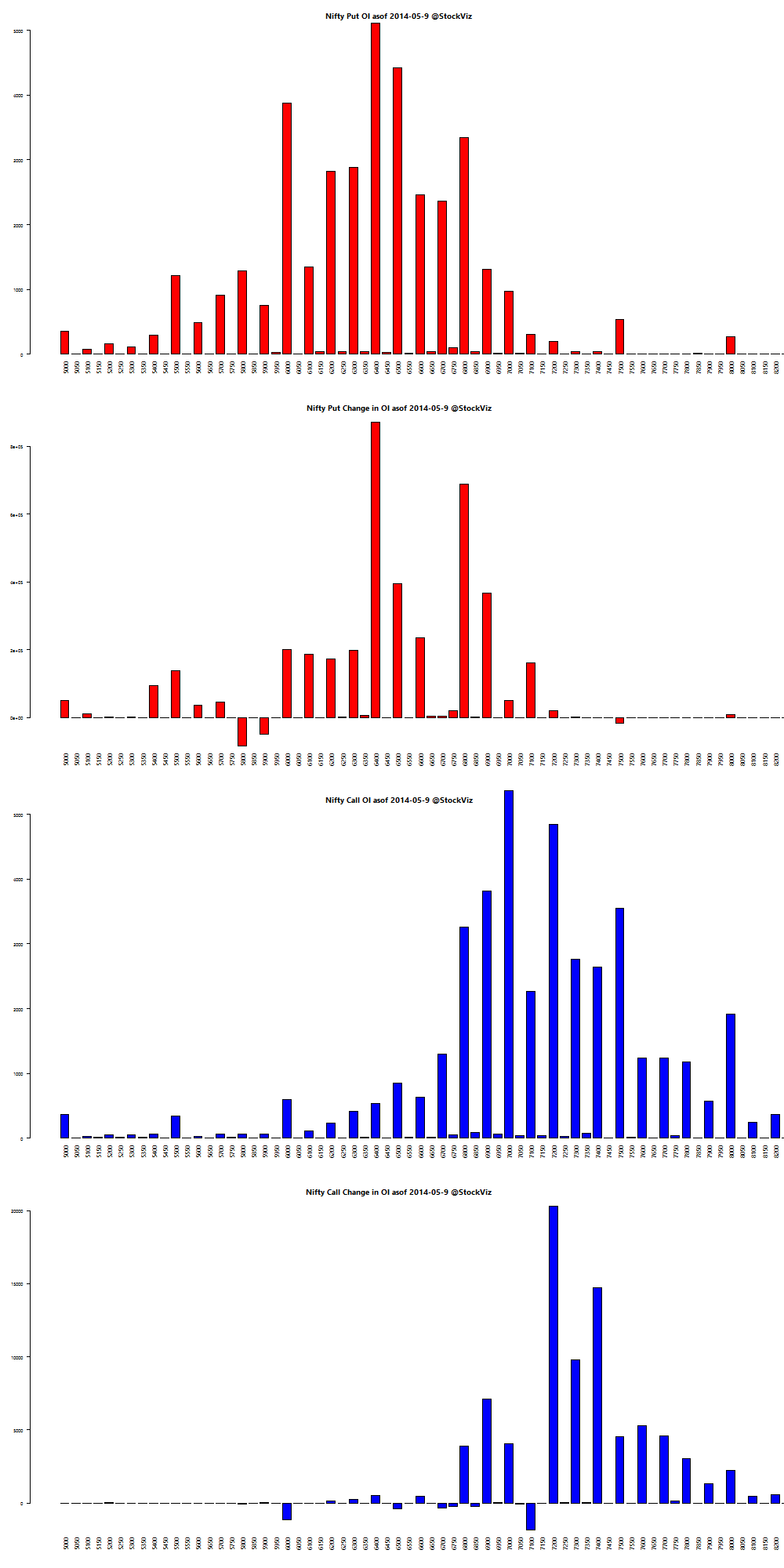

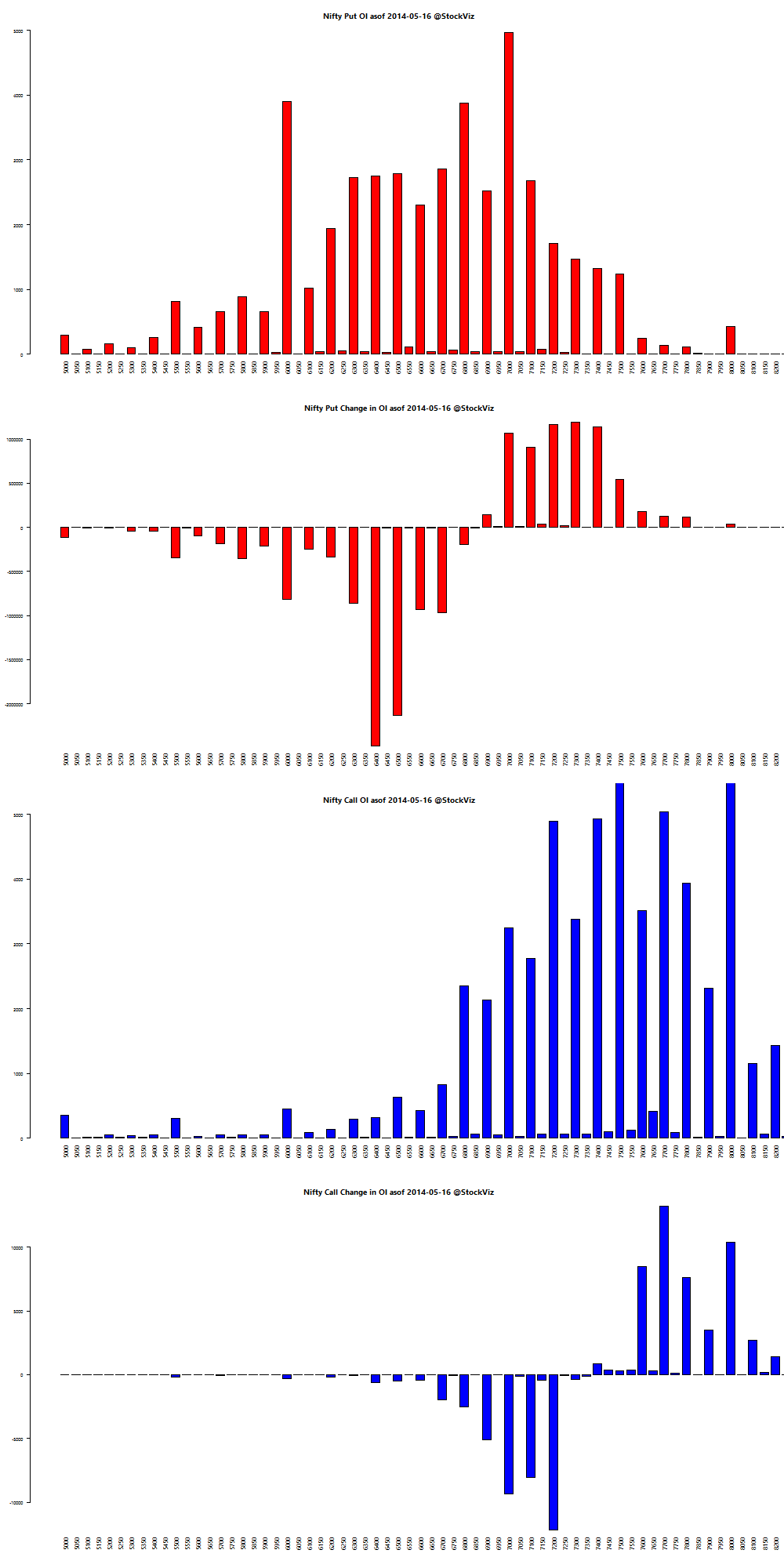

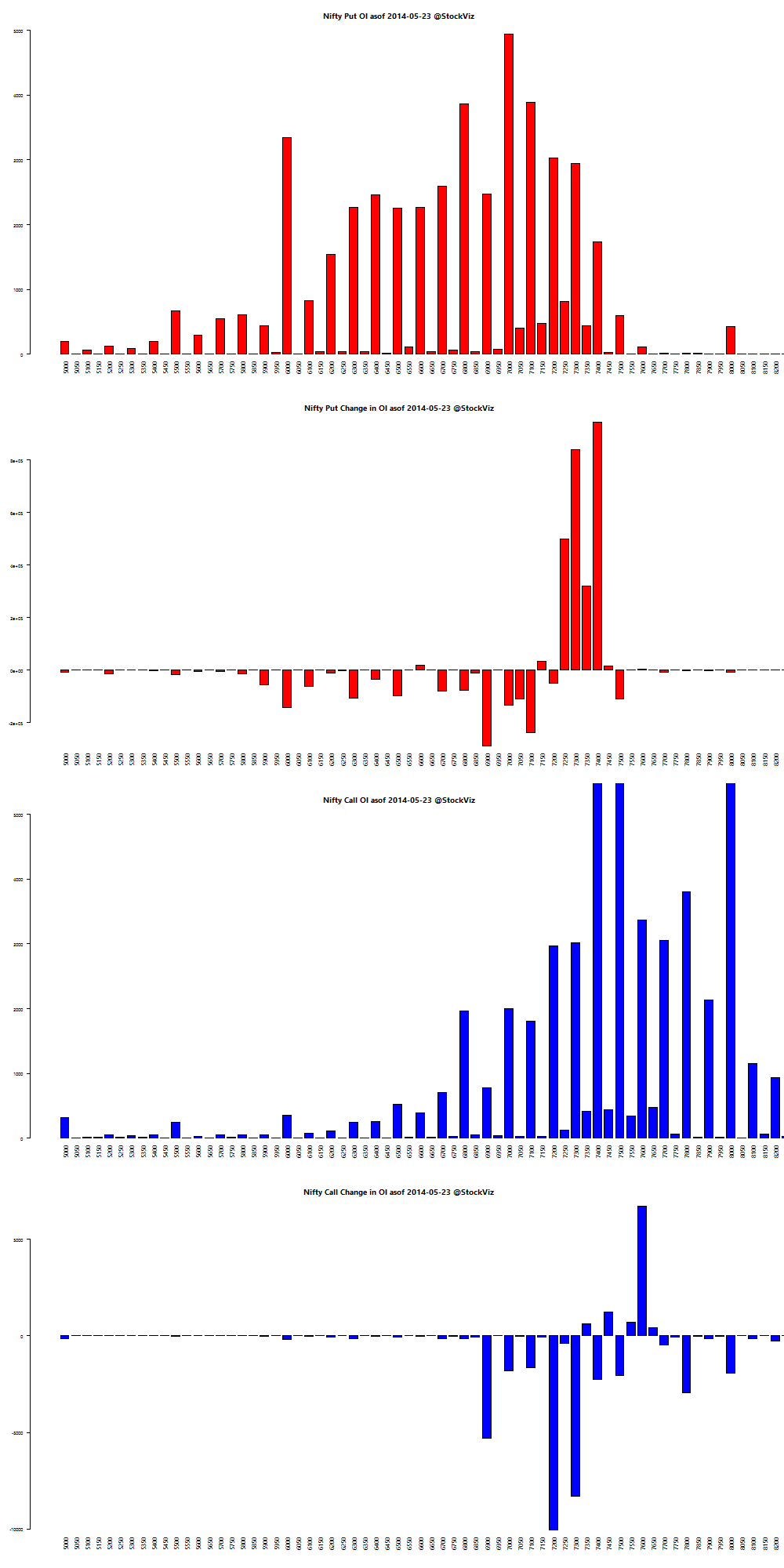

Because a covered call option strategy reflects an underlying position in equity (delta = 1) and being short a call with changing delta, we get the following situation:

- Baseline situation: equity delta = 1.0 and short call position delta = -0.5; net 0.5 delta

- In a falling market environment: equity delta = 1.0 and short call position delta = -0.25; net 0.75 delta, or higher market exposure

- In a rising market environment: equity delta = 1.0 and short call position delta = -0.75; net 0.25 delta, or lower market exposure

The insight: a covered call strategy embeds elements of a reversal strategy, not a trend-following strategy.

The cheat sheet

- Bearish on volatility? Don’t do a covered call.

- Bearish on the market? Don’t do a covered call.

- Like trend-following? Don’t do a covered call.

Sources

- Covered Calls and Their Unintended Reversal Bet (pdf)

- Own the Stock and Sell Calls: Guaranteed Win, Right? (AlphaArchitect)