Introduction

Our previous post looked at the 10 best mutual funds based on sharpe ratio, bear-beta, information ratio, draw-down depth and draw-down length between Jan-2010 and May-2015. Here are the 10 worst funds based on the same metrics.

As you can imagine, infrastructure funds performed poorly in this time-frame. We ignore them for now.

Sharpe Ratio

| Fund | SHARPE | IRR |

|---|---|---|

|

0.00

|

-0.16

|

|

|

0.01

|

0.23

|

|

|

0.01

|

0.79

|

|

|

0.02

|

1.18

|

|

|

0.02

|

0.87

|

|

|

0.02

|

1.56

|

|

|

0.02

|

1.37

|

|

|

0.02

|

1.38

|

|

|

0.02

|

1.69

|

|

|

0.02

|

1.56

|

Bear-Beta

| Fund | BETA BEAR | IRR |

|---|---|---|

|

1.19

|

1.18

|

|

|

1.12

|

3.11

|

|

|

1.05

|

5.74

|

|

|

1.03

|

0.23

|

|

|

1.01

|

1.69

|

|

|

1.00

|

4.32

|

|

|

0.97

|

5.79

|

|

|

0.96

|

2.02

|

|

|

0.95

|

1.56

|

|

|

0.93

|

7.76

|

Information Ratio

| Fund | IR | IRR |

|---|---|---|

|

-1.14

|

0.23

|

|

|

-0.81

|

0.79

|

|

|

-0.75

|

0.87

|

|

|

-0.75

|

-0.16

|

|

|

-0.67

|

1.18

|

|

|

-0.62

|

1.37

|

|

|

-0.51

|

1.49

|

|

|

-0.49

|

1.71

|

|

|

-0.49

|

1.56

|

|

|

-0.48

|

1.57

|

Draw-down Depth

| Fund | DRAW DEPTH | IRR |

|---|---|---|

|

-54.39

|

1.18

|

|

|

-52.28

|

3.11

|

|

|

-51.83

|

0.23

|

|

|

-46.87

|

0.79

|

|

|

-44.69

|

5.79

|

|

|

-42.41

|

1.56

|

|

|

-42.38

|

1.69

|

|

|

-41.63

|

0.87

|

|

|

-40.74

|

8.64

|

|

|

-40.61

|

5.74

|

Draw-down Length

| Fund | DRAW LENGTH | IRR |

|---|---|---|

|

1092.00

|

0.23

|

|

|

932.00

|

0.79

|

|

|

842.00

|

5.79

|

|

|

840.00

|

1.56

|

|

|

838.00

|

1.18

|

|

|

824.00

|

0.87

|

|

|

822.00

|

2.42

|

|

|

820.00

|

3.11

|

|

|

808.00

|

2.02

|

|

|

807.00

|

2.06

|

Past Performance

| Fund | BETA | IRR |

|---|---|---|

|

0.52

|

-0.16

|

|

|

1.09

|

0.23

|

|

|

0.82

|

0.79

|

|

|

0.84

|

0.87

|

|

|

1.01

|

1.12

|

|

|

1.18

|

1.18

|

|

|

0.85

|

1.37

|

|

|

0.73

|

1.38

|

|

|

0.26

|

1.44

|

|

|

0.75

|

1.49

|

Conclusion

Mutual funds are marketed as wealth builders. However, the truth is that most of them struggle. As you can see from the analysis here, there are quite a few of them with low-single-digit returns over 5-year time-frames. At last count, there were more than 5300 different schemes that you could choose from.

Are you getting the right advise? Get in touch with us if you are looking to invest! Call us or Whatsapp us at +918026650232

Introduction

Mutual fund investors are faced with a zillion choices in the marketplace. At last count, there were more than 5300 different schemes that an investor could choose from. When confronted with such a large number of choices, investors either spiral into an “analysis paralysis” mode and end up doing nothing or blindly invest in whatever their broker recommends – both these paths lead to situations that are injurious to the investor’s long-term financial health.

