Yearly Nifty and Defty Returns

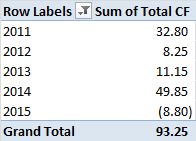

When you look at the last 24 years of returns, the NIFTY gave negative returns for 8 years – 1/3rd of the time.

Holding period matters

The most frequent advice given to new equity investors is that they should at least have a 3-year horizon. The problem with this is that there have been 7 periods where cumulative 3-year returns have been negative or single digits. This sort of advice does nothing to mentally prepare the investor to stay disciplined.

In fact, dollar investors (NRIs, etc.) have had it rougher.

It is only when you look at 7-years and beyond that you start seeing the kind of returns that begin to make sense.

Long-term portfolio but short-term horizon

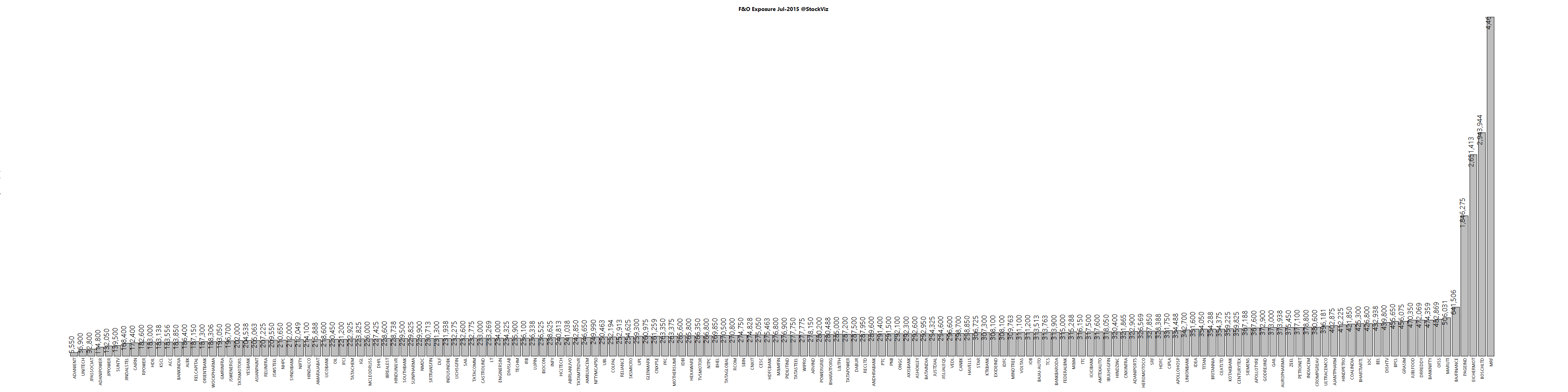

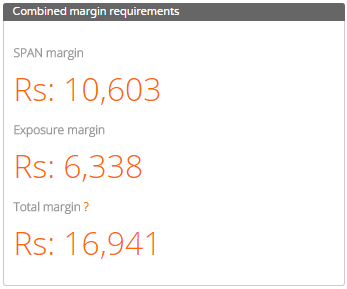

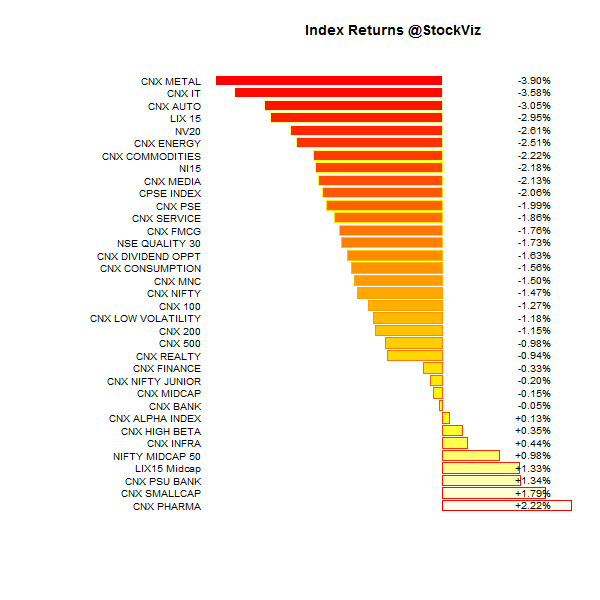

Very often, advisors set up portfolios looking at this:

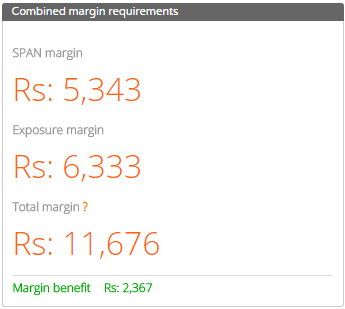

Whereas the media is feeding the investor this:

Long-term investing works if you have the discipline to ignore portfolio returns over very long time horizons. But how many of us have the discipline to stay the course over decades?