In India, there are about 6,00,000 villages, but out of these only 60,000 villages have banking facilities which means 90 % of the villages are unbanked. Against such a grim background, the Reserve Bank of India’s (RBI) recent decision to issue new licences to private corporates and public sector entities has aroused renewed hopes of improving banking services in unbanked areas.

Since India has opted for a bank-driven model to achieve financial inclusion, banks will play a crucial role in the whole process of inclusive growth.

So far, RBI has made the right noises as far as improving financial inclusion is concerned saying banks must view it as a business opportunity rather than an obligation. While issuing guidelines for bank licences in February, RBI had said, “The business plan of applicants will have to address how the bank proposes to achieve financial inclusion.”

While the intent of institutions and regulators is little to doubt, they have all come a cropper as far as execution is concerned and it is high time that we differentiate the ‘doers’ from the ‘talkers’?

Financial inclusion has been a dud so far due to lack of technology, lack of a viable business model, higher cost of transactions and absence of reach and coverage, etc.

Every year, the government spends thousands of crores (Rs 14,000 crore in 2013-14) in recapitalising public sector banks to enable timely and adequate credit and other financial services to the weaker sections and low income groups. However, PSU banks have failed to extend basic banking services to the ‘bottom of the pyramid’ due to various factors like lack of clear policy framework and poor infrastructure and execution, resulting in financial inclusion remaining only on paper.

Institutions must overcome primary challenges like high cost of transactions, huge initial investments to create the necessary infrastructure and other expenses like financial education for the poor before financial inclusion can yield dividends.

But in this era of cut-throat competition, where banks are constantly driven by higher interest margins and intoxicated by the ideology of profit maximisation, asking bankers and financial executives to opt for social banking is a conflicting proposition that makes for a great headline but will make little headway.

Past efforts like nationalisation of banks, Lead Bank Scheme, development of Regional Rural Banks and formation of Self-Help Groups to take banking services to the masses have failed to increase penetration. Even the much-famed business correspondents (BCs) model has been a laggard.

In this context, a critical question that matters is- will corporates be able to design and deliver innovative financial services at affordable cost?

Corporates must create better awareness about banking facilities and design products which are poor-centric to ensure that the poor shed their inhibitions while approaching a bank.

Another area that corporates must grapple with is the high clout that politicians and bureaucrats wield in rural areas. Driven by electoral gains, many politicians exercise undue influence to push PSU banks to extend agricultural credit and other goodies to rural households, particularly close to elections. (Example- Rs 52,000 crore Farm Loan waiver.)

In the case of the farm loan waiver, a lot of funds, aimed at poor farmers, were allegedly diverted by middlemen and politicians. The mandate for corporates is to use financial inclusion to effectively check corruption and empower the poor.

But since they have been mandated to open only 25% of the branches in unbanked areas, it is hard to figure out if they can make any meaningful impact in addressing financial inclusion.

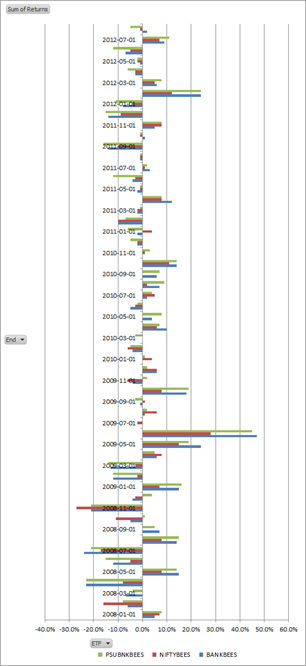

[stockquote]PSUBNKBEES[/stockquote] [stockquote]BANKBEES[/stockquote]