In this post, we try to simplify the choices in front of the investor by ranking the top 10 funds based these risk metrics: sharpe ratio, bear-beta, information ratio, draw-down depth and draw-down length between Jan-2010 and May-2015.

Sharpe Ratio

| Fund | SHARPE | IRR |

|---|---|---|

|

0.35

|

2.12

|

|

|

0.10

|

24.25

|

|

|

0.09

|

17.14

|

|

|

0.08

|

3.87

|

|

|

0.08

|

2.14

|

|

|

0.08

|

3.67

|

|

|

0.07

|

5.79

|

|

|

0.07

|

17.29

|

|

|

0.07

|

5.57

|

|

|

0.07

|

8.11

|

Glad to see the two MNC funds that we have been recommending our clients make the top end of this list.

But also note the single digit IRR funds.

Bear-Beta

| Fund | BETA BEAR | IRR |

|---|---|---|

|

-0.03

|

2.12

|

|

|

0.05

|

4.81

|

|

|

0.08

|

1.56

|

|

|

0.20

|

2.14

|

|

|

0.25

|

3.87

|

|

|

0.27

|

2.71

|

|

|

0.30

|

3.67

|

|

|

0.33

|

2.81

|

|

|

0.37

|

2.86

|

|

|

0.41

|

2.37

|

Given the single digit IRRs that test will for this metric, investors can ignore the bear-beta.

Information Ratio

| Fund | IR | IRR |

|---|---|---|

|

2.05

|

15.96

|

|

|

1.95

|

13.96

|

|

|

1.84

|

16.84

|

|

|

1.83

|

17.31

|

|

|

1.73

|

13.27

|

|

|

1.71

|

15.23

|

|

|

1.69

|

12.55

|

|

|

1.57

|

24.25

|

|

|

1.55

|

13.35

|

|

|

1.53

|

17.29

|

This is probably a better metric than the Sharpe ratio to rank funds.

Nice to see that both the Value Discovery fund and an MNC fund make this list.

Draw-down Depth

| Fund | DRAW DEPTH | IRR |

|---|---|---|

|

-0.35

|

2.12

|

|

|

-7.46

|

3.87

|

|

|

-9.69

|

2.14

|

|

|

-10.87

|

3.67

|

|

|

-11.57

|

2.81

|

|

|

-12.05

|

2.71

|

|

|

-12.06

|

2.86

|

|

|

-13.00

|

5.57

|

|

|

-13.26

|

7.30

|

|

|

-13.81

|

2.37

|

For example, the Blended Plan at the top of the list only lost 0.35% from its peak valuation between 2010 and 2015.

Portfolios with a lot of short-term bonds test well for this metric. But note the pathetic IRRs – no pain = no gain!

Draw-down Length

| Fund | DRAW LENGTH | IRR |

|---|---|---|

|

110.00

|

2.86

|

|

|

126.00

|

8.11

|

|

|

126.00

|

7.30

|

|

|

128.00

|

5.57

|

|

|

140.00

|

17.14

|

|

|

141.00

|

24.25

|

|

|

158.00

|

3.67

|

|

|

190.00

|

4.81

|

|

|

194.00

|

1.71

|

|

|

207.00

|

1.44

|

Shorter bounce-backs typically indicate high-quality portfolios.

Nice to see both the MNC funds make this list.

Past Performance

| Fund | BETA | IRR |

|---|---|---|

|

0.55

|

24.25

|

|

|

0.78

|

17.31

|

|

|

0.69

|

17.29

|

|

|

0.54

|

17.14

|

|

|

0.73

|

16.84

|

|

|

0.76

|

15.96

|

|

|

0.76

|

15.23

|

|

|

0.80

|

13.96

|

|

|

0.74

|

13.35

|

|

|

0.78

|

13.27

|

Conclusion

We looked at broad spectrum of funds – including those with bond allocations – to ferret out a good set of funds that investors can consider. Depending on what is more important to the investor, the appropriate set of metrics can be weighted to fit individual risk appetites.

