Image by Getty Images via @daylife

Any discussion on inflation is incomplete without calling out its counterpart: deflation. According to Wikipedia, deflation is a decrease in the general price level of goods and services. Deflation occurs when the annual inflation rate falls below 0% (a negative inflation rate). Inflation reduces the real value of money over time; conversely, deflation increases the real value of money – the currency of a national or regional economy. This allows one to buy more goods with the same amount of money over time.

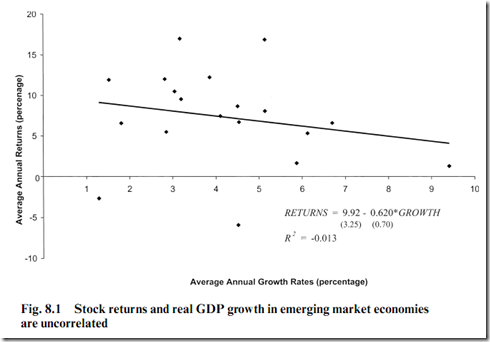

One can argue that deflation is the natural state of an advanced economy given the up-and-to-the-right advancement in technology. Technology is a natural deflator: it increases productivity (allows the same number of employees to produce more), Moore’s law gives us more processing power for the same dollar, it reduces communication costs (reducing the need to travel as much) and makes globalization more efficient (allowing businesses to shift production to lower wage/more productive regions). It also has the effect of making certain commodities irrelevant, for example, the invention of plastic tooth brushes caused a total collapse in the boar’s hair market.

However, technology deflation is a function of economies of scale and is more or less independent of monetary policy. New technologies and products come down in price over time, regardless of the state of the economy, monetary policy, or income distribution.

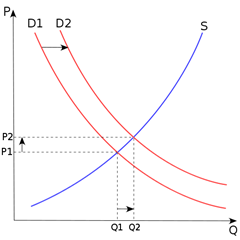

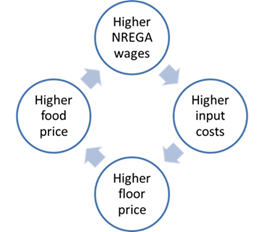

Another view of deflation is that it is caused a collapse in final demand. A fall in demand causes businesses to liquidate inventory and cut production. A cut in production would lead to cuts in workforce. Unemployment would further destroy demand, thereby creating a deflationary cycle. Since the same rupee can now buy more goods, it negatively affects people/companies who are in debt (you’ll have to repay today’s Rs. 90 debt a year from now with today’s Rs. 100, given a deflation of 10%.)

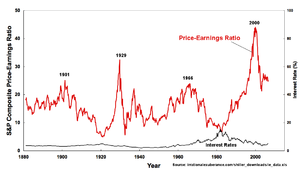

Given the high-debt loads of “important” industries, deflation is a bigger nightmare for governments and central banks than inflation. Given the recent actions of the US Fed and the UK Bank of England, it appears that there is no limit to what central banks will do to prevent deflation: set short-term rates to zero, print copious amount of new money, buy debt that nobody else wants and influence sentiment by fudging statistics.

To summarize: just like how inflation is the rise in general levels of prices of goods, deflation is a fall in price levels, usually brought on by a collapse in demand. Inflation tends to favour debtors while deflation favours savers.