This is a temporary post that was not deleted. Please delete this manually. (decec8b4-080d-45bb-bb33-55221887168f – 3bfe001a-32de-4114-a6b4-4005b770f6d7)

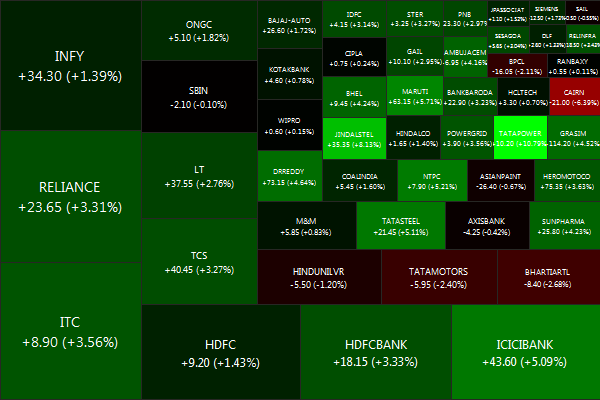

The NIFTY ended on a bullish note, shooting up +3.11% for the week. Biggest losers were CAIRN (-5.69%), BPCL (-2.52%) and TATAMOTORS (-1.88%). And the biggest winners were TATAPOWER (+10.79%), JINDALSTEL (+8.39%) and MARUTI (+6.14%).

Advancers lead decliners 42 vs 7

Gold: -1.64%, Banks: +2.95%. Infrastructure: +6.51%,

Europe soared on Friday following the summit agreement overnight. Stoxx 50 +4.9%, Germany +4.3%, France +4.7%, Italy +7% , Spain +5.8%, U.K. +1.4%.Dow +2.37% to 12901. S&P +2.7%. Nifty +2.52% to 5279

Some perspective from Floyd Norris: There has been 18 European summit meetings since the beginning of 2010, before this one; decisions seeming to indicate action were announced after 10. Over those 10 two-day stretches The MSCI European stock index was up 9.6%. But over the entire two-and-a-half-year period, the European stock index is down 17%. The pattern has been that relief because disaster was averted is followed by disappointment and eventually by a new crisis. Europe has found ways to fund whichever country (or banks) was in trouble, but has not found ways to enable those countries to become economically competitive while remaining in the euro zone. Read the while thing in NY Times.

“People need to stop spending money they don’t have. The solution to too much debt is not more debt. All this little agreement does is give them (banks) a chance to have even more debt for a while longer” – Jim Rogers

Also, FT collected all the EU-skepticism in one place.

Have a nice weekend!

Daily news summaries are here.

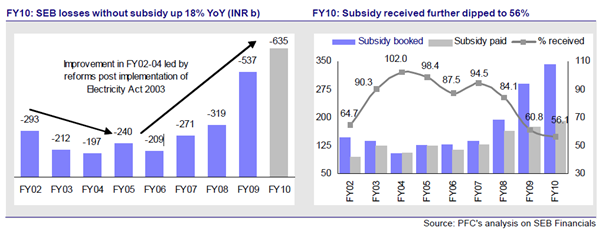

It’s do or die situation for the country’s precariously placed companies in the power sector, especially distribution companies (discoms) or state electricity boards (SEBs).

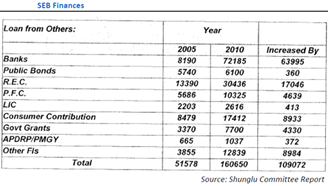

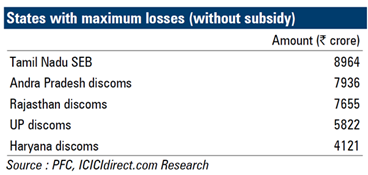

The Shunglu panel, set up by the Planning Commission, last year pegged accumulated losses of discoms at Rs 82,000 crore from 2006-10. The committee was set up to look into the financial health of discoms. The losses of SEBs indirectly impact the power producers since SEBs are the largest buyers of power in the country.

According to a report released by the 13th Finance Commission, these financial losses may increase to Rs. 116,089 crore by FY 2016-17, much higher than Rs 63,500 crore seen in FY 2010. Non-revision of tariffs and non-realisation of subsidies has severely plagued these entities.

According to a report released by the 13th Finance Commission, these financial losses may increase to Rs. 116,089 crore by FY 2016-17, much higher than Rs 63,500 crore seen in FY 2010. Non-revision of tariffs and non-realisation of subsidies has severely plagued these entities.

With debts at unmanageable levels and losses mounting, reports have hinted at a bailout for these distribution utilities that are tethering on the brink of bankruptcy. Is it a case of throwing good money after bad or will these companies get rid of their complacency and deliver hard-hitting reforms like raising power tariffs, eliminating theft and corruption through efficient delivery mechanisms?