Mutual fund investors whom we advise will immediately recognize some of these funds as they are already part of their portfolios. Get in touch with us if you are looking to invest! Call us or Whatsapp us at +918026650232

Recap

We began the exploration of a practical way to execute momentum using derivatives. We found that:

- A lookback period of one year works best (Part I)

- Because of survivorship bias, long-short underperforms long-only (Part II)

- Hedging with single-name put options doesn’t work(Part III)

- Larger long-only portfolios have smaller drawdowns and better performance than smaller long-only portfolios (Part III)

Conclusion

The way things stand, Momentum is best executed using a broad basket of stocks. There is no mechanical way to maintain a momentum driven derivative portfolio. You can explore long-only equity momentum here.

Introduction

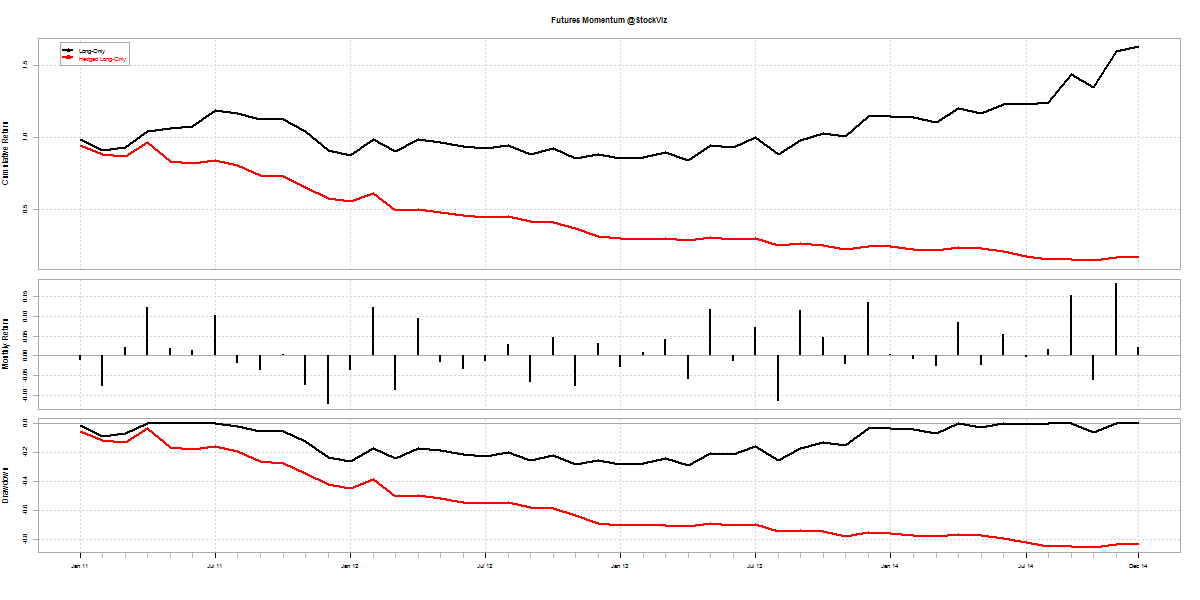

In Part II of our Practical Momentum series, we saw how adding a volatility adjustment significantly improved portfolio returns. However, we were left with a nagging observation that long-only returns were much higher than long-short returns. The problem with a long-only futures portfolio is that draw-downs can wipe you out. But what if we hedged the portfolio?

