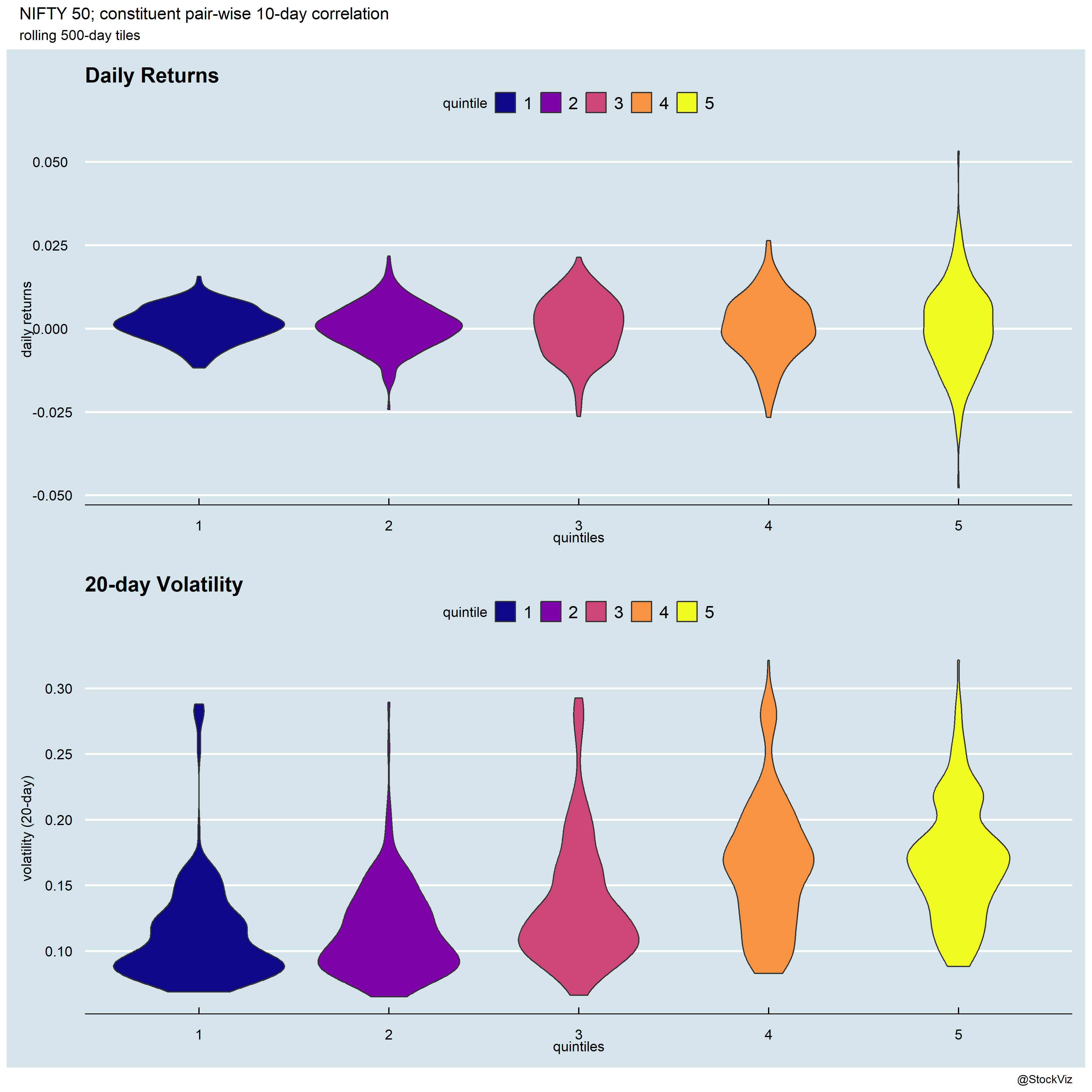

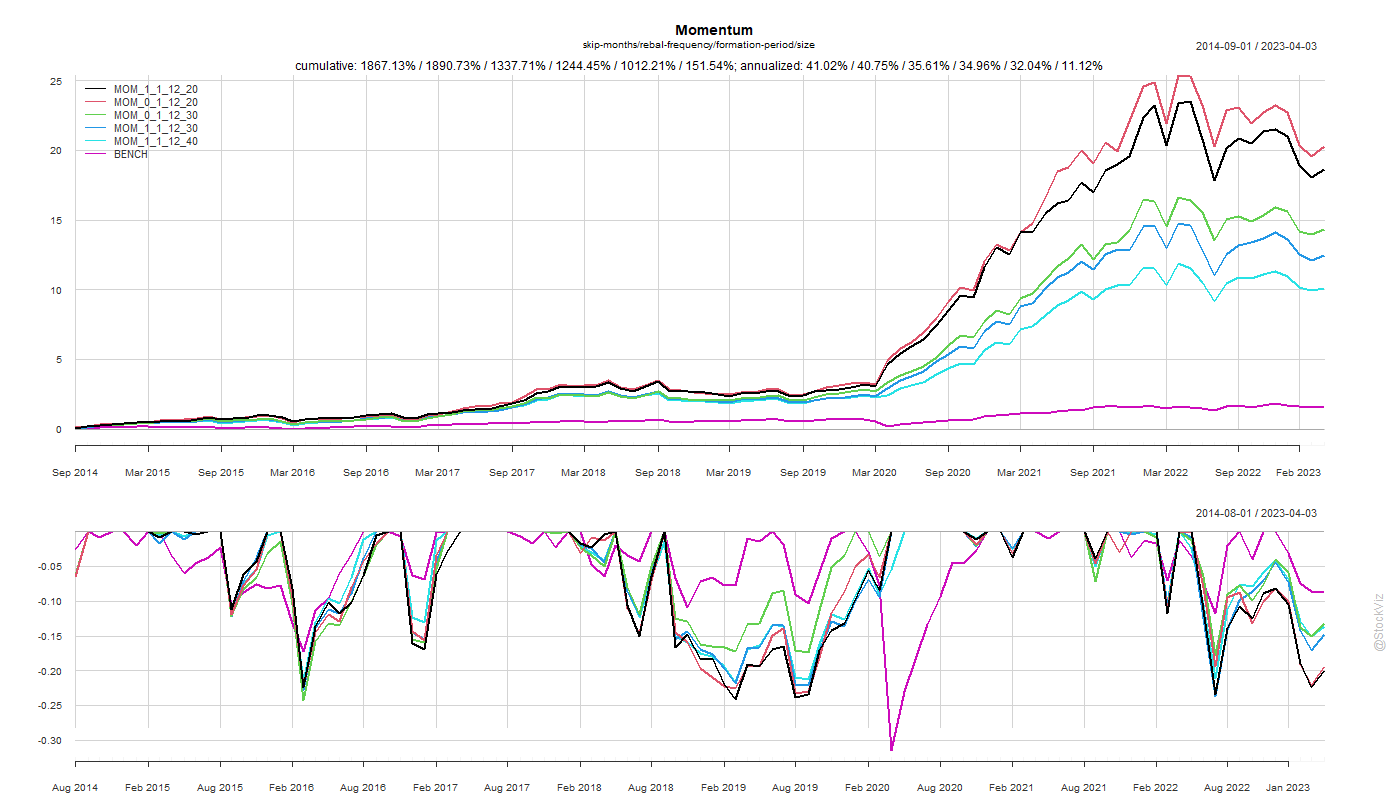

The previous post discussed how high correlation environments have fat left-tails. Can correlation states be used for timing?

