One of Thomas Friedman‘s theses states that individual countries must sacrifice some degree of economic sovereignty to global institutions, a situation he has termed the “golden straitjacket.”

From his book, The Lexus and the Olive Tree:

To fit into the Golden Straitjacket a country must either adopt, or be seen as moving toward, the following golden rules:

- making the private sector the primary engine of its economic growth,

- maintaining a low rate of inflation and price stability,

- shrinking the size of its state bureaucracy,

- maintaining as close to a balanced budget as possible, if not a surplus,

- eliminating and lowering tariffs on imported goods,

- removing restrictions on foreign investment,

- getting rid of quotas and domestic monopolies,

- increasing exports,

- privatizing state-owned industries and utilities,

- deregulating capital markets,

- making its currency convertible,

- opening its industries, stock and bond markets to direct foreign ownership and investment,

- deregulating its economy to promote as much domestic competition as possible,

- eliminating government corruption, subsidies and kickbacks as much as possible,

- opening its banking and telecommunications systems to private ownership and competition, and

- allowing its citizens to choose from an array of competing pension options and foreign-run pension and mutual funds.

When you stitch all of these pieces together you have the Golden Straitjacket.

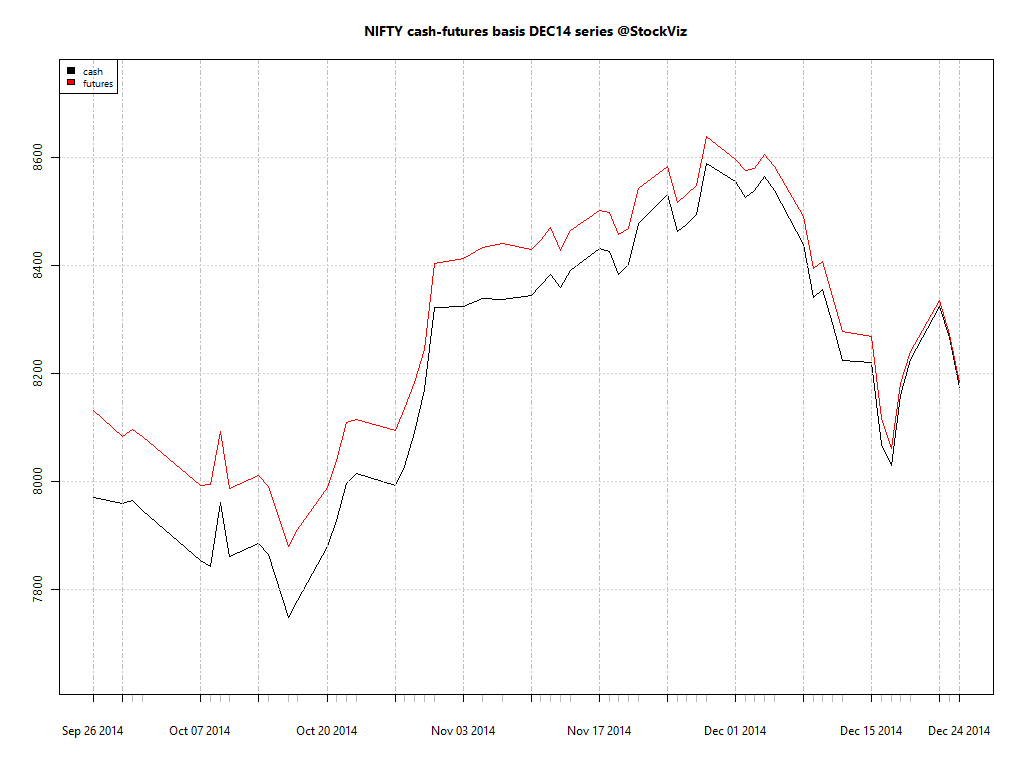

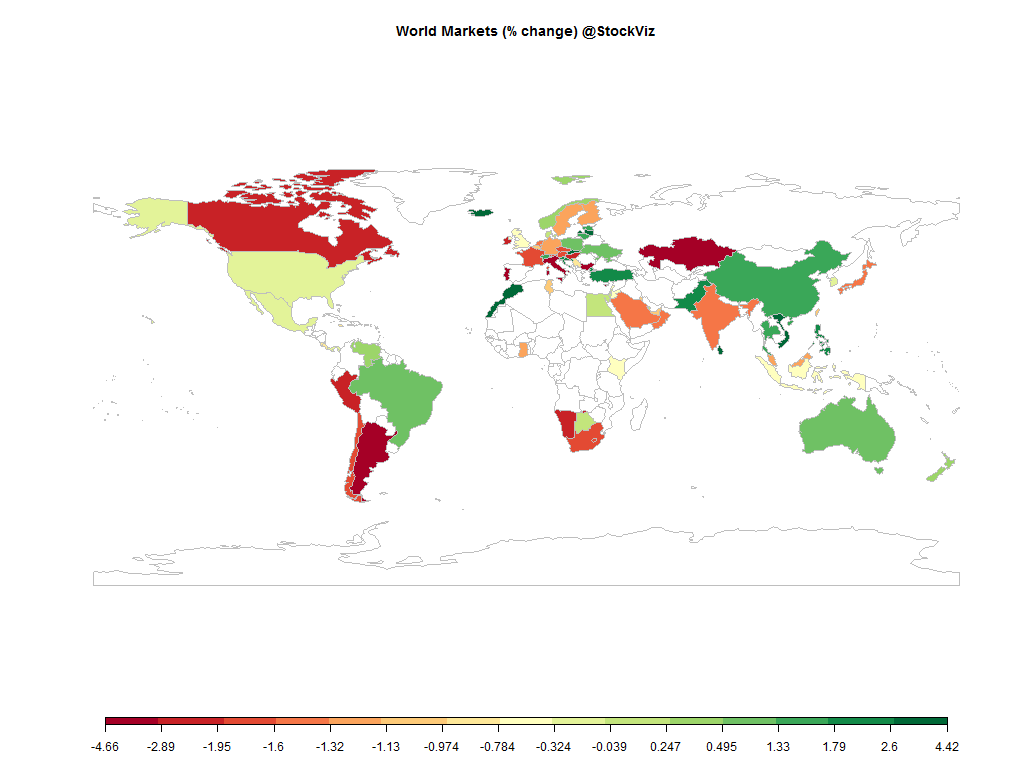

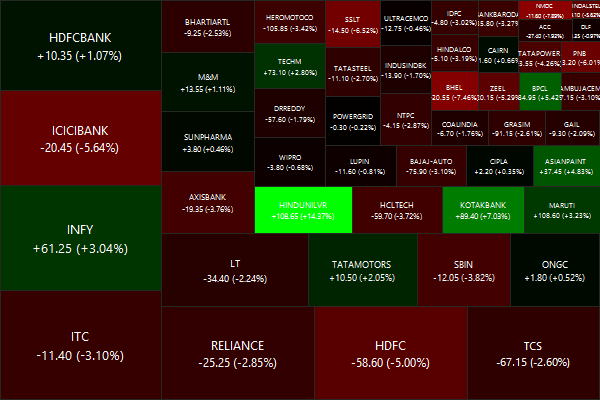

As your country puts on the Golden Straitjacket, two things tend to happen: your economy grows and your politics shrinks. That is, on the economic front the Golden Straitjacket usually fosters more growth and higher average incomes — through more trade, foreign investment, privatization and more efficient use of resources under the pressure of global competition. But on the political front, the Golden Straitjacket narrows the political and economic policy choices of those in power to relatively tight parameters. Governments — be they led by Democrats or Republicans, Conservatives or Labourites, Gaullists or Socialists, Christian Democrats or Social Democrats — that deviate too far from the core rules will see their investors stampede away, interest rates rise and stock market valuations fall.

Will the Modi-Jaitley duo make this budget the budget of the Golden Straitjacket? Or are they going to stick to the UPA/Congress playbook of rent extraction? Fingers crossed…