You can hedge a portfolio in two ways: (a) buy individual put options, and (b) calculate the beta of the portfolio and short an appropriate multiple of NIFTY futures. The problem with option (b) is that it will not protect you against idiosyncratic risk. For example, say you are long a pharma stock and the USFDA issues an import alert, the stock will tank irrespective of the NIFTY. So for the purposes of this simulation, we will try option (a)

Hedged Long-Only Momentum

With 5 long-futures hedged with long put-options below the purchase price:

black line shows long-only; red shows hedged long-only

A portfolio hedged with single-name put options performs poorly:

- There is always a d between the option payout and the underlying

- ?-decay eats away more of the option value than the protection it offers

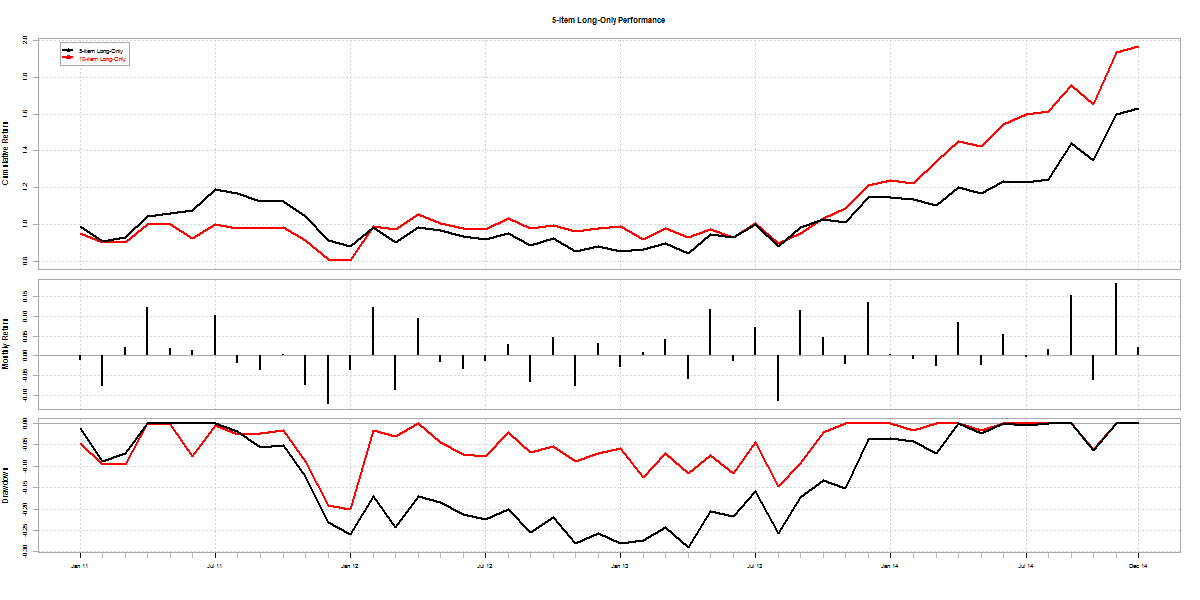

Another way to make draw-downs shallower is to diversify. When we increased the number of stocks in our long-only equity momentum portfolio from 10 to 20, it reduced portfolio volatility and boosted returns. Here’s how a 10-count long-only momentum portfolio compares with the 5 from above:

black line shows a 5-item long-only portfolio returns; red shows 10

Conclusion

The problem with leveraged momentum is that losses can wipe you out. Hedging it with single-name options doesn’t work. Are we stuck with unlevered momentum? We will explore this in the next post. Stay tuned!