Deteriorating financial position has handicapped SEBs ability to service debt. This has prompted banks to turn cautious in extending loans to the power sector as a whole. Nearly 70% of the SEB losses are financed by public sector banks. Some lenders have started insisting on riders like automatic pass-through of fuel costs and filing tariff petitions every year in their loan agreements with SEBs.

While a bailout is needed to avert a total blackout in the power sector, it must be backed by structural reforms like strict reduction in transmission and distribution losses and frequent revisions in tariffs to ease liquidity constraints faced by discoms.

Currently, regulatory framework for distribution utilities is marred due to political interference in tariff fixation.

The Shunglu panel has called for independence of the regulator, creation of a special purpose vehicle by the RBI to purchase the liabilities of distribution companies, non-creation of regulatory asset in the books of discoms, etc among other measures to prop up their finances.

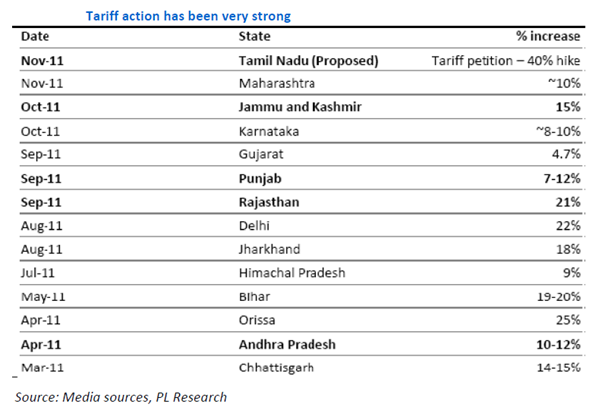

Several states have seen the writing on the wall. All the top 10 loss making states have revised tariffs in the past 18 months.

Several states have seen the writing on the wall. All the top 10 loss making states have revised tariffs in the past 18 months.

Delhi raised tariffs by 24% this week, the fourth such hike in the last 10 months, after distribution companies complained of severe financial strain due to the rising power purchase cost. Tamil Nadu proposed a tariff hike of 38% while Rajasthan raised rates by 24% in September 2011. The hikes will give some room for state distribution companies to repair their balance sheets.

While the recent tariff hikes have held out hope of a turnaround, SEBs must resort to sustainable measures like annual tariff petition filing, timely revision of tariff, increasing private participation in the distribution business, computerisation of accounts, better monitoring of funds, etc. The Shunglu committee has also called for stern action against state regulators if adequate tariff revisions are not undertaken and penal action against utilities for not filing annual accounts.

The financial health of distribution utilities is critical for the success of the power sector that will see a capacity addition of 85,000 mw during the 12th five-year plan.

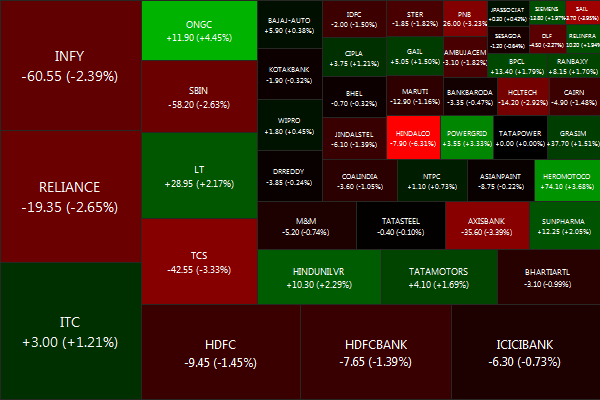

The NIFTY ended flat for the week.

Biggest losers were HINDALCO (-5.25%), TCS (-3.06%) and SAIL (-2.76%).

And the biggest winners were ONGC (+5.08%), HEROMOTOCO (+4.30%) and POWERGRID (+3.77%).

Advancers lead decliners 29 vs 20

Gold: -0.34%, Banks: +0.03%.

The week began with expectations that the RBI will cut rates – but all that the central bank did was to point a finger at the government and say “your turn.” Thursday saw the US Fed extending Operation Twist (selling short term treasuries while buying long-terms) but failing to deliver on hopes of QE3. You could say Bernanke did an RBI in that he too pointed a finger at the US government sad said “your turn.”

From an India perspective the benefits from a collapse in oil prices were negated by an almost proportional fall in the Rupee. The only thing that oil prices this low seem to be doing is laying waste to all the “alternative” energy company’s business models that require at least $100 oil.

With Europe throwing fits in the sandbox, anything can happen. Stay hedged!

Daily news summaries are here.

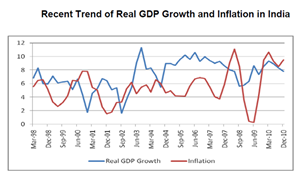

Inflation to India is what deflation is to Europe. The persistently high inflation since 2006, especially food prices, have raised serious structural economic concerns. It is no secret that RBI has failed miserably in controlling price pressure with its so-called interest rate hikes. While RBI has lost its face, the common man has lost his ‘weight’.

