Image via Wikipedia

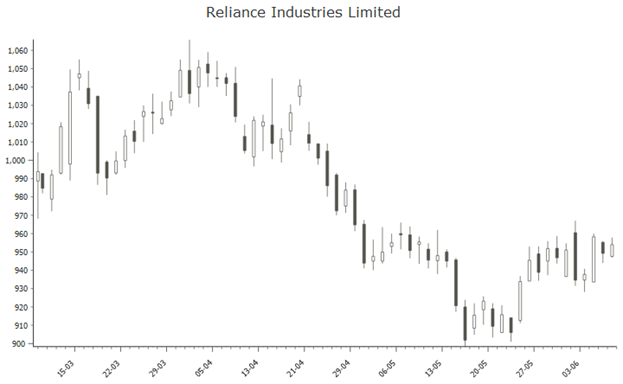

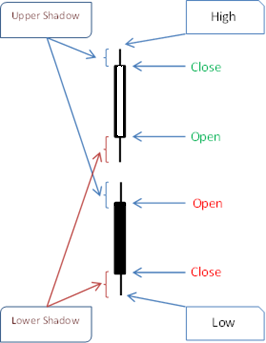

We had a look at candle-sticks, the most popular technical here. Lets turn our attention to fundamental investing. To recap, fundamental investing is based on metrics that are intrinsic to a company. Investors can choose from a broad range of fundamental investing styles to fit their temperament:

Value

Value investing was pioneered by Ben Graham and David Dodd right about the time of the Great Depression. Value investors, typically, buy stocks that trade at a discount to book value, pay out high dividends or have low PE ratios. It involves buying stocks with a “margin of safety”: the discount at which a stock trades to its intrinsic value.

Some characteristics of companies with good value:

- flexible cost structure: ability to reduce or increase costs depending on revenues

- competitive moat: ability to maintain competitive advantages in order to protect long-term profits and market share

- asset cushion: financial position to outlast a downturn

- FCF driven dividend growth: dividends need to get paid out in cash. This could either be through free-cashflow or by higher gearing.

- client base: a company should not be dependent on any one client for a large chunk of its business

In terms of performance, value investing is a lifestyle choice. There are periods where value investing underperforms the broader index. Also, just because something is “value” doesn’t mean that its market price cannot drop further (called the “value trap”).

For example, technology services companies such as HCL and Infosys are typical value plays.

Growth

Growth investors look for companies with strong growth potential. Growth stocks may appear over-valued while looking at standard PE or PB multiples, but the expectation of future earnings drive current prices higher.

Some questions that need to be answered while looking at growth stocks are:

- scalability: how quickly can the company scale operations, sales and distribution to match customer expectations?

- cost of capital: how expensive is it for the company to fund its growth

- dilution: what is the probability that the company will have to dilute existing equity holders to raise capital?

- path to profitability: how close is the company to break-even?

Chasing growth can be a volatile experience. A lot of future expectations are factored into the current price levels and any deviation from meeting those expectations can lead to sudden collapse in prices.

For example, stocks like IRB, GMR Infra trade at high PEs because the market expects a lot of growth in the near future.

Buy & Hold

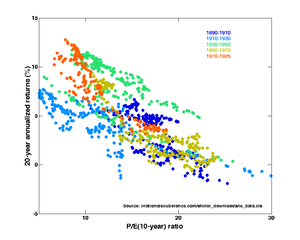

Buy and Hold investing, as the name suggests, is investing over a long term, typically in excess of 5 years. It goes hand-in-hand with constant-dollar-investing on an index through ETFs or low-cost mutual funds – investors invest a fixed amount of money on a broad, low-cost basket of securities. The idea is that as long as the fundamentals of the economy is strong (over a long term), investors keep buying an index (more when the index falls and less when it rises).

Combined with dividend reinvestment, buy & hold investing is practical for passive investors and has yielded better results compared to active investing when taking into account transaction costs and management fees.