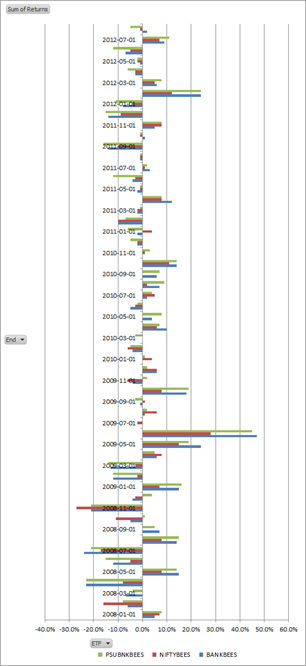

PSU banks [stockquote]PSUBNKBEES[/stockquote] have under-performed the market this year, up just 7% vs. the sector’s [stockquote]BANKBEES[/stockquote] 22% and the market’s [stockquote]NIFTYBEES[/stockquote] 9%. 2011 was not kind to the dinosaurs either, -42% vs. the Nifty’s not so great -16%.

In fact, the only time the PSUs outperformed by a meaningful measure was during the panic of 2008, where they tanked less than the rest of the market.

The gloom and doom scenario includes rising NPAs, pension provisions and rising costs leading to more capital raises. Besides, given the experience of minority shareholders in the government owned Coal India [stockquote]COALINDIA[/stockquote], FIIs have been fleeing from public sector companies in general.

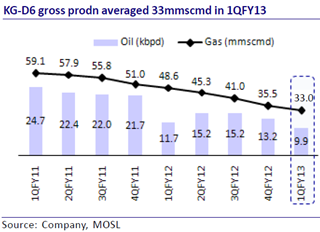

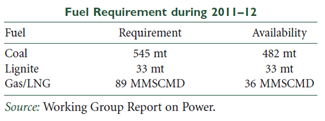

PSU banks are overexposed to bankrupt state electricity boards, with no glimmer of hope in the horizon. And given the weak monsoon, the direct exposure these banks have to the agriculture sector might land a double whammy in 2012.

But given the 35% drop since 2011, this sector is worth a second look. The Finance Minister is making the right noises regarding the deficit. The monsoon may not turn out to be all that bad after all. NPAs are getting worked through and it looks like banks will be exiting 2012 with a decent balance sheet. Besides, the yield curve is positive, so the banks don’t have to try too hard to make money. The 2012 budget has sanctioned Rs. 15,888 crore to be provided for capitalization of public sector banks and financial institutions to get them Basel III compliant, so the capital situation is not that bad.

Currently the PSU Bank ETF looks like its resting on a weak support at Rs. 300 and the near-term upside seems limited. However, if it heads towards Rs. 250, be prepared to pull the trigger.

PSU banks should on every investors radar. Remember Warren Buffett: “Buy what everybody hates”