Several factors like capital stock deficiency, demand-side drivers, import price pressures, embedded inflation expectations, weak monsoon, etc have played their part at various intervals to keep food prices elevated for an elongated period of time.

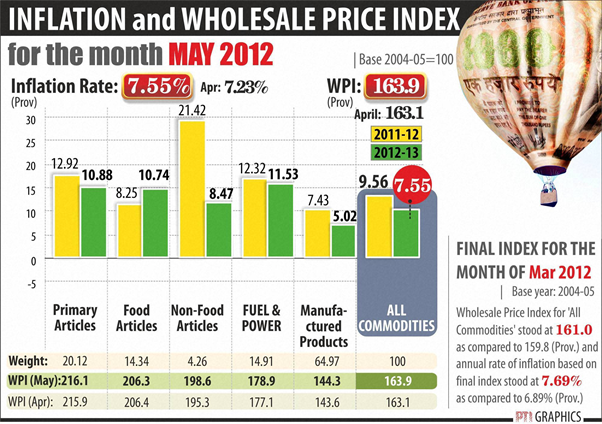

For the second month in a row, consumer price inflation- a more realistic cost-of-living index as it captures retail prices- remained at double-digit level in May.

Retail inflation rose 10.36% in May, marginally up from 10.26% in April. In cities, it was even higher at 11.52%, compared to 9.57% in rural India. The Wholesale Price Index (WPI)-based inflation in May stood at 7.55%.

The reason why RBI’s monetary tool has been ineffectual in taming inflation is because the current food price-driven inflation is fuelled by supply side constraints rather than just aggregate demand.

The reason why RBI’s monetary tool has been ineffectual in taming inflation is because the current food price-driven inflation is fuelled by supply side constraints rather than just aggregate demand.

Although current year production of cereals has been very strong, food inflation is still in double-digits as food consumption patterns have changed with the populace moving towards high protein food like milk, eggs fish, vegetables from cereals. While measures like centrally-sponsored welfare schemes, high subsidies, sixth pay commission wage hike, etc have boosted disposable income and created demand for goods and services, the government has been unable to increase supply to meet the rising demand. Inadequate infrastructure and lack of manufacturing capacity and poor stock management has meant grains continue to rot while humans go hungry.

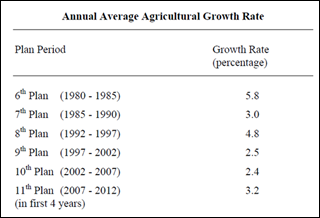

Instead of rooting for repo rate cuts, Pranab and co would do well to increase agricultural output and productivity to alleviate pressures on food prices. These would include a focus on technology, improved supply chain, water management, rural infrastructure, agricultural diversification, and private sector investment in marketing and agro industry. Reducing farm subsidies and raising productivity is needed to reform the agriculture sector.

Sustained wage pressure (thanks to MGNREGS, the government’s flagship employment programme and higher crop MSPs) has kept food price inflation high even in years of record food production as was the case in 2010-11.

Import price pressures have also been a crucial factor for overall inflation. Inadequate pass-through of international crude oil prices has failed to curb wasteful consumption leading to a high degree of suppressed inflation. Any rise in global commodity prices will put upward pressure on prices in India.

Import price pressures have also been a crucial factor for overall inflation. Inadequate pass-through of international crude oil prices has failed to curb wasteful consumption leading to a high degree of suppressed inflation. Any rise in global commodity prices will put upward pressure on prices in India.

Recent RBI survey pattern reveals high inflation expectations among Indian households. Since food price hikes are driven by supply-side shocks, it has led to speculative behaviour by traders, thus feeding into high inflation expectations. The onion crisis in late-2010 is a stark example of this.

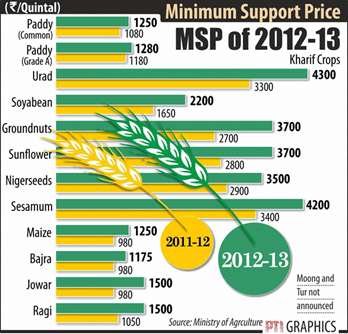

Also, the steep hike in minimum support prices (MSP) of various kharif crops last week and in the last five years have added to the structural uptrend in food price inflation and complicated RBI’s job. The sharp MSP hike, at a time of high inflation also shows the utter lack of policy co-ordination between the central bank and the government in achieving price stability.

Also, the steep hike in minimum support prices (MSP) of various kharif crops last week and in the last five years have added to the structural uptrend in food price inflation and complicated RBI’s job. The sharp MSP hike, at a time of high inflation also shows the utter lack of policy co-ordination between the central bank and the government in achieving price stability.

While hyperinflation may be a matter of history, India is in the midst of an inflationary spiral that threatens to push economy into further chaos.