Introduction

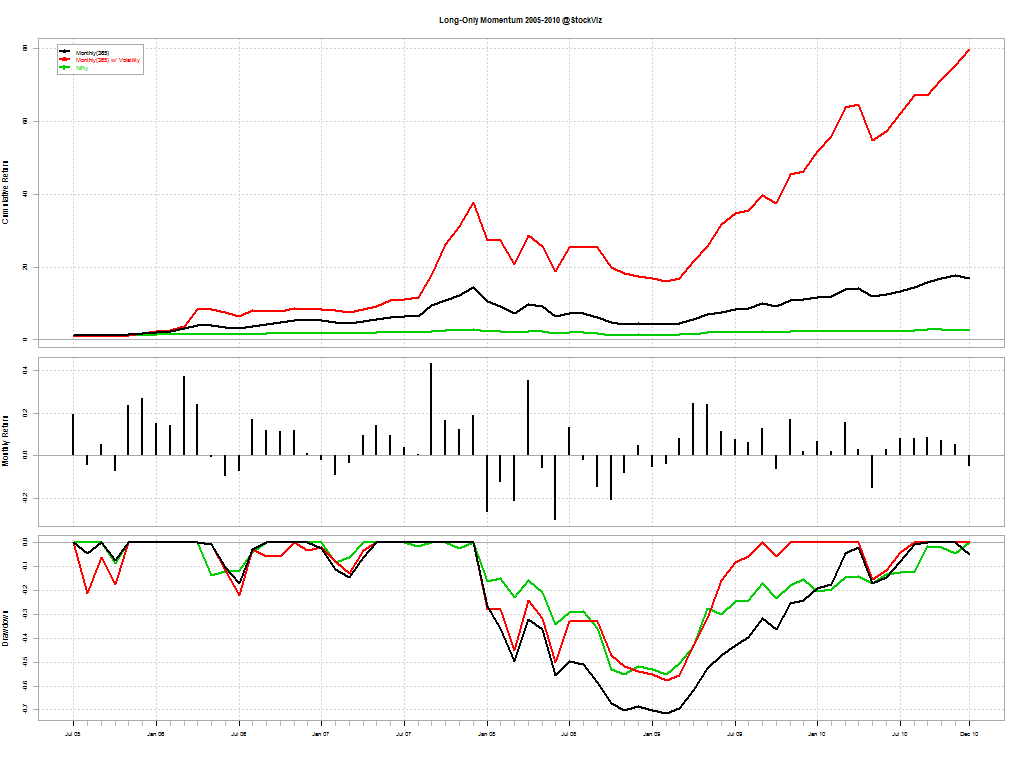

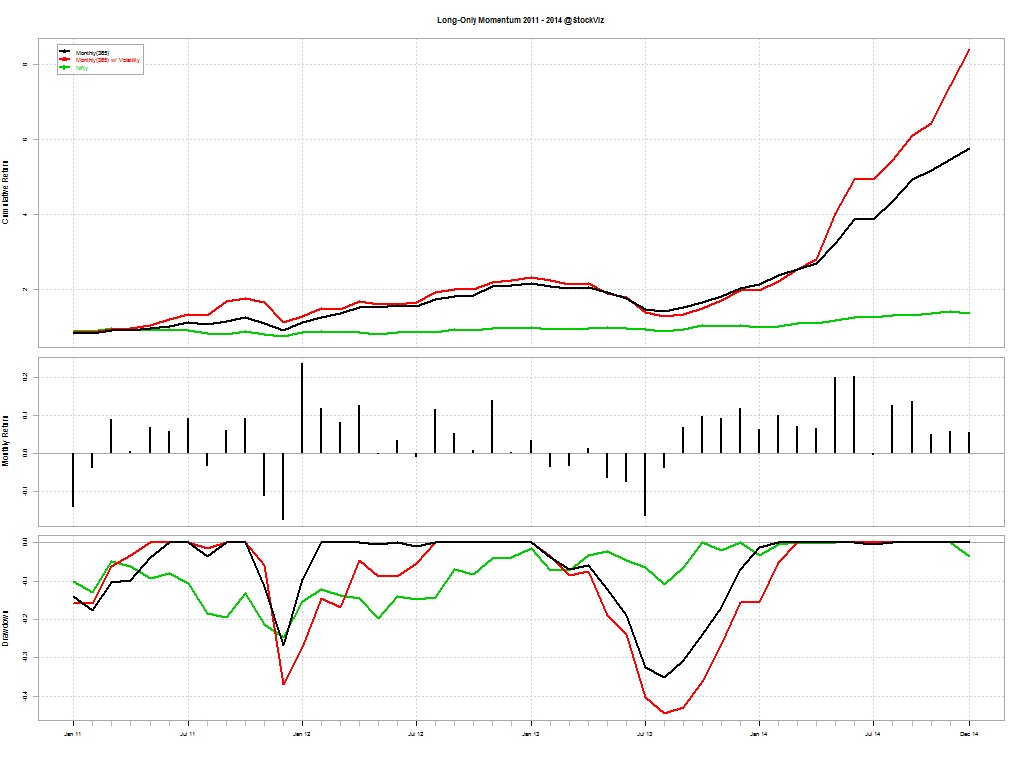

Previously, we ran back-tests on long-only and long-short momentum algorithm over a couple of look-back periods. We found that (a) momentum with a one-year look-back period out-performed one with a 100-day look-back, and (b) a long-only portfolio significantly out-performed