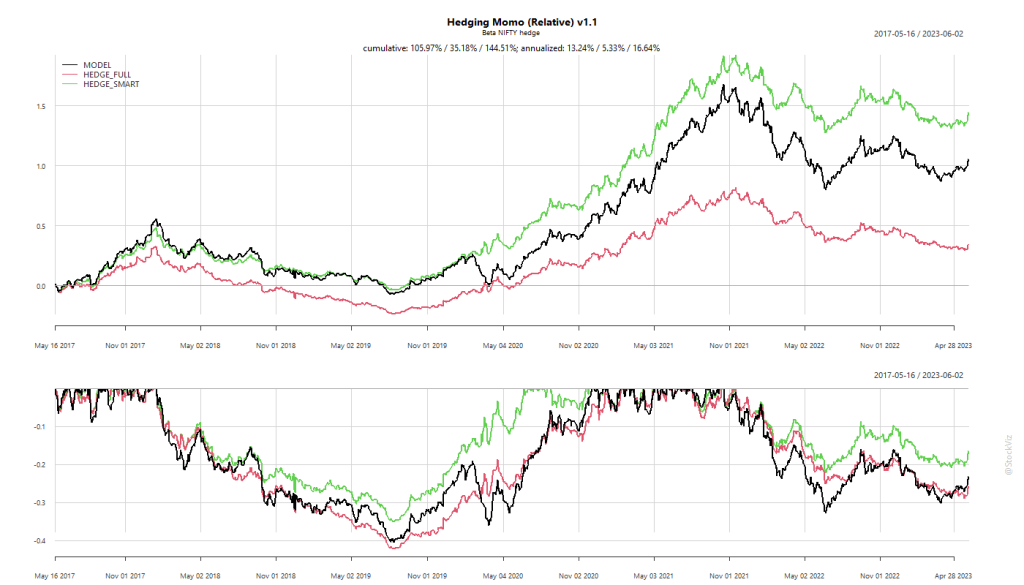

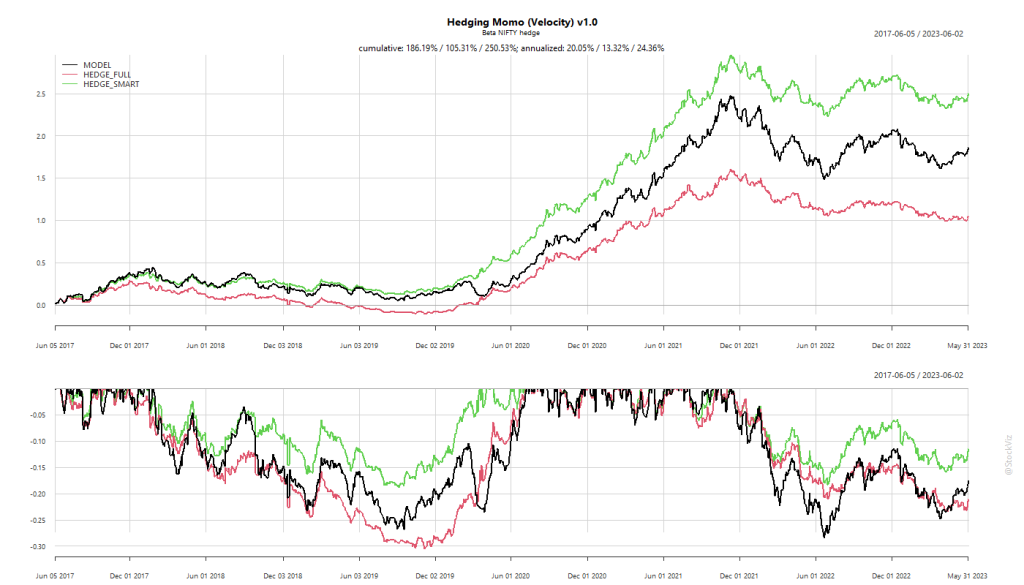

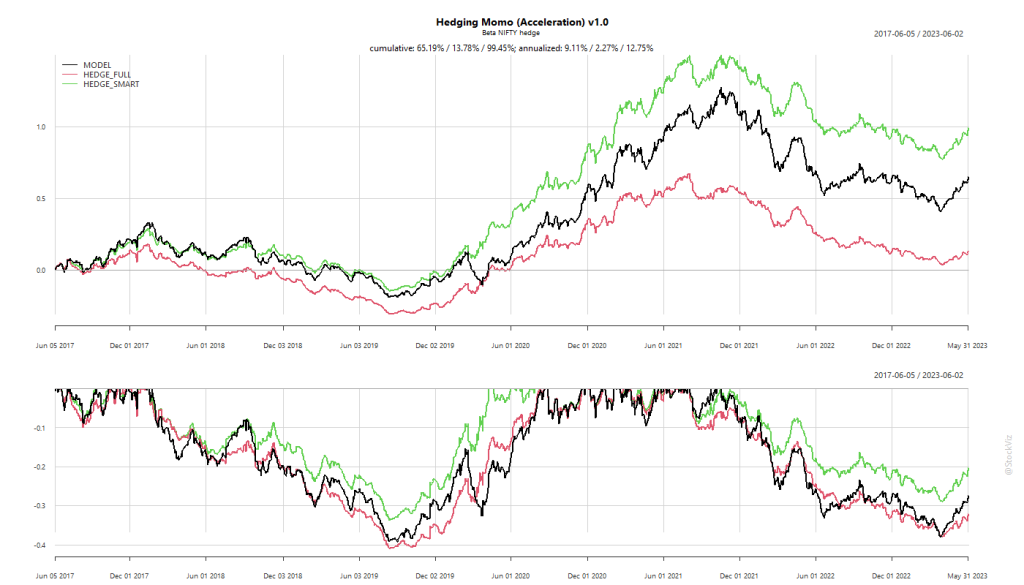

A quick look suggests that it might not be possible. Both LO (long-only) and LS (long-short) strategies that use the correlation state seem to underperform buy-and-hold.

There was some “crisis alpha” in using correlation for timing during the COVID crash of 2020. However, Buy & Hold ruled the roost both before…

… and after things normalized.

The slightly better drawdown performance of LO in some circumstances might be interesting for levered investors but the unlevered returns of these timing strategies are not much to write home about.