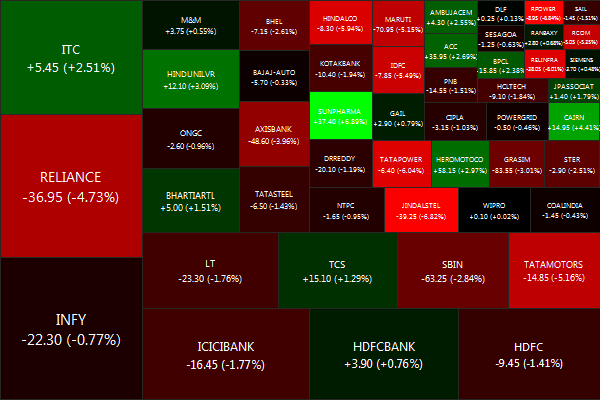

Gone are the heady days of blowout earnings and record revenues. All that has given way to defaults, debt restructuring and distress sale. The once blue-eyed boys of corporate India are now in deep red, giving blues to investors and lenders.

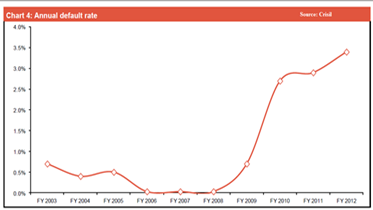

Corporate credit defaults surged to the highest in a decade last fiscal with textiles, steel and construction & engineering sectors accounting for a quarter of total defaults, according to  rating agency CRISIL. It noted that 3.4% of the companies it rates defaulted on its debts.

rating agency CRISIL. It noted that 3.4% of the companies it rates defaulted on its debts.

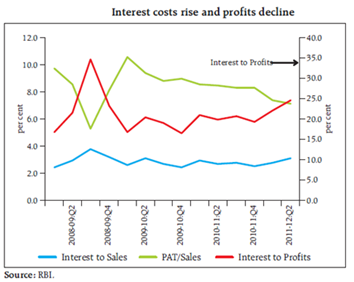

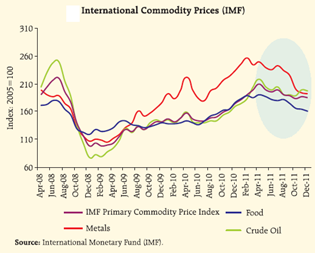

Rising input and interest costs coupled with slackening demand and weak pricing power have impacted corporate margins. Therefore, servicing of loans has come under stress. CRISIL adds that weak liquidity caused by elongation of working capital cycles have led to defaults. Companies like Bharati Shipyard, Kingfisher, GTL Ltd, Hindustan Construction Co, etc have managed to restructure their debt or sought approvals, thus avoiding default on their existing debts.

Domestic funding has been hit hard in the last 18 months, thanks to the record 13 times (175 bps) hike in repo rate since March 2010. Asset quality stress has permeated into the health of banks. Between March 31 and December 31, 2011, gross NPAs of banks rose to 2.9% of advances from 2.3% while the quantum of restructured debt spiked to 3.3% of advances from 2.5%. Higher provisioning requirements as a result of rising non-performing assets will dent the profitability of banks.

Domestic funding has been hit hard in the last 18 months, thanks to the record 13 times (175 bps) hike in repo rate since March 2010. Asset quality stress has permeated into the health of banks. Between March 31 and December 31, 2011, gross NPAs of banks rose to 2.9% of advances from 2.3% while the quantum of restructured debt spiked to 3.3% of advances from 2.5%. Higher provisioning requirements as a result of rising non-performing assets will dent the profitability of banks.

Going forward, pressure on corporates’ balance sheet is expected to ease due to lower interest rates, softening of commodity prices  and flexibility to defer capital expenditure. But credit quality may take time to recover as interest rates are only expected to decline at a slower pace while global demand, especially in the Eurozone, looks wobbly.

and flexibility to defer capital expenditure. But credit quality may take time to recover as interest rates are only expected to decline at a slower pace while global demand, especially in the Eurozone, looks wobbly.

Even as more companies opt for Corporate Debt Restructuring (CDR) or moratorium on loan payments, lenders can learn a lesson or two from these events. Their aggressive lending practices during the preceding boom years coupled with lack of due diligence and laxity in monitoring of loan accounts are also to blame for the deterioration in their asset quality. Banks would do well to tighten the screws from their end to insulate themselves in stressful situations.

[stockquote]KFA[/stockquote] [stockquote]CRISIL[/stockquote] [stockquote]GTL[/stockquote] [stockquote]BHARTISHIP[/stockquote] [stockquote]HCC[/stockquote]

![clip_image002[5]](http://stockviz.biz/wp-content/uploads/2012/04/clip_image0025_thumb.jpg)

![clip_image001[5]](http://stockviz.biz/wp-content/uploads/2012/04/clip_image0015_thumb.png)

![clip_image001[6]](http://stockviz.biz/wp-content/uploads/2012/03/clip_image0016_thumb1.png)

![clip_image001[8]](http://stockviz.biz/wp-content/uploads/2012/03/clip_image0018_thumb.png)