a long-short portfolio. We hypothesize that this is probably because the universe of stocks that we are forced to consider was heavily plucked. But what if we added a volatility metric into the mix to smooth out draw-downs?

Long-only Momentum

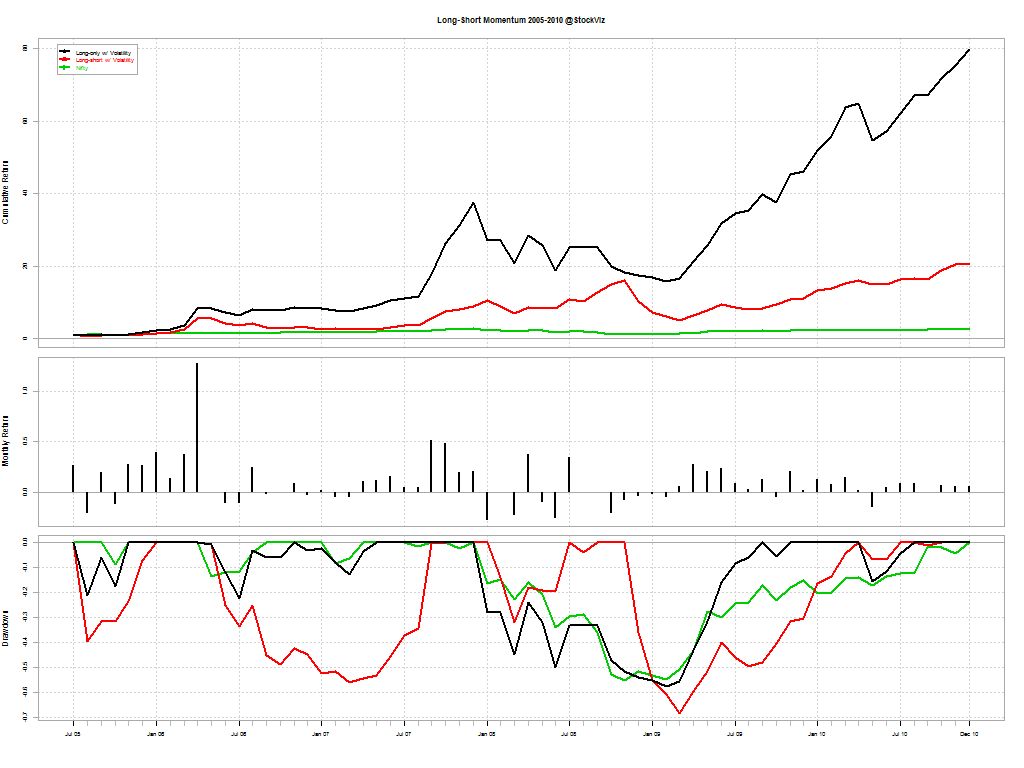

First, lets take a look at the long-only portfolio; both with a one-year look-back:

The red line is the volatility adjusted momentum; black is naive momentum; and green is buy & hold Nifty

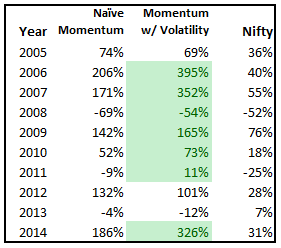

By year:

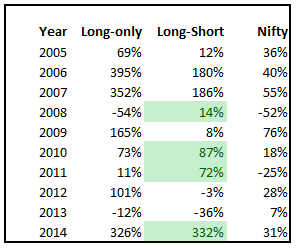

Long-short Momentum

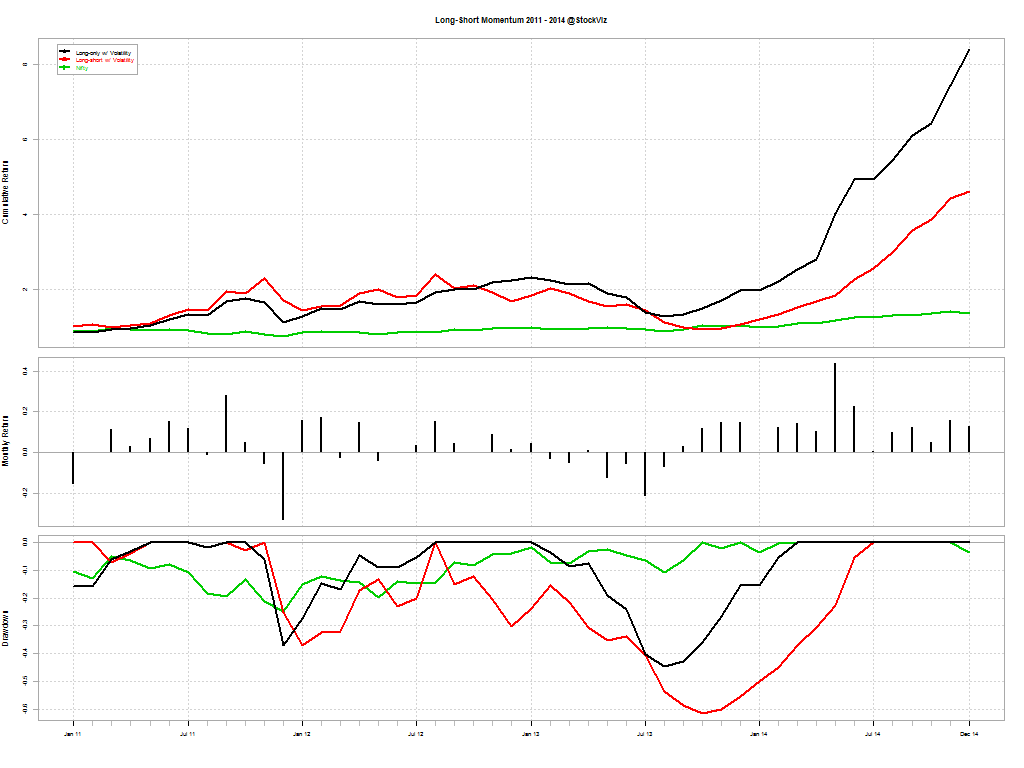

Long-short ended up under-performing long-only once again:

The red line is long-short momentum; black is long-only momentum; and green is buy & hold Nifty

By year:

Conclusion

Over the long run, long-only momentum with volatility adjustment outperformed the long-short version. However, while long-only tanked with the rest of the market in 2008, long-short was in the green. So if you are one of those guys who ask “how did this strategy perform in 2008?” Well, it performed pretty well. But would you have stuck by it when it got shellacked in 2013?

The problem with steep drawdowns is that it makes implementing the strategy with derivatives or leverage difficult. Margin calls might force you to abandon the strategy just before it turns. Next, we will explore a hedged long-only momentum strategy. Stay tuned!